The financial landscape for businesses is undergoing a seismic shift. Gone are the days when managing company finances meant solely relying on physical branches, lengthy paperwork, and limited operating hours. The rise of sophisticated technology has ushered in an era of digital banking, transforming how businesses interact with their financial institutions. For 2025, the focus is unequivocally on digital-first platforms – those built from the ground up with technology at their core, offering unparalleled efficiency, accessibility, and advanced features.

This evolution impacts everything from opening a basic banking account to managing complex commercial banking needs and even exploring avenues related to investment banking. Businesses seeking agility, cost-effectiveness, and seamless integration with their operational workflows need to embrace these modern solutions. Forget the frustrations of outdated systems; the future lies in platforms offering intuitive mobile banking, robust online banking, and proactive open banking integrations.

Choosing the right banking partner is crucial for success. It’s not just about where you keep your money; it’s about the tools, services, and support that empower your growth. This guide dives deep into the top 5 digital-first business banking platforms poised to dominate in 2025, examining their features, benefits, and why they represent the cutting edge of financial services for commerce. We’ll explore how institutions like PNC Banking, Chase Banking, Wells Fargo Banking, Bank of America, and Truist are leading this digital transformation, alongside key considerations for any business owner navigating this space. We’ll also touch upon related concepts like velocity banking, the nuances of shadow banking, and essential knowledge like eft meaning in banking.

Defining “Digital-First” Business Banking

Before diving into our top picks, let’s clarify what “digital-first” truly means in the context of business banking. It signifies a fundamental philosophy where digital channels are the primary, and often only, mode of interaction for most services. This contrasts with traditional banks that have gradually added digital layers onto existing infrastructure.

Key characteristics of digital-first platforms include:

- Mobile-Centric Design: Robust and feature-rich mobile banking apps are paramount, allowing users to perform nearly all tasks on the go, from checking balances and making transfers to depositing checks and managing approvals. This extends beyond basic personal banking features.

- Seamless Online Experience: Intuitive and comprehensive online banking portals provide a clear dashboard view of finances, facilitate complex transactions, and offer access to support. Think beyond simple logins like pnc online banking or chase online banking; these platforms offer integrated financial management.

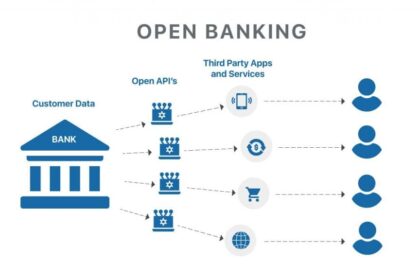

- API-Driven Integrations: Modern platforms leverage Application Programming Interfaces (APIs) to connect seamlessly with accounting software (like QuickBooks, Xero), payment processors, ERP systems, and other critical business tools. This is the essence of open banking in practice.

- Streamlined Onboarding: Opening a banking account is typically a fast, fully digital process, often completed in minutes without requiring physical branch visits.

- Data Analytics & Insights: Digital platforms often provide sophisticated reporting and analytics, offering valuable insights into cash flow, spending patterns, and financial health.

- Automated Processes: Automation of tasks like invoice payments, payroll, and reconciliation frees up valuable time for business owners and finance teams.

- Enhanced Security: While digital, these platforms employ multi-factor authentication, advanced encryption, and real-time fraud monitoring.

These platforms are built for speed, efficiency, and the modern pace of business, making them indispensable tools for growth in 2025.

The Top 5 Digital-First Business Banking Platforms for 2025

While numerous players exist, these five platforms stand out for their commitment to digital innovation, comprehensive feature sets, and focus on the evolving needs of businesses.

1. Chase Business Banking: The Integrated Powerhouse

As one of the largest financial institutions in the US, Chase Banking has made significant strides in transforming its business banking services into a digitally-driven powerhouse. While not exclusively digital-native, their investment in technology makes their platforms highly competitive.

- Platform Overview: Chase offers a suite of digital tools accessible via Chase Online and their robust mobile banking app. They cater to businesses of all sizes, from sole proprietors needing a simple banking account to large corporations requiring sophisticated commercial banking solutions.

- Key Digital Features:

- Chase Business Complete Banking: Offers a checking account with features like unlimited electronic deposits, mobile check deposit, and access to credit score monitoring. Opening this online banking account can often be done online.

- Advanced Online & Mobile Tools: Chase Online Banking provides a comprehensive dashboard for managing accounts, making wire transfers, paying bills, and accessing statements. The Chase mobile banking app allows real-time balance tracking, mobile check deposit, transaction management, and Zelle payments.

- Payment Solutions: Integrated payment processing, merchant services, and tools for managing customer payments are readily available.

- Business Credit Cards: Seamless integration with Chase business credit card management, offering rewards and spending controls.

- Treasury & Payment Solutions: For larger enterprises, Chase offers advanced digital treasury services for managing cash flow, payments, and liquidity.

- Integrations: While perhaps not as open as some newer players, Chase offers connections to popular accounting software.

- Target Audience: Startups, small to medium-sized businesses (SMEs), and large corporations seeking the stability and broad service range of a major bank combined with strong digital capabilities. Their offerings are suitable for various needs, from basic business banking to more complex financing.

- Why it’s Top Tier for 2025: Chase’s massive infrastructure, coupled with continuous investment in digital channels like Chase Online, ensures reliability and a constantly evolving feature set. Their market reach means accessibility for a vast number of businesses. They are adapting traditional banking to meet modern demands.

- Source: https://www.chase.com/business

2. PNC Banking: Innovating with Digital Accessibility

PNC Banking has embraced the digital transformation, offering powerful tools through its PNC Online Banking platform and mobile banking app, making it a strong contender for businesses prioritizing convenience and comprehensive service.

- Platform Overview: PNC provides a user-friendly digital experience for its business clients. Their focus is on providing accessible tools that simplify daily banking operations, manage cash flow, and support business growth through their various banking account options.

- Key Digital Features:

- Business Banking Accounts: Offers a range of checking and savings accounts tailored for businesses, with easy online application and management via www.pncbank.com online banking.

- Robust Online Platform: PNC Online Banking offers detailed transaction history, fund transfers (including wire transfers), bill pay services, remote check deposit, and account alerts.

- Mobile Banking Excellence: The PNC mobile banking app mirrors the functionality of the online platform, enabling users to manage accounts, deposit checks, transfer funds, and approve transactions securely from their mobile devices.

- Cash Flow Management Tools: Features designed to help businesses monitor and manage their finances effectively, including online cash flow forecasting tools and various payment solutions.

- Business Credit Options: Digital integration for applying for and managing business credit cards and loans.

- Treasury Management: Advanced digital solutions for larger businesses needing sophisticated liquidity management, payment processing, and fraud protection.

- Target Audience: SMEs, corporations, and specific industries like healthcare, with a need for reliable digital tools and the backing of a large, established institution. It’s a solid choice for businesses looking for a blend of traditional trust and modern digital functionality, including seamless pnc banking online access.

- Why it’s Top Tier for 2025: PNC’s commitment to enhancing its digital offerings, including continuous improvements to pnc online banking, provides a reliable and feature-rich environment. Their focus on user experience within the mobile banking app makes day-to-day management straightforward.

- Source: https://www.pnc.com/en/business-banking.html

3. Wells Fargo Banking: Modernizing a Legacy Giant

Wells Fargo Banking, despite facing past challenges, is heavily investing in modernizing its digital infrastructure to remain a key player in business banking. Their focus is on rebuilding trust through enhanced digital platforms and services.

- Platform Overview: Wells Fargo offers comprehensive digital tools through its online portal and mobile banking app, aiming to provide businesses with efficient ways to manage their finances. They provide a wide array of banking account types and financial services.

- Key Digital Features:

- Wells Fargo Business Online: A secure platform for managing accounts, initiating payments (ACH, wire transfers), remote deposit capture, and accessing statements and tax information.

- Mobile Banking App: Allows for on-the-go management of finances, including checking balances, depositing checks, transferring funds, and paying bills. Features are continually updated to enhance the using your mobile banking app experience.

- Digital Payment Solutions: Offers various ways for businesses to receive payments, manage payroll, and handle disbursements efficiently.

- Treasury Management Services: Robust digital tools for managing liquidity, optimizing payments, and mitigating risk for larger organizations.

- Account Integration: Facilitates connections with accounting software, simplifying bookkeeping and financial reporting.

- Business Lending & Credit: Digital application and management options for business loans, lines of credit, and credit cards.

- Target Audience: A broad range of businesses, from small businesses needing basic services to large corporations requiring complex treasury and lending solutions. Their digital push aims to serve clients seeking the stability of a major bank with improved digital access.

- Why it’s Top Tier for 2025: Wells Fargo’s significant investment in technology and digital channels, including their core wells fargo banking online platform, positions them to offer competitive solutions. Their extensive network and product range, enhanced by digital capabilities, make them a relevant choice.

- Source: https://www.wellsfargo.com/biz/

4. Bank of America Business: Comprehensive Digital Ecosystem

Bank of America offers a robust digital ecosystem for its business clients, integrating various services through its online and mobile platforms, making it a leader in blending traditional strength with digital convenience.

- Platform Overview: Online Banking Bank of America provides businesses with a unified platform to manage accounts, payments, credit, and liquidity. Their focus is on delivering a seamless, integrated digital experience that supports business operations at every stage.

- Key Digital Features:

- CashPro® Online: A sophisticated platform for managing cash flow, payments, collections, and liquidity. It offers advanced reporting and control features.

- Mobile Banking: The Bank of America app provides powerful mobile banking features for businesses, including mobile check deposit, transfers, payments, and account monitoring.

- Digital Disbursements: Tools for managing payroll, contractor payments, and other disbursements efficiently and securely.

- Business Advantage Banking®: Offers various banking account options with digital integration, including tools for overdraft protection and credit management.

- Small Business Services: Dedicated digital resources, tools, and advisors specifically for small business owners.

- Open Banking Integration: Increasingly offering API solutions, allowing businesses to connect their financial data securely with third-party applications.

- Target Audience: Startups, SMEs, and large corporations seeking a comprehensive suite of financial services backed by advanced digital tools and the security of a major financial institution. This is a strong option for those needing sophisticated treasury management via online banking bank of america.

- Why it’s Top Tier for 2025: Bank of America’s continuous innovation in digital channels, including their robust CashPro platform and user-friendly mobile app, offers businesses powerful tools for financial management. Their focus on integrating services provides a holistic digital banking experience.

- Source: https://www.bankofamerica.com/business/

5. Truist Bank: The Digital-Forward Merger

Formed from the merger of BB&T and SunTrust, Truist Bank represents a unique blend of established banking expertise and a forward-looking digital strategy. They are actively building a unified, digitally-focused platform for their business clients.

- Platform Overview: Truist Online Banking aims to provide a seamless and integrated digital experience. While still consolidating systems post-merger, their direction is clearly towards digital-first solutions, offering a modern approach to business banking.

- Key Digital Features:

- Truist Business Checking: Various account options are available, managed primarily through digital channels. The online banking account setup process is increasingly streamlined.

- Digital Banking Platform: Offers online and mobile access for managing accounts, making payments (ACH, wire), depositing checks, and viewing statements. The emphasis is on creating a unified experience across platforms.

- Treasury & Payment Solutions: Providing businesses with tools for managing cash flow, payments, fraud prevention, and liquidity through digital interfaces.

- Business Lending & Credit: Digital tools for accessing and managing business loans, lines of credit, and credit cards.

- Industry Specialization: Leveraging combined expertise to offer tailored digital solutions for specific sectors.

- Focus on Integration: Building capabilities to integrate with popular business software, aligning with open banking principles.

- Target Audience: SMEs and middle-market businesses looking for the resources of a large bank combined with a commitment to digital innovation and personalized service. It’s a strong choice for businesses seeking a partner actively shaping its digital future.

- Why it’s Top Tier for 2025: Truist’s deliberate strategy to build a leading digital platform from the ground up post-merger makes them a dynamic player. Their focus on technology and client experience, evident in truist online banking, positions them well for the future demands of business banking.

- Source: https://www.truist.com/business

Key Trends Shaping Digital Business Banking in 2025

Beyond specific platforms, several overarching trends are defining the future of business banking and influencing how these digital services evolve:

The Rise of Open Banking and API Economy

Open Banking is more than a buzzword; it’s a fundamental shift enabling secure data sharing between financial institutions and authorized third-party providers via APIs. For businesses, this means:

- Seamless Integration: Effortlessly connecting bank accounts to accounting software (nab internet banking, anz internet banking, etc.), payment platforms, and other business applications. Imagine your accounting software automatically pulling transaction data from your PNC Banking account or your payment processor linking directly to your Chase Banking account.

- Enhanced Financial Management: Creating a unified view of finances across multiple accounts and platforms.

- Embedded Finance: Banking services becoming integrated directly into non-financial platforms where businesses operate.

This trend requires banks to have robust API infrastructure, making banks like Bank of America and those embracing fintech solutions, potentially including services similar to Robinhood Banking‘s approach (though focused on business), critical players.

Hyper-Personalization and AI

Artificial Intelligence (AI) and Machine Learning (ML) are transforming digital banking. Expect platforms to offer:

- Personalized Insights: AI analyzing spending patterns, cash flow, and market trends to provide tailored advice and identify opportunities or risks.

- Predictive Analytics: Forecasting future cash flow, identifying potential bad loans risks earlier, and optimizing credit decisions.

- Smarter Customer Service: AI-powered chatbots handling routine queries 24/7, freeing up human agents for complex issues related to commercial banking or private banking.

- Enhanced Fraud Detection: Real-time monitoring and anomaly detection to protect business accounts far beyond traditional methods.

Focus on User Experience (UX) and Mobile-First

The expectation for intuitive, seamless experiences is higher than ever. This means:

- Simplified Interfaces: Clean, easy-to-navigate dashboards for both online banking and mobile banking apps.

- Frictionless Onboarding: Quick, digital setup for new accounts, whether it’s a basic banking account or a more complex business setup.

- Cross-Platform Consistency: A seamless transition between using the M&T Bank mobile banking app (when operational) and their online portal.

Businesses need tools that are as easy to use as their favorite consumer apps. This applies whether managing PNC banking online, using Regions Online Banking, or accessing services from institutions like M&T Bank or Umb.com online banking.

The Evolution of Payments

Real-time payments, faster payment networks, and evolving digital wallets are changing how businesses send and receive money. Digital-first banks are integrating these capabilities natively, reducing reliance on older methods like traditional wires or checks (though remote deposit capture remains vital). This impacts everything from B2B transactions to payroll.

Cybersecurity as a Core Pillar

As threats evolve, cybersecurity is non-negotiable. Digital-first banks invest heavily in:

- Multi-Layered Security: Combining advanced encryption, firewalls, intrusion detection systems, and robust authentication methods (biometrics, tokenization).

- Real-time Monitoring: Constantly scanning for suspicious activity across online and mobile platforms.

- Proactive Threat Intelligence: Staying ahead of emerging cyber threats targeting financial institutions.

This is crucial when users are accessing services like online banking bank of america or chase online from various locations.

The Role of Neobanks and Fintech Challengers

While we focused on established players embracing digital, fintechs and neobanks continue to innovate, often forcing traditional banks to adapt faster. They excel in specific niches and often offer highly competitive rates or unique features, pushing the boundaries of what’s possible in digital banking. Examples range from business-focused platforms to apps influencing the broader internet banking landscape.

Choosing Your Digital-First Banking Partner in 2025

Selecting the right platform requires careful consideration of your specific business needs. Here’s a framework:

- Assess Your Needs:

- Business Size & Type: Are you a startup, SME, or large corporation? Do you need basic business banking, complex commercial banking, or specialized services like private banking or investment banking support?

- Transaction Volume: How many transactions do you process monthly? Consider fees associated with different account tiers and transaction types (ACH, wires, international payments).

- Integration Requirements: What software (accounting, CRM, ERP) do you need your bank to connect with? Open banking capabilities are key here.

- Mobile vs. Online Preference: Do you primarily manage finances via your phone (mobile banking app) or desktop (online banking)? Ensure the platform excels in your preferred channel.

- Specific Services: Do you need payroll services, merchant processing, international payments, or lines of credit?

- Compare Key Features:

- Account Fees: Analyze monthly maintenance fees, transaction fees, wire fees, overdraft fees, ATM fees, etc. Look for accounts with potential fee waivers based on balances or activity.

- Digital Capabilities: Evaluate the ease of use, feature set, and reliability of the online banking portal and mobile banking app. Check reviews for specific platforms like pnc online banking, chase online banking, or umb online banking.

- Integration Options: Verify compatibility with your existing software stack.

- Customer Support: What channels are available (phone, chat, email)? What are their operating hours? Is support readily available for issues like m&t bank online banking issues?

- Security Measures: Understand the bank’s security protocols.

- Interest Rates & APY: For savings or interest-bearing checking accounts.

- Consider the Institution:

- Traditional Banks vs. Fintechs: Do you prefer the established reputation and broad services of giants like Chase Banking, PNC Banking, Wells Fargo Banking, Bank of America, or Truist Banking, or the specialized, agile approach of a fintech? Many traditional banks now offer excellent digital platforms, blurring the lines.

- Geographic Presence: While digital, some services or support might be easier with a bank that has some physical presence or strong regional support (e.g., understanding local regulations, specific services like Regions Online Banking might offer regionally).

- Reputation & Stability: Research the bank’s financial health and customer satisfaction ratings. Be aware of potential issues, like past operational problems faced by institutions (e.g., m&t bank mobile banking down incidents), and how they’ve addressed them.

- Look Ahead:

- Innovation Roadmap: Does the bank demonstrate a clear commitment to future technological advancements? Are they investing in areas like AI, open banking, and improving mobile banking features?

- Scalability: Can the platform grow with your business?

Remember that even with the best digital platforms, understanding fundamental concepts like eft meaning in banking (Electronic Funds Transfer) and staying informed about the broader financial climate (e.g., awareness of banking crisis potential, understanding shadow banking distinctions) remains important. Also, keep track of relevant dates like banking holidays 2025 – while digital banking offers 24/7 access, understanding holiday schedules is still pertinent for certain transaction types or operational planning. Knowing is columbus day a banking holiday, for instance, helps manage expectations.

Conclusion: Embracing the Digital Future of Business Banking

The shift to digital-first business banking is not just a trend; it’s the new standard. In 2025, platforms from established leaders like Chase Banking, PNC Banking, Wells Fargo Banking, Bank of America, and Truist Banking are offering sophisticated, efficient, and accessible solutions that empower businesses to thrive.

These platforms provide the tools necessary to streamline operations, manage finances effectively, and adapt quickly to market changes. Whether you’re opening your first banking account or managing complex commercial banking needs, embracing a digital-first approach is essential for competitiveness and growth.

By carefully evaluating your needs and understanding the capabilities offered by leading institutions – considering everything from mobile banking features to open banking integrations – you can choose a banking partner that acts as a true catalyst for your business success in the digital age. The future of commerce is digital, and your banking strategy must align with it.