In today’s fast-paced world, banking has evolved in ways that make managing your finances easier and more convenient. Traditional bank branches are no longer the only way to access financial services, and online banking has become increasingly popular. If you haven’t yet made the switch, you may be missing out on the numerous advantages that come with opening an online bank account. This post will dive into the benefits of using an online banking system, explain why it’s a smart choice for many individuals, and provide tips on how to get started.

The Evolution of Banking: Why Online Bank Accounts Matter

In the past, people had to visit physical bank branches to open an account, make deposits, or withdraw funds. The process was often time-consuming, requiring long waits, paperwork, and a lot of effort. Fast forward to today, and the process of managing money has been simplified thanks to online banking. Opening an online bank account is no longer a complicated process, and it brings about a multitude of benefits.

The rise of digital platforms has made banking more accessible, affordable, and convenient. Many people now prefer opening online bank accounts because they offer 24/7 access, mobile banking apps, lower fees, and a greater variety of financial services. Whether you need to pay bills, transfer money, or manage investments, online banking allows you to perform all these tasks from the comfort of your home, without stepping foot inside a bank.

Advantages of Opening an Online Bank Account

- Convenience and Accessibility

One of the most significant benefits of opening an online bank account is the convenience it offers. No longer do you need to visit a physical branch, stand in line, or wait for assistance from a bank employee. Instead, you can complete transactions at any time and from anywhere with an internet connection. Whether you’re at home, at work, or traveling abroad, your bank account is always within reach.

- 24/7 Availability

Unlike traditional bank branches, which have set working hours, online bank accounts provide access around the clock. Whether it’s early morning or late at night, you can check your balance, transfer money, pay bills, or review your transactions. This continuous availability is especially useful for individuals with busy schedules or those who live in remote areas where access to physical branches might be limited.

- Lower Fees and Costs

Online banking often comes with lower fees compared to traditional banks. This is because online banks typically have fewer overhead costs since they don’t need to maintain physical branches. As a result, they pass these savings on to their customers in the form of reduced fees for things like monthly account maintenance, ATM usage, and transaction costs.

- User-Friendly Interface and Mobile Apps

Most online banks provide easy-to-use platforms and mobile apps that make managing your finances a breeze. The user-friendly interfaces are designed to help you navigate the banking process with ease, whether you’re making a deposit, checking your balance, or reviewing your account history. These apps are often designed with intuitive features that allow for seamless navigation and enhanced usability.

- Advanced Security Measures

Security is a top priority for online banks, and many of them invest heavily in advanced security measures to protect their customers’ personal and financial information. Features like two-factor authentication, encryption, and fraud detection systems are commonly used to keep your account safe from cyber threats. With these measures in place, you can feel confident that your sensitive information is protected while you access your online bank account.

- Wide Range of Services

Opening an online bank account doesn’t mean sacrificing access to the full range of banking services. In fact, many online banks offer services that rival those of traditional banks. From savings accounts and checking accounts to mortgages and investment options, online banking gives you access to all the tools and resources you need to manage your money effectively. Some online banks even offer high-yield savings accounts, allowing you to earn more interest on your balance.

- Instant Transfers and Payments

With an online bank account, you can transfer funds and make payments instantly, a feature that may not always be available with traditional banks. Whether you’re sending money to a friend, paying for a service, or settling a bill, online banking platforms allow for quick, hassle-free transactions. This immediacy can be particularly beneficial in emergency situations or when time is of the essence.

- Financial Insights and Budgeting Tools

Many online banks come equipped with financial tools that can help you better understand your spending habits and manage your money. These tools often include budgeting features, spending trackers, and account analysis tools that break down where your money is going. This added functionality helps you make informed decisions about your financial future and encourages better money management practices.

- No Paperwork or Physical Forms

One of the most attractive aspects of opening an online bank account is the absence of paperwork. Gone are the days of filling out endless forms or providing physical documentation to open an account. Instead, the process is largely paperless, allowing you to sign up for an account and begin using it almost immediately. This streamlined process saves time and makes banking more efficient.

- Access to Innovative Banking Features

As online banking continues to evolve, new features and services are being introduced to make the customer experience even better. Many online banks now offer features like automated savings tools, investment tracking, and personalized financial advice. These innovations help individuals manage their finances more effectively, and they’re often available at no extra cost to the account holder.

How to Open an Online Bank Account

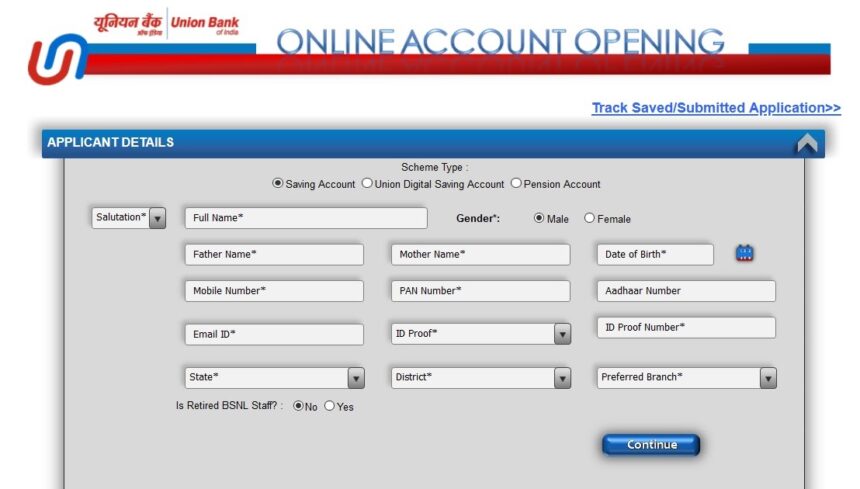

Opening an online bank account is a relatively simple process, and it can usually be completed in just a few steps. Here’s a general outline of what you can expect:

- Choose Your Bank: Start by researching different online banks to find one that offers the services and features you need. Consider factors like fees, interest rates, mobile app usability, and customer service.

- Provide Personal Information: To open an account, you’ll need to provide some basic personal information, such as your name, address, date of birth, and Social Security number (or equivalent). Some banks may also require proof of identity, such as a driver’s license or passport.

- Make a Deposit: Once your account is approved, you’ll likely be asked to make an initial deposit to activate the account. The minimum deposit amount will vary depending on the bank and the type of account you’re opening.

- Set Up Online Access: After your account is active, you can set up online access through the bank’s website or mobile app. This will involve creating a username and password and setting up security features like two-factor authentication.

- Start Using Your Account: With your account set up and access granted, you can begin using your online bank account right away. Transfer funds, pay bills, and monitor your transactions all from the comfort of your computer or mobile device.

Things to Consider Before Opening an Online Bank Account

While opening an online bank account offers many benefits, it’s important to consider a few factors before making the switch. Here are some things to keep in mind:

- Customer Service: While online banks may offer lower fees and more convenient access, their customer service may not always be as easily accessible as traditional banks. Consider whether you are comfortable with online customer support or whether you need face-to-face assistance.

- ATMs: Online banks may have limited access to physical ATMs, which can be a drawback if you frequently withdraw cash. Be sure to check whether the bank offers free ATM withdrawals or if they charge fees for using ATMs outside of their network.

- Banking Features: Ensure that the online bank you choose offers the services you need. For example, if you require specific loan or investment options, verify that these services are available before you sign up.

- Interest Rates and Fees: While online banks tend to have lower fees, it’s important to compare the interest rates they offer. Look for high-yield savings accounts and low-interest rates on loans to get the best deal for your needs.

Conclusion

Opening an online bank account is a smart decision for those seeking convenience, lower fees, and a wider range of banking services. By embracing the digital age, you gain 24/7 access to your finances, secure and easy-to-use platforms, and a greater level of control over your financial future. Whether you’re looking to save more money, invest in new opportunities, or simply manage your daily expenses, online banking has proven to be an invaluable tool for individuals worldwide.

As online banking continues to evolve, the possibilities for managing your money online are virtually limitless. By considering the benefits, researching your options, and taking the necessary steps to open an online bank account, you can take control of your financial life today.