In an era defined by rapid technological advancement and ever-evolving consumer expectations, the way we manage our money has been fundamentally transformed. Traditional brick-and-mortar institutions are increasingly challenged by agile fintech startups and the growing demand for seamless digital experiences. Amidst this dynamic landscape, established players like PNC Bank have risen to the occasion, attempting to merge the security and familiarity of conventional banking with the convenience and innovation of the digital age. One of their most prominent offerings in this space is the PNC Virtual Wallet – a product designed to revolutionize personal banking by integrating checking, savings, and short-term savings into a single, intuitive platform.

- The Genesis of Digital Banking: A Paradigm Shift

- What Exactly is PNC Virtual Wallet? A Multi-faceted Approach

- Unpacking the Pros: Why PNC Virtual Wallet Stands Out

- Dissecting the Cons: Where Virtual Wallet May Fall Short

- Virtual Wallet in the Broader Banking Landscape: Comparisons and Trends

- Who is PNC Virtual Wallet For? Identifying the Ideal User

- Maximizing Your Virtual Wallet Experience: Tips and Tricks

- The Future of Banking: Where Virtual Wallet Fits In

- Conclusion: Is PNC Virtual Wallet the Right Fit for You?

From the bustling corridors of investment banking firms to the personal finances of millions, banking accounts are the bedrock of economic activity. The concept of a digital-first banking solution, however, takes this to a new level. Our deep dive today explores PNC’s Virtual Wallet, analyzing its strengths, uncovering its weaknesses, and ultimately helping you determine if this innovative banking account aligns with your financial aspirations. We’ll look at everything from its robust mobile banking capabilities to its integration with broader financial strategies, positioning it within the larger conversation about the future of digital banking and personal finance.

The Genesis of Digital Banking: A Paradigm Shift

Before we dissect the intricacies of PNC’s Virtual Wallet, it’s essential to understand the seismic shifts that have occurred within the banking industry over the last two decades. The rise of the internet ushered in online banking, transforming how we paid bills and transferred funds. Then came the smartphone, catalyzing the mobile banking revolution, putting a virtual branch in the palm of our hands. Today, digital banking is not just a feature; it’s an expectation. Consumers demand instant access, personalized insights, and tools that simplify complex financial tasks.

This push for digital convenience extends beyond individual users. Business banking, too, has seen a dramatic shift, with small businesses and large corporations alike seeking streamlined online platforms for everything from payroll to commercial banking transactions. The ability to manage funds, monitor cash flow, and interact with banking services digitally has become paramount.

PNC, with its extensive history and nationwide presence, recognized this trend early. Rather than merely adding digital features to existing products, they aimed to create a holistic digital experience from the ground up, leading to the development of Virtual Wallet. This initiative reflects a broader trend among major institutions like Chase Banking, Wells Fargo Banking, Bank of America, and Truist, all vying for supremacy in the digital domain with their own sophisticated online banking offerings.

What Exactly is PNC Virtual Wallet? A Multi-faceted Approach

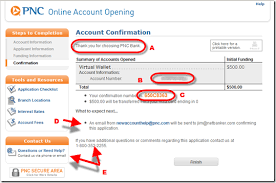

At its core, PNC Virtual Wallet is not just one account; it’s a suite of three interconnected accounts designed to help you manage your everyday spending, short-term savings, and long-term financial goals more effectively. It’s an innovative approach to personal banking that attempts to provide a clear, visual representation of your financial life.

The three primary components are:

- Spend: This is your primary checking account, designed for daily transactions. It comes with a debit card, allows for direct deposits, and offers features like bill pay and Zelle for quick transfers. Think of it as your everyday operating fund.

- Key Feature: Low Cash Mode®, which helps avoid overdraft fees by providing a grace period to bring your balance back up.

- Reserve: This acts as a short-term savings account, linked directly to your Spend account. It’s ideal for setting aside money for upcoming bills, minor emergencies, or short-term goals. Funds can be easily transferred between Spend and Reserve.

- Key Feature: Budgeting tools and customizable savings goals, allowing you to visualize your progress.

- Growth: This is your long-term savings account, typically offering a slightly higher interest rate than Reserve, though often still modest. It’s designed for larger financial objectives like a down payment on a house, retirement savings, or a significant investment.

- Key Feature: Automatic transfers from Spend or Reserve, helping to build savings effortlessly.

This tripartite structure is what sets Virtual Wallet apart, aiming to provide a comprehensive view and control over your finances within a single digital interface. It’s a direct response to the complexity many people face in managing separate checking and savings accounts across different platforms.

Source 1: PNC Official Website – Virtual Wallet Overview https://www.pnc.com/en/personal-banking/banking/checking/virtual-wallet-overview.html

Unpacking the Pros: Why PNC Virtual Wallet Stands Out

PNC’s Virtual Wallet brings a host of advantages to the table, particularly for those seeking an integrated and technologically advanced banking experience.

1. Intuitive Digital Banking Experience

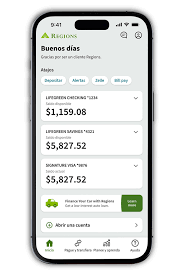

The cornerstone of Virtual Wallet’s appeal is its seamless digital interface. PNC Online Banking via www.pncbank.com online banking and especially the PNC Mobile App are lauded for their user-friendliness and comprehensive features.

- Mobile Banking Excellence: The PNC Mobile App allows users to manage all three Virtual Wallet accounts with ease. Features include mobile check deposit, instant transfers between accounts, customizable alerts, and comprehensive transaction histories. The app’s design prioritizes clarity, making it easy to see where your money is, where it’s going, and how much you have for upcoming expenses. Using your mobile banking app for daily tasks becomes second nature.

- Online Banking Robustness: The www.pncbank.com online banking platform provides a more expansive view, perfect for in-depth budgeting, reviewing statements, and setting up recurring payments. Both platforms ensure that PNC banking is accessible 24/7, providing unparalleled convenience for busy individuals.

2. Powerful Budgeting and Money Management Tools

One of Virtual Wallet’s most compelling features is its integrated money management suite. It moves beyond just displaying balances to actively helping you understand and control your spending.

- Calendar View: A unique feature is the calendar view, which overlays your predicted income and upcoming bills onto a monthly calendar. This helps users visualize their future cash flow, allowing for proactive financial planning and reducing the likelihood of overdrafts.

- Money Bar®: This visual tool shows you how much “free cash” you have after accounting for upcoming bills, giving a real-time snapshot of your disposable income. This kind of immediate feedback is invaluable for day-to-day financial decisions.

- Goals Feature: Within the Reserve and Growth accounts, users can set specific savings goals (e.g., “new car,” “vacation fund”) and track their progress, making abstract savings targets feel more concrete and achievable. This gamified approach to savings encourages discipline.

- Payment Reminders: The system can send personalized reminders for upcoming bills, helping to avoid late fees and maintain a good financial standing.

3. Overdraft Protection and Fee Management

PNC has made efforts to mitigate the common pain points associated with banking fees, particularly overdrafts.

- Low Cash Mode®: This feature stands out. If your Spend account balance is low, PNC provides an alert and a grace period (typically 24 hours) to either transfer funds from Reserve or Growth, or make a deposit, before an overdraft fee is charged. This proactive approach is a significant step towards customer-friendly banking.

- Overdraft Protection with Reserve: Since Reserve is linked, it automatically acts as a source of funds for overdraft protection, helping to cover transactions if your Spend account is depleted.

- Fee Waivers: Depending on the Virtual Wallet tier (there are typically three: Virtual Wallet, Virtual Wallet Performance Spend, and Virtual Wallet Performance Select), monthly service fees can be waived by meeting certain criteria, such as maintaining a minimum daily balance, having a certain amount in direct deposits, or using a linked PNC credit card. This rewards active engagement with PNC banking products.

4. Accessibility and Support

Despite its digital focus, PNC still offers the benefits of a large, established institution.

- Nationwide Branch and ATM Network: For those times when you need in-person assistance, cash deposits, or notary services, PNC provides a robust network of branches and ATMs across its operating regions. This hybrid approach caters to both digital natives and those who prefer occasional human interaction.

- Customer Service: Access to customer service via phone, online chat, and in-person at branches ensures that help is available when needed, contrasting with some purely online banks that rely solely on digital communication.

- Diverse Product Ecosystem: Beyond Virtual Wallet, PNC offers a wide array of other financial products, including credit cards, loans, mortgages, and investment banking services. This allows for a consolidated financial relationship if you choose, simplifying your overall financial management under one umbrella. For small business owners, their business banking solutions can also integrate well.

5. Robust Security Features

In today’s interconnected world, banking security is paramount. PNC employs industry-standard and advanced security measures to protect your accounts.

- Encryption and Firewalls: Data transmitted between your device and PNC’s servers is encrypted, and robust firewalls protect their systems from unauthorized access.

- Fraud Monitoring: PNC actively monitors transactions for suspicious activity, and their fraud departments are equipped to handle any potential breaches swiftly.

- Biometric Login: Mobile banking apps often support fingerprint or facial recognition for secure and convenient login.

- Account Alerts: Customizable alerts keep you informed of significant account activities, such as large transactions, low balances, or suspicious login attempts.

Source 2: PNC Security and Fraud Prevention https://www.pnc.com/en/security/security-and-fraud-prevention.html

Dissecting the Cons: Where Virtual Wallet May Fall Short

While PNC Virtual Wallet offers many benefits, it’s not without its drawbacks. Understanding these limitations is crucial for an informed decision.

1. Potential for Monthly Service Fees

Despite the possibility of fee waivers, Virtual Wallet accounts, particularly the basic tier, can incur a monthly service fee if certain requirements aren’t met.

- Tiered Fees: The higher-tier Virtual Wallet Performance Spend and Performance Select accounts come with higher monthly fees, though they also offer more comprehensive benefits and easier fee waiver criteria. For those with lower balances or less consistent direct deposits, these fees can eat into savings, making other online banking account options more attractive. This is a common concern across many traditional banks, including competitors like Chase online and Wells Fargo.

2. Low Interest Rates on Savings Components

The interest rates offered on the Reserve and Growth components of Virtual Wallet are often relatively low compared to high-yield savings accounts offered by purely online banks or credit unions.

- Opportunity Cost: While the convenience of integrated accounts is undeniable, users might miss out on significantly higher returns by keeping large sums in Virtual Wallet’s savings components rather than a dedicated high-yield account. For individuals focused on maximizing every penny, especially in a fluctuating economic climate, this can be a significant drawback. This is a common point of comparison when looking at me banking (often a digital-first bank with competitive rates) or newer fintech options.

3. Geographic Limitations (for in-person services)

While PNC has a substantial footprint, it’s not truly national like some other major players. If you live outside PNC’s primary operating regions, access to branches and even some ATMs might be limited, forcing a reliance solely on their mobile and online banking services. While online banking bank of America or Chase online banking might have wider physical footprints, even they can have regional gaps. For some users, especially those managing business banking operations that require frequent cash deposits, this could be a deciding factor.

4. Complexity for Some Users

For individuals accustomed to a simple checking account, the three-account structure of Virtual Wallet, while beneficial for budgeting, might initially feel overwhelming or overly complex. Managing the flow of funds between Spend, Reserve, and Growth requires a certain level of engagement and understanding, which some users might prefer to avoid. This contrasts with minimalist banking apps that prioritize extreme simplicity.

5. Over-reliance on Digital Platforms

While a pro for many, an over-reliance on digital platforms can be a con for others. Issues like m&t bank online banking issues or m&t bank mobile banking down, which occasionally plague even the most robust systems, can cause significant disruption if all your financial management is tied to a single app. Although PNC’s systems are generally stable, a major commonwealth bank outage online banking or similar widespread banking crisis event could impact access. This highlights the importance of having backup plans and understanding the system’s robustness.

Virtual Wallet in the Broader Banking Landscape: Comparisons and Trends

To truly appreciate PNC’s Virtual Wallet, it’s helpful to contextualize it within the larger banking ecosystem. The competition in digital banking is fierce, with every major player investing heavily in their online and mobile offerings.

Traditional Banks vs. Digital Innovators

- Chase Banking & Wells Fargo Banking: These giants, along with Bank of America and Truist online banking, offer robust online and mobile banking experiences, often with sophisticated budgeting tools and extensive branch networks. However, few integrate checking and multiple savings tiers as seamlessly as Virtual Wallet’s core design. Chase online, for instance, focuses on a strong user interface but typically keeps savings accounts separate.

- Regions Online Banking & M&T Bank: Regional players like Regions and M&T Bank (with its m&t mobile banking and m&t bank online banking) also strive for digital excellence, often catering to more localized customer bases. While they offer comprehensive services, their digital ecosystems might not always have the same depth of integrated financial planning tools found in Virtual Wallet.

- Online-Only Banks (e.g., Ally, Discover, “me banking” concepts): These institutions excel in offering high-yield savings accounts and often boast fee-free checking. Their primary drawback is the lack of physical branches, which can be an issue for cash transactions or in-person assistance. They represent a strong alternative for those prioritizing interest rates and minimal fees over branch access. Robinhood banking also represents a newer hybrid model merging investment and banking.

The Rise of Open Banking

PNC’s Virtual Wallet aligns with the spirit of open banking, a trend where banks allow third-party financial service providers to access customer data (with consent) to develop new apps and services. While Virtual Wallet is an integrated solution within PNC’s ecosystem, its design emphasizes data visualization and control, which are tenets of the open banking movement. This trend is gaining significant traction globally, with examples seen in ANZ Banking, Westpac Banking, NAB Banking, and Suncorp Banking in Australia, all developing robust open API frameworks for their ANZ Internet Banking, NAB Internet Banking, and Westpac Online platforms. The Australian Banking Association is at the forefront of this movement.

Adapting to Banking News and Economic Shifts

The current economic climate, characterized by fluctuating interest rates and discussions around inflation, constantly influences banking decisions. Personal banking clients are always looking for the best return on their savings and the most cost-effective ways to manage debt. Banking news reports on issues like the banking crisis or potential bad loans in banking industry can make customers more cautious and seek stable, transparent institutions. Virtual Wallet’s emphasis on visibility and control can be particularly reassuring in such times, allowing users to quickly react to changes in their financial situation or the broader economy.

Even seemingly mundane details, like is today a banking holiday or banking holidays 2025, can impact financial transactions. Knowing when banks are open or closed is crucial for planning major transfers, especially for businesses dealing with commercial banking operations. PNC, like other major banks, clearly communicates its holiday schedule, including days like Columbus Day, ensuring customers can plan accordingly.

Who is PNC Virtual Wallet For? Identifying the Ideal User

PNC Virtual Wallet isn’t a one-size-fits-all solution, but it particularly shines for certain demographics and financial needs.

1. The Digitally Savvy Individual

If you live on your smartphone, prefer managing finances through apps, and appreciate intuitive digital interfaces, Virtual Wallet is designed for you. Its robust mobile banking and online banking features make it a strong contender for those who rarely visit a physical branch. This includes a broad spectrum of users, from tech-native Gen Z to experienced professionals comfortable with digital tools.

2. Budget-Conscious Individuals and Families

The integrated budgeting tools, cash flow forecasts, and goal-setting features are invaluable for anyone looking to gain better control over their spending and accelerate their savings. For those who have struggled with traditional budgeting methods or separate accounts, Virtual Wallet provides a unified platform that simplifies the process.

3. Young Professionals and Students

For those starting their financial journey, Virtual Wallet offers a structured way to learn money management without being overly restrictive. The ability to see future balances and set savings goals makes it an excellent tool for developing sound financial habits early on. The student-specific Virtual Wallet accounts often come with reduced fees.

4. Individuals Seeking a Hybrid Banking Experience

If you appreciate the convenience of digital banking but still value the option of in-person support or the security of a large, established bank with a physical presence, Virtual Wallet offers the best of both worlds. It perfectly bridges the gap between purely online banks and traditional institutions.

5. Small Business Owners (with personal overlap)

While PNC offers dedicated business banking solutions, small business owners who also manage their personal finances through PNC might find the Virtual Wallet’s robust online tools and ease of transfer beneficial for managing personal expenditures separate from business accounts. For more complex commercial banking needs, dedicated PNC business accounts would be necessary, but Virtual Wallet can serve as a strong personal hub.

Maximizing Your Virtual Wallet Experience: Tips and Tricks

To get the most out of your PNC Virtual Wallet, consider these strategies:

- Embrace the Mobile App: Make the PNC Mobile App your primary tool for daily financial management. Set up alerts for spending, low balances, and transfers.

- Utilize the Budgeting Tools: Actively use the calendar, Money Bar®, and customizable goals. The more data you feed it and the more you interact with these tools, the better insights you’ll gain into your spending habits.

- Automate Savings: Set up recurring automatic transfers from your Spend account to your Reserve and Growth accounts. Even small, consistent transfers add up significantly over time. This is a core principle of good personal banking.

- Understand Fee Waivers: Be aware of the requirements to waive monthly service fees for your specific Virtual Wallet tier. If you’re close to meeting a requirement (e.g., a higher direct deposit amount), adjust your financial habits accordingly.

- Link External Accounts (Carefully): While Virtual Wallet keeps things within PNC, you might use other banking accounts (e.g., for investment banking, a high-yield savings elsewhere, or perhaps even a Robinhood banking account). PNC’s online platform allows you to link external accounts for a consolidated view of your finances, although detailed management of external accounts will still be done on their native platforms. This aligns with modern open banking principles.

- Stay Informed: Keep an eye on banking news and updates from PNC. Changes in fees, features, or interest rates can impact your overall financial strategy. Regularly check for information on banking holidays to plan your financial activities.

- Review Statements Regularly: Despite digital convenience, regularly reviewing your statements, either online or through the app, helps catch errors, identify fraudulent activity, and monitor your overall financial health.

The Future of Banking: Where Virtual Wallet Fits In

The banking industry is in a constant state of flux. Discussions around concepts like velocity banking (a debt repayment strategy), the impact of shadow banking on global finance, or the meaning of EFT meaning in banking (Electronic Funds Transfer) reveal a complex and dynamic sector. PNC’s Virtual Wallet, with its focus on integration, user experience, and proactive money management, represents a significant step towards a more intuitive and empowering future for personal finance.

We can expect to see further integration of AI and machine learning to offer even more personalized financial advice and predictive analytics. Imagine a Virtual Wallet that not only forecasts your cash flow but also suggests optimal times for transfers, identifies potential savings opportunities based on your spending patterns, or even proactively alerts you to opportunities in investment banking that align with your long-term goals.

PNC, alongside other major players like Chase Banking, Wells Fargo Banking, and the increasingly popular online banking bank of America, is continually innovating. The trend towards hyper-personalized experiences, seamless integration across financial products (from credit cards to mortgages to wealth management), and robust security will only accelerate. Platforms like Virtual Wallet are at the forefront of this evolution, demonstrating how traditional banks can leverage technology to remain relevant and competitive in a rapidly changing world. The emphasis on user control, transparency, and accessible tools will be key differentiators.

Conclusion: Is PNC Virtual Wallet the Right Fit for You?

PNC Virtual Wallet offers a compelling blend of traditional banking security and modern digital convenience. Its innovative three-account structure, powerful budgeting tools, and user-friendly mobile and online banking platforms make it an excellent choice for individuals who are digitally savvy, budget-conscious, or seeking a hybrid banking experience. From setting financial goals to avoiding overdrafts, Virtual Wallet empowers users to take a proactive approach to their personal banking.

However, potential users should carefully consider the possible monthly service fees and the relatively lower interest rates on savings compared to some purely online alternatives. For those who prioritize maximizing every basis point of interest or prefer a strictly no-frills, fee-free experience, exploring other options like dedicated high-yield online savings accounts might be prudent.

Ultimately, the decision rests on your individual financial habits, preferences, and priorities. If you value an integrated, intuitive, and feature-rich digital banking experience backed by the security and services of a major financial institution, PNC Virtual Wallet merits serious consideration. It’s more than just a checking account; it’s a comprehensive tool designed for the modern financial landscape, helping you navigate the complexities of money management with greater clarity and control. For many, it truly represents a significant step forward in personal finance, bringing the future of banking into the present.

Source Links:

- PNC Official Website – Virtual Wallet Overview: https://www.pnc.com/en/personal-banking/banking/checking/virtual-wallet-overview.html

- PNC Security and Fraud Prevention: https://www.pnc.com/en/security/security-and-fraud-prevention.html

- PNC Mobile Banking App Information: https://www.pnc.com/en/personal-banking/banking/mobile-online-banking.html

- Federal Reserve – About Digital Banking: https://www.federalreserve.gov/paymentsystems/fednow_whatisdigitalbanking.htm

- Consumer Financial Protection Bureau (CFPB) – Overdraft Protection: https://www.consumerfinance.gov/consumer-tools/banking/checking-accounts/overdraft-fees/