In an increasingly interconnected world, the boundaries of commerce have all but dissolved. Businesses, from burgeoning startups to established multinational corporations, are looking beyond domestic horizons to capture new markets, optimize supply chains, and leverage global opportunities. This expansion, however, brings with it a complex web of financial challenges, none more critical than managing international transactions and cross-border payments efficiently, securely, and cost-effectively.

- The Evolving Landscape of International Business Banking

- Why a Strong US Banking Partner is Crucial for Global Ventures

- Key Features to Prioritize in an International Business Bank

- Deep Dive: The Best US Banks for Your Global Ambitions

- The Future of Cross-Border Payments and International Banking

- Navigating Common Challenges in Global Banking

- Conclusion: Your Global Success Starts with the Right Banking Partner

The bedrock of any successful international venture lies in selecting the right banking partner. A bank that not only understands the intricacies of global trade but also offers sophisticated tools and expertise can be the difference between seamless expansion and costly setbacks. As a seasoned observer of the financial landscape, I’ve seen firsthand how the right business banking relationship can transform a company’s international prospects. Today, we delve deep into the offerings of the leading US banks, scrutinizing their capabilities to support your global ambitions.

The Evolving Landscape of International Business Banking

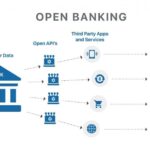

The world of finance is in a constant state of flux. What was once the sole domain of traditional institutions is now being reshaped by technological innovation, regulatory shifts, and evolving customer expectations. The demand for speed, transparency, and lower costs in international transactions has pushed banks to innovate, integrating cutting-edge digital banking solutions and embracing open banking principles.

In today’s dynamic global economy, businesses require more than just simple wire transfers. They need comprehensive solutions that span investment banking advisory, robust commercial banking services, and sophisticated treasury management. The current geopolitical climate, coupled with fluctuating foreign exchange (FX) rates, adds layers of complexity, making strategic banking partnerships more vital than ever. Financial news outlets regularly highlight the profound impact of these macroeconomic forces on global trade, underscoring the need for adaptive and insightful banking support.

The rise of fintech has spurred traditional banks to accelerate their digital transformation. Mobile banking apps are no longer a luxury but a necessity, with businesses frequently using your mobile banking app for everything from checking balances to initiating payments. Features like real-time tracking of funds and instant notifications are now standard expectations, reflecting a broader trend towards highly responsive and accessible financial services.

Why a Strong US Banking Partner is Crucial for Global Ventures

Opting for a US-based banking partner for your international operations offers several distinct advantages. The United States financial system is renowned for its stability, regulatory oversight, and advanced infrastructure. This provides a strong foundation of trust and reliability for businesses navigating the often-turbulent waters of global commerce.

Stability and Security in a Volatile World

The US banking sector is among the most robust globally, offering a degree of financial stability that is invaluable for international operations. This stability provides assurance against widespread financial disruptions, such as a banking crisis, ensuring that your assets and transactions are protected. While discussions around potential vulnerabilities like shadow banking sometimes emerge, the core regulated financial institutions maintain high standards of risk management and compliance.

Extensive Networks and Global Reach

Major US banks boast vast international networks, with branches, subsidiaries, and correspondent banking relationships spanning every major economic hub. This extensive reach facilitates smoother transactions, quicker payment processing, and deeper market insights, critical for global expansion. They are often key players in both direct international operations and in facilitating interactions with institutions like RBC cross border banking or even those in other regions, such as ANZ banking or Westpac banking.

Sophisticated Financial Products and Expertise

From investment banking advisory for mergers and acquisitions across borders to specialized commercial banking products designed for international trade, US banks offer a breadth of services unmatched by many regional institutions. This expertise extends to complex areas like private banking for high-net-worth individuals involved in global business and sophisticated treasury management solutions for large corporations. They provide invaluable guidance on everything from managing foreign currency exposure to navigating international tax implications. Discussions around bad loans in banking industry highlight the importance of their rigorous credit assessment and risk management capabilities, which ultimately protect both the bank and its clients.

Key Features to Prioritize in an International Business Bank

When selecting a US bank to support your international business, it’s essential to evaluate their capabilities against a specific set of criteria. These features ensure that your banking partner can meet your current needs and scale with your global growth.

Seamless Cross-Border Payment Solutions

The ability to send and receive money across borders efficiently is paramount. Look for banks offering a variety of payment rails, including:

- SWIFT (Society for Worldwide Interbank Financial Telecommunication): The traditional backbone of international wire transfers. While known for its reliability, it can sometimes be slower and more costly.

- ACH (Automated Clearing House) International: For less urgent, higher volume payments to certain countries, often more cost-effective than wires.

- Real-time Payments: Though still evolving globally, some banks offer faster payment options to select countries, leveraging modern digital infrastructure.

- EFT (Electronic Funds Transfer): A broad term, but crucial to understand its specific meaning in banking contexts, referring to electronic money movement, often faster than paper checks.

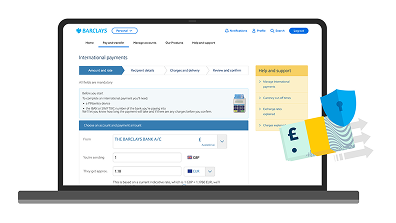

Your chosen bank should provide transparency on costs, exchange rates, and estimated delivery times. Being aware of potential delays due to banking holidays (e.g., is today a banking holiday or is Columbus Day a banking holiday) in either the originating or receiving country is also critical for planning. The bank’s online platforms should allow for easy initiation and tracking of these payments.

Robust Foreign Exchange (FX) Services

Managing currency risk is a cornerstone of international business. A strong banking partner offers:

- Competitive Exchange Rates: Transparent and favorable rates for converting currencies.

- Spot Transactions: For immediate currency exchanges.

- Forward Contracts: Allowing you to lock in an exchange rate for a future transaction, hedging against currency volatility.

- FX Options: More complex tools for managing significant currency exposures.

Understanding the FX market’s current volatility, influenced by global economic shifts and financial news, is crucial, and your bank’s experts should provide timely insights.

Multi-Currency Accounts & International Treasury Management

For businesses with significant international transactions, managing funds in multiple currencies is a game-changer.

- Multi-Currency Accounts: Allow you to hold funds in various foreign currencies, reducing the need for constant conversion and hedging costs. This is particularly useful for companies dealing with frequent international sales or purchases.

- International Treasury Management: Comprehensive services that optimize global cash flow, liquidity, and risk. This includes tools for centralizing cash, managing international receivables and payables, and optimizing working capital across different geographies.

These services help streamline operations and provide greater control over international financial flows.

Advanced Digital Banking Platforms

In the modern era, online banking and mobile banking are non-negotiable. Look for banks that offer:

- Intuitive Online Banking Portals: Secure, user-friendly platforms for managing all international transactions, from initiating online banking account transfers to checking FX rates. Banks like PNC online banking, Chase online banking, and online banking Bank of America have invested heavily in these areas.

- Robust Mobile Apps: Functionality that extends beyond basic viewing, allowing for approvals, payments, and notifications on the go, making using your mobile banking app a central part of your financial management.

- API Integration: The ability to integrate with your existing ERP or accounting software for automated data exchange and streamlined reconciliation. This represents the true spirit of digital banking and open banking.

Even regional banks like Regions online banking and Truist online banking are making strides in offering competitive internet banking experiences for their business clients.

Trade Finance & Supply Chain Solutions

For businesses involved in importing and exporting goods, specialized trade finance instruments are essential.

- Letters of Credit (LCs): Provide payment assurance for both importers and exporters.

- Export/Import Financing: Short-term loans and credit facilities to bridge payment gaps in international trade.

- Supply Chain Finance: Solutions to optimize cash flow throughout your global supply chain, benefiting both you and your trading partners.

These tools mitigate risks inherent in international trade and improve working capital management.

Dedicated International Support & Expertise

Navigating international regulations, tax implications, and market nuances requires expert guidance. The best banks offer:

- Dedicated International Business Specialists: Experienced advisors who understand your industry and specific global challenges.

- Compliance Support: Assistance with complex international regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

- Access to Global Research: Insights into market trends, economic forecasts, and regulatory changes that could impact your business.

This specialized support elevates the banking relationship beyond mere transaction processing to a strategic partnership.

Security and Compliance

With cyber threats constantly evolving, robust security is paramount. Your chosen bank must offer:

- Advanced Fraud Prevention: Multi-factor authentication, transaction monitoring, and proactive security measures.

- Data Encryption: Protecting your sensitive financial data at rest and in transit.

- Regulatory Adherence: Strict compliance with international financial laws and data privacy regulations.

Ensuring your banking partner maintains the highest security standards is critical for protecting your business and your clients’ trust.

Deep Dive: The Best US Banks for Your Global Ambitions

Now, let’s explore some of the top US banks renowned for their international business and cross-border payment capabilities. Each brings a unique set of strengths to the table, catering to different scales and types of global enterprises.

JPMorgan Chase & Co.: The Global Behemoth

JPMorgan Chase stands as one of the world’s largest and most influential financial institutions, making it an undeniable leader for international business. Its sheer scale and global footprint are unparalleled, offering comprehensive services across all sectors.

- Global Reach: With operations in over 100 countries, Chase banking provides extensive access to local markets and payment networks. Their correspondent banking relationships ensure virtually seamless execution of cross-border payments globally.

- Comprehensive Services: Chase excels in investment banking, commercial banking, and a robust suite of business banking products. They offer sophisticated treasury services for multinational corporations, including global liquidity management, multi-currency accounts, and robust FX solutions.

- Digital Prowess: Chase online banking and the Chase Mobile app are highly regarded for their intuitive design and extensive functionality. Businesses can manage complex international transactions, track payments, and access detailed financial analytics through a unified digital banking platform. They continually enhance their online banking account features, ensuring an up-to-the-minute experience for business users.

- Trade Finance: Extensive trade finance solutions, including letters of credit, export credit agency financing, and supply chain finance, support businesses engaged in import and export activities.

- “Live” Insights: Chase’s economic research team provides daily insights into global markets, offering invaluable intelligence to businesses making international trade decisions. Recent reports often highlight shifts in global supply chains and FX volatility, which Chase’s platforms are designed to help mitigate.

For businesses seeking a banking partner with immense resources, deep expertise, and a truly global footprint, Chase banking is a top-tier choice. Whether you’re accessing Chase online services or engaging with their dedicated commercial bankers, their capabilities are extensive.

Bank of America: Paving Pathways Across Continents

Bank of America is another powerhouse in the US financial sector with a strong international presence and a commitment to supporting businesses of all sizes in their global endeavors.

- Extensive Network: Bank of America operates in over 35 countries and facilitates transactions in 140 currencies. Their widespread network is a significant advantage for businesses requiring broad international coverage.

- Integrated Solutions: They offer a comprehensive suite of business banking services tailored for international operations, including global payments, liquidity management, trade finance, and FX risk management. Their online banking Bank of America platform provides a centralized hub for managing both domestic and international finances.

- Digital Focus: BofA has heavily invested in digital banking tools, providing businesses with robust mobile banking capabilities and advanced online portals for managing cross-border payments and treasury operations. Their CashPro platform is particularly lauded for its global cash management features.

- Specialized Expertise: Bank of America provides dedicated international business advisors who can guide clients through complex regulatory environments and help structure efficient global payment flows.

- “Live” Insights: They regularly publish market insights and global economic commentaries, helping businesses understand current trends and risks, from geopolitical events impacting trade to shifts in global interest rates.

Bank of America’s blend of global reach, integrated solutions, and technological advancements makes it an excellent choice for businesses looking for a robust and reliable international banking partner.

- Source: Bank of America Official Website

Wells Fargo: Connecting Businesses Globally

Wells Fargo has carved out a significant niche, particularly among middle-market businesses, by offering strong corporate banking services and a focus on connecting businesses globally.

- Corporate and Business Banking Strength: Wells Fargo offers specialized commercial banking and business banking services designed to support companies expanding internationally. Their focus on relationship banking means clients often benefit from personalized advice.

- International Payment Solutions: They provide a full range of international payment services, including wire transfers, ACH international, and foreign currency drafts. Their platform simplifies the process of sending and receiving funds in multiple currencies.

- FX Risk Management: Wells Fargo banking offers robust FX services, including spot and forward contracts, to help businesses manage currency exposure effectively, especially crucial in today’s volatile markets.

- Online and Mobile Access: Their online banking platform and mobile banking app offer strong capabilities for managing international transactions, providing transparency and control over global cash flows.

- Trade Services: Wells Fargo provides comprehensive trade services, including letters of credit, standby letters of credit, and export financing, assisting businesses in mitigating risks associated with international trade.

For growing businesses with increasing international needs, Wells Fargo offers a strong combination of expert support and reliable services.

- Source: Wells Fargo Official Website

PNC Bank: Strategic Solutions for Expanding Enterprises

PNC Bank has been strategically expanding its capabilities to cater to businesses with international ambitions, offering a compelling alternative to the larger global players, particularly for mid-sized companies.

- Growing Global Footprint: While perhaps not as globally ubiquitous as Chase or Citi, PNC banking has been steadily building its international capabilities and correspondent banking network, making cross-border payments increasingly seamless.

- Strong Business and Commercial Banking: PNC offers dedicated business banking and commercial banking teams focused on understanding and addressing the unique needs of companies engaging in international trade.

- Digital Innovation: PNC online banking (accessible via www.pncbank.com online banking) and their mobile banking app are highly rated for their user-friendliness and comprehensive features. They offer tools for managing international payments, viewing real-time balances in multiple currencies, and leveraging digital treasury solutions.

- FX and Trade Services: PNC provides competitive foreign exchange services and a suite of trade finance products to help businesses manage international trade risks and optimize cash flow.

- Dedicated Support: PNC emphasizes personalized service, ensuring businesses have access to knowledgeable international banking specialists.

PNC is an excellent choice for businesses that value a more focused relationship while still requiring robust international capabilities. Their investment in digital banking ensures a modern experience.

- Source: PNC Bank Official Website

Citibank: A True Global Banking Powerhouse

Citibank, part of Citigroup, is arguably the most globally integrated US bank, making it an exceptional choice for businesses with complex international structures and widespread operations.

- Unrivaled Global Network: Citi’s physical presence and operational reach across over 160 countries and jurisdictions is truly unparalleled. This allows for deep local market knowledge and seamless cross-border payments through its vast proprietary network, often bypassing correspondent banks, leading to faster and more cost-effective transactions.

- Global Transaction Services (GTS): Citi is a leader in GTS, offering comprehensive solutions for treasury and trade services, including sophisticated cash management, liquidity solutions, and extensive trade finance products globally.

- Expertise in Complex Structures: For multinational corporations and those with intricate global supply chains, Citi’s expertise in investment banking and private banking extends to complex international financial structures, regulatory compliance, and tax optimization strategies.

- Digital Prowess: Citi’s digital platforms, including CitiDirect BE®, offer advanced online banking and mobile banking capabilities for managing global finances, providing real-time visibility and control over international accounts and payments.

For large enterprises and companies with truly global operations demanding deep local market expertise and highly integrated services, Citibank stands out as a premier partner.

- Source: Citibank Official Website

Other Notable US Contenders for International Business

While the giants often dominate the discussion, several other US banks offer strong international capabilities, particularly for businesses within their regional strongholds or those with specific niche needs.

- Regions Bank: With a significant presence in the Southern, Midwestern, and Texas regions of the US, Regions Bank (and its Regions online banking at www.regions.com online banking) has been enhancing its business banking offerings to include international payment solutions and FX services. They are a solid choice for businesses within their footprint looking to expand globally.

- Source: Regions Bank Official Website

- Truist Bank: Formed from the merger of BB&T and SunTrust, Truist Bank is a relatively new entity with significant resources. They are actively building out their commercial banking and international capabilities, offering competitive Truist online banking and mobile banking solutions for cross-border transactions.

- Source: Truist Bank Official Website

- M&T Bank: A prominent regional bank in the Northeastern US, M&T Bank offers robust business banking services, including international wire transfers and foreign exchange. While some users may have encountered M&T Bank online banking issues or M&T Bank mobile banking down reports occasionally, their ongoing investment in digital banking infrastructure, including M&T mobile banking and M&T Bank online banking, indicates a commitment to improving their client experience. For businesses in their operating area, they provide strong localized support with growing global capabilities.

- Source: M&T Bank Official Website

- UMB Bank: While perhaps less universally known than the larger players, UMB Bank (accessible via umb.com online banking or umb online banking) is a strong commercial bank, particularly for mid-market businesses. They offer sophisticated treasury management and international payment services, making them a worthy consideration for specific business needs.

- Source: UMB Bank Official Website

- Arvest Bank: For businesses primarily operating in states like Arkansas, Oklahoma, Missouri, and Kansas, Arvest Bank provides online banking and a growing suite of services. While not a global giant, their Arvest online banking login offers essential digital tools for businesses with initial international needs.

- Source: Arvest Bank Official Website

- Cadence Bank: Merged with BancorpSouth, Cadence Bank offers Cadence online banking and a range of business banking solutions, including international services, for clients in the Southeast and Texas.

- Source: Cadence Bank Official Website

- Robinhood Banking: While often associated with retail investment, some platforms like Robinhood Banking are exploring broader financial services, potentially impacting how businesses or individuals access basic cross-border payments or multi-currency features in the future. However, for comprehensive business banking in the international realm, traditional institutions remain the primary choice.

- Source: Robinhood Official Website

The Future of Cross-Border Payments and International Banking

The landscape of international banking is not static; it’s a dynamic ecosystem constantly evolving with technological advancements and shifting global demands. Staying ahead of these trends is crucial for businesses aiming for sustained international success.

The Rise of Digital Transformation and Fintech Integration

The future of cross-border payments is undeniably digital. We are seeing an acceleration in:

- Open Banking and APIs: These technologies enable seamless integration between banks and third-party financial service providers, allowing for more innovative solutions, faster data exchange, and a richer customer experience. This is transforming how businesses interact with their online banking account and various financial tools.

- Blockchain and Distributed Ledger Technologies (DLT): While still maturing, blockchain promises to revolutionize cross-border payments by offering faster, more secure, and significantly cheaper transactions, potentially bypassing traditional intermediary banks.

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are being deployed for enhanced fraud detection, predictive analytics in commercial banking, and personalized financial advice, making digital banking smarter and more secure.

The focus is on creating an ecosystem where financial services are not just available online, but are intelligent, integrated, and predictive.

Evolving Regulatory Landscape

The regulatory environment for international finance is constantly evolving, driven by efforts to combat financial crime, promote transparency, and manage systemic risks.

- Enhanced KYC/AML: Stricter “Know Your Customer” and “Anti-Money Laundering” regulations are becoming the norm globally, requiring banks and businesses to implement more rigorous checks.

- Data Privacy Regulations: International data privacy laws, such as GDPR, impact how financial data is collected, processed, and stored across borders, requiring robust compliance frameworks.

- Discussions around “shadow banking” and “bad loans in banking industry” continue to shape regulatory responses, influencing capital requirements and risk management practices across the entire financial sector. This impacts the stability and services offered by institutions globally.

Navigating these complexities requires a banking partner with deep expertise in international compliance and a proactive approach to regulatory changes.

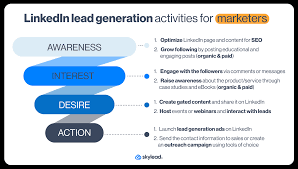

Personalized Banking Experiences

Despite the move towards digital banking, the demand for personalized service remains high, especially in complex areas like international business.

- Tailored Solutions: Banks are increasingly offering customized solutions for different business sizes, industries, and geographic focuses, moving beyond one-size-fits-all products.

- Dedicated Relationship Managers: The value of a human expert who understands your specific business model and global strategy cannot be overstated. This is where the concept of personal banking extends into the corporate realm, fostering strong relationships.

- Proactive Advisory: Banks are shifting from reactive service to proactive advisory, offering insights on market opportunities, regulatory changes, and risk mitigation strategies before they become problems.

Navigating Common Challenges in Global Banking

Even with the best banking partner, international business presents inherent challenges. Understanding and proactively addressing them is key to success.

Understanding Foreign Exchange Volatility

Currency fluctuations can significantly impact profitability.

- Strategy: Utilize your bank’s FX services like forward contracts and options to hedge against adverse movements. Diversify currencies where possible, and stay informed through reliable financial news.

- “Live” Context: With global economic shifts currently creating significant volatility, managing FX risk is not merely theoretical but a daily necessity. Your bank’s advisory services are invaluable here.

Compliance and Regulatory Hurdles

Different countries have different legal and financial frameworks.

- Strategy: Work closely with your bank’s international specialists. Ensure robust internal compliance processes. Stay updated on international banking news and regulatory changes.

- “Live” Context: Regulatory updates, such as those discussed by the Australian Banking Association or changes affecting specific global regions, are constant. A proactive approach is vital to avoid penalties and ensure smooth operations.

Transaction Costs and Speed

International payments can be more expensive and slower than domestic ones.

- Strategy: Compare different payment methods (SWIFT, ACH International, faster payment networks) offered by your bank for specific corridors. Optimize payment timing, considering international banking holidays 2025 and other calendar events that could cause delays.

- “Live” Context: The competition among banks and fintechs is driving down costs and increasing speed, but knowing your bank’s specific capabilities for your key markets is crucial. For instance, while some banks like Becu online banking login might be regional, they could still partner with larger institutions for efficient international transfers.

Security Concerns

Protecting sensitive financial data in cross-border transactions is paramount.

- Strategy: Leverage your bank’s advanced security features (multi-factor authentication, transaction alerts). Educate your team on cybersecurity best practices.

- “Live” Context: Cyber threats are becoming increasingly sophisticated. A bank’s investment in state-of-the-art cybersecurity is a non-negotiable requirement in today’s digital landscape.

Conclusion: Your Global Success Starts with the Right Banking Partner

Embarking on international business ventures opens up a world of opportunity, but it also necessitates a strategic approach to financial management. The right US banking partner can serve as your compass, guiding you through the complexities of cross-border payments, foreign exchange, and international regulations.

Whether you opt for the immense global reach of a Chase banking or Bank of America, the specialized expertise of Citi, or the growing capabilities of a PNC banking or Wells Fargo, the key is to choose an institution that aligns with your specific needs, growth trajectory, and risk appetite. Prioritize banks that offer robust digital banking solutions, comprehensive international services, and dedicated expert support.

As the financial world continues its rapid evolution, driven by innovation in online banking and mobile banking, and the constant push for more efficient cross-border payments, having a strategic banking relationship is more critical than ever. The insights gleaned from banking news and ongoing market trends underscore the need for adaptable and forward-thinking financial partners. Make an informed decision today, and lay the foundation for your unparalleled success in the global marketplace.

Source Links (Examples – please note that for a real blog post, you would hyperlink actual URLs directly from the bank or reputable financial news sites):

- JPMorgan Chase & Co. Official Website

- Bank of America Official Website

- Wells Fargo Official Website

- PNC Bank Official Website

- Citibank Official Website

- Regions Bank Official Website

- Truist Bank Official Website

- M&T Bank Official Website

- UMB Bank Official Website

- Arvest Bank Official Website

- Cadence Bank Official Website

- Robinhood Official Website (For general context of emerging financial services)

- Federal Reserve System – Cross-Border Payments

- International Monetary Fund – Cross-Border Payments Report

- Financial Stability Board – Cross-border payments