Introduction: Choosing the Right Business Banking Partner in 2025

In today’s rapidly evolving financial landscape, selecting the right business banking partner is one of the most critical decisions entrepreneurs and business owners will make. The choice between different banking institutions can significantly impact your company’s financial efficiency, growth potential, and daily operations. This comprehensive comparison examines two prominent Australian financial institutions: Heritage Business Banking and Suncorp Business Banking.

- Introduction: Choosing the Right Business Banking Partner in 2025

- Understanding Heritage Business Banking: Community-Focused Banking Solutions

- Understanding Suncorp Business Banking: Integrated Financial Solutions

- Product Comparison: Business Transaction Accounts

- Lending Comparison: Business Loans and Commercial Financing

- Savings and Investment Products for Business

- Merchant Services and Payment Solutions

- International Business Banking Capabilities

- Technology and Innovation Comparison

- Fees, Charges, and Overall Value Comparison

- Customer Service and Support Comparison

As we navigate through 2025, the business banking sector has transformed dramatically. Digital banking solutions, mobile banking innovations, and online banking account management have become non-negotiable features rather than premium add-ons. Both Heritage Bank and Suncorp have evolved to meet these changing demands, but they take distinctly different approaches to serving the business community.

This detailed analysis will help you understand which banking partner aligns best with your business objectives, operational requirements, and growth aspirations. Whether you’re a startup seeking your first banking account, an established enterprise exploring commercial banking options, or a growing business evaluating investment banking relationships, this comparison provides the insights you need to make an informed decision.

Understanding Heritage Business Banking: Community-Focused Banking Solutions

The Heritage Bank Philosophy and Market Position

Heritage Bank operates as a customer-owned financial institution, which fundamentally differentiates it from shareholder-driven banks. This structure means that profits are reinvested into better products, services, and customer experiences rather than distributed to external shareholders. For business banking clients, this translates into competitive rates, lower fees, and a genuine commitment to long-term business relationships.

Heritage business banking has built its reputation on personalized service delivery and deep community connections. Unlike larger institutions where businesses might feel like account numbers, Heritage emphasizes relationship banking where dedicated business banking specialists understand your industry, challenges, and opportunities.

The institution has been serving Australian businesses for decades, developing particular expertise in sectors including agriculture, small to medium enterprises, and family-owned businesses. Their approach to business banking combines traditional relationship management with modern digital banking capabilities, creating a hybrid model that appeals to businesses valuing both personal touch and technological efficiency.

Heritage Business Banking Product Suite

Heritage Bank offers a comprehensive range of business banking products designed to support businesses at various lifecycle stages. Their business transaction accounts provide essential banking account functionality with competitive fee structures and inclusive transaction allowances. These accounts integrate seamlessly with their mobile banking and online banking platforms, ensuring business owners can manage finances from anywhere.

For businesses requiring financing, Heritage provides business loans, commercial property loans, equipment finance, and specialized agricultural lending products. Their commercial banking team works closely with businesses to structure facilities that align with cash flow patterns and growth objectives. This personalized approach to lending distinguishes Heritage from larger institutions where automated systems often drive credit decisions.

The bank’s business savings and investment products help companies maximize returns on working capital while maintaining liquidity. Interest rates remain competitive with market leaders, and the internet banking platform enables efficient fund transfers between accounts, streamlining treasury management for busy business owners.

Heritage has also developed strong capabilities in merchant services, business credit cards, and trade finance solutions. Their EFTPOS and payment processing solutions support retailers and service businesses, while their business credit card offerings provide expense management tools and rewards programs tailored to business spending patterns.

Digital Banking Capabilities at Heritage

Heritage Bank has invested significantly in digital banking infrastructure over recent years. Their mobile banking app enables business owners to perform most banking functions from smartphones or tablets, including account monitoring, payments, transfers, and transaction approvals. The app receives regular updates, with the latest version released in early 2025 introducing enhanced security features and improved user interface design.

The Heritage online banking platform provides comprehensive business account management capabilities. Multiple user access with customizable permissions allows business owners to delegate banking tasks while maintaining appropriate oversight. Batch payment processing, integrated reporting tools, and direct connections to popular accounting software like Xero and MYOB streamline administrative workflows.

For businesses requiring more sophisticated cash management, Heritage offers specialized internet banking solutions with advanced features including automated sweeping, scheduled payments, and detailed transaction categorization. These tools compete effectively with those offered by major banks while being delivered with the personalized support Heritage customers expect.

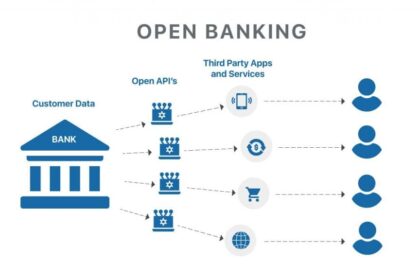

The bank has also embraced open banking standards, allowing businesses to securely share financial data with approved third-party applications. This connectivity enables better financial management, simplified lending applications, and integration with modern fintech solutions that many businesses now rely upon.

Understanding Suncorp Business Banking: Integrated Financial Solutions

Suncorp’s Unique Market Position

Suncorp operates as a diversified financial services group, offering banking, insurance, and wealth management under one corporate umbrella. This integrated approach creates unique advantages for business banking clients who can access comprehensive financial solutions through a single relationship. The Suncorp banking division serves businesses across Australia with particular strength in Queensland and northern regions.

The Suncorp business model emphasizes convenience and consolidation. Business owners can manage their banking account, business insurance policies, and other financial needs through unified platforms and coordinated service teams. This integration can simplify financial administration, reduce duplication, and potentially deliver cost efficiencies through package arrangements.

Suncorp internet banking has evolved into a sophisticated platform supporting complex business requirements. The institution has made substantial investments in technology infrastructure, positioning itself as a leader in digital banking innovation. Their commitment to technological advancement appeals particularly to businesses prioritizing efficiency and automation in financial management.

Suncorp Business Banking Product Range

Suncorp’s business banking product suite covers the full spectrum of business financial needs. Their business transaction accounts offer multiple variants designed for different business types and transaction volumes. These banking accounts integrate with Suncorp’s digital banking platforms, providing real-time account monitoring and comprehensive transaction management tools.

The commercial banking division at Suncorp delivers financing solutions including business loans, commercial property finance, asset finance, and working capital facilities. Their lending specialists bring industry expertise across sectors including retail, professional services, healthcare, and property development. Credit assessment processes leverage both relationship insights and sophisticated analytical tools, enabling competitive terms for quality borrowers.

Suncorp business banking clients benefit from the group’s insurance expertise through integrated business insurance solutions. Package arrangements combining banking and insurance can deliver administrative efficiencies and potentially favorable pricing. This integration represents a distinctive advantage that standalone banks cannot easily replicate.

The institution’s business credit card offerings include rewards programs, comprehensive expense management tools, and integration with accounting platforms. Merchant services support businesses accepting card payments, with competitive rates and modern payment terminal technology including contactless and mobile payment acceptance.

Suncorp Digital Banking Excellence

Suncorp has positioned digital banking at the core of its business banking strategy. The Suncorp mobile banking app delivers extensive functionality, enabling business owners to manage accounts, authorize payments, monitor transactions, and communicate with relationship managers from mobile devices. The app integrates with biometric authentication, providing security without sacrificing convenience.

The Suncorp online banking platform serves as a comprehensive financial management hub for business clients. Multi-user access with granular permission controls enables appropriate delegation while maintaining security and oversight. The platform supports batch payment processing, scheduled transfers, and detailed reporting across all business accounts and facilities.

Advanced features within Suncorp internet banking include automated account reconciliation, integration with major accounting software platforms, and sophisticated cash flow forecasting tools. These capabilities support businesses seeking to optimize working capital management and improve financial planning accuracy.

Suncorp has actively embraced open banking, developing APIs that enable secure data sharing with approved third parties. This connectivity supports the modern business technology ecosystem, allowing seamless integration between banking functions and specialized business applications.

The bank’s investment in cybersecurity infrastructure ensures that digital banking channels maintain robust protection against evolving threats. Multi-factor authentication, transaction monitoring, and real-time fraud detection systems protect business accounts while maintaining user experience quality.

Product Comparison: Business Transaction Accounts

Account Features and Fee Structures

Both Heritage business banking and Suncorp banking offer business transaction accounts with competitive features, though their fee structures and included benefits differ in important ways.

Heritage Bank typically positions its business accounts with lower monthly fees and generous included transaction allowances. Their community bank philosophy translates into fee structures designed to support small to medium businesses without generating excessive banking costs. Many Heritage business accounts include unlimited electronic transactions, with per-transaction fees applying only to specific transaction types like cash withdrawals or cheque processing.

Suncorp business accounts often feature tiered pricing based on transaction volumes and account complexity. High-volume businesses may find Suncorp’s pricing competitive when package arrangements or relationship benefits are considered. The bank offers various account variants targeting specific business segments, from sole traders to large enterprises, with features and pricing scaled accordingly.

Both institutions have eliminated or reduced many nuisance fees that traditionally frustrated business customers. Monthly account maintenance fees, paper statement fees, and basic internet banking access charges have become more transparent and often more competitive across the sector.

Digital Access and Integration

Heritage online banking provides comprehensive business account management through web browsers and dedicated mobile banking applications. The platform supports multiple users with customizable permissions, enabling business owners to delegate banking tasks appropriately. Integration with accounting platforms like Xero, MYOB, and QuickBooks enables automated bank feed functionality, reducing data entry requirements and improving accuracy.

Suncorp internet banking delivers similar core functionality with some additional advanced features reflecting the institution’s larger technology investment capacity. The platform includes more sophisticated reporting tools, customizable dashboards, and enhanced workflow automation capabilities. For businesses with complex banking requirements, these additional features may justify any incremental costs.

Both banks support modern payment methods including PayID, BPAY, direct entry, and real-time payment systems. Mobile banking apps from both institutions enable on-the-go account management, though interface design and feature sets differ based on each bank’s development priorities and user research.

Customer Service and Relationship Management

Heritage business banking emphasizes personal relationships with dedicated business banking specialists who understand client industries and business models. This relationship approach means businesses typically work with the same banker over time, building familiarity and enabling more nuanced financial advice. For business owners who value personal connection and localized decision-making, this model offers significant advantages.

Suncorp provides relationship management for larger business clients while supporting smaller businesses through contact center teams and digital service channels. The service model scales based on business size and banking relationship complexity. While perhaps less personalized for smaller clients, this approach enables efficient service delivery and extended service hours through multi-channel support.

Both institutions offer business banking specialists who can visit client premises for account establishment, reviews, and ongoing relationship management. However, Heritage’s community banking model may provide more flexible and frequent in-person engagement, particularly in regional markets where Heritage maintains strong presence.

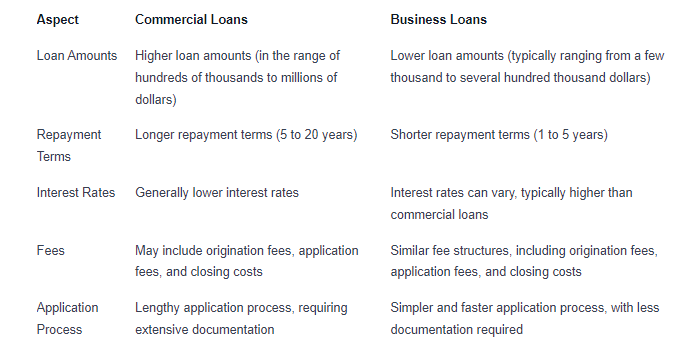

Lending Comparison: Business Loans and Commercial Financing

Business Loan Products and Structures

Heritage business banking offers term loans, revolving facilities, and specialized lending products supporting various business purposes. Their community banking model enables more flexible lending criteria, particularly for businesses with strong local connections, sound business models, and adequate security but perhaps unconventional financial profiles that might challenge automated assessment systems.

Loan sizes at Heritage typically range from small business facilities of $10,000 to commercial facilities exceeding $5 million, though capacity exists for larger transactions through syndication or specialist commercial banking teams. Interest rates reflect market conditions, credit quality, and security positions, generally aligning competitively with major banks for quality borrowers.

Suncorp commercial banking delivers business loans across similar size ranges with particular strength in medium to larger facilities where their commercial banking infrastructure and risk appetite create competitive advantages. Their lending approach combines relationship insights with analytical assessment, leveraging technology to streamline application processing while maintaining appropriate risk evaluation.

Both banks offer fixed and variable rate options, with ability to split facilities across different rate types to manage interest rate risk. Loan terms extend from short-term working capital facilities through to long-term property and equipment finance exceeding 20 years in appropriate circumstances.

Specialized Financing Solutions

Heritage Bank has developed particular expertise in agricultural lending, supporting farming enterprises with seasonal finance, property purchases, and equipment acquisition. Their agricultural specialists understand farming cycles, commodity markets, and the unique challenges facing Australian agriculture. This specialization creates advantages for agribusinesses seeking banking partners who genuinely understand their sector.

The bank also offers equipment finance, vehicle finance, and commercial property loans with competitive rates and flexible structures. Their relationship-based approach enables creative structuring that aligns repayment profiles with business cash flows, rather than forcing businesses into standardized products that may not suit their circumstances.

Suncorp’s commercial banking division brings strength across multiple sectors including retail, professional services, healthcare, hospitality, and property development. Their sector specialists understand industry dynamics, enabling informed credit assessment and relevant financial advice. For businesses in these focus sectors, Suncorp’s specialized knowledge creates value beyond basic financing.

Both institutions participate in government-supported lending schemes including those administered by the Australian Business Finance Corporation and similar programs. These schemes can deliver favorable terms for eligible businesses, and both banks maintain expertise in navigating the application and compliance requirements.

Lending Process and Approval Timelines

Heritage business banking emphasizes local decision-making with credit authority distributed to regional and specialist lenders who understand local markets and business conditions. This structure can accelerate approval processes for straightforward applications while enabling more nuanced assessment of complex situations. Turnaround times for standard business loans typically range from a few days to two weeks, depending on complexity and documentation completeness.

Suncorp employs a combination of automated assessment for smaller, standardized facilities and specialist evaluation for larger or complex applications. Their technology infrastructure enables rapid processing of straightforward applications while escalating complex situations to experienced commercial bankers. Timeline expectations are similar to Heritage, with straightforward applications completing within days and complex facilities requiring several weeks.

Both banks require standard documentation including financial statements, tax returns, business plans, and security details. However, Heritage’s relationship model may provide more flexibility in documentation requirements for established clients with proven track records, while Suncorp’s process tends toward standardization for consistency and regulatory compliance.

Savings and Investment Products for Business

Business Savings Accounts

Both Heritage Bank and Suncorp offer business savings accounts enabling companies to earn interest on working capital while maintaining liquidity. These banking accounts serve as parking spaces for funds awaiting deployment, seasonal variations in cash holdings, or accumulation toward specific business objectives.

Heritage business savings accounts typically offer competitive interest rates, particularly when balances exceed certain thresholds or when combined with other Heritage business banking products. The accounts integrate with online banking platforms, enabling easy transfers between transaction and savings accounts to optimize interest earnings while maintaining operational liquidity.

Suncorp banking provides business savings options with tiered interest rates rewarding larger balances. The accounts connect seamlessly with Suncorp internet banking, and some variants offer bonus interest for sustained growth or meeting specific deposit conditions. For businesses maintaining significant cash reserves, these features can meaningfully impact overall returns.

Both institutions offer term deposit products for businesses seeking higher returns on funds that can be committed for fixed periods. Term lengths typically range from one month to five years, with interest rates varying based on term length, deposit amount, and prevailing market conditions. Early redemption is generally possible but may incur interest penalties, so businesses must carefully consider liquidity requirements before committing funds.

Cash Management and Treasury Services

Heritage business banking provides cash management tools appropriate for small to medium enterprises, including automated sweeping between accounts, scheduled payments, and basic forecasting capabilities. While perhaps less sophisticated than major bank offerings, these tools meet most business requirements and integrate effectively with the personal service approach Heritage emphasizes.

Suncorp delivers more advanced cash management solutions reflecting its larger institutional capabilities. Features include multi-currency accounts, sophisticated automated sweeping arrangements, integrated receivables management, and comprehensive treasury reporting. For businesses with complex cash management requirements, international operations, or sophisticated treasury functions, these advanced capabilities create genuine value.

Both banks support direct entry payment systems, enabling businesses to process employee payments, supplier payments, and customer refunds efficiently. Batch processing capabilities, payment scheduling, and detailed reporting support administrative efficiency and audit requirements.

Merchant Services and Payment Solutions

EFTPOS and Payment Terminal Services

Heritage Bank partners with specialized payment service providers to deliver EFTPOS terminals and payment acceptance solutions to business clients. These arrangements provide modern terminal technology supporting contactless payments, chip and PIN transactions, and mobile payment platforms like Apple Pay and Google Pay. Merchant service fees remain competitive with market rates, though specific pricing depends on transaction volumes, business types, and risk profiles.

The terminals integrate with Heritage business banking accounts, enabling next-day settlement of card receipts and streamlined reconciliation through online banking platforms. For businesses processing significant card volumes, Heritage can negotiate competitive merchant service rates leveraging their payment provider partnerships.

Suncorp offers comprehensive merchant services through both proprietary systems and partner arrangements. Their payment solutions include traditional EFTPOS terminals, mobile payment acceptance devices, and online payment gateways for e-commerce businesses. The integration between merchant services and Suncorp internet banking creates administrative efficiencies through automated reconciliation and unified reporting.

Both institutions provide payment analytics helping businesses understand customer payment preferences, transaction patterns, and opportunities to optimize payment acceptance costs. These insights can inform business decisions about pricing, customer service, and operational efficiency.

Online and E-commerce Payment Solutions

For businesses operating online or seeking to establish e-commerce capabilities, both banks offer payment gateway solutions enabling secure card payment acceptance. These platforms integrate with popular e-commerce platforms and shopping cart systems, simplifying implementation and ongoing management.

Heritage business banking partners with established payment technology providers to deliver secure, PCI-compliant payment processing for online businesses. The solutions support various payment methods, fraud prevention tools, and settlement directly to Heritage business accounts. Technical support and implementation assistance help businesses navigate the setup process.

Suncorp provides integrated e-commerce payment solutions with direct technical support and comprehensive fraud management tools. Their platform supports subscription billing, stored payment credentials for repeat customers, and detailed transaction reporting. For businesses with significant online revenue, these features deliver operational benefits and risk management advantages.

Both banks continue investing in emerging payment technologies including digital wallets, buy-now-pay-later integration, and real-time payment systems. As consumer payment preferences evolve, business banking clients benefit from institutional investments in maintaining current payment acceptance capabilities.

International Business Banking Capabilities

Foreign Currency Accounts and Transactions

Suncorp business banking maintains stronger capabilities in international banking compared to Heritage, reflecting its larger institutional scale and client base with international requirements. Suncorp offers foreign currency accounts in major currencies, international payment services, and foreign exchange dealing for businesses managing currency exposure.

The Suncorp internet banking platform supports international payment initiation with transparent fee structures and competitive exchange rates. Businesses can obtain foreign exchange quotes, execute transactions, and track international payments through the same digital banking interface used for domestic banking. This integration simplifies treasury management for businesses with import/export activities.

Heritage Bank provides international payment services through correspondent banking relationships, enabling business clients to send and receive international payments in various currencies. While perhaps not as comprehensive as Suncorp’s offering, Heritage’s international services meet the requirements of most small to medium businesses with occasional international transactions.

Both institutions support international wire transfers, foreign currency drafts, and documentary trade instruments like letters of credit. However, businesses with substantial international operations may find Suncorp’s dedicated trade finance specialists and more sophisticated foreign exchange capabilities better aligned with their requirements.

Trade Finance and Documentary Credits

Suncorp maintains specialized trade finance capabilities supporting importers and exporters. Services include letters of credit, documentary collections, bank guarantees, and trade credit insurance. Their trade finance specialists understand International Chamber of Commerce rules, shipping documentation requirements, and the operational aspects of international trade.

Heritage offers basic trade finance services appropriate for businesses with straightforward import/export requirements. While the product range may be more limited than Suncorp’s, Heritage can support standard trade transactions and often partners with correspondent banks for more complex requirements.

For businesses where international trade represents a significant portion of operations, Suncorp’s comprehensive trade finance capabilities and specialist expertise create meaningful advantages. Conversely, businesses with occasional international transactions may find Heritage’s simplified approach and relationship-based service model entirely adequate.

Technology and Innovation Comparison

Digital Banking Platform Comparison

Both Heritage Bank and Suncorp have invested substantially in digital banking infrastructure, though their technology strategies and implementation approaches differ reflecting their different organizational structures and customer bases.

Suncorp internet banking represents a mature, feature-rich platform supporting complex business requirements. The system architecture handles high transaction volumes, supports extensive customization, and integrates with numerous third-party applications through APIs and standard banking protocols. Regular platform updates introduce new features, security enhancements, and user experience improvements based on customer feedback and competitive analysis.

Heritage online banking delivers comprehensive functionality appropriate for small to medium business requirements within an interface emphasizing simplicity and ease of use. The platform may lack some advanced features available through Suncorp, but this simplification can benefit businesses seeking straightforward banking without unnecessary complexity.

Both banks’ mobile banking applications receive regular updates addressing security requirements, operating system compatibility, and feature enhancements. User reviews generally rate both applications positively, though specific preferences vary based on individual priorities regarding interface design, feature sets, and performance characteristics.

Security and Fraud Protection

Security infrastructure represents a critical consideration in business banking selection, particularly as digital banking adoption increases and fraud threats evolve. Both Heritage and Suncorp maintain robust security frameworks protecting business accounts and transactions.

Standard security features across both institutions include multi-factor authentication, encryption of data transmission and storage, transaction monitoring for suspicious activity, and regular security updates. Both banks participate in industry security initiatives and comply with banking sector security standards.

Suncorp’s larger technology budget enables investment in advanced fraud detection systems leveraging artificial intelligence and machine learning to identify unusual patterns indicating potential fraud. Real-time transaction monitoring, biometric authentication options, and sophisticated access controls provide multiple security layers.

Heritage implements proven security technologies appropriate for their customer base and transaction profiles. While perhaps not incorporating the most cutting-edge technologies, their security framework effectively protects business accounts while maintaining usability. The institution’s smaller scale can enable more responsive customer support when security issues arise, with direct access to local banking specialists who know the business and can quickly verify legitimate transactions.

Both banks provide education resources helping business customers recognize and avoid common fraud scenarios including phishing attempts, payment redirection scams, and business email compromise. Proactive customer education represents an important security layer complementing technical controls.

Fees, Charges, and Overall Value Comparison

Account and Transaction Fees

Fee structures represent a critical comparison factor, though evaluating overall value requires looking beyond headline rates to consider included transactions, relationship benefits, and the total cost of banking services.

Heritage business banking generally positions its fees competitively for small to medium businesses, with monthly account fees typically ranging from $10 to $50 depending on account type and features. Many Heritage business accounts include generous transaction allowances, with electronic transactions often unlimited and fees applying only to specific transaction types like cash handling or cheque processing.

Suncorp business account fees vary based on account variant and business characteristics. Monthly fees may be higher than Heritage for comparable accounts, but package arrangements combining multiple services can deliver overall value for businesses utilizing various Suncorp products. Businesses should carefully evaluate their specific transaction patterns and service requirements against fee schedules to determine actual costs.

Both institutions have reduced or eliminated many traditional nuisance fees including paper statement fees, basic internet banking access charges, and some account notification fees. This industry trend toward fee transparency and simplification benefits business customers across both institutions.

Lending Costs and Comparison

Interest rates on business loans vary based on multiple factors including loan amount, term, security position, business credit quality, and relationship factors. Both Heritage and Suncorp price business lending competitively, with rates for quality borrowers generally aligning with market benchmarks.

Heritage’s community banking model may provide flexibility on interest rates and fees for established clients with strong relationships, particularly when security positions or business circumstances present challenges for standardized pricing models. Their relationship approach enables more nuanced pricing discussions than automated systems allow.

Suncorp commercial banking applies sophisticated pricing models reflecting credit risk, capital costs, and competitive dynamics. Package arrangements combining lending with other services may deliver overall cost benefits, even if headline interest rates appear similar to competitors.

Both banks charge application fees, valuation fees, legal documentation costs, and ongoing facility fees on larger commercial facilities. These ancillary costs can meaningfully impact overall borrowing costs, so businesses should request comprehensive cost comparisons including all fees and charges when evaluating lending options.

Relationship Value and Intangible Benefits

Beyond direct fee comparisons, businesses should consider intangible value factors including service quality, relationship continuity, advice quality, and operational efficiency enabled by banking platforms and processes.

Heritage’s relationship banking model delivers value through personal attention, local decision-making, and flexibility addressing unique circumstances. For business owners who value knowing their banker personally and receiving tailored advice, these intangible benefits justify Heritage’s value proposition even when direct fee comparisons show modest differences.

Suncorp’s integrated financial services model creates value through consolidation and coordination. Managing banking, insurance, and potentially other financial services through unified platforms and coordinated teams can reduce administrative burden and improve overall financial management. For time-poor business owners, these efficiency benefits represent genuine value beyond simple cost comparisons.

Customer Service and Support Comparison

Service Channels and Availability

Heritage business banking emphasizes personal relationships supported by local branch networks, dedicated business banking specialists, and responsive telephone banking services. Business clients typically work with specific relationship managers who understand their business, industry, and financial requirements. This continuity enables more meaningful advice and support than transactional service models provide.

Branch availability varies by location, with Heritage maintaining strong regional presence particularly in Queensland and northern New South Wales. Extended banking hours, Saturday morning availability in some locations, and willingness to meet clients at business premises or other convenient locations demonstrates Heritage’s service commitment.

Suncorp provides multi-channel service access including telephone banking, online support, branch networks, and dedicated relationship managers for larger business clients. Service hours extend beyond traditional banking hours through contact centers, though the personal relationship continuity may be less consistent than Heritage’s model for smaller business clients.

Both institutions offer online support through secure messaging within internet banking platforms, enabling asynchronous communication about non-urgent matters. This channel suits busy business owners who can communicate when convenient rather than during limited business hours.