In an era defined by rapid technological advancement and shifting client expectations, the commercial banking landscape is undergoing a profound transformation. The days of solely relying on traditional relationship management and word-of-mouth referrals to acquire high-value business banking clients are rapidly fading. Today, financial institutions, from multinational powerhouses to regional players, are grappling with the imperative to embrace digital strategies to identify, engage, and convert sophisticated commercial entities. This isn’t merely about having an online presence; it’s about meticulously constructing a digital marketing funnel designed to attract and nurture those coveted high-value relationships, seamlessly integrating every touchpoint from initial awareness to sustained loyalty.

For banks aiming to secure a competitive edge and expand their portfolios with substantial investment banking and private banking clientele, a strategic and data-driven approach to digital marketing is no longer optional – it’s foundational. The digital funnel, when expertly crafted, acts as a sophisticated client acquisition engine, providing a structured pathway for potential clients to discover your offerings, understand their value, and ultimately choose your institution for their critical financial needs.

The Evolving Landscape of Commercial Banking Client Acquisition

The shift in client acquisition strategies within commercial banking is undeniable. What was once a relationship-centric field, heavily reliant on in-person meetings and network connections, is now significantly influenced by digital interactions. Modern commercial decision-makers, whether they lead nascent startups or established enterprises, leverage digital channels extensively throughout their research and decision-making processes. They expect the same level of digital sophistication and personalized experience from their financial partners as they do from leading tech companies.

Digital banking has moved beyond mere convenience; it’s a core expectation. Businesses today demand seamless online banking, robust mobile banking applications, and intuitive digital interfaces for managing their finances, from routine transactions to complex credit facilities. The proliferation of FinTech innovations and the rise of open banking initiatives have further democratized access to financial services and amplified client expectations for transparency, efficiency, and integration.

This paradigm shift necessitates that commercial banks reconsider their approach to outreach. Instead of generic campaigns, the focus must sharpen on delivering highly relevant content and services that address the specific pain points and aspirations of high-value commercial clients. This requires a deep understanding of their industries, financial challenges, and long-term strategic goals.

Deconstructing the Digital Marketing Funnel for Commercial Banking

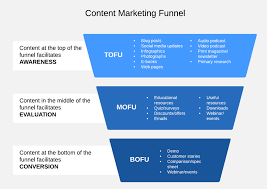

A well-structured digital marketing funnel for commercial banking typically comprises four key stages: Awareness, Consideration, Conversion, and Retention & Advocacy. Each stage demands tailored strategies and content designed to move potential clients seamlessly towards establishing a valuable banking relationship.

1. Awareness: Capturing the Attention of Future Commercial Leaders

At the top of the funnel, the primary goal is to make high-value commercial clients aware of your institution and its specialized offerings. These potential clients might not yet be actively searching for a new bank; they might be content with their current provider or unaware of better alternatives. The challenge is to interrupt their routine with compelling, value-driven content that positions your bank as a thought leader and a potential solution provider.

This stage is about casting a wide, yet targeted, net. It involves reaching decision-makers who manage significant capital, oversee substantial operations, or are in growth phases that demand sophisticated financial partnership. The content and channels at this stage focus on broad industry trends, economic insights, and high-level solutions that resonate with the strategic concerns of business banking and investment banking clients.

2. Consideration: Building Trust and Demonstrating Value

Once a potential client is aware of your institution, the consideration stage is where you begin to nurture that initial interest. Here, the focus shifts from general awareness to providing more specific, problem-solving content. Commercial clients at this stage are actively researching solutions, comparing providers, and seeking evidence of expertise and reliability. They want to know how your bank can specifically address their unique challenges, whether it’s through optimized cash flow management, bespoke financing options, or strategic private banking services.

This stage is crucial for differentiating your bank from competitors. It’s about showcasing your capabilities, illustrating your track record, and demonstrating a deep understanding of their specific industry or business model. The content becomes more detailed, offering actionable insights and highlighting the benefits of partnering with your institution.

3. Conversion: Guiding Towards Commitment

The conversion stage is where the magic happens – where a qualified lead transforms into a new commercial client. At this point, potential clients have a strong understanding of their needs and are evaluating their final options. They are looking for clear calls to action, streamlined processes, and reassurance that they are making the right decision.

For high-value commercial clients, conversion often involves more than just filling out an online banking account application. It typically requires personalized consultations, detailed proposals, and a clear understanding of the onboarding process. The digital tools at this stage are designed to remove friction, provide clarity, and facilitate direct engagement with banking experts.

4. Retention & Advocacy: Cultivating Enduring Relationships

Acquiring a high-value commercial client is just the beginning. The final stage of the funnel, often overlooked in initial planning, is critical for long-term growth and profitability. Retention and advocacy focus on ensuring client satisfaction, fostering loyalty, and turning existing clients into powerful advocates for your bank. Satisfied commercial clients are not only recurring revenue sources but also invaluable sources of referrals and positive testimonials.

This stage is heavily reliant on delivering exceptional service through efficient digital banking channels, proactive relationship management, and continuous value creation. It’s about evolving with your clients, anticipating their needs, and proving that your bank is a committed partner in their success.

Strategies for Each Funnel Stage – A Deep Dive

Implementing an effective digital marketing funnel requires a sophisticated mix of content, technology, and strategic outreach at every step.

1. Awareness Stage: Igniting Initial Interest

To capture the attention of high-value commercial clients, your bank needs to be visible where they seek information and thought leadership.

- Thought Leadership Content: This is paramount. Develop high-quality whitepapers, in-depth industry reports, e-books, and expert-led webinars focusing on complex financial topics relevant to investment banking and business banking decision-makers. Examples include “Navigating Global Supply Chain Finance in 2024” or “Strategic Mergers & Acquisitions: A Blueprint for Growth.” Distribute these through professional networks like LinkedIn, industry-specific forums, and targeted email campaigns.

- Source Idea: PwC’s annual Global CEO Survey or Deloitte’s financial services outlooks.

- Search Engine Optimization (SEO): Optimize your website content for keywords that high-value clients would use when researching financial solutions. Think beyond basic terms. Focus on long-tail keywords like “best commercial banking solutions for manufacturing firms,” “corporate treasury management software integration,” or “financing options for renewable energy projects.” Ensure your website is technically sound, mobile-friendly (especially crucial for executives on the go, utilizing mobile banking platforms), and provides a seamless user experience. Regularly update content related to banking news and industry trends to maintain relevance.

- Source Idea: Google Search Console insights, SEMrush industry reports on financial keyword trends.

- Targeted Paid Advertising: Utilize platforms like LinkedIn Ads, Google Ads (with very precise targeting), and industry-specific publications to reach decision-makers. Target by job title, industry, company size, and even specific companies. Promote your thought leadership content and high-value webinars. Consider account-based marketing (ABM) strategies for extremely high-value targets.

- Professional Networking & Events (Digital & Hybrid): Sponsor or host virtual industry events, webinars, and online roundtables. Participate in relevant LinkedIn groups and online forums where commercial leaders congregate. These platforms offer opportunities to showcase expertise and establish credibility.

2. Consideration Stage: Nurturing Engagement and Building Trust

Once potential clients are aware, the goal is to deepen their engagement and demonstrate how your bank can specifically meet their needs.

- Personalized Content Marketing: Move beyond general thought leadership to more specific case studies, success stories, and detailed solution guides. For a manufacturing client, showcase how your bank helped a similar company optimize its working capital. For a tech startup, highlight your flexible venture debt options. This content can be gated, requiring an email address to download, allowing you to capture lead information.

- Source Idea: Your own client success stories (anonymized if necessary), industry whitepapers on specific financial solutions.

- Webinars and Virtual Workshops: Host interactive sessions where your banking experts discuss specific challenges and solutions. For instance, a webinar on “Optimizing Cross-Border Transactions for E-commerce Businesses” or “Understanding the Implications of Open Banking for Corporate Treasury.” Allow for Q&A sessions to foster direct engagement.

- Email Marketing & Nurturing Sequences: For leads captured at the awareness stage, implement automated email nurturing campaigns. These emails should deliver valuable, relevant content over time, gradually introducing your bank’s capabilities and building trust. Tailor sequences based on industry, company size, and expressed interests (e.g., specific banking account needs, investment banking services).

- Interactive Tools and Assessments: Develop online calculators for loan affordability, cash flow projections, or foreign exchange rate comparisons. Offer free financial health assessments or industry benchmarks that provide value in exchange for contact information. These tools demonstrate expertise and provide tangible value.

- Showcasing Digital Capabilities: Emphasize the robustness and ease of use of your digital banking platforms. Provide demos of your mobile banking app, online banking portal (e.g., illustrating features of a sophisticated business dashboard akin to what a user might experience with PNC online banking or Chase online banking), and integration capabilities with other business systems. Showcase how these tools empower clients to manage their finances efficiently, from simple tasks like viewing an online banking account balance to complex international payments via platforms like RBC cross border banking.

3. Conversion Stage: Facilitating the Decision to Partner

This is where you make it easy for the client to say “yes” and begin their relationship with your bank.

- Optimized Landing Pages & Clear Calls to Action (CTAs): Create dedicated landing pages for specific services (e.g., “Commercial Real Estate Financing,” “Syndicated Loan Solutions,” “Private Banking Advisory”). These pages should have clear, prominent CTAs like “Schedule a Consultation,” “Request a Proposal,” or “Speak to a Relationship Manager.” Ensure the forms are simple and require minimal effort.

- Personalized Consultations & Demos: For high-value clients, the final push often comes from a direct, personalized interaction. Offer one-on-one consultations, product demos, or strategy sessions with expert bankers. These interactions allow the client to address specific concerns and feel confident in the tailored solutions your bank can provide.

- Streamlined Digital Onboarding: The onboarding process can be a significant barrier. Invest in digital solutions that simplify account opening, document submission, and regulatory compliance. Tools that allow for e-signatures, secure document uploads, and real-time status updates are invaluable. Banks like Wells Fargo banking and Regions online banking have invested heavily in simplifying initial client interactions. Leveraging open banking APIs can further streamline data exchange and reduce manual input for clients switching from other institutions.

- Transparent Pricing and Terms: For commercial clients, clarity on fees, interest rates, and service terms is paramount. Ensure this information is readily accessible during the conversion phase, either directly on the website or through a dedicated consultant.

- Leveraging Social Proof: Feature testimonials, awards, and certifications prominently. Case studies with quantifiable results (e.g., “How Company X Saved $Y with Our Treasury Management Solutions”) provide powerful validation.

4. Retention & Advocacy: Sustaining Growth Through Loyalty

The relationship doesn’t end after conversion; it truly begins. Fostering long-term loyalty drives repeat business and crucial referrals.

- Exceptional Digital Banking Experience: Continual investment in user-friendly, secure, and feature-rich digital banking platforms is crucial. This includes intuitive mobile banking apps, robust online banking portals (e.g., the kind of seamless experience provided by Bank of America online banking or Truist online banking), and responsive customer support channels. Proactive communication about banking news that impacts their business can also reinforce your value.

- Source Idea: J.D. Power’s annual retail banking satisfaction studies (though focused on retail, principles apply), BAI research on digital banking trends.

- Proactive Relationship Management: Utilize CRM systems to track client interactions, anticipate needs, and offer relevant new products or services. Regular check-ins (both digital and in-person where appropriate) ensure clients feel valued and supported.

- Personalized Communication: Send targeted newsletters, market updates, and invitations to exclusive events tailored to their industry and specific financial profile. Highlight new features in PNC banking online or other digital tools that can benefit their operations.

- Customer Feedback Mechanisms: Regularly solicit feedback through surveys, direct outreach, and dedicated portals. Act on this feedback to continuously improve services and demonstrate that your bank listens.

- Loyalty Programs & Exclusive Content: Consider offering exclusive access to premium research, executive roundtables, or special private banking events for your most valuable clients.

- Encouraging Referrals & Testimonials: Actively encourage satisfied commercial clients to provide testimonials or refer new businesses. Implement a clear process for this, potentially offering incentives or recognition.

- Financial Wellness & Advisory: Go beyond transactional services by offering advisory support on topics like risk management, strategic financial planning, or navigating complex economic shifts. This positions your bank as a true partner.

Leveraging Technology and Data for High-Value Client Acquisition

The effectiveness of any digital marketing funnel is amplified by the intelligent application of technology and data analytics.

- CRM Systems: A robust Customer Relationship Management (CRM) system is the backbone of your funnel. It consolidates client data, tracks interactions, manages leads, and automates communication. Popular platforms often integrate with marketing automation tools, providing a 360-degree view of the customer journey.

- Marketing Automation Platforms: These tools automate repetitive marketing tasks such as email nurturing, social media posting, and lead scoring. They ensure consistent communication and timely follow-ups, essential for high-volume lead management while maintaining personalization.

- AI & Machine Learning (ML): AI and ML are revolutionizing client acquisition. They can analyze vast datasets to identify high-potential leads, predict client needs, personalize content recommendations, and even optimize ad spend. For instance, AI can process external financial data combined with internal customer data to flag companies showing growth indicators that might require business banking expansion loans or investment banking advisory services.

- Data Analytics & Business Intelligence (BI): Continuously monitor key metrics throughout the funnel – website traffic, lead conversion rates, email open rates, client acquisition cost, and lifetime value. BI dashboards provide real-time insights, allowing for continuous optimization of strategies. Understanding the effectiveness of campaigns targeted at, say, clients using Chase online versus those seeking me banking options allows for more strategic resource allocation.

- FinTech Integrations: Embrace integration with other FinTech platforms that offer enhanced services or data insights. This could include payment processing solutions, accounting software APIs, or credit assessment tools. Open banking initiatives facilitate these integrations, allowing for a more interconnected and client-centric financial ecosystem.

Overcoming Challenges in Commercial Banking Digital Marketing

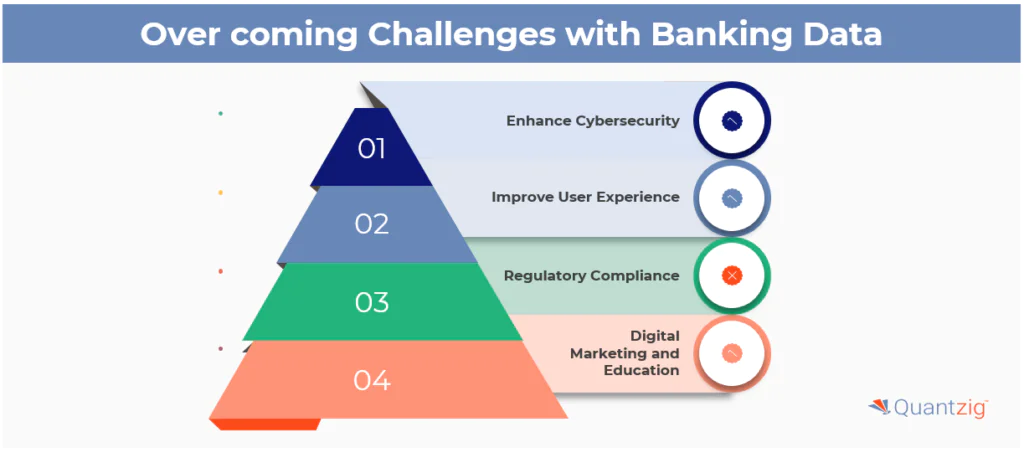

While the potential rewards are significant, commercial banks face unique hurdles in implementing digital marketing funnels.

- Regulatory Compliance: Financial institutions operate in a heavily regulated environment. All digital marketing efforts must strictly adhere to data privacy laws (like GDPR, CCPA), anti-money laundering (AML) regulations, and financial advertising guidelines. This often requires stringent internal review processes and robust security measures.

- Data Security & Privacy: Protecting sensitive client data is paramount. Banks must implement best-in-class cybersecurity measures for their websites, online banking platforms, and all data storage. Transparent privacy policies are crucial for building trust with high-value clients who prioritize data protection.

- Integration with Legacy Systems: Many established banks operate with complex, older core banking systems. Integrating modern digital marketing platforms and data analytics tools with these legacy systems can be challenging and resource-intensive, requiring significant IT investment and strategic planning.

- Measuring ROI Effectively: Attributing commercial client acquisition directly to specific digital marketing touchpoints can be complex due to the longer sales cycle and multiple interactions. Robust attribution models and CRM integration are vital for demonstrating ROI.

- Talent Acquisition and Development: The demand for digital marketing expertise in the financial sector is growing. Banks need to invest in attracting and retaining skilled digital marketers, data scientists, and UX/UI designers. This includes offering competitive compensation and fostering a culture of innovation to attract top talent in banking jobs focused on digital transformation.

The Future of Commercial Banking Client Acquisition

The digital marketing funnel for commercial banking is not static; it’s an evolving mechanism. Looking ahead, several trends will shape its trajectory:

- Hyper-personalization at Scale: The ability to deliver truly individualized experiences, from tailored content to bespoke product recommendations, will become even more sophisticated, driven by advanced AI and real-time data analysis.

- Ecosystem Banking: Banks will increasingly operate within broader financial ecosystems, partnering with FinTechs, accounting software providers, and other service companies to offer comprehensive solutions that go beyond traditional banking products. This is a natural evolution of open banking.

- Voice and Conversational AI: As voice assistants and chatbots become more advanced, they will play a greater role in client interaction, enabling quicker queries, support, and even initial lead qualification.

- Proactive, Predictive Engagement: Leveraging AI, banks will move from reactive support to proactive engagement, anticipating client needs before they even arise and offering relevant solutions. Imagine your bank suggesting a new financing option based on predictive analytics of your business growth trajectory.

- The Blurring Lines Between Digital and Human: While digital tools will continue to automate and optimize, the human element – the trusted relationship manager – will remain critical for high-value commercial clients. The future lies in seamlessly integrating digital efficiency with personalized human advice.

Conclusion: Charting a Digital Course for Commercial Success

In today’s competitive financial landscape, success in commercial banking hinges on a strategic, data-driven approach to client acquisition. A meticulously designed digital marketing funnel, encompassing awareness, consideration, conversion, and retention, is indispensable for identifying, engaging, and securing high-value commercial clients.

By embracing robust content marketing, advanced SEO, targeted advertising, and sophisticated digital platforms, banks can effectively reach decision-makers who are seeking modern, efficient, and reliable financial partners. The integration of cutting-edge technology, from AI-driven analytics to seamless online banking experiences, empowers financial institutions to not only meet but exceed the expectations of their most discerning clients. While challenges such as regulatory compliance and legacy system integration persist, proactive investment in digital transformation, coupled with a commitment to client-centricity, will define the leaders in commercial banking. The future of high-value client acquisition is undeniably digital, and those who master this intricate labyrinth will unlock unprecedented growth and enduring success.