Choosing a bank is one of the most significant financial decisions you’ll make. It’s more than just a place to stash your cash; it’s a partnership that can influence your ability to buy a home, start a business, and build wealth. In the United States, two names loom larger than most: JPMorgan Chase and Wells Fargo. These are not just banks; they are sprawling financial empires with a presence on nearly every street corner and in every digital wallet.

- A Head-to-Head Battle of Banking Titans: Chase vs. Wells Fargo

- Personal Banking: Accounts for Every Stage of Life

- The Digital Frontier: Mobile and Online Banking Experience

- Powering Ambition: Business Banking and Commercial Solutions

- Growing Your Wealth: Investment and Private Banking Services

- The Elephant in the Room: Reputation, Scandals, and Customer Trust

- A Global and Cross-Border Perspective

- Practical Considerations: Accessibility, Fees, and Holidays

- The Future of Banking: Trends to Watch

- Final Verdict: Who Wins the Crown?

- Frequently Asked Questions (FAQ)

But which one is the right choice for you? The answer is complex, wrapped in layers of product offerings, digital capabilities, customer service reputations, and a history of both triumph and controversy. This comprehensive guide will dissect these two titans of American finance, going far beyond a simple comparison of checking accounts. We’ll explore everything from personal banking and business banking to the exclusive world of private banking and complex investment banking services. Whether you’re opening your first banking account or you’re a seasoned entrepreneur managing a commercial enterprise, this analysis will provide the clarity you need.

A Head-to-Head Battle of Banking Titans: Chase vs. Wells Fargo

Before we dive deep, let’s set the stage. JPMorgan Chase & Co. is the largest bank in the United States by assets, a behemoth with a powerful brand synonymous with premium credit cards and a robust digital banking platform. Wells Fargo, while smaller, boasts a larger retail footprint, with more physical branches than any other bank in the country, making it a cornerstone of communities from coast to coast.

Their rivalry represents a fundamental choice for consumers: do you prioritize cutting-edge technology and a vast, integrated financial ecosystem (Chase), or do you value unparalleled physical accessibility and a deep-rooted community presence (Wells Fargo)?

At a Glance: Key Differences and Similarities

| Feature | JPMorgan Chase | Wells Fargo |

|---|---|---|

| Total Assets (Approx.) | ~$3.9 Trillion | ~$1.9 Trillion |

| U.S. Branches (Approx.) | ~4,700+ | ~4,500+ |

| ATM Network | ~15,000+ | ~12,000+ |

| Primary Strength | Technology, Credit Cards, Investment | Widespread Branch Network, Mortgages |

| Mobile App Rating (Avg.) | 4.8 Stars | 4.8 Stars |

| Key Offerings | Chase Online Banking, Sapphire/Freedom Cards | Nationwide Mortgage Lending, Small Business |

(Note: Live daily information on asset sizes, branch counts, and market data can fluctuate. Always consult the banks’ investor relations pages for the most current figures.)

Sources:

Personal Banking: Accounts for Every Stage of Life

For most people, the journey begins with a simple checking or savings account. This is the foundation of your financial life, and both banks offer a tiered range of products designed for students, everyday professionals, and high-net-worth individuals.

Checking Accounts: The Daily Driver

Your checking account is your financial workhorse. It’s where your paycheck lands and from which your bills are paid.

- Chase: The flagship account is Chase Total Checking®. It has a monthly fee that is relatively easy to waive with a qualifying direct deposit or by maintaining a minimum daily balance. Chase’s ecosystem shines here; the checking account seamlessly integrates with its credit cards and investment platforms through a single chase online login. This interconnectedness is a major draw for customers who want a holistic view of their finances.

- Wells Fargo: The primary offering is the Wells Fargo Everyday Checking account. Like Chase, it comes with a waivable monthly fee based on similar criteria. A key differentiator for Wells Fargo banking has historically been its massive branch network, offering a sense of security and in-person support that many still value.

For those with more substantial balances, both banks offer premium checking accounts (e.g., Chase Sapphire™ Banking, Wells Fargo Premier) that come with added perks like waived ATM fees worldwide, higher interest rates, and dedicated customer service lines.

Savings Accounts and Wealth Accumulation

When it comes to standard savings accounts, neither Chase nor Wells Fargo is known for offering chart-topping interest rates. Their rates are typically low, reflecting the reality of large brick-and-mortar institutions.

However, where they compete is in convenience and relationship benefits. Linking a savings account to your checking account makes transfers effortless and can help you avoid monthly fees. For serious saving, many financial advisors would suggest looking at high-yield savings accounts from online-only banks, but for emergency funds or short-term goals, the convenience of having your savings at your primary mega-bank can’t be ignored.

The Digital Frontier: Mobile and Online Banking Experience

In today’s world, your bank is in your pocket. A superior mobile banking app can be a deciding factor, and this is an area where the competition is fierce. The quality of a bank’s digital banking platform is paramount, affecting everything from simple transfers to complex investment trades.

The Chase Mobile App & Chase Online Banking

Chase has invested billions into its technology and it shows. The Chase Mobile® app is widely regarded as one of the best in the industry. Its interface is clean, intuitive, and powerful.

Key Features:

- Unified Dashboard: View checking, savings, credit card, mortgage, and investment balances in one place.

- Chase QuickDeposit℠: Deposit checks with your phone’s camera.

- Zelle® Integration: Send and receive money from friends and family quickly.

- Credit Journey: Monitor your credit score for free.

- Seamless

chase online banking: The desktop experience mirrors the app’s functionality, making for a consistent user experience whether you’re at home or on the go.

The stability and comprehensive nature of the chase banking online platform make it a primary reason many customers choose and stay with Chase.

The Wells Fargo Mobile App & Online Portal

Wells Fargo has made significant strides to catch up and, in many areas, match Chase’s digital prowess. The Wells Fargo Mobile® app is also highly-rated and packed with features.

Key Features:

- Card-Free ATM Access: Use your app to get cash from a Wells Fargo ATM without your physical debit card.

- FICO® Score Access: Eligible customers can view their FICO credit score for free.

- Control Tower®: A digital dashboard to see where your card information is being used for recurring payments and online merchants, giving you greater control over your digital financial footprint.

Technology and Reliability: A Critical Factor

The importance of a stable online platform cannot be overstated. Occasional outages can be a major headache for customers. We’ve seen reports of issues across the industry, such as users searching for “m&t bank online banking issues” or “m&t bank mobile banking down,” which highlights the fragility of these complex systems. While no bank is immune, both Chase and Wells Fargo have massive, dedicated technology teams focused on ensuring uptime and security for their internet banking services. Their investment in robust infrastructure is a key advantage over smaller regional banks.

Powering Ambition: Business Banking and Commercial Solutions

For entrepreneurs and business owners, the choice of a bank takes on even greater significance. You need a partner that can scale with you, providing everything from a basic business banking account to sophisticated treasury management and lines of credit.

Small Business Banking

Both Chase and Wells Fargo have robust offerings for small businesses.

- Chase for Business: Offers a range of business checking accounts (e.g., Chase Business Complete Banking℠) that integrate payment processing through their Ink credit card ecosystem. Their merchant services are particularly strong, making them a popular choice for retail and e-commerce businesses.

- Wells Fargo for Business: Leverages its vast branch network to offer personalized, in-person support for small business owners. They are a leading Small Business Administration (SBA) lender and have a deep product suite tailored to businesses of all sizes.

When comparing, it’s also wise to look at other major players. For instance, the business banking solutions from PNC Banking are highly competitive, especially in the regions where they operate. Similarly, exploring the features of Truist Online Banking can provide a valuable benchmark for what a modern business platform should offer.

Commercial Banking for Larger Enterprises

As businesses grow, their needs become more complex. Both J.P. Morgan (Chase’s commercial and investment banking arm) and Wells Fargo’s Commercial Banking division are global leaders. They provide services like:

- Treasury and Cash Management

- Large-Scale Financing and Corporate Loans

- Capital Markets and Foreign Exchange Services

- Supply Chain Financing

At this level, the decision is less about mobile apps and more about relationships, industry expertise, and the bank’s ability to structure complex financial deals.

Growing Your Wealth: Investment and Private Banking Services

Beyond everyday banking, these institutions are gateways to the world of investing and wealth management. This is where the high-net-worth services that generate headlines and shape markets come into play.

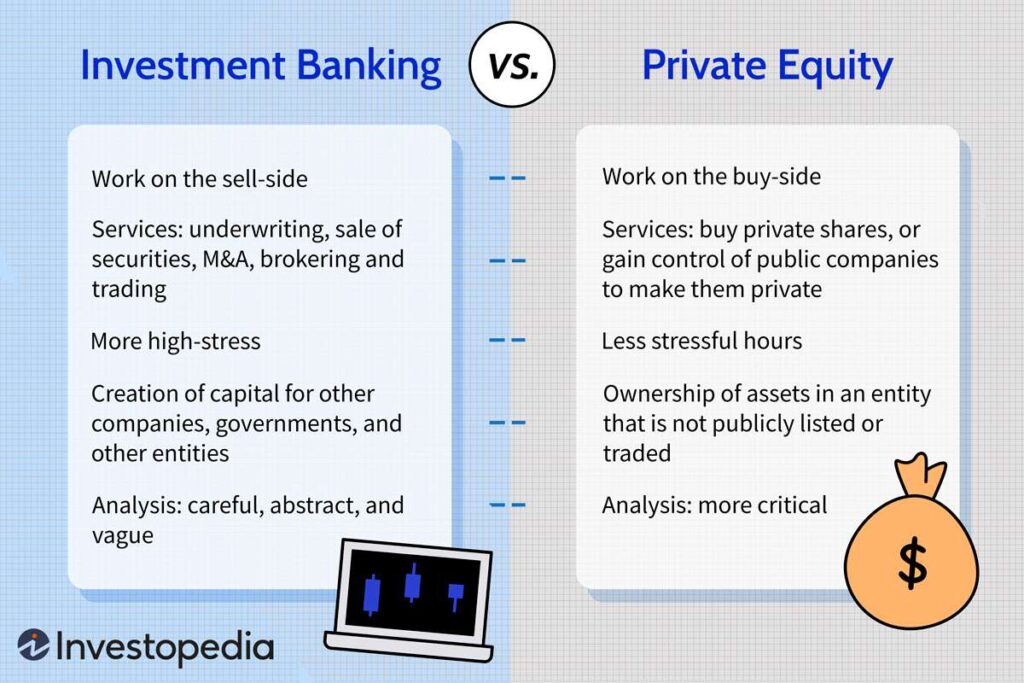

Investment Banking and Advisory Services

When people talk about Wall Street, they’re often talking about the investment banking divisions of firms like J.P. Morgan. This is the arm of the bank that handles major corporate mergers, acquisitions, and IPOs. While most retail customers won’t interact with this side directly, its strength and profitability contribute to the overall stability and prestige of the Chase brand.

For individual investors:

- J.P. Morgan Wealth Management: Chase offers a full spectrum of advisory services, from automated robo-advisors to dedicated financial advisors for affluent clients. They also offer J.P. Morgan Self-Directed Investing, a platform for those who want to manage their own stock and ETF trades, competing directly with platforms like Robinhood banking.

- Wells Fargo Advisors: This is one of the largest full-service retail brokerage firms in the country. They offer a similar range of services, from the DIY WellsTrade® platform to comprehensive wealth management and financial planning.

Private Banking: The Ultra-High-Net-Worth Experience

For the wealthiest clients, both banks offer private banking. This is a bespoke, white-glove service that goes far beyond standard banking. Private banking clients have a dedicated team to manage not just their investments, but their entire financial lives, including complex estate planning, trust services, customized lending, and even philanthropic strategies. This is a highly exclusive world where relationships and trust are the most valuable currency.

The Elephant in the Room: Reputation, Scandals, and Customer Trust

No comparison of these two banks would be complete without addressing their pasts. A bank’s reputation is a critical asset, and both have faced significant challenges.

Wells Fargo’s Account Fraud Scandal

Wells Fargo is still working to rebuild its reputation after the highly publicized 2016 account fraud scandal, where employees opened millions of unauthorized accounts to meet aggressive sales quotas. This event, along with subsequent issues in their auto and mortgage lending divisions, led to massive fines, regulatory penalties, and a significant erosion of public trust. The term bad loans in banking industry and the memory of the 2008 banking crisis were brought back to the forefront. The bank has since undergone a complete overhaul of its leadership and corporate culture, but the shadow of the scandal remains a consideration for many potential customers.

Chase’s Regulatory Scrutiny

Chase has not been without its own controversies, having paid billions in fines over the years related to its role in the mortgage crisis and other regulatory infractions. However, they have largely avoided a single, defining scandal on the scale of Wells Fargo’s in recent years. Their brand has remained strong, particularly among younger, tech-savvy demographics.

The Path to Redemption: Both banks have invested heavily in compliance and ethics programs. For consumers, the key takeaway is to remain vigilant. The era of blind trust in financial institutions is over. It’s crucial to monitor your accounts, understand the terms of any product you sign up for, and be aware of your rights as a consumer.

A Global and Cross-Border Perspective

In our interconnected world, banking is no longer a purely domestic affair. For expats, frequent travelers, or those with family abroad, a bank’s international capabilities are crucial.

Cross-Border Banking and International Transfers

If you have financial ties to Canada, for example, you might be familiar with specialized services like RBC Cross Border Banking. While Chase and Wells Fargo don’t offer an identical integrated product, their large-scale wire transfer systems and foreign exchange services are robust. They allow you to send and receive money globally, though fees and exchange rates should always be compared.

Lessons from the Australian Banking Scene

Looking at other developed markets can offer a glimpse into the future of banking. Australia, for instance, has been a hotbed of innovation. The rise of net banking and competition between the “Big Four” (NAB banking, Westpac banking, ANZ banking, and Commonwealth Bank) has driven digital adoption. We see users searching for terms like “nab internet banking login” or “westpac online” with the same frequency as their American counterparts search for Chase or BofA.

The Australian government’s push for Open Banking—a system that gives consumers more control over their financial data—is a trend that is slowly making its way to the US. Banks like Suncorp, St George Banking, and others are part of a vibrant ecosystem that highlights the global push towards more transparent and customer-centric finance. Understanding these international trends, and even how foreign social security payments like the Australian centrelink cash boost 2025 are managed across borders, informs what we should demand from our domestic banks.

Practical Considerations: Accessibility, Fees, and Holidays

The grand strategies of finance ultimately boil down to daily practicalities. Can you access your money when you need it?

Navigating Banking Holidays

A common question is, “is today a banking holiday?” US banks, including Chase and Wells Fargo, observe federal holidays. This means branches are closed, and some transactions may be delayed. Planning ahead is key. Here are the standard banking holidays 2025:

- New Year’s Day (Jan 1)

- Martin Luther King, Jr. Day

- Presidents’ Day

- Memorial Day

- Juneteenth National Independence Day

- Independence Day (July 4)

- Labor Day

- Columbus Day (is columbus day a banking holiday? Yes, it is.)

- Veterans Day

- Thanksgiving Day

- Christmas Day (Dec 25)

Always check your mobile banking app or the bank’s website, as hours can vary.

Understanding Fees and Niche Concepts

Understanding banking terminology is vital. An EFT meaning in banking simply refers to an Electronic Funds Transfer, the backbone of all digital payments. Be aware of overdraft fees, monthly maintenance fees, and wire transfer fees.

Some advanced users explore strategies like velocity banking, a method of using a line of credit to pay down loans faster. While a niche concept, it underscores the importance of understanding the full range of financial products available.

The Future of Banking: Trends to Watch

The financial landscape is in constant flux. The rise of “neobanks” (digital-only banks) and the concept of shadow banking—credit and financial services offered outside the traditional regulatory system—are challenging the status quo. The universe of finance is ever-expanding, its complexity as fascinating as the celestial movements of the moon venus.

Both Chase and Wells Fargo are actively investing in AI, machine learning, and blockchain to stay competitive. The move towards Open Banking will continue to be a defining theme, promising a future where you can manage accounts from multiple institutions through a single app, creating a truly personalized online banking account experience.

Final Verdict: Who Wins the Crown?

There is no single winner. The “right” bank is entirely dependent on your individual needs and priorities.

Choose Chase if…

- You are a tech-savvy individual who values a best-in-class, seamlessly integrated mobile banking and chase online experience.

- You are invested in or want to get into the Chase Ultimate Rewards® ecosystem with their premium Sapphire and Freedom credit cards.

- You prioritize a modern, prestigious brand with strong investment banking and wealth management credentials.

- You live in an urban or suburban area with easy access to Chase branches and ATMs.

Choose Wells Fargo if…

- Your top priority is physical branch accessibility, and you live or travel frequently in areas where their dense network is an advantage.

- You are primarily focused on mortgage products and want to work with one of the nation’s largest lenders.

- You are a small business owner who values the potential for a long-term, in-person relationship with your banker.

- You have moved past their previous reputational issues and are confident in their new direction.

Ultimately, the best strategy is to do your own homework. Visit their websites, compare the latest fee structures, read recent customer reviews, and perhaps even visit a local branch. Your financial future is worth the effort.

Frequently Asked Questions (FAQ)

Q: Can I open a banking account online with both Chase and Wells Fargo?

A: Yes, both banks have streamlined processes for opening a personal online banking account through their websites or mobile apps, typically requiring your Social Security number and a government-issued ID.

Q: What are the requirements for a business banking account?

A: Requirements vary, but generally, you will need your business formation documents (e.g., Articles of Incorporation), your Employer Identification Number (EIN) from the IRS, and personal identification for all owners.

Q: Between Chase and Wells Fargo, who offers better banking jobs?

A: Both are massive employers offering a vast range of banking jobs, from bank tellers to data scientists to investment banking analysts. Chase, with its J.P. Morgan arm, is often seen as more prestigious for high-finance roles, while Wells Fargo offers extensive opportunities across the country in retail and commercial banking.

Q: What is the difference between online banking and digital banking?

A: The terms are often used interchangeably. Online banking or internet banking traditionally referred to accessing your account via a web browser. Digital banking is a broader term that encompasses all digital channels, including mobile banking apps, online portals, and even ATM interfaces.

Q: Are there alternatives to Chase and Wells Fargo?

A: Absolutely. Other national giants like Bank of America (with its popular online banking bank of america platform) and regional powerhouses like PNC Banking (with its pnc online banking and Virtual Wallet) are strong competitors. Credit unions and online-only banks also present compelling alternatives depending on your needs.