Introduction: The Foundation of Financial Success Starts With the Right Account

Selecting the appropriate banking account represents one of the most crucial financial decisions you’ll make in your lifetime. Whether you’re a recent graduate entering the workforce, a seasoned professional optimizing your wealth management strategy, or a business owner seeking efficient cash flow solutions, your banking relationship fundamentally shapes your financial trajectory.

- Introduction: The Foundation of Financial Success Starts With the Right Account

- Understanding Your Personal Finance Goals Before Choosing an Account

- Types of Banking Accounts and Their Strategic Applications

- Business Banking: Separating Personal and Professional Finances

- The Digital Revolution: Mobile Banking and Online Banking Platforms

- Regional and Specialized Banking Providers

- Fee Structures and How to Minimize Banking Costs

- Security Considerations in Modern Banking

- International Banking Considerations

- Advanced Banking Strategies for Wealth Optimization

- Making the Final Decision: A Step-by-Step Selection Process

- Current Banking Industry Trends Affecting Your Decision

The modern banking landscape has transformed dramatically over the past decade. Traditional brick-and-mortar institutions now compete with innovative digital banking platforms, while specialized services like private banking and commercial banking cater to diverse financial needs. With options ranging from basic checking accounts to sophisticated investment banking products, understanding how to align your account selection with your personal finance goals has never been more important.

This comprehensive guide will walk you through every consideration necessary to make an informed decision about your banking account, exploring various account types, fee structures, technology offerings, and strategic approaches to maximize your financial wellness.

Understanding Your Personal Finance Goals Before Choosing an Account

Defining Short-Term vs. Long-Term Financial Objectives

Before exploring specific banking account options, you must establish clarity around your financial objectives. Your goals typically fall into two categories: short-term needs and long-term aspirations.

Short-term goals might include:

- Building an emergency fund covering 3-6 months of expenses

- Saving for a vacation or major purchase within the next year

- Managing monthly cash flow and bill payments

- Establishing credit history

Long-term goals often encompass:

- Retirement planning and wealth accumulation

- Purchasing property or real estate investment

- Funding children’s education

- Building generational wealth through strategic investing

According to the Consumer Financial Protection Bureau (https://www.consumerfinance.gov/), aligning your banking products with these specific goals increases the likelihood of achieving them by 40% compared to those without clearly defined objectives.

Assessing Your Current Financial Situation

Conduct a thorough assessment of your present financial standing:

Income Analysis: Document all income sources, including salary, freelance work, rental income, or investment returns. This determines which tier of personal banking services suits you best, as many institutions offer enhanced benefits for customers maintaining higher deposit relationships.

Expense Tracking: Understanding your spending patterns helps identify whether you need robust mobile banking features for on-the-go transaction monitoring or prefer comprehensive online banking platforms like chase online banking or pnc online banking for detailed analysis.

Liquidity Requirements: Determine how much cash you need readily accessible versus funds you can commit to longer-term vehicles. This influences whether you prioritize checking accounts, savings accounts, or a combination approach.

Risk Tolerance: Your comfort with financial risk affects whether you lean toward traditional banking relationships or explore newer digital banking options and open banking frameworks.

Types of Banking Accounts and Their Strategic Applications

Personal Checking Accounts: Your Financial Command Center

Checking accounts serve as the hub of daily financial activity, facilitating bill payments, purchases, and cash withdrawals. Modern checking accounts have evolved far beyond basic transaction capabilities.

Standard Checking Accounts provide fundamental services: check writing, debit card access, and ATM availability. Major institutions like Wells Fargo banking, regions online banking, and online banking bank of america offer these accounts with varying fee structures, typically ranging from $5-15 monthly unless minimum balance requirements are met.

Interest-Bearing Checking combines transactional convenience with modest earnings potential. While interest rates on checking accounts historically lag savings vehicles, they’ve become more competitive, with some accounts offering 0.25%-0.50% APY according to recent Federal Reserve data (https://www.federalreserve.gov/).

Premium Checking Accounts cater to high-net-worth individuals, offering enhanced services such as:

- Waived ATM fees worldwide

- Dedicated customer service lines

- Access to private banking specialists

- Relationship benefits across investment banking and wealth management services

- Higher transaction limits for mobile banking operations

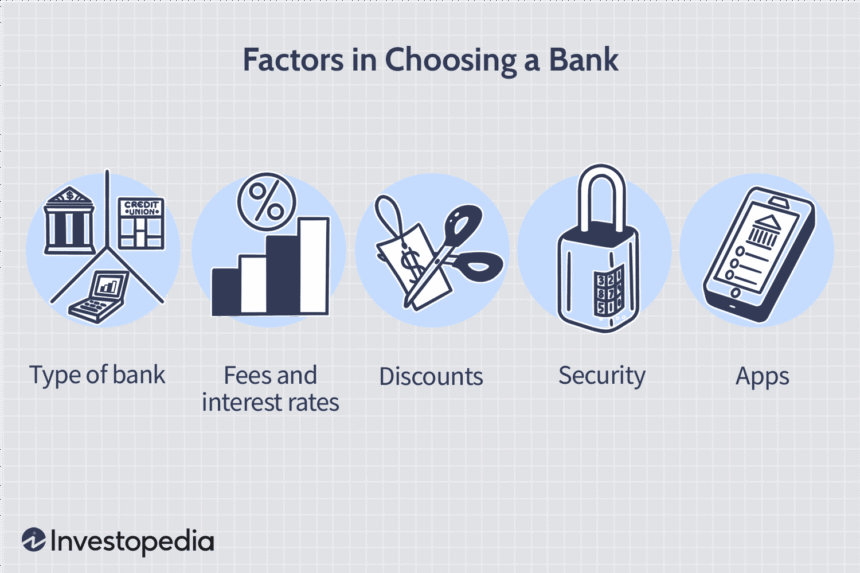

When evaluating checking accounts, examine these critical factors:

- Monthly maintenance fees: Can these be waived through direct deposit, minimum balances, or relationship banking?

- ATM network access: Does the institution participate in surcharge-free networks?

- Overdraft policies: What are the fees, and does the bank offer overdraft protection options?

- Digital capabilities: How robust are the mobile banking and online banking account management tools?

Savings Accounts: Building Your Financial Foundation

Savings accounts represent your first line of defense against financial emergencies and the foundation for achieving medium-term goals.

Traditional Savings Accounts offered by institutions like chase banking, truist online banking, and pnc banking typically provide modest interest rates (0.01%-0.10% APY) but offer FDIC insurance protecting up to $250,000 per depositor.

High-Yield Savings Accounts have revolutionized personal finance by offering significantly higher returns, often 10-20 times traditional rates. Many digital banking platforms specializing in online-only operations minimize overhead costs, passing savings to customers through enhanced interest rates currently ranging from 4.00%-5.00% APY based on recent market conditions.

Money Market Accounts blend checking and savings features, offering check-writing privileges and debit card access while maintaining higher interest rates than standard savings. These work exceptionally well for emergency funds, providing both accessibility and growth.

According to Bankrate (https://www.bankrate.com/), the average American maintains approximately $8,863 in savings accounts, though financial advisors typically recommend significantly higher emergency reserves.

Specialized Banking Accounts for Specific Goals

Certificates of Deposit (CDs): These time-bound savings vehicles offer guaranteed returns in exchange for committing funds for specific periods (3 months to 5 years). Current CD rates range from 4.50%-5.50% for competitive offerings, making them attractive for goals with defined timelines.

Youth and Student Accounts: Designed for younger customers, these accounts typically feature no monthly fees, lower minimum balance requirements, and financial education resources. They serve as excellent training grounds for developing sound money management habits.

Joint Accounts: Ideal for couples, families, or business partnerships requiring shared financial management. These accounts offer multiple access points while maintaining unified transaction histories.

Trust Accounts: For estate planning and wealth transfer purposes, trust accounts provide structured management of assets according to specified terms and beneficiary arrangements.

Business Banking: Separating Personal and Professional Finances

Why Business Owners Need Dedicated Business Banking Accounts

If you operate any form of business—from freelance consulting to retail operations—establishing separate business banking infrastructure is non-negotiable for several critical reasons:

Legal Protection: Maintaining distinct personal and business accounts preserves liability protection for LLC and corporation structures. Commingling funds can expose personal assets to business liabilities.

Tax Compliance: Separate accounts dramatically simplify tax preparation, providing clear documentation of business income and expenses. This reduces audit risk and ensures accurate deduction claims.

Professional Credibility: Business checks and branded debit cards enhance professional image when dealing with clients, vendors, and partners.

Financial Clarity: Distinct accounts provide accurate performance metrics, helping you understand true business profitability versus personal financial health.

Major institutions offering comprehensive business banking solutions include:

- Chase Banking: Offers tiered business checking with varying transaction limits and fees ranging from $15-95 monthly depending on account type and average balances

- Wells Fargo Banking: Provides business checking, merchant services, and small business lending integrated through unified online banking platforms

- PNC Banking: Features business banking accounts with cash flow analysis tools and integrated payroll services through pnc online banking portals

- Regions Online Banking: Delivers business solutions with particular strength in regional markets across the Southeast and Midwest

Commercial Banking for Growth-Stage Businesses

As businesses scale beyond startup phase, commercial banking relationships become essential. These services extend far beyond basic checking and savings:

Lines of Credit: Flexible borrowing arrangements providing working capital for inventory, seasonal fluctuations, or opportunity investments.

Merchant Services: Payment processing infrastructure accepting credit cards, digital payments, and modern transaction methods.

Treasury Management: Sophisticated cash management tools optimizing liquidity, automating payments, and maximizing interest earnings on idle cash.

Commercial Lending: Term loans and equipment financing supporting expansion, real estate acquisition, or major capital investments.

According to the Small Business Administration (https://www.sba.gov/), businesses leveraging comprehensive commercial banking relationships grow 35% faster than those relying solely on basic transaction accounts.

The Digital Revolution: Mobile Banking and Online Banking Platforms

Evaluating Digital Banking Capabilities

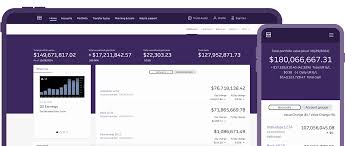

The shift toward digital-first banking has accelerated dramatically, with mobile banking and online banking account access now standard expectations rather than premium features.

Mobile Banking Apps: Top-tier applications like those offered through chase online, pnc online banking, and truist online banking provide:

- Real-time transaction notifications and alerts

- Mobile check deposit capabilities

- Person-to-person (P2P) payment functionality

- Budgeting and spending analysis tools

- Biometric security features (fingerprint, facial recognition)

- Card lock/unlock capabilities for lost or stolen cards

- ATM locators and branch appointment scheduling

When evaluating mobile banking platforms, test these specific features:

- User Interface: Is navigation intuitive? Can you complete common tasks in 3 clicks or fewer?

- Loading Speed: Do screens and transactions process quickly or lag frustratingly?

- Feature Completeness: Can you execute all necessary functions via mobile, or must you switch to desktop for certain operations?

- Security Protocols: What authentication methods are employed? Are they convenient yet robust?

Online Banking Platforms: Comprehensive web-based banking portals excel at complex tasks:

- Detailed transaction searching and export capabilities

- Wire transfer initiation (domestic and international)

- Account statement access and archiving

- Complex bill pay setups with payees and scheduling

- Integration with financial management software like QuickBooks or Mint

The Rise of Digital-First Banks and Open Banking

Digital Banking institutions operate without physical branches, dramatically reducing overhead and passing savings through enhanced interest rates, lower fees, and superior technology experiences. These platforms typically offer:

- No monthly maintenance fees

- High-yield savings rates exceeding traditional institutions by 4-5%

- Extensive fee-free ATM networks through partnerships

- Superior mobile banking experiences as core competency

- 24/7 customer support through digital channels

Open Banking represents a transformative framework allowing customers to securely share financial data with authorized third parties. This enables:

- Account aggregation showing all financial relationships in unified dashboards

- Enhanced lending decisions based on comprehensive financial pictures

- Automated switching between financial products for optimal rates

- Innovative personal finance management tools analyzing spending across all accounts

The European Union pioneered open banking through PSD2 regulations, and similar frameworks are expanding globally, fundamentally reshaping how consumers interact with financial institutions according to McKinsey research (https://www.mckinsey.com/).

Regional and Specialized Banking Providers

National vs. Regional Banks: Weighing the Tradeoffs

National Banking Institutions like Wells Fargo banking, chase online banking, and online banking bank of america offer:

Advantages:

- Extensive branch and ATM networks across the country

- Sophisticated technology platforms with mature mobile banking

- Comprehensive product suites from basic checking to investment banking

- Brand recognition and perceived stability

- Nationwide convenience for frequent travelers

Disadvantages:

- Higher fee structures than regional competitors

- Less personalized service relationships

- More bureaucratic processes for exception handling

- Generic product offerings less tailored to local markets

Regional Banks such as regions online banking and truist online banking provide:

Advantages:

- Stronger community connections and local market knowledge

- More flexible underwriting for loans and credit decisions

- Personalized relationship banking with consistent contacts

- Competitive rates seeking to win market share from national players

- Support for local economic development

Disadvantages:

- Limited geographic footprint for branches and branded ATMs

- Potentially less sophisticated technology platforms

- Fewer specialized services like international banking or investment banking

- May lack 24/7 customer service capabilities

Credit Unions: The Member-Owned Alternative

Credit unions operate as not-for-profit cooperatives owned by members rather than shareholders. This fundamental difference creates distinct value propositions:

- Lower Fees: Without profit maximization pressures, credit unions typically charge fewer and lower fees

- Better Rates: Both loan rates (lower) and deposit rates (higher) tend to favor members

- Personalized Service: Smaller member bases enable relationship-focused banking

- Democratic Governance: Members vote on leadership and policy decisions

- Shared Branching: Cooperative networks allow transactions at thousands of credit union locations nationwide

According to the National Credit Union Administration (https://www.ncua.gov/), credit unions save members an average of $156 annually compared to traditional banking relationships.

Fee Structures and How to Minimize Banking Costs

Common Banking Fees and Avoidance Strategies

Banking fees silently erode wealth, with American consumers paying approximately $34 billion annually in overdraft fees alone according to Consumer Financial Protection Bureau data.

Monthly Maintenance Fees ($5-25/month): Often waivable through:

- Maintaining minimum daily balances (typically $500-2,500)

- Setting up qualifying direct deposits ($500-1,500/month)

- Maintaining combined relationship balances across multiple accounts

- Meeting age requirements (students, seniors)

Overdraft Fees ($30-35 per occurrence): Minimize through:

- Linking savings accounts for overdraft protection

- Opting out of overdraft coverage for debit transactions

- Setting up low-balance alerts through mobile banking

- Maintaining adequate buffer balances

ATM Fees ($2.50-3.50 per out-of-network transaction): Eliminate via:

- Using only in-network ATMs

- Choosing banks with extensive surcharge-free networks

- Utilizing cash-back options when making debit purchases

- Selecting accounts with ATM fee reimbursement programs

Wire Transfer Fees ($15-50 per transfer): Reduce by:

- Using ACH transfers for non-urgent transactions (typically free)

- Leveraging P2P payment platforms for person-to-person transfers

- Consolidating multiple transfers when possible

- Negotiating fee waivers for private banking relationships

Minimum Balance Fees: Charged when accounts fall below specified thresholds. Avoid by maintaining required balances or choosing accounts without minimums.

Paper Statement Fees ($1-5/month): Eliminate by opting for electronic statement delivery through online banking account settings.

The True Cost of “Free” Checking

Many institutions advertise “free” checking accounts, but scrutinize the fine print. These accounts may actually cost more through:

- No interest earnings on deposits

- Limited fee-free ATM access

- Charges for basic services like cashier’s checks or money orders

- Upselling pressure for fee-based services

- Opportunity costs from inferior savings rates on linked accounts

Calculate the total relationship cost across all accounts and services rather than focusing exclusively on checking account fees.

Security Considerations in Modern Banking

Protecting Your Banking Accounts from Fraud and Theft

Financial fraud continues escalating, with the Federal Trade Commission reporting consumers lost $8.8 billion to fraud in recent years (https://www.ftc.gov/). Protecting your banking account requires layered security approaches:

Authentication Protocols:

- Enable multi-factor authentication on all online banking account access

- Use complex, unique passwords for banking (never reused across platforms)

- Leverage biometric authentication features in mobile banking apps

- Consider hardware security keys for ultimate protection

Transaction Monitoring:

- Configure real-time alerts for all transactions above specified thresholds

- Review accounts weekly at minimum through online banking platforms

- Immediately report suspicious activity to your institution

- Monitor credit reports quarterly for unauthorized account openings

Device Security:

- Install and maintain current antivirus/anti-malware software

- Use banking apps only on personal devices, never public computers

- Enable remote wipe capabilities on mobile devices

- Update operating systems and apps promptly

- Avoid banking on public Wi-Fi networks

Social Engineering Protection:

- Never share account credentials via phone, email, or text

- Independently verify requests claiming to be from your bank

- Be skeptical of urgent requests demanding immediate action

- Understand that legitimate banks never request passwords or PINs

Digital Banking Specific Risks: While platforms like chase online, regions online banking, and truist online banking employ bank-grade security, users remain the weakest link. Most breaches result from compromised credentials rather than institutional security failures.

FDIC Insurance and Deposit Protection

The Federal Deposit Insurance Corporation (FDIC) protects deposits up to $250,000 per depositor, per insured bank, for each account ownership category. Understanding these protections ensures your wealth remains secure even if your institution fails.

Coverage Categories include:

- Single accounts: $250,000

- Joint accounts: $250,000 per co-owner

- Retirement accounts (IRA, etc.): $250,000

- Trust accounts: $250,000 per beneficiary

For balances exceeding these limits, consider:

- Distributing deposits across multiple FDIC-insured institutions

- Utilizing different ownership categories within a single institution

- Exploring CDARS (Certificate of Deposit Account Registry Service) programs that spread large deposits across multiple banks while maintaining single-relationship convenience

Credit union deposits receive equivalent protection through the National Credit Union Share Insurance Fund (NCUSIF).

International Banking Considerations

Cross-Border Banking Solutions

For individuals with international financial lives—whether through frequent travel, foreign property ownership, or global business operations—specialized banking capabilities become essential.

International Wire Transfers: Traditional banking account wire transfers incur substantial fees ($40-50 outbound, $15-25 inbound) plus unfavorable exchange rates. Alternatives include:

- Specialized services like TransferWise (Wise) or OFX offering competitive rates

- Multi-currency accounts maintaining balances in several currencies

- International banking platforms specifically designed for global money movement

Foreign Transaction Fees: Standard debit and credit cards often charge 3% on foreign purchases. Seek accounts offering fee-free international transactions for frequent overseas usage.

Multi-Currency Accounts: Some institutions like HSBC, Citibank, and specialized digital banking platforms offer accounts maintaining balances in multiple currencies, eliminating conversion costs for recurring currency needs.

Expatriate Banking: Americans living abroad face unique challenges including:

- FATCA (Foreign Account Tax Compliance Act) reporting requirements

- Difficulty maintaining U.S. banking relationships from overseas

- Currency conversion complexities

- Time zone differences for customer service

Specialized expatriate banking services address these challenges through globally-oriented infrastructure.

Advanced Banking Strategies for Wealth Optimization

Velocity Banking: Accelerating Debt Elimination

Velocity banking represents a strategic approach using lines of credit to accelerate debt payoff while maintaining liquidity. This advanced technique involves:

- Securing a home equity line of credit (HELOC) or similar revolving credit facility

- Depositing income directly against the line of credit

- Using the line for monthly expenses

- Leveraging the average daily balance reduction to minimize interest charges

- Applying savings toward principal debt reduction

This strategy requires disciplined execution and isn’t appropriate for all financial situations, but can potentially save tens of thousands in interest payments while maintaining emergency liquidity according to financial planning research.

Private Banking for High-Net-Worth Individuals

Once assets exceed $250,000-500,000, private banking relationships unlock significant value through:

Dedicated Relationship Managers: Single points of contact coordinating all financial services across banking, investment banking, trust services, and lending.

Enhanced Product Access:

- Premium deposit rates not advertised publicly

- Preferential loan terms and rates

- Alternative investment opportunities

- Structured products customized to specific goals

Lifestyle Services:

- Concierge services for travel, dining, and entertainment

- Priority customer service with 24/7 access

- Invitations to exclusive client events

- Preferential access during banking holidays when standard services may be limited

Integrated Financial Planning: Comprehensive wealth management addressing:

- Tax optimization strategies

- Estate planning coordination

- Philanthropic giving structures

- Intergenerational wealth transfer

- Risk management and insurance analysis

Banking Account Laddering for Optimized Returns

Strategic account laddering maximizes returns while maintaining liquidity through:

- Immediate Access Tier: High-yield savings in digital banking accounts for 1-2 months expenses

- Short-Term Tier: 3-6 month CDs for emergency fund remainder

- Medium-Term Tier: 1-2 year CDs for planned expenses (property taxes, insurance premiums, known purchases)

- Long-Term Tier: 3-5 year CDs for maximum rates on funds not needed soon

As CDs mature, reassess rates and either renew or reallocate based on current market conditions and evolving goals.

Making the Final Decision: A Step-by-Step Selection Process

Step 1: Document Your Requirements

Create a comprehensive requirements document addressing:

- Account types needed: Checking, savings, business banking, investment accounts?

- Geographic requirements: Need for local branches or purely digital relationship?

- Transaction volume: How many monthly transactions across all categories?

- Technology priorities: Must-have mobile banking and online banking features?

- Service preferences: Value personal relationships or comfortable with digital-only support?

- Special needs: International banking, commercial banking, investment banking integration?

Step 2: Research and Compare Institutions

Develop a shortlist of 5-7 candidates including:

- 2-3 national banks (chase banking, wells fargo banking, online banking bank of america)

- 2-3 regional institutions (regions online banking, truist online banking, pnc banking)

- 1-2 digital banking platforms

- 1 credit union if appropriate for your situation

For each candidate, document:

- Fee structures across all relevant products

- Interest rates for deposits and loans

- Technology ratings and reviews

- Customer service reputation

- Branch/ATM availability

- Account opening bonuses or promotional offers

Step 3: Test the User Experience

Before fully committing:

- Download and explore mobile banking apps

- Navigate online banking demo environments

- Visit branches to assess service culture

- Contact customer service with test questions

- Read recent customer reviews on independent platforms

Step 4: Understand the Full Relationship

Recognize that your initial banking account represents just the beginning of a potentially decades-long relationship. Consider the institution’s capabilities in areas you may need eventually:

- Mortgage lending

- Auto loans

- Investment services

- Business banking as your career evolves

- Private banking if wealth accumulation goals are achieved

- Trust services for estate planning

Switching banks creates friction, so selecting an institution capable of growing with you delivers long-term value.

Step 5: Execute the Transition Strategically

When opening new accounts or switching banks:

- Open new accounts first before closing existing relationships

- Transfer automatic payments gradually rather than all at once

- Maintain minimum balances in old accounts during transition period

- Update direct deposits with employers and other income sources

- Monitor both old and new accounts for 60-90 days ensuring nothing falls through cracks

- Document everything including account numbers, routing numbers, and contact information

- Formally close old accounts once confident all transitions completed successfully

Current Banking Industry Trends Affecting Your Decision

The Ongoing Banking Crisis and Institutional Stability

Recent banking news has highlighted institutional vulnerabilities even among established players. The 2023 bank failures, while affecting relatively few institutions, demonstrated important considerations:

Size Doesn’t Guarantee Safety: Several failed institutions ranked among the 20 largest U.S. banks, proving that scale alone doesn’t ensure stability.

Concentration Risk Matters: Institutions heavily exposed to specific industries or asset classes face heightened risk during sector downturns.

Regulatory Classification: Banks under $250 billion in assets face less stringent stress testing and capital requirements than larger “systemically important” institutions.

Deposit Mix: Banks with high percentages of uninsured deposits (exceeding $250,000 FDIC limits) proved more vulnerable to rapid withdrawal during stress.

When evaluating institutions, review:

- Capital ratios (higher is stronger)

- Texas ratio (lower indicates better financial health)

- Recent regulatory ratings

- Deposit composition and concentration

The Federal Reserve provides financial data on all institutions through its National Information Center (https://www.federalreserve.gov/apps/nicpubweb/nicweb/nichome.aspx).