The world of business banking has, for decades, felt like a walled garden. Each financial institution—be it a high-street giant or a specialized lender—held its customer data in a proprietary silo. For businesses, this meant a fragmented financial reality: juggling multiple logins for every banking account, manually downloading statements, and painstakingly piecing together a complete picture of their financial health. This cumbersome process was the accepted norm, a frustrating but necessary part of commerce.

- What Exactly Is Open Banking? A Simple Breakdown

- The UK as the Global Epicenter of the Open Banking Revolution

- The Tangible Benefits: How Open Banking is Reshaping UK Business Finance

- Real-World Examples: Open Banking in Action

- The Global Ripple Effect: Is the US and Australia Next?

- Navigating the Challenges and Security Concerns

- The Future of Business and Investment Banking

- Daily Developments & Keeping Abreast of Banking News

- The Unstoppable Shift in the Financial Landscape

But in the United Kingdom, a seismic shift has occurred. This shift, known as Open Banking, is not merely an incremental update; it is a full-scale revolution, fundamentally rewiring the relationship between businesses, their data, and their financial partners. What began as a regulatory mandate has blossomed into a vibrant ecosystem of innovation, turning the once-static world of commercial banking on its head and creating unprecedented opportunities for small and medium-sized enterprises (SMEs) to thrive. This transformation is moving far beyond the UK, with financial powerhouses from the US to Australia watching intently, understanding that this new era of digital banking is not a trend, but the future.

This deep dive explores the mechanics of Open Banking in the UK, its tangible benefits for businesses, and the global shockwaves it’s sending through the entire financial industry.

What Exactly Is Open Banking? A Simple Breakdown

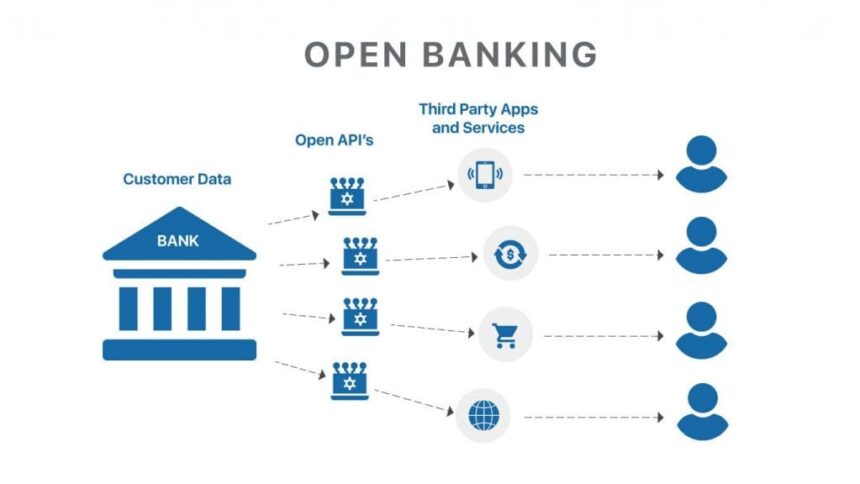

At its core, Open Banking is a framework built on a simple but powerful premise: you own your financial data, and you should be able to share it securely with whomever you choose.

Before Open Banking, if you wanted a third-party application—say, an accounting software or a budgeting app—to access your financial data, you often had to resort to “screen scraping.” This involved giving the app your online banking username and password, a practice that was both insecure and unreliable. If your bank, like M&T Bank, had online banking issues or changed its website layout, the connection would break.

Open Banking replaces this fragile system with Application Programming Interfaces (APIs). Think of an API as a secure, standardized messenger. Instead of giving a third party the keys to your entire financial house (your login credentials), you give them a specific, secure request to pass to your bank. The bank then sends back only the precise data requested, all with your explicit consent.

This regulatory-driven initiative in the UK, spearheaded by the Competition and Markets Authority (CMA), mandated that the nine largest banks (the “CMA9”) build these secure APIs. This allows authorized and regulated third-party providers (TPPs) to, with user permission:

- Access Account Information (AISP): Securely pull data from a user’s banking account, such as transaction history and balances, to present it in new ways.

- Initiate Payments (PISP): Securely initiate payments directly from a user’s account to another, bypassing traditional card networks.

This seemingly technical change has unleashed a torrent of innovation, creating a new competitive landscape where fintech startups and established players alike can build services on top of the traditional banking infrastructure. It’s the move from a closed system to an open, collaborative platform.

Source: Open Banking Implementation Entity (OBIE)

The UK as the Global Epicenter of the Open Banking Revolution

While the concept of financial data sharing isn’t new, the UK’s approach has made it the global leader. The revolution was officially kickstarted in 2018, born from a 2016 investigation by the CMA into the UK’s retail banking market. The report concluded that the market was not competitive enough and that older, larger banks did not have to compete hard enough for customers’ business.

The CMA’s solution was radical: force the nine biggest UK banks (including Barclays, HSBC, Lloyds, and NatWest) to create a standardized Open Banking framework. This was further bolstered by the European Union’s second Payment Services Directive (PSD2), which had similar goals of increasing competition and innovation across the European banking sector.

This government and regulatory push created a fertile ground for growth. Unlike in other regions where data-sharing initiatives have been more industry-led and fragmented, the UK’s top-down mandate created a level, standardized playing field. This has led to an explosion in the number of regulated providers and innovative applications, setting a “gold standard” that nations around the world are now seeking to emulate. The journey has been so profound that the difference between pre-2018 business banking and today’s ecosystem is like comparing the moon venus—two entirely different worlds in terms of visibility and potential.

Source: Competition and Markets Authority Retail Banking Market Investigation

The Tangible Benefits: How Open Banking is Reshaping UK Business Finance

For a business owner, the theoretical underpinnings of Open Banking are less important than the practical, real-world advantages. These benefits are not abstract; they are directly impacting efficiency, profitability, and strategic decision-making.

A Unified Financial Dashboard: The End of Siloed Data

The most immediate benefit is the aggregation of financial data. A typical SME might have a primary business banking account with one provider, a credit card with another, and a loan from a third. Previously, getting a holistic view required logging into multiple portals—like Chase online banking, PNC online banking, and Wells Fargo banking platforms—and manually consolidating the information in a spreadsheet.

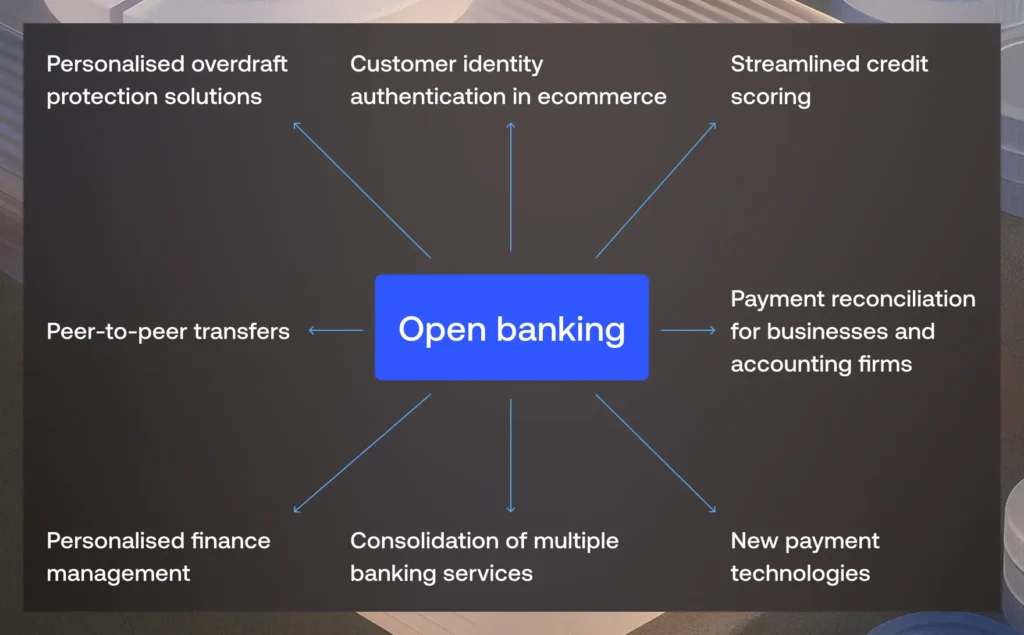

Open Banking-powered apps (like Fluidly, Snoop, or Emma) allow a business to connect all of these disparate accounts into a single, real-time dashboard. With one login to the third-party app, a business owner can see every pound and penny across every online banking account. This provides an unprecedented, up-to-the-minute overview of their complete financial position, a task that used to take hours now takes seconds. This isn’t just a convenience; it’s a strategic advantage.

Streamlined and Automated Accounting

The integration between Open Banking and cloud accounting software (like Xero, QuickBooks, and Sage) has been a game-changer. Instead of manual statement uploads or unreliable bank feeds, Open Banking APIs create a direct, secure, and automatic link.

Every transaction from a connected banking account is fed directly into the accounting software in real-time. This dramatically reduces manual data entry, minimizes human error, and makes bank reconciliation almost instantaneous. This automation frees up countless hours for business owners and their accountants, allowing them to focus on value-added activities like strategic analysis rather than tedious data management. The conversation shifts from “Did you categorize these expenses?” to “Based on this real-time data, how can we optimize our spending?”

Supercharged Lending and Credit Decisions

Securing business financing has traditionally been a slow, paper-intensive process. Lenders in commercial banking would demand months or even years of bank statements, financial reports, and cash flow projections. The underwriting process was slow and often opaque.

Open Banking completely transforms this dynamic. When applying for a loan, a business can now grant a prospective lender temporary, secure access to their real-time transaction data. Instead of relying on historical, static documents, the lender can use this rich, up-to-date data to:

- Assess Creditworthiness Instantly: Algorithms can analyze income, expenditure patterns, and cash flow volatility in minutes, not weeks.

- Offer More Tailored Products: Lenders can get a true picture of a business’s health and offer products and rates that accurately reflect its risk profile.

- Reduce Fraud and Improve Risk Management: Direct access to bank-verified data helps lenders combat fraud and make more accurate risk assessments, which is crucial for avoiding the pitfalls of bad loans in the banking industry.

This leads to faster decisions, higher approval rates for healthy businesses, and more competitive pricing. It’s a win-win, reducing friction for the borrower and improving the quality of underwriting for the lender, a far cry from the conditions that can lead to a banking crisis.

Enhanced Cash Flow Management and Forecasting

Cash flow is the lifeblood of any SME. Open Banking has given rise to a new generation of powerful cash flow forecasting tools. By analyzing historical and real-time transaction data, these platforms can use AI and machine learning to predict future cash flow with remarkable accuracy.

These tools can identify recurring payments, predict future revenue based on invoicing patterns, and flag potential cash crunches weeks or even months in advance. For a business owner, this means moving from reactive crisis management to proactive financial planning. Concepts similar to velocity banking, where the goal is to maximize cash flow efficiency, become easier to implement when you have a precise, forward-looking view of your finances. This is a level of financial intelligence that was previously only accessible to large corporations with dedicated treasury departments.

Frictionless Payments and Simplified Invoicing

Open Banking’s payment initiation (PISP) functionality is creating new, more efficient payment rails. When a customer pays an invoice, they can be prompted to “Pay by Bank.” With a few clicks, they are securely authenticated with their bank’s mobile banking app (like the one from Barclays Bank) and approve the payment directly from their account to the business’s account.

This method offers several advantages over traditional card payments or bank transfers (with their complex discussions of EFT meaning in banking):

- Lower Transaction Costs: It bypasses expensive card networks, saving the business money on every transaction.

- Instant Settlement: Unlike card payments that can take days to settle, these payments can be near-instantaneous.

- Reduced “Fat Finger” Errors: The payment details (amount, reference, recipient account) are pre-populated, eliminating the risk of a customer typing the wrong information.

- Improved Security: The entire process is handled using the bank’s own robust security and authentication.

Real-World Examples: Open Banking in Action

- Tide: A popular digital banking platform in the UK focused on SMEs, Tide uses Open Banking to allow its customers to connect and view their accounts from other banks within the Tide app. This makes Tide a central financial hub for its users.

- Xero: This leading accounting software uses Open Banking APIs to provide reliable, real-time bank feeds, making reconciliation a breeze for millions of small businesses.

- Credit Kudos (now part of Apple): A credit reference agency that uses Open Banking data to provide a more accurate and fairer assessment of creditworthiness, helping individuals and businesses who might be overlooked by traditional credit scoring models.

These examples show that Open Banking isn’t just theory; it’s a practical tool being deployed to solve real-world business banking problems every single day. The ease of using your mobile banking app to consent and share data is central to its rapid adoption.

The Global Ripple Effect: Is the US and Australia Next?

The success of the UK model has not gone unnoticed. Financial sectors worldwide are now in various stages of implementing their own versions of open data sharing.

- Australia: Australia’s Consumer Data Right (CDR) is a close cousin to Open Banking. It started in the banking sector and is now expanding to energy and telecommunications, showing the broader potential of the “open” concept. Major players like ANZ Banking, Westpac Banking, NAB Banking, and Commonwealth Bank are all deeply involved in the CDR rollout, accessible through their respective internet banking platforms (ANZ internet banking, NAB internet banking login, etc.). Platforms like St George internet banking and Suncorp internet banking are also part of this ecosystem.

- United States: The US has taken a more market-driven approach rather than a top-down regulatory one. While there isn’t a direct equivalent of the UK’s CMA mandate, Section 1033 of the Dodd-Frank Act provides a foundation for consumer data rights. Major US banks like Chase Banking, PNC (with its popular www.pncbank.com online banking), and Bank of America are developing their own API strategies, often in partnership with data aggregators like Plaid. The conversation is happening in the boardrooms of every major institution, from Truist to M&T Bank. The potential for enhanced private banking and wealth management services through data aggregation is particularly compelling for the US market.

- Canada: Canada is also actively developing its own “consumer-directed finance” framework, with institutions like RBC exploring cross border banking solutions powered by these new data-sharing capabilities.

This global movement signifies a fundamental acceptance that the future of finance is open. The question is no longer if other countries will adopt similar models, but how and when. The challenges of platform stability, such as a Commonwealth Bank outage online banking or finding the M&T Bank mobile banking down, actually strengthen the case for a decentralized, multi-provider ecosystem built on Open Banking principles.

Navigating the Challenges and Security Concerns

No revolution is without its challenges. The primary concern for both consumers and businesses is, understandably, security. Handing over financial data requires immense trust.

The UK’s Open Banking framework was designed with security at its core.

- Strict Regulation: All third-party providers (TPPs) must be authorized and regulated by the Financial Conduct Authority (FCA). They are subject to rigorous security, data handling, and capital requirements. This regulated environment stands in stark contrast to the opaque world of shadow banking, where activities occur outside the regulatory perimeter.

- Bank-Level Security: You never share your online banking login credentials with the TPP. All authentication happens directly with your bank, using their own multi-factor authentication.

- Explicit Consent: No data is shared without your explicit and informed consent. You decide which TPPs can access your data, what data they can see, and for how long. This consent must be renewed periodically (typically every 90 days).

While the system is robust, the challenge remains in educating the public and building trust. High-profile incidents, even if unrelated to Open Banking (like a major M&T Bank online banking outage), can create generalized anxiety about digital banking security. Continuous transparency and user education are key to overcoming this hurdle.

The Future of Business and Investment Banking

Open Banking is just the first step. The next evolution is “Open Finance,” which will extend these data-sharing principles to a wider range of financial products, including savings, investments, mortgages, insurance, and pensions. Imagine a single platform where a business can not only manage its cash flow but also optimize its insurance coverage, manage its corporate investment banking portfolio, and plan for employee pensions in a seamless, data-driven way.

For private banking clients and sophisticated investors, this could mean hyper-personalized wealth management services that analyze their entire financial life—across all institutions—to provide holistic advice. Even complex fields like investment banking could see benefits in areas like due diligence and M&A analysis, using aggregated, real-time data to assess target companies more effectively.

Furthermore, looking at global trends in government services, one can speculate how this infrastructure could streamline social security. While a specific policy like the centrelink cash boost 2025 is an Australian government initiative, the underlying technology of Open Banking could one day be used to verify eligibility and distribute such payments with far greater efficiency and accuracy than current systems allow, reducing fraud and administrative overhead.

Daily Developments & Keeping Abreast of Banking News

The world of Open Banking and fintech is in constant motion. What is revolutionary today will be standard tomorrow. For any business leader or finance professional, staying informed is critical. This digital transformation doesn’t pause for a banking holiday; in fact, the 24/7 nature of APIs means that asking “is today a banking holiday?” becomes increasingly irrelevant for data-driven financial management.

To keep up with the latest banking news and developments:

- The Open Banking Implementation Entity (OBIE): The official body in the UK provides regular updates, reports, and insights.

- Financial News Publications: The Financial Times, The Wall Street Journal, and Bloomberg have dedicated sections covering fintech and financial innovation.

- Tech and Fintech Media: Outlets like TechCrunch, Finextra, and AltFi provide daily coverage of startups, funding rounds, and new product launches in the space.

The Unstoppable Shift in the Financial Landscape

Open Banking in the UK is more than just a technological upgrade; it is a fundamental paradigm shift that has permanently altered the business banking landscape. It has broken down decades-old data silos, fostered unprecedented competition, and empowered SMEs with financial tools and insights that were once the exclusive domain of large corporations.

By placing data ownership and control firmly in the hands of the customer, it has unleashed a wave of innovation that is improving efficiency, reducing costs, and enabling smarter financial decisions. From automated accounting and real-time cash flow forecasting to faster lending and frictionless payments, the benefits are tangible and growing every day.

The revolution that started in the UK is now a global movement. The principles of open, secure, and consent-driven data sharing are setting the agenda for the future of finance worldwide. For businesses, this is not a change to be feared, but an opportunity to be seized. The era of closed, siloed banking is over. The future of banking is open, and it’s happening now.