Introduction: The Digital Revolution in Investment Banking

The landscape of investment banking has undergone a seismic shift in recent years. Gone are the days when deals were made exclusively in boardrooms and on golf courses. Today’s top-tier financial institutions are embracing digital transformation, and LinkedIn has emerged as the premier platform for sophisticated lead generation strategies. As traditional business banking models evolve, investment bankers are discovering that their next billion-dollar deal might just be one LinkedIn message away.

- Introduction: The Digital Revolution in Investment Banking

- The Strategic Imperative: Why Investment Banking Needs LinkedIn

- Core Strategies Top Investment Banking Firms Deploy on LinkedIn

- Industry-Specific LinkedIn Strategies

- The Technology Stack Behind Successful LinkedIn Lead Generation

- Compliance and Regulatory Considerations

- Advanced LinkedIn Features for Investment Banking

- Case Studies: Success Stories from Leading Firms

- The Future of LinkedIn Lead Generation in Investment Banking

- Best Practices and Common Pitfalls

- Integration with Traditional Investment Banking Business Development

- Measuring Return on Investment

- The Role of Firm Pages vs. Individual Profiles

- The Changing Nature of Banking and Digital Transformation

- Global Perspectives on LinkedIn Lead Generation

- Sector-Specific Deep Dives

- Building Internal Capabilities

- Conclusion: The Future of Investment Banking Business Development

- Additional Resources and References

The convergence of finance and technology has created unprecedented opportunities for banking professionals. Whether you’re in commercial banking, private banking, or specialized investment banking, understanding how to leverage LinkedIn effectively has become as crucial as understanding market fundamentals. This comprehensive guide explores the cutting-edge strategies that elite investment banking firms employ to generate high-quality leads, build relationships with C-suite executives, and close transformative deals through the world’s largest professional network.

The Strategic Imperative: Why Investment Banking Needs LinkedIn

Understanding the Modern Banking Landscape

The financial services industry has experienced dramatic changes over the past decade. Traditional personal banking and digital banking services have moved almost entirely online, with platforms like pnc online banking, chase online banking, and wells fargo banking offering comprehensive digital solutions. This shift has fundamentally changed how banking professionals interact with clients.

According to recent research from McKinsey & Company (https://www.mckinsey.com/industries/financial-services/our-insights), over 75% of corporate decision-makers now prefer digital channels for initial business interactions. This trend has forced investment banking firms to reconsider their entire approach to client acquisition and relationship management.

The rise of mobile banking applications and online banking account accessibility has created a generation of executives who are comfortable conducting significant business online. Major institutions offering services from regions online banking to truist online banking have recognized this shift, investing billions in their digital infrastructure.

Why LinkedIn Outperforms Traditional Channels

LinkedIn’s unique position as a professional networking platform makes it ideally suited for investment banking lead generation. Unlike other social media platforms, LinkedIn users are in a business mindset when they log in. They’re actively seeking professional opportunities, industry insights, and valuable connections.

The platform boasts over 900 million users globally, with more than 61 million users in senior-level positions and 40 million in decision-making roles (Source: LinkedIn Official Statistics – https://news.linkedin.com/about-us#statistics). For investment bankers pursuing M&A opportunities, capital raising mandates, or advisory engagements, this concentration of decision-makers is unprecedented.

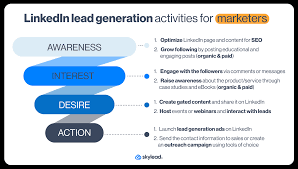

Core Strategies Top Investment Banking Firms Deploy on LinkedIn

1. Building Authoritative Personal Brands

Top-tier investment banking professionals understand that their personal brand is inseparable from their firm’s reputation. Leading bankers from Goldman Sachs, JP Morgan, and Morgan Stanley invest significant time cultivating their LinkedIn presence.

Content Creation and Thought Leadership

The most successful investment bankers publish regular content addressing:

- Market analysis and economic trends

- Industry-specific insights (technology, healthcare, energy sectors)

- Deal structure innovations

- Regulatory changes affecting commercial banking and capital markets

- Digital transformation in financial services

Senior managing directors at major investment banks typically publish 2-3 articles or posts weekly, focusing on providing genuine value rather than promotional content. This approach positions them as trusted advisors rather than salespeople.

Profile Optimization

Elite investment bankers optimize every element of their LinkedIn profiles:

- Professional headshots conveying approachability and competence

- Headlines emphasizing specialization (e.g., “Technology M&A | Helping SaaS Companies Scale Through Strategic Acquisitions”)

- Detailed experience sections highlighting specific deal experience and sector expertise

- Rich media including presentations, articles, and case studies

- Strategic keyword placement for search optimization

2. Advanced Search and Targeting Techniques

Investment banking firms leverage LinkedIn’s powerful search capabilities to identify ideal prospects with laser precision.

Sales Navigator Mastery

Top firms invest heavily in LinkedIn Sales Navigator, which offers advanced filtering options:

- Company size and revenue parameters

- Recent funding rounds or acquisitions

- Job title and seniority level

- Geographic location

- Industry and sub-industry classifications

- Company growth indicators

According to LinkedIn’s internal data (https://business.linkedin.com/sales-solutions/resources/sales-research), Sales Navigator users see 3x more InMail response rates compared to standard LinkedIn users.

Boolean Search Techniques

Sophisticated investment bankers use Boolean search operators to find highly specific prospects:

text(CFO OR "Chief Financial Officer" OR "VP Finance") AND (SaaS OR "Software as a Service") AND ("Series B" OR "growth stage") NOT competitorThese advanced searches allow investment banking professionals to identify companies at specific inflection points where banking services become most valuable.

3. Relationship-Based Outreach

The most effective investment bankers recognize that LinkedIn lead generation is fundamentally about relationship building, not transactional selling.

The Warm-Up Sequence

Rather than immediately pitching services, top performers follow a systematic warm-up approach:

- Initial Engagement – Like and thoughtfully comment on prospects’ posts

- Value Addition – Share relevant articles or insights without asking for anything

- Connection Request – Send personalized connection requests referencing shared interests or mutual connections

- Continued Nurturing – Provide ongoing value through the relationship

- Strategic Conversation – Only after establishing credibility, transition to exploratory conversations

This approach typically spans 4-8 weeks before any direct business discussion occurs. While this requires patience, it generates significantly higher-quality conversations and conversion rates.

Personalization at Scale

Leading firms use sophisticated CRM integrations to maintain personalization while operating at scale. They track:

- Prospect company news and developments

- Individual career progressions and achievements

- Content engagement patterns

- Mutual connections and potential introduction paths

- Relevant trigger events (funding rounds, leadership changes, market expansions)

4. Content Marketing Excellence

Investment banking firms increasingly operate sophisticated content marketing operations rivaling traditional media companies.

Pillar Content Strategy

Top firms develop comprehensive “pillar” content pieces addressing major topics in their focus sectors. For example, a healthcare-focused investment banking team might produce:

- Annual healthcare M&A trend reports

- Quarterly valuation benchmark studies

- Regulatory impact analyses

- Technology disruption assessments

These substantial pieces (typically 3,000-10,000 words) serve as lead magnets, requiring email registration for access. They establish deep expertise while building targeted prospect lists.

Multi-Format Content Distribution

Sophisticated firms repurpose core insights across multiple formats:

- Long-form LinkedIn articles

- Short-form posts highlighting key statistics

- Video commentary on market developments

- Infographics visualizing complex data

- Podcast discussions with industry leaders

- Webinar presentations on specialized topics

This multi-channel approach ensures maximum visibility and accommodates different content consumption preferences.

Industry-Specific LinkedIn Strategies

Technology Sector Investment Banking

Technology-focused investment banking teams deploy specialized strategies:

Developer and Technical Founder Engagement

Many technology companies are founded by technical leaders who spend significant time on LinkedIn. Investment bankers serving this sector often:

- Participate in technology-focused LinkedIn groups

- Comment on technical and product development posts

- Share insights on SaaS metrics, unit economics, and scaling challenges

- Position themselves as understanding both finance and technology

Ecosystem Mapping

Successful tech bankers map entire ecosystems including:

- Portfolio companies of specific venture capital firms

- Companies using similar technology stacks

- Businesses serving similar customer segments

- Organizations with overlapping leadership or board members

Healthcare and Life Sciences Banking

Healthcare-focused investment bankers face unique challenges given industry complexity and regulation.

Clinical and Scientific Credibility

Leading healthcare bankers enhance their credibility by:

- Collaborating with medical advisory boards

- Publishing content reviewed by clinical experts

- Attending and live-posting from major medical conferences

- Building relationships with key opinion leaders in specific therapeutic areas

Regulatory Intelligence

Healthcare investment banking professionals provide immense value by tracking and analyzing:

- FDA approval pathways and timeline expectations

- Reimbursement landscape changes

- Healthcare policy developments

- Clinical trial results and implications

Energy and Infrastructure Banking

Energy sector investment bankers use LinkedIn to navigate the industry’s transformation.

Energy Transition Focus

Forward-thinking energy bankers position themselves at the intersection of traditional energy and sustainability:

- Renewable energy financing structures

- Carbon credit markets and trading

- Energy storage and grid modernization

- Electric vehicle infrastructure development

Project Finance Expertise

Infrastructure investment banking requires deep technical knowledge. Top performers demonstrate expertise through:

- Detailed project finance structure analyses

- Risk allocation framework explanations

- Public-private partnership case studies

- Tax equity and incentive optimization discussions

The Technology Stack Behind Successful LinkedIn Lead Generation

CRM Integration and Data Management

Top investment banking firms integrate LinkedIn with enterprise CRM systems like Salesforce, Microsoft Dynamics, or custom platforms.

This integration enables:

- Automatic profile data enrichment

- Activity tracking across all client touchpoints

- Team collaboration on relationship development

- Pipeline management and conversion analytics

- Compliance and regulatory documentation

Marketing Automation Platforms

Sophisticated firms deploy marketing automation tools that work alongside LinkedIn:

- HubSpot for inbound marketing and lead nurturing

- Marketo for enterprise-scale campaign management

- Pardot for B2B marketing automation

- Custom platforms for specialized workflows

These systems enable personalized communication at scale while maintaining the human touch essential in investment banking relationships.

Analytics and Performance Tracking

Leading firms obsessively measure LinkedIn performance:

Profile Analytics

- Profile view trends and sources

- Search appearance data

- Post engagement rates

- Follower growth and composition

Content Performance Metrics

- Impressions and reach

- Engagement rate (likes, comments, shares)

- Click-through rates on external links

- Lead generation conversion rates

- Content type performance comparisons

Relationship Development Metrics

- Connection acceptance rates

- InMail response rates

- Conversation progression rates

- Meeting conversion rates

- Pipeline contribution and deal attribution

According to research from the Rain Group (https://www.rainsalestraining.com/), top-performing sellers who leverage social selling generate 45% more opportunities and are 51% more likely to hit quota.

Compliance and Regulatory Considerations

Investment banking operates under strict regulatory oversight, making LinkedIn strategy more complex than in other industries.

FINRA and SEC Requirements

Investment banking firms must navigate:

Communications Supervision

All LinkedIn activity by registered representatives falls under communications supervision requirements. Leading firms implement:

- Pre-approval workflows for certain content types

- Automated monitoring of posts and messages

- Archiving systems for regulatory compliance

- Regular training on acceptable communications

Disclosure Requirements

Investment bankers must be careful about:

- Deal announcements and confidential information

- Performance claims and testimonials

- Material non-public information

- Conflicts of interest

Global Privacy Regulations

International investment banking operations must comply with various privacy regimes:

GDPR Compliance (Europe)

Firms must ensure:

- Explicit consent for data processing

- Right to erasure capabilities

- Data portability options

- Privacy policy transparency

CCPA Compliance (California)

Similar requirements apply for California residents, affecting many technology companies.

Cross-Border Data Transfer

Investment banks with global operations must implement appropriate safeguards for international data transfers.

Advanced LinkedIn Features for Investment Banking

LinkedIn Events for Industry Leadership

Progressive investment banking teams use LinkedIn Events to:

- Host virtual industry conferences

- Conduct deal market updates

- Provide regulatory briefings

- Facilitate sector-specific networking

These events generate qualified leads while positioning firms as industry conveners and thought leaders.

LinkedIn Live for Real-Time Engagement

Select investment bankers have access to LinkedIn Live, enabling:

- Live market commentary during significant events

- Q&A sessions on industry developments

- Interview-style conversations with industry leaders

- Conference coverage and insight sharing

Live content generates 7x more reactions and 24x more comments than standard video content (Source: LinkedIn Marketing Blog – https://business.linkedin.com/marketing-solutions/blog).

LinkedIn Newsletter Feature

Top investment bankers leverage LinkedIn’s newsletter functionality to build subscriber bases reaching thousands of industry professionals. Successful newsletters:

- Publish on consistent schedules (weekly or bi-weekly)

- Provide genuinely valuable insights not available elsewhere

- Incorporate original research and data

- Feature clear, actionable takeaways

- Build anticipation through consistent quality

LinkedIn Polls for Engagement and Research

Strategic investment bankers use LinkedIn polls to:

- Gauge market sentiment on industry issues

- Generate engagement that increases post visibility

- Gather informal market intelligence

- Spark discussions in comments sections

- Demonstrate thought leadership through insightful questions

Case Studies: Success Stories from Leading Firms

Case Study 1: Middle Market Technology M&A

A boutique investment bank specializing in software M&A implemented a comprehensive LinkedIn strategy:

Approach:

- Identified 500 target companies using Sales Navigator

- Published weekly content on SaaS valuation trends

- Engaged systematically with target company executives

- Shared relevant industry news with personalized commentary

Results:

- Generated 47 qualified conversations over 6 months

- Closed 3 M&A advisory engagements worth $1.8M in fees

- Built pipeline of 12 additional active opportunities

- Reduced customer acquisition cost by 62% compared to traditional methods

Case Study 2: Healthcare Services Investment Banking

A healthcare-focused investment banking team targeted healthcare services companies for growth capital and M&A advisory:

Approach:

- Developed comprehensive quarterly reports on healthcare services valuations

- Created video content featuring physician advisors discussing industry trends

- Built relationships with private equity firms focused on healthcare

- Engaged with healthcare administrators and executives through thoughtful commentary

Results:

- 180% increase in inbound inquiries over 12 months

- Generated 8 new client mandates

- Expanded referral network by 300+ qualified connections

- Established firm as go-to advisor for outpatient services M&A

Case Study 3: Energy Transition Advisory

An investment bank pivoted to focus on renewable energy and sustainability:

Approach:

- Repositioned team profiles to emphasize energy transition expertise

- Published thought leadership on project finance structures for renewables

- Engaged with cleantech venture capital community

- Participated actively in sustainability-focused LinkedIn groups

Results:

- Successfully repositioned from traditional energy to renewables focus

- Secured 5 renewable energy project finance mandates

- Built relationships with 30+ impact investors

- Generated speaking opportunities at 4 major industry conferences

The Future of LinkedIn Lead Generation in Investment Banking

Artificial Intelligence and Machine Learning

The next frontier in LinkedIn lead generation involves sophisticated AI applications:

Predictive Lead Scoring

AI systems will increasingly analyze:

- Company growth trajectories and inflection points

- Leadership team changes and their implications

- Market conditions indicating transaction readiness

- Behavioral signals indicating banking service needs

Automated Personalization

Advanced natural language processing will enable:

- Customized message creation at scale

- Real-time conversation suggestions

- Content recommendation engines

- Relationship strength assessment

Virtual and Augmented Reality

As LinkedIn experiments with immersive technologies, investment banking professionals may eventually:

- Conduct virtual roadshows and pitch presentations

- Host immersive industry conferences

- Create 3D data visualizations and deal models

- Facilitate virtual deal room experiences

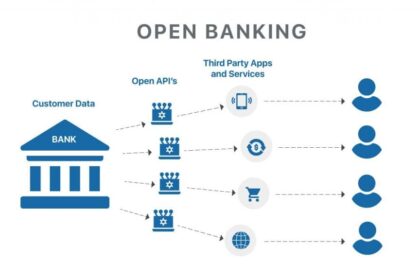

Integration with Open Banking and Financial Data

The open banking movement is creating new data sources that could integrate with LinkedIn:

- Real-time financial performance indicators

- Banking relationship data (with appropriate permissions)

- Transaction trend analyses

- Working capital and cash flow patterns

This integration could revolutionize how investment bankers identify opportunities and provide advice.

Best Practices and Common Pitfalls

What Works: Proven Best Practices

Consistency Over Intensity

The most successful investment bankers maintain consistent presence rather than sporadic bursts of activity. Publishing twice weekly outperforms publishing ten times in one week then disappearing for months.

Generosity Before Requests

Top performers provide value in a 10:1 ratio—ten valuable interactions before asking for anything. This approach builds genuine relationships rather than transactional connections.

Authenticity and Vulnerability

Contrary to traditional investment banking culture emphasizing perfection, LinkedIn rewards authentic voices willing to share lessons learned, challenges faced, and genuine perspectives.

Long-Term Relationship Focus

Elite bankers recognize that today’s junior manager may be tomorrow’s CEO. They invest in relationships regardless of immediate transaction potential.

What Doesn’t Work: Common Mistakes

Immediate Pitching

Nothing destroys credibility faster than connecting with someone and immediately pitching services. This approach generates blocking, reporting, and reputation damage.

Generic Mass Messaging

While scale is important, obviously templated messages with minimal personalization generate minimal results. The “spray and pray” approach fails in investment banking.

Overly Promotional Content

Constant self-promotion and deal announcements without educational value causes audiences to disengage. The 80/20 rule applies—80% educational value, 20% promotional.

Inconsistent Activity

Prospects need multiple touchpoints before engaging. Bankers who post actively for two months then disappear lose momentum and credibility.

Ignoring Compliance

Regulatory violations can result in severe consequences. All LinkedIn activity must comply with industry regulations governing communications, disclosures, and information sharing.

Integration with Traditional Investment Banking Business Development

LinkedIn strategies work best when integrated with traditional business banking and investment banking business development approaches:

Conference and Event Amplification

Smart bankers amplify conference value through LinkedIn:

Pre-Conference Outreach

- Identify attendees using LinkedIn

- Request meetings before schedules fill

- Share preview content building anticipation

- Establish initial contact before in-person meetings

During-Conference Engagement

- Live-post key insights and takeaways

- Tag speakers and panelists appropriately

- Share photos and moments (with permission)

- Facilitate introductions between connections

Post-Conference Follow-Up

- Share comprehensive event recaps

- Continue conversations started at events

- Connect with new contacts made

- Distribute presentations or materials

Integration with Traditional Media

Investment bankers featured in traditional media amplify coverage through LinkedIn:

- Share articles with personal commentary

- Thank journalists and publications

- Engage with comments and questions

- Repurpose insights into LinkedIn-native content

According to the Edelman Trust Barometer (https://www.edelman.com/trust/trust-barometer), earned media credibility increases by 40% when shared by individuals versus company pages.

Referral Network Development

LinkedIn excels at building and maintaining referral relationships:

Professional Services Network

Investment bankers cultivate relationships with:

- Corporate attorneys at major law firms

- Accounting firm partners serving middle market and enterprise clients

- Management consultants identifying client needs

- Private banking professionals serving high-net-worth entrepreneurs

- Commercial real estate advisors

Industry Executives and Board Members

Former clients, retired executives, and board members provide invaluable referrals. LinkedIn enables maintenance of these relationships through:

- Celebrating career milestones and achievements

- Sharing relevant industry insights

- Periodic check-ins without specific agendas

- Providing value without immediate expectations

Measuring Return on Investment

Sophisticated investment banking firms track LinkedIn ROI across multiple dimensions:

Direct Revenue Attribution

Deal Source Tracking

Leading firms implement systems tracking every client mandate back to original source:

- LinkedIn-originated conversations

- Referrals facilitated through LinkedIn relationships

- Influence of LinkedIn content on prospect decisions

- Acceleration of existing pipeline through LinkedIn nurturing

Pipeline Contribution

Beyond closed deals, firms measure:

- Qualified opportunities in pipeline

- Expected value of LinkedIn-sourced pipeline

- Conversion rate comparisons across channels

- Time-to-close differences by origination source

Brand Value and Market Position

Share of Voice

Investment banks track their visibility relative to competitors:

- Follower counts and growth rates

- Content engagement comparisons

- Thought leadership recognition

- Media and speaking opportunity generation

Talent Attraction

An often-overlooked benefit: strong LinkedIn presence attracts top talent. Firms measure:

- Recruiting funnel improvements

- Application quality increases

- Reduced time-to-hire

- Improved acceptance rates for offers

Relationship Capital Development

Network Growth and Quality

Sophisticated firms track not just connection quantity but quality:

- Percentage of connections in target buyer personas

- Relationship strength indicators

- Engagement rate among key connections

- Mutual connection overlap with prospects

The Role of Firm Pages vs. Individual Profiles

Successful LinkedIn strategies leverage both company pages and individual profiles:

Investment Banking Firm Pages

Company pages serve specific functions:

Brand Consistency and Credibility

- Showcase firm history and credentials

- Highlight major transactions and achievements

- Present team expertise and capabilities

- Demonstrate industry recognition and awards

Recruitment and Culture

- Attract top analyst and associate talent

- Showcase firm culture and values

- Share employee spotlights and success stories

- Promote diversity and inclusion initiatives

Content Distribution Hub

- Republish individual content for broader reach

- Share firm research and market insights

- Announce new hires and promotions

- Distribute press releases and media coverage

Individual Banker Profiles

Personal profiles drive most actual lead generation:

Relationship Building

People connect with people, not companies. Individual profiles enable authentic relationship development impossible through company pages.

Thought Leadership

Personal perspectives and insights resonate more powerfully than corporate communications. Individual voices build trust and credibility.

Network Effects

Each banker’s network extends the firm’s reach. A 50-person investment banking team with 500 connections each creates a potential network of 25,000 first-degree connections.

The Changing Nature of Banking and Digital Transformation

The convergence of traditional banking services and digital innovation is reshaping the industry landscape:

Digital Banking Revolution

The rise of digital banking platforms has fundamentally altered customer expectations. Services from chase banking to pnc banking now emphasize seamless digital experiences. This transformation extends beyond retail banking account services into commercial banking and even investment banking.

Major institutions have invested billions in digital capabilities:

- Bank of America online banking serves over 40 million digital users

- Wells Fargo banking processed over 6 billion digital transactions annually

- Chase online banking capabilities include integrated financial planning tools

- Regions online banking offers sophisticated treasury management for business clients

- Truist online banking emerged from a merger specifically designed to create digital-first banking

Mobile Banking as Industry Standard

Mobile banking has evolved from novelty to necessity. Whether through pnc banking apps or m&t mobile banking, customers expect full-featured experiences on smartphones.

Investment bankers must understand this context when approaching prospects. C-suite executives accustomed to managing personal finances through mobile banking apps expect similar digital sophistication from their investment banking partners.

Open Banking and Data Sharing

The open banking movement is creating new paradigms for financial data sharing and third-party service integration. This trend, more advanced in Europe and Australia than the United States, enables unprecedented data access with customer permission.

Australian institutions like anz banking, westpac banking, nab banking, and suncorp banking have implemented comprehensive open banking frameworks. Similar capabilities are emerging in U.S. markets, creating opportunities for investment bankers who understand the implications.

The ability to access real-time financial data through anz internet banking, westpac banking online, nab internet banking, or suncorp internet banking platforms creates new advisory possibilities.

Global Perspectives on LinkedIn Lead Generation

North American Market

The U.S. and Canadian investment banking markets are most mature in LinkedIn adoption:

Market Characteristics

- High LinkedIn penetration among business executives

- Sophisticated content marketing ecosystems

- Advanced marketing technology integration

- Competitive landscape requiring differentiation

Regional Considerations

- Different regulatory frameworks across states and provinces

- Sector concentration in specific geographies (technology in San Francisco, financial services in New York, energy in Houston)

- Cultural differences between regions affecting communication styles

European Market

European investment banking faces unique considerations:

Regulatory Environment

- GDPR creating strict data protection requirements

- MiFID II affecting research distribution and client communications

- Varying regulations across EU member states

- Brexit implications for UK-EU financial services

Cultural Factors

- Language diversity requiring multilingual capabilities

- Different professional communication norms across countries

- Varying LinkedIn adoption rates by country

- Preference for local relationships in many markets

Asia-Pacific Market

The Asia-Pacific region presents both opportunities and challenges:

Growth Markets

Rapid digitalization in countries like Singapore, Australia, Hong Kong, and India creates opportunities. Australian banks including commonwealth bank online banking, st george banking, bendigo bank e banking, and greater bank online banking have embraced digital transformation.

Services from anz banking login to westpac login and nab login internet banking login demonstrate sophisticated digital capabilities. Similarly, st george internet banking and macquarie internet banking showcase advanced features.

Regional players like kenya commercial bank online banking, bsp online banking png, and bank of melbourne business banking are expanding digital capabilities.

Cultural Considerations

- Relationship-based business cultures requiring patient cultivation

- Preference for in-person meetings in many markets

- Face-saving considerations in communications

- Varying LinkedIn penetration by country and sector

Middle East and African Markets

These emerging markets present unique dynamics:

Opportunities

- Rapid economic growth creating investment banking opportunities

- Young, digitally-savvy executive populations

- Increasing LinkedIn adoption among business leaders

- Underserved markets with less competitive intensity

Challenges

- Infrastructure limitations in some markets

- Political and economic volatility

- Currency and capital control considerations

- Cultural and religious considerations affecting business practices

Sector-Specific Deep Dives

Financial Services Investment Banking

Bankers serving financial institutions face unique dynamics:

Understanding Digital Transformation

When advising traditional banks on M&A or capital raises, understanding their digital challenges is essential. Topics include:

- Legacy system modernization

- Mobile banking platform development

- Digital banking competitive positioning

- Fintech partnership versus acquisition strategies

- Cybersecurity and fraud prevention

- Banking account opening and onboarding optimization

Regulatory Expertise

Financial services clients value bankers understanding:

- Bank holding company regulations

- Capital adequacy requirements

- Resolution and recovery planning

- Consumer protection regulations

- Anti-money laundering frameworks

- Open banking implementation requirements

Consumer and Retail Banking

Bankers serving consumer-facing businesses leverage LinkedIn to demonstrate understanding of customer trends:

Digital Consumer Behavior

Investment bankers provide value by analyzing:

- E-commerce penetration trends

- Mobile commerce adoption

- Payment method preferences

- Subscription model evolution

- Direct-to-consumer channel development

- Customer acquisition cost trends

Omnichannel Retailing

Understanding integration of:

- Physical retail locations

- E-commerce platforms

- Mobile applications

- Social commerce

- Marketplace presence

- Customer data integration

Industrial and Manufacturing

LinkedIn is particularly effective for reaching industrial decision-makers:

Industry 4.0 and Digital Transformation

Manufacturing executives value insights on:

- IoT and connected equipment

- Predictive maintenance and AI

- Supply chain digitalization

- Additive manufacturing and 3D printing

- Robotics and automation

- Sustainability and circular economy

Consolidation and Value Chain Integration

Manufacturing sectors experience ongoing consolidation. Investment bankers demonstrate value by analyzing:

- Vertical integration opportunities

- Horizontal consolidation drivers

- Cross-border expansion strategies

- Technology acquisition rationales

- Private equity interest in industrial sectors

Building Internal Capabilities

Successful LinkedIn lead generation requires organizational commitment:

Training and Development

Leading investment banking firms invest in:

LinkedIn Fundamentals Training

- Profile optimization workshops

- Content creation training

- Search and targeting techniques

- Compliance and regulatory requirements

- Personal branding development

Advanced Skills Development

- Video content creation

- Data analytics and performance measurement

- Marketing automation platforms

- CRM integration and utilization

- Sales and negotiation skills

Organizational Support

Content Support Teams

Progressive firms provide:

- Professional copywriting and editing

- Graphic design and visual content creation

- Video production and editing

- SEO optimization

- Compliance review processes

Technology Infrastructure

Essential investments include:

- LinkedIn Sales Navigator enterprise licenses

- CRM platforms with LinkedIn integration

- Marketing automation systems

- Content management platforms

- Analytics and reporting tools

Cultural Change Management

Perhaps the biggest challenge is cultural:

Overcoming Traditional Mindsets

Many senior investment bankers built careers through traditional networking and resist digital approaches. Successful firms:

- Demonstrate ROI through pilot programs

- Celebrate early adopter successes

- Provide competitive intelligence on peer firm activities

- Incorporate LinkedIn metrics into performance evaluations

- Allocate protected time for LinkedIn activities

Balancing Control and Autonomy

Firms must balance:

- Compliance and risk management requirements

- Brand consistency and messaging coordination

- Individual authenticity and personal brand development

- Firm culture and individual expression

Conclusion: The Future of Investment Banking Business Development

LinkedIn has fundamentally transformed lead generation for investment banking firms. What began as a digital resume platform has evolved into the most powerful business development tool in finance.

The most successful investment bankers recognize that LinkedIn excellence requires:

Strategic Commitment – Not occasional activity but systematic, consistent engagement

Authentic Relationship Building – Not transactional selling but genuine value creation

Content Excellence – Not promotional messaging but insightful thought leadership

Technical Sophistication – Not manual processes but integrated technology systems

Organizational Alignment – Not individual efforts but coordinated firm strategies

As the banking industry continues its digital transformation—from mobile banking apps to open banking frameworks—investment bankers who master LinkedIn will enjoy significant competitive advantages. They’ll build larger networks, generate higher-quality leads, close more transactions, and build more sustainable businesses.

The firms that succeed will be those that embrace this reality, invest appropriately, develop capabilities systematically, and execute consistently. The future of investment banking business development is digital, relationship-focused, and content-driven—and LinkedIn sits at the center of this transformation.

Whether you’re in commercial banking, private banking, or specialized investment banking, the question isn’t whether to embrace LinkedIn for lead generation but how quickly and effectively you can build world-class capabilities. The competitive landscape rewards early movers and consistent performers.

The transformation is already underway. Top-tier investment banking firms are generating millions in fees from LinkedIn-originated relationships. The only question is whether your firm will lead this transformation or be left behind.

Additional Resources and References

For more information on investment banking and digital transformation in financial services, consider these authoritative sources:

- McKinsey & Company Financial Services Insights: https://www.mckinsey.com/industries/financial-services

- Deloitte Banking & Capital Markets: https://www2.deloitte.com/global/en/industries/financial-services.html

- PwC Financial Services: https://www.pwc.com/gx/en/industries/financial-services.html

- LinkedIn Official Business Blog: https://business.linkedin.com/marketing-solutions/blog

- Harvard Business Review Finance & Investing: https://hbr.org/topic/finance-and-investing

- Financial Times Banking Section: https://www.ft.com/companies/financials

- Bloomberg Banking News: https://www.bloomberg.com/banking

- American Banker: https://www.americanbanker.com

- The Financial Brand (Digital Banking): https://thefinancialbrand.com