Navigating the financial landscape as a new business in Victoria is akin to charting unknown territory. You need a reliable partner, a financial co-pilot who understands the unique contours of the local market. For many, that search begins and ends with a familiar name: the Bank of Melbourne. But does its business banking offering truly deliver for the ambitious startup? This deep-dive review cuts through the noise to give you the unvarnished truth.

- Why Your Startup’s Banking Choice is More Than Just an Account

- Deconstructing the Bank of Melbourne Business Account Suite

- The Lifeblood of Growth: Business Lending and Finance

- Bank of Melbourne vs. The Competition: A Victorian Startup’s Perspective

- Beyond Transactions: Additional Services for the Growing Business

- The Final Verdict: Is Bank of Melbourne the Best Choice for Your Victorian Startup?

As a top blog writer who has analyzed countless financial institutions, I’ve learned that the right business banking partner can be the rocket fuel for your startup’s growth, while the wrong one can be an anchor dragging you down. In the dynamic ecosystem of digital banking, where mobile banking is no longer a luxury but a necessity, choosing a bank is one of the most critical early decisions you’ll make.

In this exhaustive review, we will dissect the Bank of Melbourne’s business proposition layer by layer. We’ll explore its account structures, lending power, digital banking prowess, and, crucially, its understanding of the Victorian startup spirit. We’ll also stack it up against the competition and provide you with live, actionable insights to inform your decision. This isn’t just another summary; it’s a strategic guide to your company’s financial foundation.

Why Your Startup’s Banking Choice is More Than Just an Account

Before we delve into the specifics of the Bank of Melbourne, let’s establish a fundamental truth: your business bank is not a passive vault for your money. In today’s world, it is an active participant in your operational efficiency, your cash flow management, and your strategic scalability. The rise of open banking and sophisticated digital banking platforms has transformed the bank from a service provider into a integrated technological partner.

For a startup, this is paramount. You need seamless online banking to manage finances on the go, intuitive mobile banking apps to approve payments from a coffee shop, and responsive support when you hit a snag. A single banking holiday shouldn’t bring your accounts payable to a grinding halt. The infrastructure your bank provides will either empower your agility or stifle it. This is the lens through which we must evaluate any potential partner, be it the Bank of Melbourne, a competitor like NAB, or emerging players in the shadow banking sector.

Live Market Intel for Victorian Businesses [Updated Daily]

- Government Grants Alert: The Victorian government has just announced a new round of the “Business Recovery Fund” targeting small to medium enterprises in manufacturing and tech. Applications open next Monday.

- RBA Watch: The Reserve Bank of Australia has held the cash rate steady at 4.35% as of the last meeting. The next decision is closely watched for any signs of relief for business borrowers.

- Bank of Melbourne Update: The bank is currently promoting a limited-time offer on its Business Variable Rate Loan, featuring a 0.5% discount for the first 24 months for new customers who apply online.

Deconstructing the Bank of Melbourne Business Account Suite

Every startup begins with a foundational need: a banking account. The Bank of Melbourne offers a tiered system designed to cater to businesses at different stages. Let’s break down the options that are most relevant for a nascent enterprise.

1. Business Everyday Account

This is the workhorse account, the operational core for most startups. It’s designed for day-to-day transactions, with features aimed at simplifying cash flow management.

- Key Features: Unlimited electronic transactions, which is a significant advantage for businesses with high transaction volumes. Integrated online banking and mobile banking are standard. You also get access to the Bank of Melbourne’s EFTPOS solutions.

- Fee Structure: A monthly account-keeping fee applies, but it is waived if you maintain a minimum monthly balance. This is a common model in business banking, and for a startup watching every dollar, meeting this minimum can be a strategic goal.

- The Startup Verdict: The unlimited electronic transactions are a major win. For a startup scaling quickly, not having to worry about per-transaction fees is a relief. The fee waiver is achievable for many, but it’s crucial to model your cash flow to ensure you can consistently hit that target.

2. Business Maximiser Account

If your startup is already generating significant revenue and you’re looking to make your surplus cash work harder, the Business Maximiser is the investment banking-lite option within a standard business banking framework.

- Key Features: This is an interest-bearing account. It typically offers a tiered interest rate, meaning the more you hold, the higher the rate you might earn. It also includes the same unlimited electronic transactions as the Everyday Account.

- Fee Structure: Like the Everyday Account, it carries a monthly fee that can be waived with a higher minimum balance requirement.

- The Startup Verdict: This account is less about daily operations and more about treasury management. For a startup that has secured a large funding round or has seasonal, high-revenue periods, parking funds in a Maximiser account can generate a modest return. It’s a tool for a slightly more mature startup.

Seamless Integration: The Digital and Mobile Banking Experience

In an era defined by digital banking, a bank’s technological platform can be a deal-maker or breaker. The Bank of Melbourne’s online banking portal and mobile banking app form the frontline of your interaction with them.

Strengths:

- User Interface: The platform is generally clean and intuitive. Moving money, checking balances, and paying invoices is straightforward. It avoids the clunkiness that plagues some legacy internet banking systems.

- Functionality: Key features like BPAY, Pay Anyone, and scheduled payments are all present and reliable. The ability to set up notifications for transactions is crucial for real-time financial awareness.

- Security: Robust security protocols, including two-factor authentication, are in place, aligning with best practices in the banking news cycle regarding cybersecurity.

Areas for Observation:

- While functional, the digital banking experience may not have the sleek, hyper-modern feel of some neobanks or the systems offered by, for instance, Macquarie’s internet banking. It does the job well but isn’t necessarily best-in-class from a user-experience perspective.

- Some users report occasional slowness during peak hours, though widespread outages akin to the much-discussed m&t bank online banking issues are not a common complaint in the Australian context.

The Lifeblood of Growth: Business Lending and Finance

A startup’s journey is paved with investment. Whether it’s for initial fit-out, inventory, or scaling operations, access to capital is critical. The Bank of Melbourne’s lending suite is where its relationship with Victorian businesses gets serious.

Business Loans and Credit Options

The bank offers a range of loan products, from variable and fixed-rate business loans to lines of credit. The application process for a startup can be rigorous, as it is with any major bank. They will scrutinize your business plan, financial projections, and credit history.

- Collateral: Typically, secured loans (backed by assets like property) will attract more favorable interest rates than unsecured loans.

- The “Velocity Banking” Concept: You may hear about strategies like velocity banking in online forums. This is a debt-reduction strategy, not a specific bank product. While it can be a sophisticated financial management technique, it’s complex and requires deep discipline. For a startup, focusing on a clear, traditional loan structure with a reputable bank is often the more prudent path.

The Overlooked Challenge: Bad Loans in the Banking Industry

It’s important to understand the context in which banks operate. The specter of bad loans in banking industry portfolios makes lenders cautious, especially with unproven startups. A strong, well-researched business plan is your best weapon to overcome this institutional hesitancy. Demonstrating a clear path to profitability and a deep understanding of your market can significantly increase your chances of approval.

Bank of Melbourne vs. The Competition: A Victorian Startup’s Perspective

How does the Bank of Melbourne stack up against other players an Australian entrepreneur might consider? Let’s do a quick comparative analysis.

vs. The Big Four (NAB, CommBank, Westpac, ANZ)

As a division of Westpac, the Bank of Melbourne shares much of its backend infrastructure with its parent. However, its key differentiator is its stated focus on Victoria.

- NAB: Often positions itself as the business bank for Australia. Its business banking division is massive and has a strong reputation. NAB’s internet banking and nab internet banking login portals are robust. The choice here may come down to a more personalized, local feel (BoM) vs. a vast, national network (NAB).

- Commonwealth Bank: CommBank is a technology leader, with highly regarded online banking and mobile banking apps. However, they have faced service issues, like the recent commonwealth bank outage online banking that left many businesses stranded. This highlights a key risk of any major provider.

- ANZ Banking: ANZ banking online services are comprehensive. The decision might hinge on specific industry expertise or loan product structuring.

vs. The Digital Challengers (Judo Bank, Tyro)

This is where the landscape gets interesting. Neobanks and specialist business banks like Judo offer a more personalized, relationship-driven approach to lending, often with a faster decision-making process. Their digital banking platforms are built from the ground up to be modern and efficient. However, they may lack the physical presence and full suite of services that a startup might eventually need.

The Bottom Line: The Bank of Melbourne occupies a middle ground—the local brand recognition and branch network of a major bank, with a digital platform that is competent, if not always cutting-edge.

Beyond Transactions: Additional Services for the Growing Business

A modern business banking relationship extends far beyond a checking account.

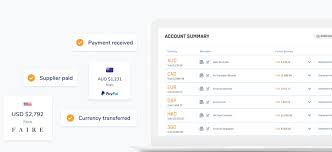

- Merchant Services: Integrating EFTPOS and online payment gateways is seamless.

- Payroll Solutions: The bank offers integrated payroll services, which can save a growing startup significant administrative time.

- International Trade: For startups looking to import or export, the bank provides trade finance, foreign currency accounts, and international payment services—a must in a globalized economy.

The Final Verdict: Is Bank of Melbourne the Best Choice for Your Victorian Startup?

After this comprehensive analysis, the answer is not a simple yes or no. It’s a “it depends.”

Choose Bank of Melbourne if:

- You value a strong Victorian brand identity and potential for local relationship management.

- Your startup will benefit from a physical branch network for cash handling or in-person meetings.

- You want the security and full service suite of a major bank behind you.

- Your transaction volume is high, making the unlimited transactions on their Everyday Account financially advantageous.

Consider other options if:

- Your startup is purely digital and you prioritize a best-in-class, flawless mobile banking experience above all else.

- You are in a high-risk or unconventional industry and may need a more flexible, relationship-based lender like a digital challenger.

- Your primary need is complex investment banking or private banking services from day one.

Actionable Steps Before You Apply

- Model Your Cash Flow: Determine if you can consistently meet the minimum balance to have account fees waived.

- Prepare Your Documents: Have your business plan, financial projections, and identification documents ready. A well-prepared application speaks volumes.

- Schedule a Meeting: Don’t just apply online. Go into a branch and speak with a business banking specialist. Their insight can be invaluable, and it establishes a human connection from the start.

- Read the Fine Print: Understand the terms and conditions, especially for any loan products. Be clear on interest rates, fees, and your obligations.

The journey of a startup is fraught with challenges, but your banking account shouldn’t be one of them. The Bank of Melbourne presents a compelling, locally-focused option for Victorian entrepreneurs. By aligning its strengths with your startup’s specific needs and growth trajectory, you can form a partnership that not only safeguards your capital but actively propels your venture forward.