Introduction to Modern Digital Banking in Australia

The Australian banking landscape has undergone a dramatic transformation over the past decade. Traditional brick-and-mortar institutions are no longer the only option for consumers seeking reliable financial services. The rise of digital banking has introduced innovative alternatives that challenge conventional banking models, offering streamlined services, competitive rates, and user-friendly platforms that cater to tech-savvy customers.

- Introduction to Modern Digital Banking in Australia

- What is ME Banking? Understanding Australia’s Digital-First Bank

- Core Banking Account Options at ME Banking

- Digital Banking and Mobile Banking Excellence

- Fee Structure and Cost Comparison

- Interest Rates and Competitive Positioning

- Customer Service and Support Quality

- Security Features and Account Protection

- Comparison with Other Australian Banking Options

- Velocity Banking Strategy and ME Banking

- Real Customer Experiences and Reviews

- Who Should Choose ME Banking?

- How to Open an ME Banking Account

- ME Banking in 2025: Current Developments and Future Outlook

- Alternatives to Consider Alongside ME Banking

- Making Your Decision: Is ME Banking Right for You?

- Conclusion: ME Banking’s Value Proposition in 2025

Among these modern financial institutions, ME Banking (Members Equity Bank) has emerged as a notable player in Australia’s competitive banking sector. As an online-only bank, ME Banking represents the evolution of financial services, where customers can manage their entire banking experience through mobile banking apps and internet banking platforms without ever stepping foot in a physical branch.

This comprehensive review examines whether ME Banking is the right choice for your personal banking needs in 2025. We’ll explore everything from account types and interest rates to digital banking features and customer service quality, providing you with the information needed to make an informed decision about your financial future.

What is ME Banking? Understanding Australia’s Digital-First Bank

ME Banking, officially known as Members Equity Bank Limited, was established in 1994 as a mutual bank owned by industry superannuation funds. This unique ownership structure means the bank operates for the benefit of its members rather than external shareholders, allowing it to focus on delivering value directly to customers.

Unlike traditional banks such as Commonwealth Bank, Westpac, ANZ, or NAB, ME Banking operates exclusively online without physical branches. This digital-first approach positions it alongside other innovative banking solutions that have revolutionized how Australians manage their money. The bank holds a full Australian banking license and is regulated by the Australian Prudential Regulation Authority (APRA), providing the same level of security and government guarantee as traditional banks.

The shift toward online banking and internet banking has accelerated significantly, with the Australian Banking Association reporting that over 95% of banking transactions now occur outside physical branches. ME Banking has positioned itself at the forefront of this trend, offering comprehensive banking services entirely through digital channels.

Source: Australian Banking Association – Digital Banking Statistics

Core Banking Account Options at ME Banking

Everyday Transaction Accounts

ME Banking’s primary personal banking product is the ME Everyday Transaction Account, designed to handle your daily financial needs without the burden of monthly account fees. This banking account offers unlimited electronic transactions, making it ideal for customers who primarily use digital banking methods.

The account includes a Visa debit card for purchases and ATM withdrawals, access to over 10,000 ATMs across Australia through various banking networks, and comprehensive mobile banking capabilities. Unlike some traditional business banking or commercial banking accounts that charge substantial monthly fees, ME Banking’s everyday account maintains a customer-friendly fee structure.

For those comparing this to other options like chase banking, pnc banking, or wells fargo banking available in the United States, it’s important to note that Australian banking regulations and consumer protections differ significantly, often favoring customers more heavily.

Savings Account Features

ME Banking’s savings accounts compete directly with products from established institutions like Westpac banking, ANZ banking, and Suncorp banking. The bank offers competitive interest rates on savings balances, with bonus interest available when customers meet specific monthly conditions.

These conditions typically include making a minimum number of transactions from a linked transaction account and growing the balance each month. This structure encourages positive savings habits while rewarding active customers. The current rates as of 2025 remain competitive within the Australian market, though specific rates fluctuate with the Reserve Bank of Australia’s monetary policy decisions.

To access your savings account, customers use the ME Bank login portal through the internet banking platform or the mobile banking app, both of which offer intuitive interfaces for monitoring balances and transferring funds.

Source: Reserve Bank of Australia – Interest Rate Statistics

Home Loan Products

While our focus remains on transaction and savings accounts, it’s worth noting that ME Banking also offers competitive home loan products. These loans feature flexible repayment options, offset accounts, and competitive interest rates that often undercut major banks. This positions ME Banking as a comprehensive banking solution rather than simply an online banking account provider.

The integration between transaction accounts, savings accounts, and home loans creates a cohesive banking experience where customers can manage multiple financial products through a single internet banking login interface.

Digital Banking and Mobile Banking Excellence

The ME Banking Mobile App Experience

In today’s fast-paced world, mobile banking has transitioned from a convenience to a necessity. The ME Banking mobile app represents one of the institution’s strongest offerings, consistently receiving positive reviews on both iOS and Android platforms.

When using your mobile banking app from ME Banking, customers gain access to a full suite of features including:

- Instant balance checks across all accounts

- Rapid transfers between ME accounts or to external banks

- Bill payment functionality using BPAY

- Digital card management with instant freeze/unfreeze options

- Biometric login using fingerprint or facial recognition

- Transaction categorization and spending insights

- Instant notifications for all account activity

The app’s interface rivals those offered by larger institutions offering chase online banking, pnc online banking, or regions online banking services in other markets. ME Banking’s commitment to digital banking excellence ensures that customers never feel disadvantaged by the absence of physical branches.

Unlike some institutions that have experienced technical issues (similar to the m&t bank online banking issues or m&t mobile banking problems reported in other markets), ME Banking has maintained relatively stable platform performance, though occasional maintenance windows do occur.

Internet Banking Platform Capabilities

For customers who prefer desktop access, ME Banking’s internet banking platform provides comprehensive account management tools. The web-based interface offers everything available in the mobile app plus additional features better suited to larger screens.

Comparing this to established Australian platforms like ANZ internet banking, Westpac banking online, NAB internet banking, or St George internet banking, ME Banking’s interface is notably cleaner and more modern. The streamlined design reflects the bank’s digital-native approach rather than a legacy system adapted for online use.

Key features of the internet banking platform include:

- Detailed transaction history with advanced filtering

- Statement downloads in multiple formats

- Third-party payment setup and management

- Scheduled payments and recurring transfers

- Account settings and preference management

- Secure messaging with customer support teams

The platform uses industry-standard security protocols including two-factor authentication, similar to the security measures employed by Commonwealth Bank online banking and other major Australian institutions.

Source: APRA – Banking Security Standards

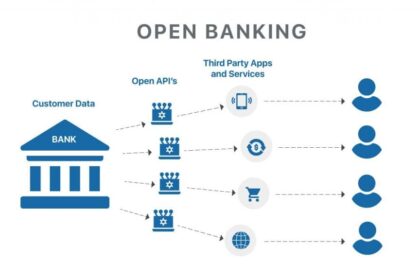

Open Banking and Data Sharing

As part of Australia’s Consumer Data Right (CDR) initiative, ME Banking participates in open banking frameworks. This allows customers to securely share their banking data with accredited third-party applications and services, enabling innovative financial management tools and comparison services.

Open banking represents a significant shift in how customers interact with their financial data, providing greater control and enabling more informed financial decisions. ME Banking’s implementation of these standards demonstrates its commitment to modern banking practices and customer empowerment.

Fee Structure and Cost Comparison

Transaction and Account Fees

One of ME Banking’s most attractive features is its straightforward fee structure. The everyday transaction account carries no monthly account fees, international transaction fees, or domestic ATM fees when using partner networks. This transparent approach contrasts sharply with some traditional institutions that burden customers with numerous small charges.

When comparing ME Banking to online banking account options from major banks, the fee savings can be substantial. Many traditional banks charge monthly fees ranging from $5 to $30 unless customers maintain minimum balances or meet complex transaction requirements.

For business banking needs, ME Banking’s offerings are more limited compared to specialized commercial banking solutions from institutions focusing on that sector. Businesses requiring extensive commercial banking features, merchant services, or dedicated business banking support may find better options elsewhere.

International Transactions and Currency Exchange

While ME Banking doesn’t charge international transaction fees on its debit cards, customers should be aware of currency conversion rates applied to foreign purchases. These rates include a margin above the wholesale exchange rate, which is standard practice across the banking industry.

For frequent international travelers or those making regular overseas purchases, specialized travel cards or dedicated foreign exchange services might offer better value. However, for occasional international transactions, ME Banking’s offering remains competitive within the Australian market.

Interest Rates and Competitive Positioning

Savings Account Interest Rates

As of 2025, ME Banking continues to offer competitive interest rates on savings balances, though exact rates fluctuate with broader economic conditions and Reserve Bank of Australia policy decisions. The bank typically offers a base rate plus a bonus rate, with the bonus requiring customers to meet specific monthly conditions.

These conditions usually include:

- Depositing at least $2,000 into a linked transaction account each month

- Making at least five debit card purchases from the transaction account

- Growing the savings account balance from the previous month

When these conditions are met, customers can earn interest rates that compete with or exceed those offered by Suncorp internet banking, Westpac online savings accounts, and other mainstream options.

The tiered interest structure means that customers with larger balances may receive different rates compared to those with minimal deposits. This approach aligns with standard practices across Australian banking, where institutions reward larger deposits with better returns.

Source: Canstar – Savings Account Comparison 2025

Home Loan Interest Rates

ME Banking’s home loan products consistently rank among the most competitive in the Australian market. The bank offers both variable and fixed-rate loans with features including:

- Offset accounts that reduce interest charges

- Unlimited additional repayments on variable loans

- No ongoing monthly fees

- Competitive comparison rates

These features make ME Banking an attractive option for property buyers seeking value without sacrificing service quality. The bank’s streamlined operations and online-only model allow it to pass savings to customers through reduced interest rates and fees.

Customer Service and Support Quality

Digital-First Support Channels

Operating without physical branches means ME Banking relies entirely on digital and phone-based customer support. The bank offers several contact channels:

- Telephone support during extended business hours

- Secure messaging through the internet banking platform

- Email support for non-urgent queries

- Comprehensive online help center and FAQ database

- Social media monitoring and response

Customer feedback regarding ME Banking’s support quality remains generally positive, with most issues resolved efficiently through the available channels. However, customers who value face-to-face interactions or prefer in-person banking assistance may find this model less satisfying.

Compared to traditional banks where you might visit a branch for complex issues, ME Banking requires customers to be comfortable managing their finances remotely. This approach works well for straightforward transactions and account management but can present challenges for more complex banking needs.

Response Times and Accessibility

ME Banking’s customer service team typically responds to phone inquiries promptly during business hours, though wait times can extend during peak periods. The secure messaging system through internet banking usually receives responses within 24-48 hours for non-urgent matters.

For customers accustomed to the immediacy of branch banking or those dealing with time-sensitive issues, this response timeframe may feel slower than desired. However, it aligns with industry standards for online banking providers.

Banking holidays 2025 affect ME Banking’s operations similarly to other Australian institutions. On banking holidays, customer service availability is reduced, and some transactions may experience processing delays. Customers should plan accordingly around these dates to avoid inconvenience.

Source: Australian Government – Public Holidays

Security Features and Account Protection

Multi-Layer Security Approach

ME Banking implements comprehensive security measures to protect customer accounts and data:

- 256-bit SSL encryption for all internet banking sessions

- Two-factor authentication for login and sensitive transactions

- Biometric authentication options in the mobile banking app

- Instant transaction notifications via SMS and push notifications

- Card freeze/unfreeze functionality for immediate fraud response

- Suspicious activity monitoring and automated alerts

These security features match or exceed those offered by major banks including NAB login systems, ANZ banking login protocols, and Westpec banking login security measures.

Government Guarantee and Regulatory Protection

As a fully licensed Australian bank, ME Banking deposits are protected under the Australian Government’s Financial Claims Scheme up to $250,000 per account holder per institution. This guarantee provides the same level of protection offered by Commonwealth Bank, Westpac, ANZ, NAB, and other major Australian banks.

The bank’s regulation by APRA ensures compliance with strict prudential standards, capital requirements, and operational guidelines. This regulatory oversight provides customers with confidence that ME Banking operates under the same stringent requirements as traditional banks.

Source: APRA – Bank Supervision Framework

Comparison with Other Australian Banking Options

ME Banking vs Traditional Big Four Banks

When comparing ME Banking to Australia’s major banks (Commonwealth Bank, Westpac, ANZ, and NAB), several key differences emerge:

Advantages of ME Banking:

- No monthly account fees on transaction accounts

- Competitive interest rates on savings and home loans

- Streamlined, modern digital banking platforms

- Fewer complex fee structures

- Customer-focused approach without shareholder profit pressures

Advantages of Traditional Banks:

- Extensive branch networks for in-person service

- Broader range of business banking and commercial banking products

- Established international banking services

- More extensive private banking offerings

- Longer operational history and brand recognition

For customers comfortable with digital banking and primarily conducting transactions online, ME Banking offers compelling value. Those requiring extensive in-person services, complex commercial banking solutions, or international banking features may find traditional banks better suited to their needs.

ME Banking vs Other Digital Banks

Australia’s digital banking sector includes several competitors to ME Banking:

ING Australia offers similar fee-free transaction accounts with competitive savings rates and a cashback rewards program. Their mobile banking experience rivals ME Banking’s platform quality.

Ubank (owned by NAB) provides straightforward digital banking with competitive rates and a user-friendly app, though some customers report limitations in product range.

Macquarie Bank offers comprehensive online banking through their Macquarie internet banking platform, including transaction accounts, savings accounts, home loans, and investment products. Their offering is more extensive but can be more complex to navigate.

86 400 (now part of Ubank) pioneered innovative features like instant rewards and spending insights, pushing the entire industry toward better digital experiences.

ME Banking distinguishes itself through its mutual ownership structure, consistent rate competitiveness, and balanced approach to product offerings without overwhelming customers with excessive complexity.

Regional and Community Banking Alternatives

Beyond national players, regional options like Bendigo Bank (with their Bendigo e banking platform), Heritage Bank (offering Heritage business banking), and Greater Bank (with Greater Bank online banking) provide community-focused alternatives.

These institutions often combine physical branch presence with digital banking capabilities, appealing to customers who want local service with modern technology. Organizations like RACQ (through RACQ online banking) and credit unions such as Summerland Credit Union (via Summerland Credit Union internet banking) offer member-focused services with competitive rates.

ME Banking positions itself between pure digital banks and community institutions, offering the technological sophistication of the former with the customer-first philosophy of the latter.

Velocity Banking Strategy and ME Banking

For financially sophisticated customers exploring advanced debt reduction strategies, the velocity banking concept has gained attention in recent years. This approach involves strategically using home loan offset accounts and line of credit facilities to minimize interest payments and accelerate debt elimination.

While ME Banking’s products can support elements of velocity banking through their offset account features on home loans, customers should thoroughly understand these strategies before implementation. Velocity banking requires disciplined financial management and careful cash flow planning to execute effectively.

The bank’s transparent fee structure and flexible home loan features make it a viable platform for customers pursuing this approach, though professional financial advice is recommended before committing to such strategies.

Real Customer Experiences and Reviews

Positive Feedback Themes

Customer reviews from various platforms highlight several consistent strengths:

Competitive Rates: Many customers specifically mention ME Banking’s attractive interest rates on both savings accounts and home loans as primary reasons for choosing the institution.

User-Friendly Technology: The mobile banking app and internet banking platform receive frequent praise for intuitive design and reliable functionality.

Transparent Fees: Customers appreciate the straightforward fee structure without hidden charges or complex requirements.

Responsive Support: Many reviewers note satisfactory experiences with customer service teams when issues arise.

Streamlined Account Opening: The digital account application process is frequently described as quick and hassle-free compared to traditional banking procedures.

Common Concerns and Criticisms

No financial institution is perfect, and ME Banking has received criticism in certain areas:

Limited Branch Access: Customers who prefer in-person banking or need face-to-face support for complex issues find the online-only model restrictive.

Product Range Limitations: Compared to full-service banks, ME Banking offers a narrower product range, particularly for business banking and investment services.

Bonus Interest Requirements: Some customers find the monthly conditions for earning bonus interest rates on savings accounts somewhat restrictive or difficult to maintain.

Processing Times: Occasional reports of slower processing for certain transactions compared to major banks, particularly for international transfers.

System Maintenance: While relatively rare, scheduled maintenance windows can temporarily restrict access to internet banking and mobile banking services.

These concerns should be weighed against the benefits when determining whether ME Banking aligns with your personal banking requirements.

Source: ProductReview.com.au – ME Bank Reviews

Who Should Choose ME Banking?

Ideal Customer Profiles

ME Banking is particularly well-suited for:

Digital-Native Customers: Individuals comfortable managing all banking activities through mobile and internet banking platforms without needing branch access.

Fee-Conscious Consumers: Those seeking to minimize banking costs through fee-free transaction accounts and competitive interest rates.

First Home Buyers: Young property purchasers attracted to competitive home loan rates and flexible features.

Simple Banking Needs: Customers requiring straightforward transaction accounts, savings accounts, and potentially home loans without complex requirements.

Value Seekers: Individuals prioritizing rate competitiveness and fee transparency over extensive product ranges or in-person service.

Who Might Look Elsewhere

ME Banking may not be the best fit for:

Business Owners: Those requiring comprehensive business banking or commercial banking services with dedicated business support teams.

Traditional Banking Preferences: Customers who value branch access for deposits, withdrawals, or face-to-face consultations.

Complex Financial Situations: Individuals needing specialized services like private banking, extensive investment products, or international banking facilities.

Frequent International Users: Those regularly conducting international transfers or requiring multi-currency accounts.

Technology-Averse Customers: Individuals uncomfortable with exclusively digital banking platforms.

Understanding these customer profiles helps determine whether ME Banking’s model aligns with your specific circumstances and preferences.

How to Open an ME Banking Account

Account Application Process

Opening an account with ME Banking follows a straightforward digital process:

Step 1: Online Application

Visit the ME Banking website and select the account type you wish to open. The online application form requests personal information including:

- Full name and date of birth

- Residential address and contact details

- Tax File Number (optional but recommended)

- Employment information

Step 2: Identity Verification

ME Banking uses digital identity verification processes to confirm your identity without requiring branch visits. This typically involves:

- Providing driver’s license or passport details

- Answering questions based on credit report information

- Uploading supporting documentation if automated verification fails

Step 3: Initial Deposit

Once approved, you’ll receive account details and instructions for making your initial deposit. This can be done via bank transfer from an existing account at another institution.

Step 4: Activate Your Account

After your initial deposit is processed, you can complete account activation through the internet banking platform or mobile banking app, setting up your login credentials and security preferences.

Step 5: Order Debit Card

Your Visa debit card will be mailed to your verified address, typically arriving within 5-10 business days. You’ll receive a PIN separately for security purposes.

The entire process usually takes 1-3 business days for straightforward applications, making it considerably faster than traditional branch-based account opening.

Setting Up Internet Banking and Mobile Banking

Once your account is active, configuring your digital banking access is essential:

Internet Banking Setup:

- Visit the ME Banking website

- Select the registration option

- Enter your customer number and account details

- Create your username and password

- Set up security questions

- Configure notification preferences

Mobile Banking App:

- Download the ME Bank app from the App Store or Google Play

- Use your internet banking credentials to log in

- Enable biometric authentication for convenient access

- Configure push notification preferences

- Explore the app interface and features

Taking time to familiarize yourself with both platforms ensures you can efficiently manage your accounts and access all available features.

ME Banking in 2025: Current Developments and Future Outlook

Recent Platform Updates

ME Banking continues investing in its digital infrastructure, with recent updates including:

Enhanced Mobile App Features: Improved spending insights, better categorization of transactions, and more intuitive navigation based on customer feedback.

Open Banking Integration: Expanded compatibility with third-party financial management apps and comparison services through Australia’s Consumer Data Right framework.

Security Enhancements: Additional authentication options and real-time fraud monitoring capabilities to protect customer accounts.

Payment Platform Improvements: Faster processing for PayID and Osko instant payments, reducing transaction times.

Competitive Position in 2025

As of 2025, ME Banking maintains a strong competitive position in Australia’s digital banking sector. The institution continues attracting customers seeking alternatives to traditional banks, particularly among younger demographics comfortable with exclusively digital banking.

The bank’s mutual ownership structure provides strategic flexibility not available to shareholder-driven institutions, potentially allowing more aggressive rate competition and customer-friendly policy decisions.

However, competition intensifies as traditional banks improve their digital offerings and new fintech challengers enter the market. ME Banking’s success depends on maintaining its technological edge, competitive rates, and customer service quality.

Regulatory Environment and Consumer Protection

The Australian banking sector operates under increasingly stringent regulatory oversight following recommendations from the Banking Royal Commission. These reforms benefit consumers through:

- Enhanced complaint handling procedures

- Stricter responsible lending requirements

- Improved transparency in fees and charges

- Better protection against predatory practices

ME Banking complies with all applicable regulations, providing customers with robust consumer protections equivalent to those at traditional banks.

Source: Australian Securities and Investments Commission – Banking Reforms

Alternatives to Consider Alongside ME Banking

Australian Digital Banking Competitors

ING Australia offers Orange Everyday accounts with no monthly fees and rebates on international ATM fees when deposit requirements are met. Their Savings Maximiser account provides competitive bonus interest rates.

Ubank provides straightforward Save and Spend accounts with competitive rates and a user-friendly app experience backed by NAB’s infrastructure.

Macquarie Bank delivers comprehensive banking through Macquarie internet banking, including transaction accounts, high-interest savings, home loans, and investment products.

Traditional Bank Online Banking Platforms

For customers wanting digital convenience with branch access options:

Commonwealth Bank online banking combines extensive digital features with Australia’s largest branch and ATM network.

Westpac banking online and Westpac online platforms offer sophisticated digital banking backed by comprehensive in-person services.

ANZ banking online and ANZ internet banking provide feature-rich platforms with strong international banking capabilities.

NAB internet banking and NAB login systems deliver robust digital banking with extensive business banking support.

St George internet banking and St George banking offer competitive products with both digital and branch-based service options.

Specialized Banking Solutions

For specific needs:

Business Banking: Institutions like Bank of Melbourne (through Bank of Melbourne business banking) or specialized commercial banking divisions of major banks offer comprehensive business solutions.

International Banking: Banks with strong global networks provide better support for frequent international transactions and multi-currency needs.

Private Banking: High-net-worth individuals might explore private banking services from institutions specializing in wealth management.

Credit Unions: Member-owned organizations like those offering beyond bank login internet banking login services or Australian Unity internet banking provide community-focused alternatives.

Making Your Decision: Is ME Banking Right for You?

Key Advantages Summary

Financial Benefits:

- No monthly account fees on transaction accounts

- Competitive interest rates on savings accounts

- Attractive home loan rates with flexible features

- Transparent fee structure without hidden charges

- Mutual ownership model focusing on customer value

Technology and Convenience:

- Modern, user-friendly mobile banking app

- Sophisticated internet banking platform

- Instant notifications and transaction monitoring

- Digital account opening without branch visits

- Comprehensive online account management

Security and Protection:

- Government guarantee on deposits up to $250,000

- Multi-layer security features and fraud monitoring

- Regulatory oversight by APRA

- Instant card freeze functionality

- Biometric authentication options

Key Limitations Summary

Service Constraints:

- No physical branches for in-person service

- Limited business banking and commercial banking options

- Restricted international banking features

- Customer service primarily phone and digital-based

- Smaller product range compared to full-service banks

Potential Considerations:

- Bonus interest rates require meeting monthly conditions

- Technology-dependent service model

- Processing times occasionally slower than major banks

- Limited support for complex financial needs

- Not ideal for customers preferring face-to-face banking

Decision Framework

Consider ME Banking if you:

- Primarily bank online using internet banking and mobile banking

- Want to minimize fees while accessing competitive rates

- Value simplicity and transparency in banking relationships

- Are comfortable with digital-only customer service

- Have straightforward banking needs

Consider alternatives if you:

- Require extensive business banking or commercial banking services

- Prefer in-person banking for complex transactions

- Need comprehensive international banking capabilities

- Value broad product ranges including investment services

- Are uncomfortable with exclusively digital banking

Conclusion: ME Banking’s Value Proposition in 2025

ME Banking represents a compelling choice for Australian consumers seeking modern digital banking without the complexity and costs often associated with traditional institutions. The bank’s online-only model allows it to deliver competitive rates, minimal fees, and sophisticated technology platforms that rival or exceed those offered by major banks.

The institution’s mutual ownership structure aligns its interests with customers rather than external shareholders, potentially providing long-term benefits through customer-focused policies and competitive pricing. This philosophical approach differentiates ME Banking from both traditional banks and newer fintech challengers backed by venture capital.

For digitally comfortable customers with straightforward personal banking needs, ME Banking delivers excellent value through its no-fee transaction accounts, competitive savings rates, and attractive home loan products. The mobile banking app and internet banking platform provide comprehensive account management capabilities without requiring branch visits.

However, the bank’s online-only model and limited product range mean it’s not universally suitable. Business owners requiring comprehensive commercial banking solutions, frequent international banking users, or customers preferring face-to-face service should carefully evaluate whether ME Banking meets their specific requirements.

As the Australian banking landscape continues evolving, ME Banking’s commitment to digital innovation, competitive pricing, and customer value positions it well for continued growth. The bank successfully balances technological sophistication with operational simplicity, creating an accessible banking experience for its target market.

Ultimately, choosing ME Banking depends on aligning your banking preferences, technological comfort level, and financial needs with the institution’s strengths. For the right customer, ME Banking offers an excellent alternative to traditional banking models—providing modern digital banking services, competitive rates, and transparent fees in a streamlined package designed for today’s connected consumers.

Before making your final decision, consider opening accounts with multiple institutions to compare firsthand experiences. Many Australians maintain accounts at different banks, using each for their particular strengths—perhaps ME Banking for everyday transactions and savings while utilizing another institution for specialized services.

The Australian banking sector offers abundant choice, and ME Banking’s distinctive approach contributes valuable competition that benefits all consumers through improved services and better pricing across the industry.

Disclaimer: Banking products, interest rates, fees, and features are subject to change. Always verify current offerings directly with ME Banking or other financial institutions before making account decisions. This review represents information current as of 2025 but should not be considered financial advice. Consider consulting licensed financial advisors for personalized recommendations based on your individual circumstances.

Sources Referenced:

- Australian Banking Association: https://www.ausbanking.org.au/

- Reserve Bank of Australia: https://www.rba.gov.au/

- Australian Prudential Regulation Authority: https://www.apra.gov.au/

- Australian Securities and Investments Commission: https://www.asic.gov.au/

- Canstar Financial Comparison Service: https://www.canstar.com.au/

- ProductReview.com.au: https://www.productreview.com.au/

- Australian Government Services: https://www.australia.gov.au/