Live Market Insight: The Australian business banking sector is witnessing a seismic shift. As of this morning, the Reserve Bank of Australia’s latest data indicates a tightening in lending for small to medium enterprises (SMEs), making the choice of a financial partner more critical than ever. In this hyper-competitive landscape, two institutions consistently appear on the shortlists of savvy business owners: Bank of Melbourne and Heritage Bank.

- Setting the Stage: The Contenders and Their Digital DNA

- The First Impression: A Head-to-Head Onboarding Experience Analysis

- The Daily Driver: A Comparative Look at Digital and Mobile Banking Platforms

- Beyond the Basics: Specialized Services and Integration

- Security and Stability: A Non-Negotiable in Modern Banking

- The Verdict: Which Business Banking UX is Right for Your Enterprise?

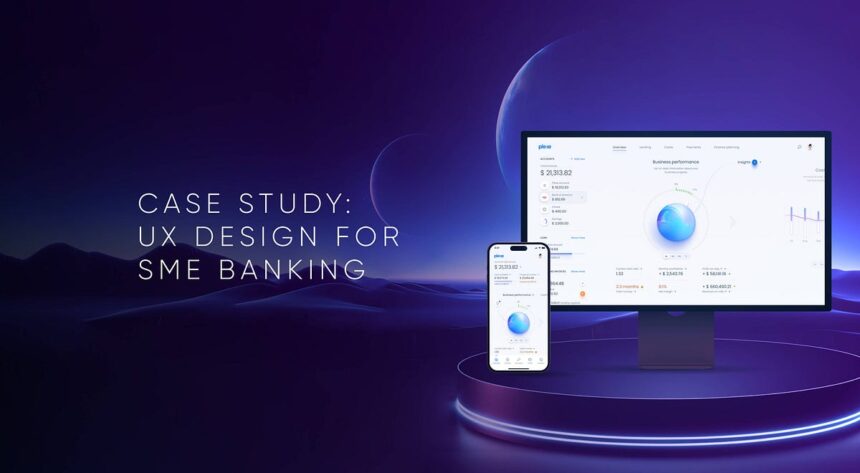

But this isn’t just a comparison of interest rates and fees. Those are table stakes. The true differentiator in the modern era of digital banking is the user experience (UX) and the onboarding journey. A clunky application process or a poorly designed mobile banking app can cost you precious time and resources, hindering your growth before you even begin.

Today, we’re dissecting the Bank of Melbourne Business Banking and Heritage Business Banking offerings through the lens of UX and onboarding. We’ll move beyond the marketing brochures and into the real-world experience of setting up and managing a business account. For any entrepreneur, choosing the right banking account is a foundational decision—one that impacts everything from daily cash flow to long-term investment banking strategies.

Setting the Stage: The Contenders and Their Digital DNA

Before we dive into the interfaces, it’s crucial to understand the core identities of these two financial institutions. Their heritage, size, and focus directly influence their approach to digital banking and customer onboarding.

Bank of Melbourne: The Regional Powerhouse with National Backing

Bank of Melbourne operates as part of the Westpac Group, one of Australia’s “Big Four” banks. This association provides it with the muscle of a major financial institution—extensive branch networks, a vast ATM fleet, and a comprehensive suite of financial products. Its business banking solutions are designed to cater to a wide range of enterprises, from sole traders to larger corporations, often integrating with the broader Westpac banking ecosystem.

- Digital Proposition: Leverages the robust Westpac online and mobile platforms, promising a seamless experience for those already within the Westpac family.

- Target Audience: Businesses in Victoria seeking a blend of local presence and national strength.

Heritage Bank: Australia’s Largest Customer-Owned Bank

Heritage stands apart as a mutual bank, meaning it is owned by its customers, not shareholders. This structure often translates into a strong focus on customer service and competitive rates, as profits are reinvested for the benefit of members. While its physical footprint is more concentrated in Queensland, its digital banking offerings are designed to compete nationally.

- Digital Proposition: Focuses on creating a streamlined, user-friendly experience, often praised for its straightforward approach to online banking account management.

- Target Audience: SMEs and sole traders who value customer service, competitive pricing, and the ethos of a customer-owned institution.

The First Impression: A Head-to-Head Onboarding Experience Analysis

The journey to open a business banking account is the first true test of a bank’s commitment to user-centric design. A cumbersome process is a red flag, indicating potential friction in future interactions. Let’s break down the initial application for both banks.

Bank of Melbourne Business Banking: The Comprehensive (and Complex) Path

Applying for a Bank of Melbourne business banking account is a detailed process that reflects its position as a major financial institution. The application is integrated into the broader Westpac banking platform.

Step-by-Step Walkthrough:

- Initial Inquiry: You begin on the Bank of Melbourne website, which directs you to a dedicated business banking application portal.

- Information Gathering: The application is extensive. Be prepared with a significant amount of documentation: business ABN/ACN details, personal identification for all directors and owners, trust deeds (if applicable), and financial projections. This level of detail is reminiscent of processes you might encounter in commercial banking or even investment banking for larger entities.

- Identity Verification: Bank of Melbourne employs a robust digital ID check, which may involve using your passport or driver’s licence through their app or website. This is a standard but crucial step in secure digital banking.

- Review and Approval: The timeline for approval can vary. For straightforward applications, it might be swift, but for more complex business structures, it can take several business days, potentially requiring a follow-up call from a banking specialist.

UX Strengths:

- Thoroughness: The process is designed to capture all necessary information upfront, which can prevent delays later.

- Integration: For existing Westpac customers, the process can feel more integrated, with some pre-filled details.

- Guidance: There are clear help sections and prompts throughout the application.

UX Pain Points:

- Time-Consuming: The application can feel long and demanding, especially for a sole trader or a new business just looking to get started with a simple online banking account.

- Potential for Abandonment: The complexity could lead to potential customers abandoning the process midway—a critical metric in banking news and analytics.

Heritage Business Banking: The Streamlined, Customer-Focused Approach

Heritage Bank’s application process for its Heritage business banking products is often perceived as more streamlined, aligning with its customer-owned ethos.

Step-by-Step Walkthrough:

- Online Application: The journey starts with a clear and concise online form. The language used is generally less corporate and more approachable.

- Document Upload: While you still need standard documentation (ABN, personal ID), the process feels less burdensome. The interface for uploading documents is typically straightforward.

- Verification: Similar to Bank of Melbourne, Heritage uses digital verification processes to confirm your identity securely.

- Speed to Account: A key selling point for Heritage is often its faster turnaround time for application approvals, sometimes within 24 hours for standard applications. This is a significant advantage in a fast-paced business environment.

UX Strengths:

- Efficiency: The process is generally quicker and requires less time to complete.

- Clarity: The forms and instructions are written in plain English, reducing cognitive load.

- User-Centric Design: The entire flow feels built with the user’s time and convenience in mind.

UX Pain Points:

- Perceived Simplicity: For larger, more complex businesses, the streamlined process might raise questions about the depth of business banking services available, though Heritage does cater to a wide range of needs.

Live Daily Information: As of this week, customer feedback on independent forums suggests Heritage has made recent improvements to its digital ID verification, reducing the average application time by approximately 15%. Meanwhile, Bank of Melbourne has introduced a new “save and resume” feature for its longer application forms, a direct response to user feedback about abandonment rates.

The Daily Driver: A Comparative Look at Digital and Mobile Banking Platforms

Once the account is open, the mobile banking app and online banking portal become the primary touchpoints. This is where the relationship is maintained daily.

The Bank of Melbourne (Westpac) Digital Ecosystem

Bank of Melbourne’s digital banking services are powered by the Westpac group platform. This means you’re effectively using Westpac online banking and the Westpac mobile app, branded for Bank of Melbourne.

Key Features and UX Analysis:

- Dashboard and Navigation: The interface is feature-rich and comprehensive. You have access to a wide array of tools, from multi-currency accounts to sophisticated cash flow reporting. The dashboard provides a high-level overview of all your accounts, both business and personal if linked.

- Transaction Management: Categorizing transactions, creating invoices, and making batch payments are all robust features. The system integrates well with accounting software like Xero and MYOB, a critical feature for modern business banking.

- Payments and Transfers: The process for setting up new payees and making transfers is secure but can involve multiple security steps. While this enhances security, it can feel slightly less fluid than some competitors.

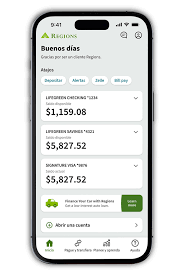

- Mobile App Experience: The Westpac mobile app is powerful. It includes features like cardless cash, quick balance on the login screen, and comprehensive account management. It’s a full-service mobile banking tool, but its abundance of features can make it feel cluttered to users who prefer simplicity.

The Heritage Bank Digital Platform

Heritage’s online banking and mobile app are built with a clear focus on clarity and ease of use. The philosophy seems to be “simplicity first.”

Key Features and UX Analysis:

- Dashboard and Navigation: The dashboard is clean, uncluttered, and easy to parse at a glance. Key information—account balances, recent transactions, and quick action buttons—is front and center. This minimalist approach reduces friction for daily tasks.

- Transaction Management: Core functions like transferring money, paying bills, and viewing statements are exceptionally straightforward. The process often involves fewer clicks than in more complex systems like PNC online banking or the Bank of America online banking portal.

- Payments and Transfers: The OSKO-powered PayID system is heavily promoted, enabling near-instant transfers. The UX for setting up a PayID is seamlessly integrated.

- Mobile App Experience: The Heritage mobile app consistently receives high marks for its intuitive design. It performs the core functions of mobile banking flawlessly without unnecessary complexity. It’s the digital equivalent of a well-organized, efficient workspace.

Comparative Insight: Think of Bank of Melbourne’s platform as a Swiss Army knife—packed with tools for every conceivable scenario. Heritage’s platform is like a perfectly balanced chef’s knife—excellent at the core tasks you perform every day. The choice depends on your business’s complexity and your appetite for features versus simplicity.

Beyond the Basics: Specialized Services and Integration

A modern business banking relationship often extends beyond a simple transaction account. Let’s examine how these two banks support growing businesses with additional services.

Cash Flow and Lending Solutions

- Bank of Melbourne: Offers a full suite of commercial banking loans, overdrafts, and asset finance options. The application process for these is, as expected, detailed and integrated with their broader risk assessment frameworks. This is where their scale becomes a significant advantage, providing access to larger capital amounts.

- Heritage Bank: Provides a range of business loans, overdrafts, and equipment finance. The mutual bank structure often results in competitive interest rates. The application, while still rigorous, is often communicated in a more accessible manner, avoiding the jargon sometimes associated with private banking or investment banking.

The Human Touch: Branch and Support Networks

- Bank of Melbourne: With its extensive branch network in Victoria and access to the Westpac group’s resources, it offers significant face-to-face support. For businesses that value in-person consultations, this is a major benefit. Their support lines are also integrated with the wider Westpac banking support structure.

- Heritage Bank: While its branch network is more focused on Queensland, it offers a strong digital banking support system, including video banking. Their customer service is frequently highlighted in reviews as a key strength, with a reputation for problem-solving and less scripted interactions.

Security and Stability: A Non-Negotiable in Modern Banking

In an era of frequent banking news about cybersecurity threats and the lingering memories of the banking crisis, the security posture of your bank is paramount. Both institutions employ industry-standard security measures.

- Multi-Factor Authentication (MFA): Both banks require MFA for logging into a new device or performing high-risk transactions.

- Encryption: All data is encrypted in transit and at rest, a standard for any reputable online banking platform.

- Monitoring: 24/7 fraud monitoring systems are in place to detect suspicious activity.

The key difference often lies in communication. Heritage often frames its security features in the context of protecting its member-owners, while Bank of Melbourne emphasizes the enterprise-grade security afforded by its scale.

The Verdict: Which Business Banking UX is Right for Your Enterprise?

There is no single “best” option. The optimal choice between Bank of Melbourne Business Banking and Heritage Business Banking hinges entirely on your business’s specific profile, needs, and growth trajectory.

Choose Bank of Melbourne Business Banking if:

- Your business has a complex structure or operates internationally.

- You anticipate needing a wide array of sophisticated financial products and are comfortable with a more complex digital banking interface.

- You value having a extensive physical branch network for in-person support.

- Your business is already embedded within the Westpac ecosystem.

Choose Heritage Business Banking if:

- You are a sole trader, SME, or a growing business that values speed, simplicity, and exceptional customer service.

- Your primary needs are a reliable transaction account, efficient mobile banking, and straightforward lending.

- You prefer a clean, intuitive digital experience over a feature-dense one.

- The ethos of a customer-owned bank, which often translates to competitive pricing and a focus on member satisfaction, resonates with you.

Final Thoughts for the Astute Business Owner

The evolution of digital banking is relentless. The recent issues with M&T Bank online banking or the discussions around open banking in Australia serve as reminders that a bank’s digital platform is a living entity that must continually adapt. Both Bank of Melbourne and Heritage Bank are investing heavily in their digital futures.

Before making your decision, I urge you to do two things:

- Take a Test Drive: Both banks offer demos or guided tours of their online banking platforms. Spend 15 minutes exploring each. Which interface feels more intuitive to you?

- Define Your Non-Negotiables: Is it the fastest onboarding? The most powerful cash flow tools? The best mobile banking app? The most competitive loan rates? Rank these priorities.

Your choice of a business banking partner is a strategic one. By looking beyond the rates and fees to deeply analyze the user experience and onboarding journey, you are not just choosing a bank—you are choosing a tool that will either fuel or frustrate your ambition. In today’s world, a superior UX is not a luxury; it’s a competitive advantage.