Choosing a business banking partner is one of the most foundational decisions you’ll make as a small business owner. It’s not just about finding a place to park your cash; it’s about establishing a financial relationship that can support your growth, streamline your operations, and provide you with the tools you need to thrive. Your banking account is the central nervous system of your company’s finances.

- At a Glance: Chase vs. PNC Quick Comparison

- Deep Dive: Business Checking Accounts

- Mobile and Digital Banking Experience

- Lending, Credit, and Financial Growth

- Today’s Banking Snapshot & Market Pulse (As of October 26, 2023)

- Branch Network and Physical Presence

- Specialized Services: Treasury, Investment, and The Future

- Who is Chase Best For?

- Who is PNC Best For?

- Final Verdict: Making Your Choice

In the vast landscape of American finance, two names consistently rise to the top for small businesses: Chase and PNC. Both are banking titans with extensive networks and a comprehensive suite of services. But which one is the right fit for your business?

This isn’t a simple question with a one-size-fits-all answer. The ideal choice depends on your business model, transaction volume, geographic location, and future growth ambitions. Are you a high-volume retailer who needs robust merchant services? A digital nomad who lives and breathes mobile banking? Or a service-based business looking for a simple, low-fee online banking account?

In this ultimate showdown, we’ll dissect every facet of Chase banking and PNC banking for US small businesses. We will go beyond the marketing brochures to give you the granular detail needed to make an informed, confident decision. Let’s get started.

At a Glance: Chase vs. PNC Quick Comparison

| Feature | Chase for Business | PNC for Business |

|---|---|---|

| Best For | Businesses seeking a massive national footprint, premium credit card rewards, and integrated merchant services. | Businesses in the East and Midwest, those seeking advanced treasury management, and those who value a strong relationship-based approach. |

| National Reach | Over 4,700 branches in 48 states. One of the largest ATM networks. | Over 2,600 branches, primarily in 27 states (East Coast, South, Midwest). |

| Core Checking | Chase Business Complete Banking® | PNC Business Checking / PNC Business Checking Plus |

| Digital Tools | Highly-rated Chase online banking & mobile app. Zelle integration. | Robust PNC online banking (Cash Flow Insight®), strong mobile banking app. |

| Key Strength | Unmatched scale, convenience, and a powerful ecosystem of products (especially credit cards). | Sophisticated cash flow management tools and a personalized, advisory approach for growing businesses. |

| SBA Lending | A top SBA 7(a) lender, known for high volume. | A preferred SBA lender with a strong reputation. |

Deep Dive: Business Checking Accounts

The cornerstone of any business banking relationship is the checking account. It’s where your revenue lands and your expenses are paid. Let’s break down the primary offerings from both institutions.

Chase: The Power of Simplicity and Scale

Chase’s flagship product is the Chase Business Complete Banking® account. This account is designed to be an all-in-one solution, integrating a checking account with payment acceptance capabilities.

- Monthly Fee & Waivers: The monthly fee is typically $15. However, it’s relatively easy to waive. You can do so by maintaining a minimum daily balance (check Chase’s site for the current amount, usually around $2,000), making a certain amount in purchases on a linked Chase Ink Business credit card, or depositing a specific amount from Chase QuickAccept℠ transactions. This flexibility is a major plus for new businesses.

- Transactions: You get 100 fee-free transactions per month. This is a crucial number to know. If you’re a high-volume business, you’ll want to watch this limit closely.

- Cash Deposits: This is a critical factor for brick-and-mortar businesses. The account typically includes up to $5,000 in fee-free cash deposits per month. For many small businesses, this is adequate, but for cash-heavy operations like restaurants or laundromats, it could be a limitation.

- Integrated Payments: A standout feature is the built-in Chase QuickAccept, which allows you to accept card payments via a mobile app or a physical card reader. The funds are often available the same day, a significant cash flow advantage.

For larger businesses, Chase offers Performance Business Checking and Platinum Business Checking, which come with higher transaction limits, higher cash deposit allowances, and waived fees on other services, but require much higher balances to avoid hefty monthly fees. These accounts move into the realm of commercial banking.

PNC: The Analyst’s Choice for Cash Flow

PNC takes a slightly different, more analytical approach, especially with its integrated tools. Their main offerings start with PNC Business Checking and PNC Business Checking Plus.

- Monthly Fee & Waivers: The basic

PNC bankingaccount often has a monthly fee around $12, which can be waived by maintaining an average monthly balance (e.g., $1,500) or using a linked PNC business credit card. The requirements are comparable to Chase’s at the entry level. - Transactions: The entry-level account typically offers 150 fee-free transactions, which is a slight edge over Chase’s 100. The “Plus” account boosts this to 500, making it a better fit for businesses with moderate transaction volume.

- Cash Deposits: PNC generally offers a similar fee-free cash deposit limit of $5,000 per month on its entry-level accounts, with higher limits on its more premium tiers.

- Cash Flow Insight®: This is PNC’s killer app and a major differentiator. Integrated directly into your

PNC online bankingdashboard, this tool provides sophisticated cash flow analysis and forecasting. You can see projected cash surpluses or gaps, create budgets, and manage payables and receivables all in one place. For a business owner who wants deep financial intelligence without investing in separate software, this is an incredibly powerful feature of theirdigital bankingecosystem.

For businesses scaling further, PNC offers Treasury Enterprise Plan and Analysis Business Checking, which provide advanced treasury management services often associated with private banking or large-scale commercial banking.

Verdict: For a new business prioritizing simplicity and a massive physical footprint, Chase is hard to beat. For a business owner who geeks out on data and wants powerful, built-in tools to manage and forecast cash flow, PNC’s Cash Flow Insight® gives it a distinct advantage.

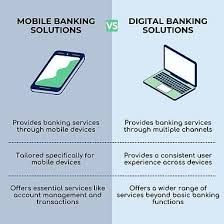

Mobile and Digital Banking Experience

In today’s world, your bank is in your pocket. A clunky app or a confusing website can be a major source of friction. The quality of a bank’s mobile banking and online banking platforms is paramount.

Chase Online and Mobile Banking

The Chase online banking experience is widely regarded as one of the best in the industry. The platform is clean, intuitive, and fast.

- User Interface: The Chase for Business mobile app is highly rated on both iOS and Android. It’s easy to navigate, allowing you to check balances, pay bills, transfer funds, and deposit checks with your phone’s camera.

- Features: Key features include Zelle® for business payments, security alerts, and seamless integration with Chase credit cards and merchant services. The ability to manage your personal and

business bankingwith a singlechase onlinelogin is a huge convenience for many entrepreneurs. - Reliability: While no system is perfect (as occasional

m&t bank online banking issuesor acommonwealth bank outage online bankingscare can attest), Chase’s digital infrastructure is famously robust and reliable.

PNC Online Banking and Mobile App

PNC has invested heavily in its digital presence, and it shows. The pnc online banking portal is powerful, especially when you factor in its unique tools.

- User Interface: The PNC Mobile Banking app is also well-designed and feature-rich. It covers all the essential functions: mobile check deposit, bill pay, and fund transfers.

- Features: As mentioned, the integration of Cash Flow Insight® is the star. Being able to access these powerful analytics

using your mobile banking appis a game-changer. PNC also offers Zelle® and robust security features. You can easily navigate from your businessbanking accountto other products via thewww.pncbank.com online bankingportal. - Business-Specific Tools: PNC’s digital tools feel more purpose-built for business. The ability to set up different levels of user access for employees is granular and well-executed, a feature often needed as a business grows.

Verdict: This is incredibly close. Chase wins on overall polish, speed, and the unified experience if you’re already in their consumer ecosystem. PNC wins for its business-specific analytical tools that are baked directly into the platform, offering more than just basic banking functions.

Lending, Credit, and Financial Growth

A bank’s true value as a partner is often revealed when you need capital to grow. This includes business credit cards, lines of credit, and term loans, including those backed by the Small Business Administration (SBA).

Chase: A Lending Powerhouse

- Business Credit Cards: Chase’s Ink Business card lineup is legendary. Cards like the Ink Business Preferred®, Ink Business Cash®, and Ink Business Unlimited® offer some of the best rewards structures on the market, especially for common business expenses like travel, advertising, and internet services. The Ultimate Rewards points are incredibly valuable and flexible.

- SBA Loans: Chase is consistently one of the top SBA 7(a) lenders in the country by volume. This means they have a streamlined process and a deep understanding of the SBA’s requirements. If you’re seeking an SBA loan, having your primary

business bankingrelationship with a top lender can be a significant advantage. - Lines of Credit: Chase offers both business and commercial lines of credit to help businesses manage short-term cash flow needs.

PNC: A Relationship-Based Lending Approach

- Business Credit Cards: PNC also offers a solid lineup of business credit cards with cash back and points options. While perhaps not as famous as Chase’s Ink cards, they are competitive and integrate perfectly within the

PNC bankingecosystem. - SBA Loans: PNC is also an SBA Preferred Lender, meaning they have the authority to make final credit decisions on behalf of the SBA, which can speed up the loan approval process. They often pride themselves on a more hands-on, advisory approach to lending.

- Asset-Based Lending: For larger businesses, PNC has a strong reputation in asset-based lending, allowing companies to borrow against assets like accounts receivable or inventory. This is a key part of their

commercial bankingdivision.

Verdict: For the sheer power of its credit card rewards ecosystem and its massive volume in SBA lending, Chase has a slight edge, especially for businesses that can leverage those rewards. However, businesses looking for a more consultative and relationship-focused lending experience may prefer PNC’s approach.

Today’s Banking Snapshot & Market Pulse (As of October 26, 2023)

Live Information Notice: The financial world moves quickly. Interest rates, offers, and economic data change daily. The information below is a snapshot for today. Always visit the banks’ official websites for the most current and accurate data.

- Federal Reserve Watch: The market is currently anticipating the Federal Reserve’s next move on interest rates. This directly impacts the rates banks offer on savings accounts and charge for loans. Current sentiment suggests a pause, but inflation data remains a key variable. This is the most significant piece of

banking newsfor business owners right now. - Is Today a Banking Holiday? No, today is not a banking holiday. Banks are open. The next federal banking holiday is Veterans Day. When planning your finances, it’s wise to keep a calendar of

banking holidays. Looking ahead,banking holidays 2025will include the standard federal holidays like New Year’s Day, Martin Luther King, Jr. Day, etc. Note thatis columbus day a banking holidayis a common question; yes, it is a federal banking holiday, though some banks may choose to remain open. - Current APY Examples (for illustrative purposes):

- Chase Business Savings: Typically offers a very low standard APY, but relationship rates can be slightly higher. Check their site for current tiered rates.

- PNC Business Money Market: Often offers a tiered APY that becomes more competitive at higher balance levels. Check their site for today’s Premier Money Market rates.

- EFT Meaning in Banking: You’ll see this term often. EFT stands for Electronic Funds Transfer. It’s a broad term that covers any transfer of funds initiated through an electronic terminal, including ACH transfers (direct deposit, bill pay), wire transfers, and ATM transactions.

Branch Network and Physical Presence

While digital banking is king, the importance of a physical branch cannot be overstated, especially for businesses that handle cash, need notary services, or value face-to-face conversations with their banker.

- Chase: With over 4,700 branches across 48 of the 50 states and one of the largest ATM networks, Chase’s physical presence is nearly ubiquitous in the United States. If you travel for business or have operations in multiple states, this massive network is a compelling advantage.

- PNC: PNC’s footprint is more concentrated. With around 2,600 branches, they have a very strong presence on the East Coast, in the South, and throughout the Midwest. However, they are largely absent from the West Coast. If your business is located in or primarily serves these regions, PNC’s network is more than sufficient. But if you’re in California or Washington, you’ll be relying entirely on their

digital bankingtools.

Verdict: For nationwide coverage, Chase is the undisputed champion. This isn’t just a win; it’s a knockout. For businesses operating solely within PNC’s territory, it’s a non-issue, but for national ambitions, Chase’s network is a significant factor.

Specialized Services: Treasury, Investment, and The Future

As your business grows, its financial needs become more complex. This is where specialized services come into play, touching on areas like investment banking and advanced treasury management.

- Chase: Through its J.P. Morgan arm, Chase offers an incredible depth of services for large and scaling companies. This includes everything from

private bankingand wealth management for business owners to sophisticatedinvestment bankingservices like M&A advisory and capital markets access. For a small business with ambitions to become a large enterprise, Chase offers a clear and proven upward path. - PNC: PNC is no slouch here, either. Their Treasury Management division is highly respected and provides a suite of tools designed to optimize working capital, manage payments, and mitigate risk. Their approach is often more consultative and tailored for mid-market companies. They focus on being the primary

banking accountand financial brain for established businesses.

The Future: Open Banking and Digital Evolution

The concept of open banking — where banks allow third-party developers to access financial data through secure APIs — is reshaping the industry. It promises a future where you can connect your banking account to a vast ecosystem of fintech apps for accounting, investing (like robinhood banking), and financial planning.

Both Chase and PNC are actively participating in this evolution. Their robust API strategies are crucial for ensuring their platforms remain central to their customers’ financial lives. The future of business banking will be less about the bank as a silo and more about the bank as a secure, connected hub. This trend is visible globally, with institutions from ANZ banking in Australia to Barclays Bank online banking in the UK embracing this new paradigm.

Who is Chase Best For?

You should strongly consider Chase banking if:

- Your business operates nationwide or you travel frequently.

- You want access to the best-in-class business credit card rewards program.

- You value the convenience of a massive ATM and branch network.

- You are already a Chase personal banking customer and want a unified experience.

- You plan to seek an SBA loan and want to work with a high-volume lender.

Who is PNC Best For?

PNC banking might be the ideal choice if:

- Your business is located within PNC’s primary service area (East, South, Midwest).

- You are a data-driven owner who would greatly benefit from the built-in Cash Flow Insight® tools.

- You have moderate-to-high transaction volume and can benefit from their 500 free transactions tier.

- You prefer a more relationship-based, consultative approach to banking and lending.

- You need advanced treasury management features as your business scales.

Final Verdict: Making Your Choice

There is no single “winner” in the Chase vs. PNC showdown. The “best” bank is the one that best aligns with your specific needs.

Chase is the financial equivalent of a national superstore. It has everything, it’s everywhere, and its core products are streamlined for mass-market efficiency and appeal. Its digital tools are slick, and its credit card ecosystem is a powerhouse.

PNC is more like a high-end specialty advisor. It offers a more focused, analytical toolkit designed to give business owners deep financial intelligence. Its strength lies not just in its products, but in how it helps you use them to make smarter decisions.

Your Action Plan:

- Analyze Your Needs: Quantify your monthly transactions, average cash deposits, and daily balance. Where is your business located and where will it be in five years?

- Explore Their Websites: Dive deep into the current fee schedules and account terms on their official sites. Information changes.

- Speak to a Banker: Visit a local branch of both banks. Talk to a business banker. Ask them to make the case for why their bank is a better fit for your specific business model. The quality of this interaction can tell you a lot about the bank’s culture and its approach to

business banking.

Ultimately, choosing between Chase and PNC is a good problem to have. Both are top-tier institutions that can serve a small business well. By doing your homework and aligning their strengths with your business’s unique profile, you will establish a financial partnership that serves as a launchpad for your success.

Source Links: