In an era defined by rapid technological advancement and unprecedented connectivity, the financial sector finds itself at a pivotal crossroads. Traditional banking models are being continuously reshaped, giving way to innovative digital solutions that prioritize accessibility, personalization, and security. Nowhere is this transformation more critical, or more nuanced, than within the realm of private banking. For high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), the expectation is not merely for robust financial management, but for a seamless, sophisticated digital experience that mirrors the exclusivity and bespoke service they receive offline.

- The Evolving Landscape of Private Banking: Digital as the New Cornerstone

- Unpacking Apex Private Wealth’s Digital DNA: A Case Study in Excellence

- The Impact of Digital Leadership: Beyond the Bottom Line

- Challenges and The Road Ahead: Navigating Tomorrow’s Digital Frontier

- Conclusion: The Enduring Imperative of Digital Vision

This article embarks on a comprehensive case study, dissecting the digital presence of a hypothetical, yet representative, private banking leader – let’s call them “Apex Private Wealth.” Apex exemplifies the vanguard of financial institutions that have not only embraced digital transformation but have actively sculpted it to meet the exacting demands of their clientele. Our exploration will uncover the strategies, technologies, and philosophies that underpin their digital superiority, offering invaluable insights for anyone interested in the future of finance, from seasoned investment banking professionals to individuals seeking superior personal banking services. We will delve into how such leaders craft an online ecosystem that extends beyond mere functionality, fostering trust, delivering unparalleled insights, and maintaining a competitive edge in a fiercely contested market.

The Evolving Landscape of Private Banking: Digital as the New Cornerstone

Private banking, traditionally characterized by white-glove service, personal relationships, and discreet wealth management, has always been an exclusive domain. Historically, it thrived on face-to-face interactions, bespoke advice delivered in luxurious offices, and a human touch that seemed impervious to technological disruption. However, the 21st century brought with it a profound shift in client expectations, driven by the ubiquity of advanced digital tools in every other facet of their lives. Today’s HNWIs, many of whom are digital natives or highly proficient in technology, demand the same level of sophistication and convenience from their financial institutions as they do from their preferred luxury brands or tech platforms.

This shift has made digital banking not just an add-on, but a foundational pillar for any private bank aiming for leadership. The imperative to innovate is clear: deliver an exceptional online banking account experience, provide intuitive mobile banking solutions, and ensure that every digital touchpoint reinforces the brand’s commitment to excellence and security. The challenge lies in integrating these digital advancements without diluting the personalized, relationship-driven core that defines private banking.

Key Trends Shaping the Digital Private Banking Frontier:

- Hyper-Personalization: Moving beyond generic advice to tailored insights based on granular data.

- Seamless Omnichannel Experience: Ensuring a consistent and integrated experience across

online banking, mobile apps, and human advisor interactions. - Advanced Analytics and AI: Leveraging data to predict client needs, optimize portfolios, and detect anomalies.

- Robust Cybersecurity: Protecting vast sums of wealth and highly sensitive personal information from increasingly sophisticated threats.

- Open Banking Integration: Collaborating with fintechs to offer an expanded suite of services and deeper insights.

These trends underscore that digital presence in private banking is not just about having a website or an app; it’s about building a holistic ecosystem that serves as a seamless extension of the bank’s core value proposition.

Unpacking Apex Private Wealth’s Digital DNA: A Case Study in Excellence

Apex Private Wealth (our hypothetical leader) stands out by strategically integrating technology into every layer of its service delivery. While specific implementations may vary across real-world institutions like PNC banking, Chase banking, or Wells Fargo banking, Apex embodies the best practices observed across these leaders and many more, including regions online banking, truist online banking, and online banking Bank of America. Their approach is characterized by a relentless focus on the client, meticulous attention to security, and a future-forward technological roadmap.

1. The Core Digital Platform: Apex Online & Mobile

At the heart of Apex’s digital strategy is its integrated online and mobile banking platform. This isn’t just a transactional portal; it’s a comprehensive wealth management dashboard designed for intuitive navigation and deep insights.

A. User Experience (UX) and Interface (UI) Excellence:

Apex understands that their clientele values efficiency and elegance. Their online banking portal and mobile banking app (available on all major app stores) boast a clean, minimalist design that prioritizes clarity and ease of use. From the moment a client performs an online banking account login, they are greeted with a personalized dashboard offering a consolidated view of their entire financial landscape with Apex.

- Customizable Dashboards: Clients can arrange widgets to display what matters most to them – be it real-time portfolio performance, cash flow summaries, upcoming

investment bankingopportunities, or a quick link to their dedicated advisor. - Intuitive Navigation: Complex financial data is visualized through interactive charts and graphs, making it digestible and actionable. Whether managing a

business bankingaccount or reviewing personal investments, the flow is logical and streamlined. - Consistency Across Devices: The experience is fluid, whether accessed via

www.pncbank.com online banking(if Apex were PNC) or through their bespoke mobile application, ensuring that clients can seamlessly transition between devices without losing context. This consistency is a hallmark of leaders, contrasting sharply with occasional disruptions some users face with platforms likem&t bank mobile banking downorm&t bank online banking issuesreported by other institutions.

B. Advanced Features for Sophisticated Management:

Beyond basic transactions, Apex’s digital platforms offer a suite of advanced features tailored for high-net-worth individuals:

- Real-time Portfolio Performance: Clients have instant access to their investment portfolios, complete with detailed breakdowns of asset allocation, performance against benchmarks, and risk analysis. This includes granular data on individual holdings across various asset classes.

- Secure Document Vault: A highly encrypted digital vault allows clients to securely store and access important financial documents, statements, and legal agreements. This significantly reduces reliance on physical paperwork and enhances convenience.

- Personalized Insights and Research: Leveraging AI and machine learning, the platform provides tailored market insights, investment recommendations, and economic analyses relevant to the client’s specific portfolio and risk appetite. This goes far beyond generic

banking newsto deliver truly actionable intelligence. - Direct Advisor Communication: Integrated secure messaging and video conferencing tools allow clients to connect directly with their private wealth advisor. This strengthens the

personal bankingrelationship, ensuring that the human touch remains even in the digital realm. - Automated Financial Planning Tools: Interactive tools help clients model different financial scenarios, plan for major life events, and track progress towards their long-term wealth goals. This is particularly valuable for complex estate planning or multi-generational wealth transfer strategies.

- Integrated

Business BankingServices: For entrepreneurial clients, the platform extends to manage theircommercial bankingneeds, offering tools for cash management, treasury services, and trade finance, all accessible from a single portal.

C. Cybersecurity: The Unseen Shield of Trust:

For a private banking leader, security is non-negotiable. Apex invests heavily in multi-layered cybersecurity protocols to protect client assets and data.

- Multi-Factor Authentication (MFA): Mandatory for all logins and critical transactions, often employing biometric authentication (fingerprint, facial recognition) on

mobile bankingapps, as well as hardware tokens or secure app-based authenticators. - Advanced Encryption: All data, both in transit and at rest, is secured with state-of-the-art encryption standards.

- AI-Powered Fraud Detection: Continuous monitoring of transactional patterns for suspicious activities, leveraging machine learning to identify and flag potential fraud in real-time. This protects against

bad loans in banking industryby flagging suspicious large movements or unusual activity. - Regular Security Audits and Penetration Testing: Apex undergoes frequent independent security audits and penetration tests to identify and remediate vulnerabilities before they can be exploited.

- Client Education: Proactive communication campaigns educate clients on best practices for online security, recognizing phishing attempts, and maintaining strong passwords.

This robust security posture is paramount in maintaining client trust, especially when considering the significant financial value and sensitive personal information handled by private banking institutions.

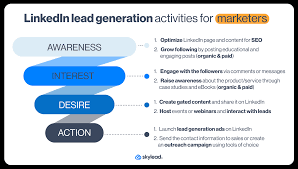

2. Data Analytics & Hyper-Personalization: The Intelligence Engine

The true differentiator for Apex Private Wealth lies in its sophisticated use of data analytics to deliver hyper-personalized services. This moves beyond simply knowing a client’s name; it’s about understanding their financial journey, preferences, and future aspirations at a deep, predictive level.

A. Holistic Client View:

Apex aggregates data from all client interactions – financial transactions, investment performance, website behavior, advisor communications, and even external market data. This creates a 360-degree view of each client, enabling the bank to anticipate needs and proactively offer relevant solutions. For example, if a client frequently explores international investment banking opportunities, the platform will automatically highlight relevant global market reports or cross-border investment strategies.

B. AI-Driven Insights and Recommendations:

Machine learning algorithms analyze this vast dataset to:

- Predict Life Events: Identify potential triggers for major financial decisions, such as a child nearing college age, an impending business sale (relevant for

business bankingclients), or retirement planning. - Tailor Product Offerings: Recommend specific financial products,

banking accounttypes, orinvestment bankingopportunities that align with the client’s current goals and risk profile. - Optimize Portfolio Management: Provide dynamic adjustments and rebalancing suggestions based on market conditions, client goals, and risk tolerance.

- Detect Early Warning Signs: Monitor for signs of financial distress or unusual activity that might indicate a

banking crisisfor a client’s specific sector or even broadershadow bankingconcerns.

C. Content Personalization:

The digital platform curates a personalized feed of banking news, market commentaries, and educational content, ensuring that clients receive information that is directly relevant to their interests and portfolio. This can range from detailed analyses of specific sectors relevant to their commercial banking ventures to insights on global economic trends impacting their investment banking holdings.

3. Client Relationship Management (CRM) Reimagined: Blending Digital & Human

While technology drives efficiency and insights, Apex recognizes that private banking remains a relationship business. Their digital presence is designed to enhance, not replace, the human advisor relationship.

A. Integrated Communication Channels:

The platform offers multiple secure channels for client-advisor interaction, including:

- Secure Messaging: For quick queries and confidential discussions.

- Video Conferencing: For virtual meetings, especially useful for clients with global footprints or busy schedules.

- Shared Workspaces: For collaborative planning, where advisors and clients can co-edit financial plans or review documents in real-time.

This ensures seamless communication, whether a client is accessing chase online banking equivalents or interacting directly with their advisor.

B. Advisor Empowerment Tools:

Apex equips its private wealth advisors with advanced digital tools that leverage client data to provide more informed and personalized advice. Advisors have access to the same 360-degree client view, enabling them to prepare for meetings with deep insights into client needs and preferences. This minimizes time spent on administrative tasks and maximizes time spent on high-value client engagement.

C. Proactive Engagement:

The system flags advisors when a client might need attention – perhaps due to a significant market event affecting their holdings, a change in their spending patterns, or even based on their activity within the online banking platform (e.g., spending extended time on a specific investment research page). This allows for truly proactive and personalized outreach.

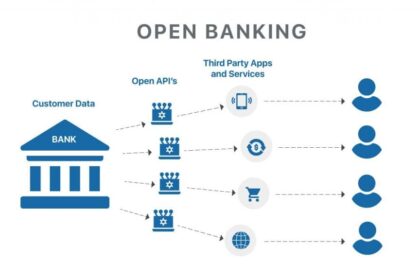

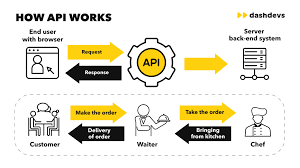

4. Open Banking & API Strategy: The Future of Connectivity

A hallmark of a forward-thinking digital leader like Apex is its embrace of open banking principles. While often associated with retail banking, open banking holds immense potential for private wealth management by enabling secure and controlled data sharing with third-party providers.

A. Enhanced Financial Visibility:

Through secure APIs, clients can link their Apex accounts with other financial platforms they use, providing a consolidated view of their entire financial ecosystem – from external brokerage accounts to other online banking account holdings. This offers a truly comprehensive financial picture, which is invaluable for holistic wealth management.

B. Integration with Specialist Fintechs:

Apex partners with curated fintech companies that offer specialized services complementary to its core offerings. This could include:

- Advanced Tax Optimization Platforms: Seamlessly integrating tax data and strategies.

- Estate Planning Software: Connecting legal and financial aspects of wealth transfer.

- Philanthropy Management Tools: Helping clients manage charitable giving efficiently.

- Specialized

Investment BankingResearch Platforms: Offering niche insights.

This collaborative approach expands the value proposition for clients, providing them with a broader suite of best-in-class tools, all accessible through the Apex ecosystem, or via secure links to platforms like Arvest online banking login or BECU online banking login if these were external services.

C. Future-Proofing:

By building an API-first infrastructure, Apex positions itself to rapidly integrate new technologies and services as they emerge, ensuring its digital platform remains at the cutting edge and avoids becoming technologically stagnant.

5. Regulatory Compliance & Operational Resilience: The Backbone of Trust

In the highly regulated world of finance, especially private banking, a digital presence must be built on an unshakeable foundation of compliance and operational resilience. Apex invests heavily in these areas.

A. Regulatory Adherence:

Apex’s digital systems are designed from the ground up to comply with global financial regulations, including data privacy laws (e.g., GDPR, CCPA) and anti-money laundering (AML) directives. This includes robust audit trails for all digital transactions and communications, ensuring transparency and accountability. Even specific operational considerations like eft meaning in banking are meticulously handled within their digital frameworks.

B. Business Continuity and Disaster Recovery:

Understanding that continuous access is paramount, Apex maintains redundant systems and comprehensive disaster recovery plans. This ensures that online banking services remain available even during unforeseen events, preventing disruptions like those experienced by some users when m&t bank mobile banking down reports surface. This also includes clear communication protocols for banking holidays like Columbus Day or unexpected service impacts, ensuring clients are always informed.

C. Financial Health and Stability:

While not directly part of the digital platform, the underlying financial health of a private bank contributes significantly to trust in its digital presence. Apex maintains strong capital reserves and transparent financial reporting, mitigating concerns about bad loans in banking industry or a broader banking crisis, which could erode confidence in any online banking offering.

The Impact of Digital Leadership: Beyond the Bottom Line

The meticulous development and deployment of Apex Private Wealth’s digital ecosystem yield multifaceted benefits, extending far beyond simple operational efficiencies.

- Enhanced Client Engagement and Satisfaction: A superior digital experience directly translates into higher client satisfaction and deeper engagement. Clients feel more connected, empowered, and valued when they have seamless access to their wealth and personalized insights. This differentiates Apex from competitors still relying on outdated

internet bankingportals. - Competitive Advantage: In a crowded market with institutions ranging from

PNCtoChasetoBank of America, a leading digital presence is a powerful differentiator, attracting new clients who prioritize digital sophistication alongside traditional service. - Operational Efficiency and Cost Savings: Automation of routine tasks, self-service options, and streamlined internal processes lead to significant operational efficiencies, allowing advisors to focus on higher-value activities.

- Revenue Growth: By offering more personalized products and insights, Apex can identify and capture new

investment bankingandbusiness bankingopportunities, leading to increased assets under management and higher revenue per client. - Attraction and Retention of Talent: A technologically advanced environment is attractive to top-tier talent in

banking jobs, particularly those with expertise in fintech, data science, and digital strategy. This ensures Apex can continuously innovate. - Resilience and Adaptability: A robust digital infrastructure allows the bank to quickly adapt to market changes, new regulations, and evolving client demands, ensuring long-term sustainability. For instance, being prepared for

banking holidays 2025or immediate responses to market shifts are baked into their digital framework.

Challenges and The Road Ahead: Navigating Tomorrow’s Digital Frontier

Even a leader like Apex Private Wealth faces ongoing challenges in maintaining its digital supremacy. The pace of technological change shows no signs of slowing, and client expectations continue to rise.

- The Quantum Leap: The advent of quantum computing poses both a threat (to current encryption methods) and an opportunity (for vastly more powerful data analysis). Leaders must invest in research and development to understand and prepare for its impact.

- AI and Machine Learning Ethics: As AI becomes more deeply embedded in decision-making, ethical considerations around data bias, transparency, and accountability will become paramount. Apex must navigate these complexities with care and foresight.

- Evolving Regulatory Landscape: The regulatory environment for

digital bankingis constantly evolving, particularly concerningopen banking, cross-border data flows (e.g.,RBC cross border bankingconsiderations), and cybersecurity. Staying ahead of these changes requires continuous vigilance. - Talent Gap: The demand for specialized skills in AI, data science, blockchain, and cybersecurity within the financial sector continues to outstrip supply. Attracting and retaining this talent for crucial

banking jobsremains a key challenge. - Maintaining the Human Touch: The ultimate challenge is to leverage digital tools to enhance, rather than diminish, the personalized relationship that defines

private banking. Finding the right balance between automation and human interaction will be crucial for institutions likeANZ bankingandWestpac bankingas they continue their digital journeys. - Addressing Emerging Risks: From sophisticated ransomware attacks to the complexities of

shadow bankingactivities, the threat landscape is ever-changing. Continuous investment in threat intelligence and adaptive security measures is non-negotiable.

Conclusion: The Enduring Imperative of Digital Vision

Apex Private Wealth’s case study illuminates a critical truth: in modern private banking, digital presence is no longer a luxury, but a strategic imperative. It’s about more than just transactional efficiency; it’s about building an intelligent, secure, and deeply personalized ecosystem that anticipates client needs and seamlessly integrates into their lives. From intuitive mobile banking apps mirroring the ease of Chase Online to the sophisticated analytics driving investment banking decisions, every digital element contributes to a cohesive, value-driven experience.

As we look towards the future, the boundaries of digital banking will continue to expand, driven by innovations such as blockchain, advanced AI, and immersive digital interfaces. The leaders of tomorrow will be those who not only adopt these technologies but weave them into the very fabric of their client relationships, maintaining the delicate balance between cutting-edge innovation and the timeless values of trust, discretion, and personalized service. For institutions across the globe, from NAB internet banking in Australia to Kenya Commercial Bank online banking in Africa, the lessons from Apex Private Wealth offer a clear roadmap: a future-proof private bank is, unequivocally, a digitally-driven bank, constantly adapting, constantly innovating, and always prioritizing the unparalleled experience of its discerning clientele. The digital frontier of finance is vast and exciting, and its most successful navigators will be those with a clear vision, unwavering commitment, and a relentless focus on excellence.