The world of finance is no longer a collection of walled gardens. For decades, legacy institutions like Chase Banking, Wells Fargo Banking, and PNC Banking held customer data in tightly controlled silos, accessible only through their proprietary platforms like chase online banking or a dedicated mobile banking app. That era is definitively over. A seismic shift is underway, and at its epicentre is a concept known as Open Banking.

- What is Open Banking, Really? Beyond the Buzzwords

- The Data Goldmine: What Information Can Marketers Leverage?

- Revolutionizing Marketing: From Segmentation to Hyper-Personalization

- Actionable Strategies for Marketers in Key Sectors

- The Global Context: More Than a UK Phenomenon

- Navigating the Challenges and Inherent Risks

- The Future is Open: Open Finance and Beyond

- Conclusion: Your Mandate as a Marketer

This isn’t just another piece of fintech jargon or a minor update to your online banking account. This is a fundamental rewiring of the entire financial ecosystem, with the UK leading the charge. For marketers, this isn’t just “banking news”; it’s the dawn of a new age of data-driven strategy, hyper-personalization, and customer engagement that was previously the stuff of science fiction.

In this definitive guide, we will dissect the Open Banking revolution from a marketer’s perspective. We’ll move beyond the technicalities and focus on the strategic opportunities you can leverage today to gain an unprecedented competitive edge. We will explore how this impacts everything from personal banking and business banking to the very fabric of commercial banking and private banking. Prepare to rethink everything you thought you knew about financial marketing.

What is Open Banking, Really? Beyond the Buzzwords

At its core, Open Banking is a regulatory-driven framework that compels major UK banks to share their customer data, with explicit consent, with authorized third-party providers (TPPs) through secure application programming interfaces (APIs).

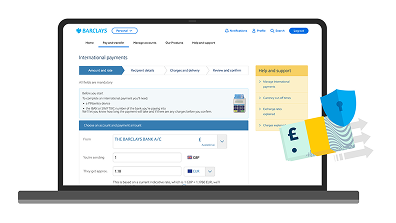

Think of it this way: for years, you’ve used your Google or Facebook account to log into other apps. You grant permission, and the new app securely uses your profile data to create an account. Open Banking applies this same principle to your most valuable data set: your financial history. A customer of, say, Barclays can grant permission for a new budgeting app to securely access their transaction data, all without sharing their password or login credentials for Barclays Bank online banking.

This was mandated in the UK by the Competition and Markets Authority (CMA) and built upon the EU’s Second Payment Services Directive (PSD2). The initial mandate forced the UK’s nine largest banking providers (the “CMA9” – including major players like HSBC, Barclays, Lloyds, and Santander) to open their data gates. This wasn’t a suggestion; it was a rule designed to break up monopolies and foster innovation.

Key Distinction from Traditional Banking:

- Traditional

Digital Banking: You log into your specific bank’s portal, likewww.pncbank.com online bankingor the M&T Bank mobile banking app. Your data stays there. You can see your banking account details, but that’s it. The experience is isolated. Open Banking: You grant consent for different apps and services to access that data. This creates a unified, interconnected network. Your budgeting app, your mortgage advisor’s platform, and your investment portfolio can all speak to each other, painting a complete picture of your financial life.

This moves the industry beyond the isolated experiences of regions online banking or online banking Bank of America and into a fluid, data-rich environment.

Source: For a foundational understanding, the Open Banking Implementation Entity (OBIE) is the official body tasked with developing the standards in the UK.

The Data Goldmine: What Information Can Marketers Leverage?

When a consumer grants consent, a TPP can access a treasure trove of information. This is the fuel for the marketing revolution. The data primarily falls into two categories, governed by two types of TPPs:

- Account Information Service Providers (AISPs): These services can read financial data. This is where the marketing magic happens. They can access:

- Transaction Data: Every debit and credit, including amounts, dates, and merchant descriptions.

- Account Details: Account numbers, balances, and overdraft limits.

- Standing Orders & Direct Debits: A clear view of recurring payments for subscriptions, rent, utilities, and loan repayments.

- Income Streams: Regular salary payments and other sources of income.

- Spending Categories: The ability to algorithmically categorize spending into groceries, travel, entertainment, etc.

- Payment Initiation Service Providers (PISPs): These services can initiate payments directly from a user’s bank account, again with explicit consent for each transaction. This is a direct challenge to traditional card networks.

For marketers, the AISP data is a paradigm shift. You are no longer guessing a customer’s financial situation based on demographic data or their browsing history. You can, with their permission, understand their actual financial behaviour.

Revolutionizing Marketing: From Segmentation to Hyper-Personalization

The true power of Open Banking for marketers lies in its ability to enable a level of personalization that makes current methods look archaic. It’s the difference between targeting “people who like travel pages on social media” and “people who have spent £2,000 on flights in the past 6 months and have a recurring savings deposit of £500.”

Hyper-Personalized Product and Service Recommendations

Imagine you work for a financial institution or a challenger brand like Robinhood Banking. Instead of a generic ad for a savings account, you can now deliver surgically precise offers.

- Mortgage & Lending: An app can identify a user consistently paying £1,500/month in rent, with a stable income and a growing savings pot. Your marketing message can shift from “Thinking about a mortgage?” to “Based on your current rent and savings, you could be eligible for a mortgage on a property up to £350,000 with a monthly payment of £1,450. See your pre-approved options now.” This transforms marketing into a genuine service. This also provides lenders with a powerful tool to more accurately assess risk, potentially helping to avoid the kind of miscalculations that contribute to

bad loans in banking industryand, on a macro scale, abanking crisis. - Investment & Wealth Management: A user of your personal banking app has a high income and a significant amount of cash sitting in a low-yield savings account. An Open Banking integration can trigger a message: “Did you know £20,000 of your savings could be working harder for you? Explore our low-risk investment funds.” This bridges the gap between everyday banking and the world of investment banking and private banking.

Business Banking: An SME’s business banking data shows a consistent, cyclical cash flow crunch every quarter. A lender can proactively offer a flexible line of credit specifically designed to cover that 30-day gap, right when the business needs it most. This is a world away from the traditional, painful application process.

Crafting Smarter Loyalty and Rewards Programs

Forget generic points systems. Open Banking allows you to link rewards directly to spending behaviour across all of a customer’s accounts.

- A travel company could offer a customer bonus air miles not just for booking flights, but by detecting they’ve spent money on a hotel through a competitor, a rental car, or even at a specific restaurant in a holiday destination.

- A retailer could partner with a FinTech app to offer cashback rewards whenever a user shops with them, regardless of which card or account they use. The app sees the transaction via the Open Banking API and credits the user’s reward wallet.

Predictive and Proactive Customer Service

Marketing isn’t just about acquisition; it’s about retention. By analyzing transaction data, companies can identify customers heading for financial difficulty.

- A bank can detect a customer has missed a credit card payment from another provider. Instead of waiting for the customer to default on their own products, the bank can proactively reach out with a message offering a debt consolidation loan or a free consultation with a financial advisor. This builds immense brand loyalty and trust. This is a powerful countermeasure to the issues that often plague consumers, such as dealing with

M&T Bank online banking issuesor a completeM&T Bank mobile banking downsituation, by offering proactive support before frustration boils over.

Actionable Strategies for Marketers in Key Sectors

The application of Open Banking isn’t one-size-fits-all. Its power is best understood by looking at specific industry use cases.

For Financial Services (Lending, Mortgages, Insurance)

This is ground zero for the revolution. The ability to perform real-time, highly accurate affordability and creditworthiness checks is game-changing. Instead of relying on slow, often outdated credit reports, lenders can instantly verify income and analyze spending habits directly from the source. This speeds up loan approvals from weeks to minutes. Marketers can now confidently use language like “instant approval” and “get a decision in minutes” in their campaigns. Furthermore, FinTech apps are emerging that use this data to help users with specific financial strategies, like velocity banking, by providing a complete, real-time view of all debts and income streams needed to execute the strategy effectively.

For Commercial Banking and B2B Services

For small and medium-sized enterprises (SMEs), Open Banking is a lifeline. Many accounting software platforms (like Xero and QuickBooks) are already deeply integrated.

- Strategy: B2B marketers for accounting, payroll, or cash flow forecasting software can target SMEs by highlighting the benefit of “one-click bank reconciliation” and “real-time cash flow visibility.” The pain point of manual data entry is immense, and Open Banking is the cure. This is a massive selling point for any platform catering to business banking clients.

- Example: A marketing campaign for a forecasting tool can say, “Stop guessing your cash position. Connect your

online banking accountin 60 seconds and get a 12-month forecast based on your real transaction history.”

For Retail and E-commerce

The big innovation here is “Pay by Bank.” This is a PISP function that allows customers to pay for goods online directly from their bank account, with authentication happening securely within their own mobile banking app (e.g., the chase online app or the Truist online banking portal).

- Marketer’s Angle: The key benefits to push are security and simplicity. There are no card details to enter (and potentially be stolen). For merchants, the transaction fees are significantly lower than card networks. Marketers can frame this as “The most secure way to pay” or “Checkout in one click with your bank.”

For Private Banking and Wealth Management

High-net-worth individuals often have complex financial lives with assets spread across multiple institutions. A wealth manager or private banking advisor can use an Open Banking-powered platform to get a single, consolidated view of their client’s entire portfolio—current accounts, savings, investments, properties, and loans. This “holistic view” allows for far more sophisticated and accurate financial planning and advice, becoming a cornerstone of the service offering. The conversation shifts from “What assets do you have?” to “I see your complete financial picture; here’s how we can optimize it.”

The Global Context: More Than a UK Phenomenon

While the UK is a clear leader, the principles of Open Banking are spreading globally, albeit with different regulatory approaches. Understanding this landscape is crucial for international marketers.

- Australia: Australia’s equivalent is the Consumer Data Right (CDR), which is even broader than the UK’s model, initially focusing on banking but designed to extend to energy and telco sectors. The major banks, including ANZ Banking, Westpac Banking, NAB Banking, and Commonwealth Bank, are all part of this ecosystem. Marketers in Australia should be watching the developments around the ANZ internet banking and NAB internet banking APIs closely. Discussions around government support, such as a hypothetical

centrelink cash boost 2025, could see CDR used to help individuals manage their finances more effectively. Outages, like a hypotheticalcommonwealth bank outage online bankingevent, highlight the need for robust API infrastructure in this new world. - United States: The US has taken a more market-driven approach rather than a top-down regulatory one. Companies like Plaid have become the de facto leaders in connecting fintech apps with users’ bank accounts from thousands of institutions, including giants like Chase Banking, PNC, and even smaller players like Arvest. This means marketers targeting the US market will likely be working with these intermediary platforms rather than directly with the banks’ APIs. It’s a different model but with a similar data-rich outcome. The concept of shadow banking, where credit activities happen outside traditional regulatory perimeters, is a key area that market-led open data initiatives aim to bring into the light for better risk assessment.

- Other Regions: Countries from Canada (RBC cross-border banking is a key area) to Brazil and Singapore are all at different stages of implementing their own versions. Even in Africa, innovators like Kenya Commercial Bank online banking are exploring digital possibilities. The trend is global and undeniable.

Navigating the Challenges and Inherent Risks

It would be remiss to present Open Banking as a utopia without risks. Marketers must be acutely aware of the challenges to build sustainable, trust-based strategies.

- Consumer Trust and Security: This is the single biggest hurdle. The idea of sharing financial data is scary for many. Marketers must lead with a “security-first” message. Emphasize that the system uses “bank-grade security,” “never shares your password,” and is “read-only” (for AISP functions). Consent must be explicit, easy to understand, and simple to revoke.

- Regulatory Compliance: Navigating GDPR in Europe and other data privacy laws is paramount. The “right to be forgotten” and principles of data minimization must be built into any marketing strategy from day one.

- System Reliability: The system is only as good as the APIs the banks provide. Occasional downtime or glitches, analogous to experiencing

M&T Bank online banking issuesor acommonwealth bank outage online banking, can disrupt the user experience and damage trust. Your marketing should set realistic expectations, and your tech stack must be resilient. - The Data Divide: Not all customers will consent. Strategies must be developed to cater to both the “Open Banking-enabled” customer and the traditional customer, ensuring no one is left behind.

The Future is Open: Open Finance and Beyond

Open Banking is just the first step. The logical evolution is Open Finance, which will extend the same data-sharing principles to a consumer’s entire financial life:

- Pensions

- Investments

- Mortgages

- Insurance

Imagine a single platform where a user can see their pension performance, insurance renewal dates, mortgage balance, and daily spending all in one place. The marketing possibilities are staggering. An app could alert a user, “Your car insurance is up for renewal next month. Based on your driving habits (from your telematics data) and new offers on the market, you could save £150 by switching.”

This is the ultimate destination: a truly unified, consent-driven financial identity. For the traditional banking world, this journey from siloed internet banking to an interconnected Open Finance ecosystem is as monumental as a voyage between the moon and venus. It’s a complete reimagining of the customer relationship.

For marketers, this future requires a new set of skills. You will need to be part data scientist, part privacy expert, and part customer experience designer. The ability to interpret complex financial data and translate it into a simple, valuable, and empathetic customer proposition will be the most sought-after skill in the industry.

Conclusion: Your Mandate as a Marketer

Open Banking is not a future trend; it’s a present-day reality that is rapidly gaining momentum. The infrastructure is built, the regulations are in place, and consumer adoption is growing daily.

For marketers, the mandate is clear:

- Educate Yourself: Understand the mechanics, the players (AISPs, PISPs), and the regulations (PSD2, GDPR, CMA Order).

- Prioritize Trust: Build every campaign and customer journey on a foundation of transparent consent and robust security.

- Think Service, Not Sales: Use this data to solve real customer problems and provide tangible value. Shift from selling products to offering personalized financial solutions.

- Partner Strategically: You don’t have to build the technology yourself. Collaborate with established TPPs and FinTechs who have already done the heavy lifting.

The question is no longer if Open Banking will fundamentally change the marketing landscape—it already is. The only remaining question is how you will adapt and leverage this financial revolution to build deeper, more valuable relationships with your customers. The starting gun has been fired; it’s time to get in the race.