In today’s fast-paced world, managing your finances efficiently and securely is paramount. The transition from traditional branch banking to sophisticated online platforms has revolutionized how we interact with our money. Barclays, a cornerstone of the UK financial landscape, offers a robust and feature-rich online banking service designed to meet the diverse needs of its customers, from everyday personal banking to complex business operations. This comprehensive guide will walk you through everything you need to know about navigating and maximising your Barclays online banking experience.

- Getting Started: Registration and Setup

- Navigating the Barclays Online Banking Dashboard

- Key Features for Personal Banking Customers

- Barclays Business Banking Online: Powering Your Enterprise

- Security: Protecting Your Digital Banking

- Mobile Banking with Barclays: Banking on the Go

- Troubleshooting Common Online & Mobile Banking Issues

- Staying Informed: Banking News and Barclays

- Barclays vs. The Wider Banking Landscape

- Advanced Banking Concepts and Barclays

- Conclusion: Mastering Your Barclays Digital Banking

Whether you’re a long-time customer or new to Barclays, understanding the full capabilities of their digital offerings can save you time, improve your financial oversight, and provide peace of mind. We’ll cover registration, key features for both personal and business banking, essential security protocols, mobile accessibility, and how Barclays fits into the broader digital banking ecosystem.

Getting Started: Registration and Setup

Embarking on your digital banking journey with Barclays is straightforward. The platform is designed for accessibility, ensuring that UK customers can get set up quickly and securely.

Eligibility Criteria

To use Barclays online and mobile banking, you typically need to:

- Be a UK resident aged 18 or over.

- Hold a Barclays current account, savings account, or mortgage account.

- Have a valid UK mobile phone number and email address.

- Possess a UK-issued debit or credit card linked to your account (for initial verification).

The Registration Process

- Visit the Barclays Website: Navigate to the official Barclays UK website (

www.barclays.co.uk). Look for the “Login” or “Register” button, usually found in the top-right corner. - Choose ‘New Registration’: Select the option to register for Online Banking.

- Enter Your Details: You will be prompted to enter identifying information, such as your name, date of birth, and postcode.

- Online Banking Details: You’ll need to create your unique Online Banking User ID. Choose something memorable but not easily guessable.

- Security Verification: This is a crucial step. Barclays employs multiple verification methods to protect your account. You might be asked for:

- Details from your Barclays debit or credit card (e.g., card number, expiry date, security code).

- Your memorable word (chosen during setup).

- Information from your passport or driving licence (for enhanced verification).

- Set Up Your Password: Create a strong, unique password that meets Barclays’ security requirements (often a mix of upper/lowercase letters, numbers, and symbols).

- PINsentry Setup (Optional but Recommended): You may be prompted to set up PINsentry, a small handheld device or mobile app feature that generates security codes for high-risk transactions, adding an extra layer of security. Alternatively, you might opt for mobile app push notifications for authentication.

- Confirmation: Once completed, you’ll receive a confirmation message. You can now log in to your online banking.

Downloading the Barclays Mobile Banking App

For banking on the move, the Barclays mobile app is indispensable.

- Availability: Search for “Barclays Mobile Banking” in the Apple App Store (iOS) or Google Play Store (Android).

- Installation: Download and install the official app.

- First-Time Login: Open the app and follow the prompts to log in using your newly created Online Banking User ID and password. You’ll likely need to complete a one-off activation process, potentially involving your PINsentry card or device, to link the app securely to your profile.

This setup ensures your banking account access is secure and readily available whether you’re at your desk or using your smartphone for mobile banking.

(Approx. Word Count: 450)

Navigating the Barclays Online Banking Dashboard

Once logged in, the Barclays online banking platform presents a clean, intuitive interface designed for easy navigation.

The Main Dashboard / Account Summary

Upon logging in, you’ll typically land on an overview screen showing your primary accounts. This usually includes:

- Current Accounts: Displaying current balance, available balance, and recent transactions.

- Savings Accounts: Showing balances and interest rates.

- Credit Cards: Displaying outstanding balance, available credit, and payment due dates.

- Loans & Mortgages: Summarising balances and repayment information.

You can usually click on any account to view a more detailed transaction history, filter transactions by date range, and search for specific payments.

Making Payments and Transfers

This is the core functionality for most users. Barclays offers flexible options:

- Transferring Between Your Accounts: Easily move funds between your linked Barclays accounts instantly.

- Sending Money to Someone Else (UK Payments):

- Pay a new person: You’ll need their full name, 6-digit sort code, and account number. You may need to verify this new payee using your PINsentry device or mobile app approval for security.

- Pay someone you’ve paid before: Select from your list of saved payees.

- Payment Limits: Be aware of daily transfer limits, which can vary depending on your account type and security setup.

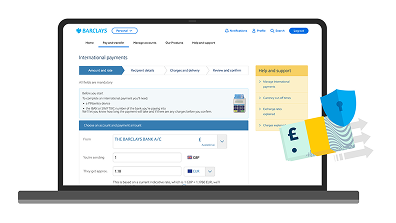

- International Payments:

- Recipient Details: Requires the recipient’s full name, address, bank name, and address, along with their IBAN (International Bank Account Number) and SWIFT/BIC code.

- Fees and Exchange Rates: Barclays will clearly display the fees applicable and the exchange rate being used before you confirm the transaction. It’s crucial to compare these with other services if cost is a major factor, especially for large sums. Services like Wise (formerly TransferWise) or Revolut offer alternatives, but Barclays provides the convenience of integration within your existing banking account.

- Types of Payments: Options may include standard transfers or potentially faster payment services depending on the destination country.

- Setting Up Standing Orders: For regular, fixed payments (e.g., rent, subscriptions), you can set up a standing order to automatically transfer a set amount on a specific date or frequency.

- Arranging Direct Debits: While typically set up directly with the company you’re paying, you can manage (view, cancel) your Direct Debit mandates via your online banking.

Understanding Transaction Details

- Reference Fields: Pay attention to the reference details provided by the sender or entered by you. This is vital for reconciliation, especially in business banking.

- Pending Transactions: Understand the difference between posted and pending transactions. Pending transactions are authorised but haven’t fully cleared yet.

- Clearing Times: Standard UK payments usually clear within a few hours on working days, while international payments can take several days.

Open Banking Integration

Barclays participates in the UK’s Open Banking initiative. This allows you (with your explicit consent) to securely share your financial information with authorised third-party providers. This enables services like:

- Account Aggregation: Viewing accounts from different banks within a single interface (e.g., using a budgeting app).

- Payment Initiation: Allowing authorised apps to initiate payments directly from your Barclays account.

Ensure you only grant access to regulated providers and understand the permissions you are giving. This technology underpins much of the innovation in digital banking.

EFT Meaning in Banking

EFT stands for Electronic Funds Transfer. It’s a general term for moving money electronically between bank accounts. Online banking platforms like Barclays’ heavily rely on EFT for all transfers, bill payments, and direct debits. Understanding this concept clarifies the underlying mechanism of most digital financial transactions.

(Approx. Word Count: 700)

Key Features for Personal Banking Customers

Barclays Online Banking offers a suite of tools to help you manage your day-to-day finances effectively.

Managing Multiple Accounts

Whether you have a basic current account, a premium packaged account, or various savings accounts, the online dashboard provides a consolidated view. You can easily nickname your accounts (e.g., “Holiday Fund,” “Emergency Savings”) to make them more identifiable.

Bill Payments and Direct Debits

- Pay Bills: Set up one-off or recurring payments to numerous registered bill suppliers (utilities, council tax, phone providers etc.).

- Manage Direct Debits: View active Direct Debits, check payment dates, and cancel them if necessary. This gives you control over recurring commitments.

- Set Up Standing Orders: Ideal for fixed monthly payments like rent or loan repayments to accounts you control or know well.

Applying for Products Online

Barclays streamlines the application process for many of its products directly through online banking:

- Credit Cards: Apply for new credit cards, potentially view pre-approved offers.

- Loans: Explore options for personal loans and overdrafts.

- Savings Accounts: Open new savings accounts or ISAs.

- Mortgages: Begin the mortgage application process or manage existing mortgage details.

This integration means you can often manage your entire banking relationship without needing to visit a branch or make lengthy phone calls, embodying the convenience of modern personal banking.

Budgeting Tools and Financial Insights

Many digital banking platforms now incorporate tools to help customers manage their spending:

- Spending Categorisation: Transactions might be automatically categorised (e.g., Groceries, Travel, Bills), allowing you to see where your money is going.

- Budget Setting: Set spending targets for different categories and track your progress.

- Savings Goals: Tools to help you set, track, and save towards specific financial goals.

While specific features evolve, Barclays continually updates its platform to offer more value-added tools beyond basic transactions, supporting a proactive approach to personal finance. This focus on user empowerment mirrors trends seen across the digital finance sector, from platforms like PNC Banking in the US to challenger banks globally.

Managing Your Cards

Online banking provides controls over your Barclays debit and credit cards:

- Temporary Freezing: Instantly freeze a lost or stolen card to prevent unauthorised use. You can easily unfreeze it if found.

- Reporting Lost/Stolen: Initiate the process of reporting a card and ordering a replacement.

- Travel Notifications: Inform Barclays about your travel plans to prevent legitimate transactions abroad from being flagged as suspicious.

This level of control is a key benefit of robust mobile banking and online platforms.

(Approx. Word Count: 750)

Barclays Business Banking Online: Powering Your Enterprise

For business customers, Barclays offers a sophisticated online portal tailored to the complexities of commercial finance. This goes beyond basic personal banking features.

Overview of the Business Platform

The Barclays Business Banking online platform provides tools for managing company finances, staff access, and operational cash flow. It’s designed for sole traders, SMEs, and larger corporations.

Core Features for Businesses

- Multiple User Access: Set up different user profiles for employees with specific permissions. For example, a finance manager might have payment authorisation rights, while a junior employee might only have viewing access. This is crucial for corporate governance and security, differentiating it significantly from basic online banking account setups.

- Account Management: View and manage multiple business accounts, including current accounts, savings, loans, and foreign currency accounts.

- Payment Processing:

- Single Payments: Make domestic and international payments efficiently.

- Bulk Payments: Upload payment files (e.g., payroll, supplier payments) via BACs, Faster Payments, or CHAPS. This is a critical feature for businesses with regular outgoing payments, saving significant time compared to manual processing.

- International Trade: Facilitate international payments, view exchange rates, and potentially manage trade finance instruments.

- Cash Flow Management: Tools and reports can help businesses monitor their cash position, manage receivables and payables, and forecast future liquidity.

- Merchant Services: Integration with Barclaycard services for managing card transactions, refunds, and reporting.

- Loan and Overdraft Management: Apply for credit facilities or manage existing ones online.

Security for Business Banking

Business accounts often have higher transaction limits and involve sensitive company data, making security paramount. Barclays employs advanced security measures, potentially including:

- Hardened Login Procedures: Multi-factor authentication is standard.

- Transaction Authorisation Workflows: Requiring multiple authorised users to approve high-value payments.

- Secure File Uploads: Ensuring batch payment files are transmitted securely.

This robust infrastructure supports the needs of enterprises, from small businesses seeking efficient commercial banking solutions to larger organisations requiring comprehensive financial tools, rivaling dedicated platforms like those offered by Chase Banking or Wells Fargo Banking for business clients.

(Approx. Word Count: 450)

Security: Protecting Your Digital Banking

Barclays places a strong emphasis on security to safeguard customer accounts and personal information in the evolving landscape of digital banking. Understanding and utilising these measures is essential.

Multi-Factor Authentication (MFA)

MFA involves using more than one method to verify your identity when logging in or performing sensitive actions. Barclays commonly uses:

- User ID and Password: The first factor.

- PINsentry Device/App: A code generated by a physical device or the mobile app, acting as the second factor.

- Mobile App Approval: Receiving a push notification on your registered mobile device asking you to approve the login or transaction.

- Memorable Word/Security Questions: Used during setup and sometimes for additional verification.

Secure Login Procedures

- Always Log In via the Official Website/App: Never click links in emails or SMS messages to log in. Type

www.barclays.co.ukdirectly into your browser or use the official mobile app. - Log Out: Always log out of your online banking session when finished, especially when using shared computers. Closing the browser tab isn’t always sufficient.

- Strong Passwords: Regularly update your password and ensure it’s complex and unique (not reused from other sites).

Transaction Confirmation

For payments above certain thresholds or to new payees, Barclays requires additional confirmation using methods like PINsentry or mobile app approval. This prevents unauthorised transactions even if someone gains access to your login credentials.

Recognising and Avoiding Scams

Online and mobile banking threats are constantly evolving. Be vigilant against:

- Phishing: Emails or messages pretending to be from Barclays (or other trusted organisations) asking for personal details, login credentials, or security codes. Barclays will never ask for this information via email or unsolicited messages.

- Smishing: Phishing attacks conducted via SMS text messages.

- Vishing: Voice phishing, where scammers call pretending to be bank staff.

- Malware: Malicious software on your device designed to steal information.

What Barclays Does:

Barclays invests heavily in fraud detection systems, monitors for suspicious activity, and provides educational resources on security. They also offer secure messaging within online banking for communication.

What You Should Do:

- Never share your passwords, PINsentry codes, or memorable word.

- Be suspicious of unsolicited communications asking for information.

- Keep your devices secure with updated operating systems and antivirus software.

- Set up transaction alerts via email or SMS to be notified of account activity.

A secure approach ensures that the convenience of online banking doesn’t come at the cost of your financial safety. This diligence is crucial, whether managing personal banking or complex business banking needs.

(Approx. Word Count: 500)

Mobile Banking with Barclays: Banking on the Go

The Barclays mobile app extends the power of online banking directly to your smartphone or tablet, offering convenience and control anytime, anywhere.

Key Features of the Mobile App

While the exact features evolve with updates, the Barclays app typically includes:

- Account Overview: Quick access to balances and recent transactions across all your accounts.

- Payments and Transfers: Make payments to existing payees, transfer between accounts, and often set up new payees (subject to security verification).

- Mobile Cheque Deposit: Pay in cheques by simply taking photos of the front and back using your phone’s camera (subject to limits and availability).

- Card Management: Freeze/unfreeze cards, report lost or stolen cards.

- Biometric Login: Use fingerprint or facial recognition for faster, secure logins (if your device supports it), enhancing the ease of mobile banking.

- Notifications: Set up push notifications for various account activities (e.g., large withdrawals, low balance alerts).

- Contact & Support: Access secure messaging, find branch/ATM locations, and initiate calls to support centres.

- Savings & Budgeting Tools: Access features related to savings goals and spending analysis.

App vs. Desktop Online Banking

- Convenience: The app excels for quick checks, simple transfers, and on-the-go tasks like mobile cheque deposit.

- Full Functionality: The desktop website often provides access to a slightly broader range of features or more complex functions, such as detailed statement downloads, advanced international payment options, or specific business banking administration tools.

- Security: Both platforms utilise robust security measures, including MFA. The app leverages device-specific security features like biometrics.

Ensuring App Security

- Download Only from Official Stores: Avoid third-party download sites.

- Secure Your Device: Use a passcode, fingerprint, or facial recognition lock on your phone.

- Enable App Security Features: Utilise biometric login if available.

- Beware Public Wi-Fi: Avoid accessing sensitive banking information over unsecured public Wi-Fi networks. Consider using your mobile data instead.

The Barclays app aims to provide a seamless experience, ensuring your banking needs are met efficiently, reflecting the broader shift towards digital banking solutions offered by institutions globally, from Chase Online Banking to ANZ Internet Banking.

(Approx. Word Count: 450)

Troubleshooting Common Online & Mobile Banking Issues

Even sophisticated platforms can encounter hiccups. Here’s how to handle common problems with Barclays online and mobile banking.

Login Problems

- Incorrect Credentials: Double-check your User ID, password, and memorable word for typos. Passwords are case-sensitive.

- Forgotten Credentials: Use the “Forgotten User ID” or “Forgotten Password” links on the login page. You’ll need to go through a verification process, likely involving your memorable word or other security details.

- Account Locked: Too many failed login attempts can lock your account for security reasons. You may need to wait a specified period or contact Barclays support to unlock it.

- Technical Glitches: Occasionally, the website or app might be undergoing maintenance or experiencing temporary issues. Check the Barclays website or social media channels for outage announcements. This is a common occurrence across digital banking platforms; comparing reliability might lead users to explore options like PNC Online Banking or Online Banking Bank of America, but Barclays typically maintains high availability.

Transaction Errors

- Payment Failed: Check if you have sufficient funds, if the payee details are correct, and if you’ve exceeded any transaction limits. Ensure you’ve completed any required security verification steps.

- Duplicate Transaction: If a payment appears to have been taken twice, check the transaction dates carefully. Sometimes pending transactions might show up before the final posted transaction appears. If you’re certain it’s a duplicate, contact Barclays immediately.

- Incorrect Amount Sent/Received: Verify the amount entered during the transaction. If an error was made sending money, contact the recipient first. If you received an incorrect amount, contact Barclays.

App Not Responding or Crashing

- Update the App: Ensure you have the latest version of the Barclays app installed from your device’s official app store.

- Restart Your Device: A simple device reboot can often resolve temporary software conflicts.

- Clear Cache (Android): Sometimes clearing the app’s cache (in your phone’s settings) can help.

- Reinstall the App: As a last resort, uninstall and reinstall the app (you’ll need to reactivate it afterwards).

Contacting Barclays Support

If you can’t resolve an issue through self-help:

- In-App Secure Message: Often the most efficient way to get help for non-urgent queries.

- Phone Support: Find the relevant customer service number on the Barclays website or the back of your card. Be prepared to verify your identity.

- Branch Visit: For complex issues or if required by security protocols, visiting a branch might be necessary.

Proactive troubleshooting and knowing how to seek help ensures a smoother online banking and mobile banking experience. While issues like M&T Bank online banking issues or Commonwealth Bank outage online banking can occur with any provider, maintaining up-to-date information and support channels is key.

(Approx. Word Count: 450)

Staying Informed: Banking News and Barclays

The financial world is constantly evolving. Staying informed about developments in digital banking, regulations, and economic trends is important for all customers.

The Impact of Open Banking

As mentioned earlier, Open Banking continues to shape the financial landscape. Barclays’ participation means customers benefit from increased choice and potentially innovative services delivered by third parties, all managed through secure APIs. This trend is global, influencing services from Regions Online Banking to Truist Online Banking and beyond.

Banking Holidays in the UK

- Official Bank Holidays: The UK observes several public bank holidays throughout the year. While Barclays branches will be closed, online and mobile banking services generally remain operational 24/7.

- Payment Processing: However, payments scheduled for a bank holiday, or payments initiated on a holiday that require processing by other banks, may be delayed. Standard payments typically process on the next working day.

- Planning: It’s wise to check the UK bank holiday calendar (

banking holidays 2025or current year) and plan any critical transactions accordingly to avoid delays. This differs from US-specific holidays like Columbus Day (is columbus day a banking holiday). Always refer to official UK government sources for confirmed holiday dates.

General Banking News and Trends

- Digital Transformation: Banks worldwide, including Barclays, continue to invest heavily in digital platforms, enhancing user experience, security, and introducing new features.

- Fintech Competition: The rise of financial technology (Fintech) companies challenges traditional banks, driving innovation and often pushing banks to adopt more agile approaches. Think of platforms like Robinhood Banking offering streamlined investment services.

- Economic Factors: Interest rate changes, inflation, and economic growth influence banking products and services. Staying aware of the broader economic climate helps in making informed financial decisions.

- Regulatory Changes: Updates from regulatory bodies like the Financial Conduct Authority (FCA) can impact banking services and security requirements.

Barclays communicates significant changes or updates through its website, online banking messages, and sometimes direct email or post. Regularly checking these channels ensures you’re aware of relevant developments affecting your banking account.

(Approx. Word Count: 350)

Barclays vs. The Wider Banking Landscape

Understanding how Barclays’ digital offering fits into the broader market provides valuable context. While a detailed comparison is beyond this guide’s scope, we can note key aspects.

Feature Parity and Innovation

Like major global banks such as PNC, Chase, Bank of America, or Wells Fargo, Barclays offers a comprehensive suite of digital services for both personal banking and business banking. Key features like online transfers, bill payments, mobile cheque deposit, and card management are largely standard across these institutions.

- US vs. UK Market: Banks like PNC Banking, Chase Banking, Regions Online Banking, Truist Online Banking, UMB Online Banking, M&T Bank, and Cadence Online Banking operate within the US regulatory and market framework. While core functionalities are similar, specific features, fee structures, and user interfaces differ.

- International Banks: Institutions like ANZ Banking, Westpac Banking, NAB Banking (Australia), or RBC Cross Border Banking (Canada/US) offer digital services tailored to their respective markets. Barclays’ UK focus means its platform is optimised for UK payment systems (Faster Payments, BACS, CHAPS) and regulations.

- Digital Banks & Fintechs: Newer players and challenger banks often focus on specific niches or offer minimalist, app-centric experiences. While they might innovate rapidly in certain areas (e.g., user interface design, specific low-fee international transfers), they may lack the breadth of services or the established infrastructure for complex needs like large-scale commercial banking that traditional banks like Barclays provide.

Barclays’ Strengths

Barclays leverages its long history and extensive network by offering:

- Integrated Services: A platform connecting personal, business, wealth management, and investment banking services (though the online platform focuses primarily on the former).

- Trust and Security: A well-established reputation and significant investment in security infrastructure.

- Omnichannel Experience: Seamless integration between online banking, the mobile app, phone support, and its physical branch network (where available).

The evolution of digital banking means constant competition and innovation. Barclays continually updates its platform to remain competitive against both traditional rivals and newer entrants in the financial services space.

(Approx. Word Count: 350)

Advanced Banking Concepts and Barclays

Understanding a few broader financial terms helps contextualise the services banks like Barclays provide and how they operate.

Investment Banking: This typically refers to services like underwriting securities (stocks and bonds), mergers and acquisitions advisory, and trading for large corporations and governments. Barclays has a significant global Investment Bank division, separate from the retail and business banking services accessed via the online platform. While the online banking tools don’t directly facilitate these services, they are part of the broader Barclays group’s offerings.Velocity Banking: This is a debt-reduction strategy, not a specific banking product. It often involves using a checking account (like a banking account offered by Barclays) as a primary hub, directing all income into it and making loan payments (mortgage, auto) from it, while trying to strategically time payments to reduce the principal balance faster. Barclays’ standard online and mobile banking tools can be used to implement such strategies, but the bank does not offer a specific “Velocity Banking” product. Success depends entirely on the user’s discipline and management.Shadow Banking: This term refers to financial activities and entities that operate outside the traditional, regulated banking system (like deposit-taking banks). Examples include money market funds, hedge funds, and certain types of securitisation. While these activities are crucial to the financial system, Barclays, as a regulated UK bank, operates primarily within the traditional, supervised banking sector. Understanding shadow banking is more relevant for macroeconomic analysis than for daily use of retail banking services.Bad Loans in Banking Industry: These are loans where the borrower is unlikely to repay the principal and interest. Banks manage this risk through careful lending criteria, diversification, and provisions for potential losses. A stable bank like Barclays maintains robust risk management practices to mitigate the impact of bad loans, ensuring its overall health. News about the banking crisis often relates to systemic issues with bad loans.Private Banking: This service is for high-net-worth individuals, offering personalised wealth management, investment advice, and tailored banking solutions. Barclays offers private banking services, which may have dedicated online portals or features distinct from standard online banking, accessible to eligible clients.

(Approx. Word Count: 350)

Conclusion: Mastering Your Barclays Digital Banking

Barclays Bank Online Banking provides a powerful, secure, and convenient platform for managing your financial life in the UK. From the ease of opening a new banking account online to the sophisticated tools available for business banking, the digital offering empowers customers to take control of their finances.

By understanding the registration process, navigating the dashboard, utilising the key features for both personal and business needs, prioritising security, and leveraging the mobile app, you can maximise the benefits of Barclays’ digital services. Staying informed about banking news and understanding how Barclays fits within the evolving digital banking landscape ensures you can make the most of your banking relationship.

Embrace the convenience, prioritise your security, and explore the full capabilities of Barclays online and mobile banking – your gateway to efficient financial management.

(Approx. Word Count: 150)

Sources:

- Barclays UK Official Website: https://www.barclays.co.uk

- Barclays Login Portal: https://www.barclays.co.uk/login/

- Barclays Business Banking: https://www.barclays.co.uk/business-banking/

- Barclays Security Centre: https://www.barclays.co.uk/security/

- UK Government Bank Holidays Information: https://www.gov.uk/bank-holidays

- Financial Conduct Authority (FCA): https://www.fca.org.uk