2026 Cadillac Motorhome Unveiled: The Ultimate Luxury RV Redefining Travel with Innovation, Comfort, and Elegance

The Whisper Becomes a Roar: The 2026 Cadillac Motorhome is Here For…

St George vs. Westpac: The Ultimate Family Banking Comparison for Australians (2025 Insights)

Navigating the Australian banking landscape can feel like traversing a complex maze,…

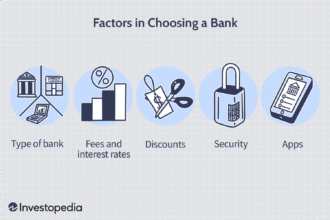

How to Choose the Right Banking Account for Your Personal Finance Goals

Introduction: The Foundation of Financial Success Starts With the Right Account Selecting…

2026 Cadillac Motorhome Unveiled: The Ultimate Luxury RV Redefining Travel with Innovation, Comfort, and Elegance

The Whisper Becomes a Roar: The 2026 Cadillac Motorhome is Here For years, the world of ultimate luxury travel has been a trifecta: the private jet, the superyacht, and the…

2026 Cadillac Motorhome Unveiled: The Ultimate Luxury RV Redefining Travel with Innovation, Comfort, and Elegance

The Whisper Becomes a Roar: The 2026 Cadillac Motorhome is Here For…

St George vs. Westpac: The Ultimate Family Banking Comparison for Australians (2025 Insights)

Navigating the Australian banking landscape can feel like traversing a complex maze,…

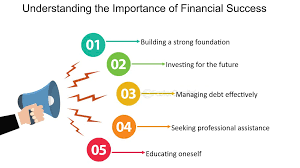

How to Choose the Right Banking Account for Your Personal Finance Goals

Introduction: The Foundation of Financial Success Starts With the Right Account Selecting…

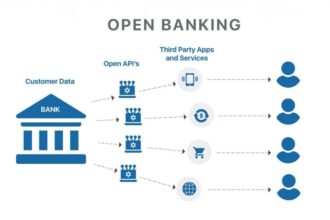

Banking

A bank contains financial services like accepting deposits and providing loans, often acting as a secure place to store and manage money. It also offers other products and services such as checking and savings accounts, ATMs, and foreign exchange services. Banks are fundamental to the economy, using customer deposits to fund loans for individuals and businesses and helping with financial managemen

The Ultimate Guide to the Best High-Yield Savings Accounts in the USA for 2025

Let's be frank: if your life savings are languishing in a traditional…

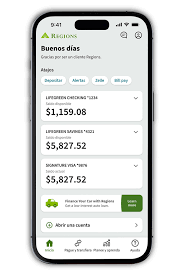

Regions Online Banking: A Full 2025 Review of Features, Fees, and App Usability

In today's fast-paced world, your bank is more than a building; it's…

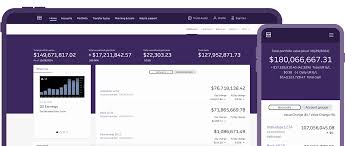

Truist Online Banking: The Definitive Guide After the SunTrust/BB&T Merger (2024)

The financial world watched with bated breath as two of America's most…

Online Banking

Online banking is managing your bank accounts and performing financial transactions over the internet using a computer or mobile device. It allows you to check balances, transfer funds, pay bills, and deposit checks without visiting a physical branch. Access is typically provided through a bank’s secure website or a dedicated mobile app

Barclays Bank Online Banking: Your Complete UK Guide to Digital Financial Management

In today's fast-paced world, managing your finances efficiently and securely is paramount.…

ME Banking (Australia) Review: Is This Online-Only Bank a Good Choice?

Introduction to Modern Digital Banking in Australia The Australian banking landscape has…

The Digital Teller Line: A Head-to-Head Exploration of Bank of America and Chase Online Banking

In the relentless rhythm of modern finance, the grand, marble-lined banking hall…

E-Banking

E-banking, or electronic banking, is the process of using electronic devices and the internet to perform banking transactions. Also called online banking, it allows customers to manage their finances through digital platforms like a bank’s website or mobile app, without having to visit a physical branch. Key services include checking balances, transferring money, paying bills, and applying for loans.

Navigating the Future of Finance: An In-Depth Review of PNC’s Virtual Wallet Account

In an era defined by rapid technological advancement and ever-evolving consumer expectations, the way we manage our money has been…

Chase Banking vs. Wells Fargo Banking: Which US Mega-Bank is Right for You?

Choosing a bank is one of the most significant financial decisions you'll make. It’s more than just a place to…

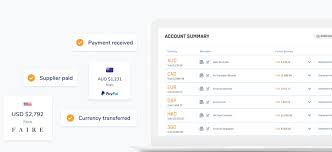

Revolutionizing Commerce: The Top 5 Digital-First Business Banking Platforms Shaping 2025

The financial landscape for businesses is undergoing a seismic shift. Gone are the days when managing company finances meant solely…

Scaling Your Business: When to Move from Personal Banking to a Full Business Account

Understanding the Critical Transition Point in Your Business Journey Every entrepreneur begins somewhere. For most small business owners, that somewhere…

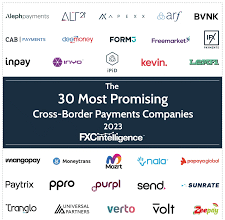

RBC Cross Border Banking Review: The Strategic Advantage for US-Canada Business Operations

In the intricate dance of global commerce, few relationships are as symbiotic and economically vital as the one between the…

Mobile Banking

Mobile banking is a service that allows a bank’s customers to conduct financial transactions using a mobile device. Unlike the related internet banking it uses software, usually an app, provided by the bank. Mobile banking is usually available on a 24-hour basis.

Bank Saving

Bank saving is the practice of depositing money in a special bank account, called a savings account, to keep it secure and earn interest over time. Unlike a checking account used for daily spending, a savings account is designed to hold funds for future goals like an emergency fund or a down payment, and the bank pays you interest for keeping your money with them.

Heritage Business Banking vs. Suncorp Business Banking: A Side-by-Side Comparison

Introduction: Choosing the Right Business Banking Partner in 2025 In today's rapidly…

Bank of Melbourne Business Banking Review: The Definitive Guide for Victorian Startups in 2025

Navigating the financial landscape as a new business in Victoria is akin…

The Ultimate Guide to Opening a Commercial Banking Account for Your LLC

As an entrepreneur navigating the dynamic world of business, establishing a solid…