In today’s fast-paced world, your bank is more than a building; it’s a digital partner. The quality of a bank’s online and mobile platforms can make or break your financial management experience. While giants like Chase banking and Wells Fargo banking often dominate the conversation, regional powerhouses offer compelling alternatives, often with a more personalized touch. Today, we’re diving deep into one such major player: Regions Bank.

- A Glimpse into Regions Bank: Who Are They?

- Regions Online Banking: A Deep Dive into the Desktop Experience

- The Regions Mobile Banking App: Is It Your Pocket-Sized Branch?

- Beyond the Basics: Regions’ Comprehensive Financial Ecosystem

- Analyzing Regions Bank Fees and Account Structures

- How Regions Stacks Up: A Competitive Showdown

- Understanding the Broader Banking Landscape

- Current System Status and Daily Information

- Final Verdict: Is Regions Online Banking the Right Choice for You?

This comprehensive review will dissect every facet of Regions Online Banking. We’ll explore its features, compare it to competitors like PNC banking, analyze its fee structures, and test its mobile banking app’s usability. Whether you’re considering opening a new banking account or are a current customer wondering if you’re getting the most out of the service, this guide is for you. We aim to provide a complete picture, moving beyond a simple feature list to offer a real-world analysis of what it’s like to manage your finances through their digital banking ecosystem.

A Glimpse into Regions Bank: Who Are They?

Before we log in to www.regions.com online banking, let’s get acquainted with the institution itself. Regions Financial Corporation is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services.

Headquartered in Birmingham, Alabama, Regions primarily serves the South, Midwest, and Texas. While they might not have the coast-to-coast physical presence of Bank of America, their robust online banking platform makes them a viable option for customers even outside their primary service areas. Their focus on community involvement and customer service has cultivated a loyal following, but how does that translate to their digital offerings? Let’s find out.

Regions Online Banking: A Deep Dive into the Desktop Experience

The first stop for most users is the main website. A successful internet banking platform must be intuitive, secure, and powerful. Here’s how Regions’ desktop portal stacks up.

The Main Dashboard and Navigation

Upon logging in, you’re greeted with a clean, well-organized dashboard. Your primary accounts—checking, savings, credit cards, and loans—are displayed front and center with their current balances. The layout is modern and uncluttered, a notable improvement over some older, more complex banking portals.

Key features accessible from the main navigation include:

- Account Summary: A snapshot of all your financial products with Regions.

- Payments: This is the hub for Bill Pay, Zelle®, and internal transfers.

- Services: Access stop payments, order checks, and view statements.

- Customer Service: A portal for secure messages, alerts, and finding help.

- Rewards: A look into the Regions Relationship Rewards and Cashback Rewards programs.

The user experience feels streamlined. Finding transaction history, downloading statements, or setting up a new payee for Bill Pay is straightforward. Compared to the sometimes-dense interface of chase online banking, Regions feels slightly more accessible for the less tech-savvy user while still retaining powerful features.

Transfers, Payments, and Financial Movement

The core function of any online banking account is moving money. Regions offers a comprehensive suite of tools for this.

- Internal Transfers: Moving funds between your own Regions accounts is instantaneous and simple. You can schedule future-dated or recurring transfers, which is essential for automated savings plans.

- External Transfers: You can link accounts from other financial institutions to move money in and out. The setup process is standard, requiring micro-deposit verification. The transfer times are typical for ACH, usually taking 1-3 business days. This is an area where all traditional banks, including Regions, are feeling the pressure from fintech solutions like Robinhood banking, which sometimes offer faster transfers.

- Bill Pay: The Bill Pay system is robust. You can add virtually any company or individual as a payee. Electronic payments are quick, while paper checks are mailed for payees not in their network. You can set up eBills to receive your bills directly within the Regions portal, a feature that helps centralize your financial life.

- Zelle® Integration: Like most major US banks, Regions has fully integrated Zelle® for peer-to-peer payments. You can send and receive money with friends and family using just their email or U.S. mobile number. It’s fast, free, and integrated directly into the online banking and mobile banking app, a significant advantage over using a separate P2P payment app.

One crucial term to understand in this context is EFT, meaning in banking Electronic Funds Transfer. This is the broad category that covers everything from direct deposits and Bill Pay to Zelle and wire transfers. Regions’ platform is essentially a sophisticated EFT management tool.

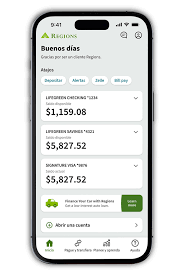

The Regions Mobile Banking App: Is It Your Pocket-Sized Branch?

In an era where using your mobile banking app is the primary way many people interact with their bank, app quality is non-negotiable. A clunky app can be a deal-breaker. We tested the Regions app on both iOS and Android to evaluate its usability, features, and stability.

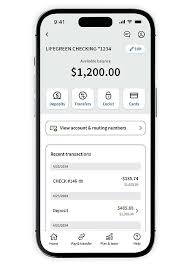

User Interface and Overall Usability

The Regions mobile banking app carries over the clean design of the desktop site. The bottom navigation bar provides quick access to your accounts, payments, check deposit, and more. The app is responsive and loads quickly.

Biometric login (Face ID and fingerprint) is supported and works reliably, saving you from typing your password every time. The experience feels on par with other top-tier apps from competitors like PNC online banking and Truist online banking.

Key Mobile-Only Features

- Mobile Check Deposit: This is a must-have feature, and Regions’ implementation is excellent. The image capture is guided and intuitive, and the processing is generally quick, with clear instructions on when your funds will be available.

- Card Services (Lock/Unlock): This is a standout security feature. If you misplace your debit or credit card, you can instantly “lock” it from the app, preventing any transactions. Find the card? Unlock it just as easily. This provides immense peace of mind.

- Alerts Customization: You can set up a wide array of push notifications directly from the app. Get alerted for low balances, large transactions, deposits, and more. Proactive alerts are a cornerstone of modern digital banking.

There are occasional reports of stability issues, similar to complaints you might see for any major bank, such as “m&t bank mobile banking down” or “commonwealth bank outage online banking.” No platform is perfect. Regions provides a “System Status” page on their website to check for any ongoing service disruptions, which is a transparent and welcome practice.

Beyond the Basics: Regions’ Comprehensive Financial Ecosystem

A bank review is incomplete without looking at the broader product suite. High-value customers and businesses need more than just a checking account. This is where we explore services that often correlate with higher-value financial decisions, from investment banking to commercial banking.

Regions Business Banking Solutions

For entrepreneurs and business owners, a separate business banking platform is critical. Regions offers a tiered approach to serve businesses of all sizes.

- For Small Businesses: They offer a variety of checking accounts designed for different transaction volumes, along with business credit cards and access to merchant services for accepting credit card payments. The online platform for business mirrors the personal one, making it easy to manage both.

- For Commercial Clients: This is where Regions steps into the commercial banking arena. They offer sophisticated treasury management services, commercial loans, and specialized financing for various industries. This direct competition with the business divisions of M&T Bank and PNC shows Regions’ ambition to be a full-service financial partner. Understanding the health of these commercial loan portfolios is key to analyzing a bank’s stability, especially when considering topics like bad loans in the banking industry.

Wealth Management and Private Banking

For individuals with more complex financial needs, Regions provides wealth management and private banking services.

- Regions Investment Solutions: Financial advisors are available to help clients with retirement planning, education savings, and building investment portfolios. While not a pure-play investment banking firm like those on Wall Street, they provide the essential advisory services most individuals need.

- Private Banking: This is a premium service for high-net-worth clients, offering a dedicated relationship manager, preferential rates, and access to more sophisticated credit and investment products. This service competes directly with the private banking arms of national giants like Chase and Bank of America.

Analyzing Regions Bank Fees and Account Structures

Fees can be a major pain point for banking customers. A transparent and fair fee structure is the hallmark of a customer-centric institution.

- LifeGreen Checking Accounts: This is Regions’ flagship line of personal checking accounts. They come with monthly fees that can typically be waived by meeting certain requirements, such as maintaining a minimum daily balance or setting up a qualifying direct deposit.

- eAccess Account: This is an online-focused banking account with a lower monthly fee that is waived simply by making a certain number of purchases with your debit or credit card. It’s designed for users who primarily bank online and want to avoid branch-related fees.

- Overdraft Fees: Like most traditional banks, Regions charges overdraft fees. However, they have introduced services like Overdraft Protection (linking your savings account) and an “Early Pay” feature that can give you access to your direct deposit up to two days early, potentially helping you avoid overdrafts. It’s crucial to read the fee schedule for any account you consider.

The key to a good banking relationship is understanding how to use the products to avoid fees. Regions provides clear paths to do so, but it requires customer diligence.

How Regions Stacks Up: A Competitive Showdown

No bank exists in a vacuum. To truly gauge the value of Regions Online Banking, we must compare it to its peers.

- Regions vs. Chase Banking: Chase Online is a titan in the industry, known for its powerful platform and the highly-regarded Chase Sapphire credit cards. Chase has a larger national footprint and a more dominant position in the credit card market. However, Regions often wins on a more personal customer service experience and can be more competitive with relationship-based interest rates in their local markets.

- Regions vs. PNC Banking: PNC is a very close competitor, especially in overlapping markets in the Southeast and Midwest. Both have strong online platforms. PNC Banking Online is famous for its “Virtual Wallet” tools, which are excellent for budgeting and goal-setting. Regions counters with its robust Relationship Rewards program. The choice between them often comes down to specific product needs and local branch convenience. You can find more on their platform at

www.pncbank.com online banking. - Regions vs. Digital-Only Banks: When compared to fintechs and online-only banks, traditional institutions like Regions often have higher fees and lower interest rates on savings accounts. However, Regions offers a full spectrum of services—mortgages, wealth management, business banking—and the invaluable option of walking into a physical branch for complex issues, something a digital-only bank cannot provide.

Understanding the Broader Banking Landscape

To fully appreciate Regions’ place in the market, it’s helpful to understand a few key industry concepts.

- Open Banking: This is a movement forcing traditional banks to allow customers to share their financial data securely with third-party fintech apps. While more advanced in Europe, it’s influencing U.S. banking, leading to greater integration and competition. A bank like Regions must adapt to this trend to stay relevant.

- Digital Banking vs. Internet Banking: These terms are often used interchangeably. Internet banking typically refers to the desktop website experience, while digital banking is the overarching term that includes the website, the mobile banking app, and all other digital touchpoints.

- Shadow Banking: This term refers to financial activities that happen outside the traditional, regulated banking system. While it sounds ominous, it includes things like money market funds and certain investment vehicles. Understanding this helps appreciate the security and regulation (like FDIC insurance) that comes with a chartered institution like Regions, which is a stark contrast to the shadow banking world.

- Banking Holidays: It’s important to remember that even in the 24/7 world of online banking, the underlying financial system still observes holidays. Transactions like wire transfers and even some ACH transfers will not process on a banking holiday. If you’re wondering “is today a banking holiday?“, you can always check the Federal Reserve’s official schedule. Online access will still be available, but money movement will be paused. We expect the banking holidays 2025 schedule to be similar to this year’s.

Current System Status and Daily Information

For real-time updates on the status of Regions Online and Mobile Banking, it’s always best to check the official source. Issues like the ones that sometimes plague other banks (m&t bank online banking issues) are communicated directly by Regions.

- Live System Status: You can check the official Regions System Status page for any reported outages or maintenance. [Source: Regions Bank Official Website]

- Daily Market News: For general banking news and financial market updates that could affect your investments, reliable sources like The Wall Street Journal or Bloomberg are invaluable. [Source: The Wall Street Journal, Bloomberg]

- Federal Reserve Banking Holiday Schedule: For definitive information on banking holidays. [Source: FederalReserve.gov]

Final Verdict: Is Regions Online Banking the Right Choice for You?

After an exhaustive review, it’s clear that Regions Online Banking is a formidable and highly capable platform. It stands shoulder-to-shoulder with the offerings from the biggest national banks, providing a secure, feature-rich, and user-friendly experience for both personal and business customers.

You should strongly consider Regions if:

- You live in their primary service area and value the option of in-person branch support.

- You want a single institution for a wide range of financial needs, from a basic banking account to wealth management and business services.

- You appreciate a clean, straightforward user interface on both desktop and mobile.

- You can meet the requirements to waive monthly fees on their flagship accounts.

You may want to look elsewhere if:

- Your absolute top priority is earning the highest possible interest rate on your savings, as online-only banks often lead in this area.

- You live far outside their branch network and have no need for in-person services.

- You are looking for highly specialized investment banking or international private banking services.

Ultimately, Regions has successfully navigated the transition to a digital banking-first world. They have built a platform that is not just a utility for managing money but a comprehensive financial hub. It empowers users with the tools they need for daily transactions, long-term planning, and business management, making it a compelling choice in the crowded American banking landscape.