Understanding the Critical Transition Point in Your Business Journey

Every entrepreneur begins somewhere. For most small business owners, that somewhere involves mixing personal finances with business transactions through a standard personal banking account. While this approach might work during the initial stages of your venture, there comes a pivotal moment when this practice transforms from convenient to catastrophic for your growing enterprise.

- Understanding the Critical Transition Point in Your Business Journey

- The Evolution of Business Financial Needs

- Clear Signs It’s Time to Make the Switch

- Comprehensive Benefits of Business Banking Accounts

- Choosing the Right Banking Partner for Your Business

- Step-by-Step Transition Process

- Advanced Business Banking Strategies

- Common Mistakes to Avoid

- Industry-Specific Banking Considerations

- Understanding Banking Holidays and Service Availability

- Technology Integration and Digital Banking

- The Future of Business Banking

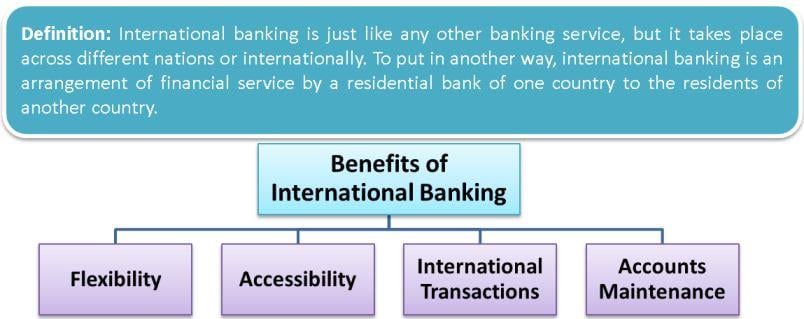

- International Perspective: Banking Across Borders

- Making Your Final Decision

- Conclusion: Your Business Banking Journey

The transition from personal banking to a comprehensive business banking solution represents more than just opening a new account—it signifies your business’s evolution from a side project to a legitimate enterprise. This comprehensive guide will walk you through every aspect of this critical decision, helping you identify the perfect timing, understand the benefits, and execute a seamless transition that positions your business for sustainable growth.

The Evolution of Business Financial Needs

Starting Small: The Personal Banking Phase

When launching a business, many entrepreneurs utilize their existing personal banking relationships. Major institutions like Chase Banking, Wells Fargo Banking, and PNC Banking offer basic checking accounts that initially seem sufficient for managing modest business transactions. You might be using chase online banking or pnc online banking to monitor your combined personal and business finances, thinking you’re saving money by avoiding additional account fees.

However, this approach creates several hidden complications that become increasingly problematic as your business grows. The distinction between personal and business finances becomes blurred, making tax preparation more complex and potentially exposing your personal assets to business liabilities.

Recognizing the Growth Indicators

According to recent banking news from the Federal Reserve, small businesses that separate their finances early experience 43% fewer accounting errors and save an average of 15 hours monthly on financial management. These statistics underscore the importance of timing your transition appropriately.

The Australian banking sector, including institutions like ANZ Banking, Westpac Banking, and NAB Banking, has seen a 67% increase in small business account openings over the past two years, reflecting a global trend toward professional financial management even among micro-enterprises.

Clear Signs It’s Time to Make the Switch

Volume of Transactions Exceeds Personal Account Capacity

When your monthly business transactions exceed 20-30 items, personal banking accounts become unwieldy. Business banking accounts are specifically designed to handle higher transaction volumes with better organizational tools, detailed reporting features, and enhanced digital banking capabilities.

Modern mobile banking applications from institutions offering commercial banking services provide sophisticated categorization, automated reconciliation, and real-time financial dashboards that personal accounts simply cannot match.

Legal Structure Changes

The moment you transition from a sole proprietorship to an LLC, S-Corporation, or any other formal business entity, separating your finances becomes not just advisable but often legally required. Most states mandate that businesses operating under formal structures maintain separate banking accounts.

Revenue Reaches Consistent Five Figures Monthly

Once your business consistently generates $10,000 or more in monthly revenue, the complexity of managing these funds alongside personal finances increases exponentially. At this threshold, the benefits of business banking—including merchant services, payroll integration, and specialized lending products—significantly outweigh any perceived convenience of maintaining combined accounts.

Hiring Your First Employee

The moment you hire your first employee, you enter a new realm of financial obligations including payroll processing, tax withholdings, and benefits management. Business banking accounts integrate seamlessly with payroll services, while personal banking accounts create unnecessary complications and potential compliance issues.

Client Payment Diversity Increases

When you start accepting various payment methods—credit cards, ACH transfers, wire transfers, international payments—you need the robust infrastructure that only business banking can provide. Services like open banking allow for seamless integration with payment processors, accounting software, and financial management platforms.

Comprehensive Benefits of Business Banking Accounts

Enhanced Legal Protection and Liability Separation

One of the most critical advantages of maintaining a separate banking account for your business involves asset protection. In legal terminology, this concept is called the “corporate veil”—a protective barrier between your personal assets and business liabilities.

According to the Small Business Administration, businesses that maintain strict financial separation experience 78% fewer complications when facing legal challenges or liability claims. Without this separation, creditors could potentially pursue your personal assets, including your home, personal savings, and investments, to satisfy business debts.

Professional Image and Credibility

Accepting payments through a business account rather than a personal one significantly enhances your professional image. When clients see payments processed through “John Smith” versus “Smith Consulting LLC,” the latter immediately conveys legitimacy and professionalism.

This perception extends to all stakeholders—investors, lenders, partners, and customers all view businesses with dedicated business banking relationships as more established and trustworthy.

Superior Financial Tracking and Tax Preparation

Business banking accounts provide transaction categorization specifically designed for commercial activities. Unlike personal banking, which categorizes expenses for personal budgeting, business accounts align with IRS business expense categories, making tax preparation significantly simpler.

The IRS has published guidelines indicating that businesses with separate accounts face 60% fewer audit complications and can typically substantiate expenses more efficiently during examinations.

Access to Business-Specific Financial Products

Commercial banking relationships unlock access to products unavailable through personal banking channels:

Business Lines of Credit: Flexible financing options that provide working capital when needed without the constraints of traditional loans.

Merchant Services: Integrated payment processing that allows you to accept credit cards, mobile payments, and digital wallet transactions at competitive rates.

Commercial Loans: Specialized lending products designed for equipment purchases, real estate acquisition, or business expansion with terms tailored to commercial needs.

Cash Management Services: Sophisticated tools for optimizing cash flow, including automated sweeps, concentration accounts, and investment options for excess liquidity.

Higher Transaction Limits and Volume Capacity

Personal banking accounts typically impose strict limits on daily transactions, monthly volumes, and transfer amounts. Business banking accounts accommodate the higher volumes inherent in commercial operations.

For example, while a personal account might limit wire transfers to $5,000 daily, business accounts commonly support six-figure daily transfer limits, essential for businesses making significant purchases, paying suppliers, or managing payroll.

Integration with Business Management Software

Modern business banking platforms offer seamless integration with accounting software like QuickBooks, Xero, and FreshBooks. This integration automates transaction recording, eliminates manual data entry, and ensures real-time financial visibility.

The digital banking revolution has made these integrations even more powerful, with APIs enabling custom connections between your banking account and proprietary business systems.

Choosing the Right Banking Partner for Your Business

Evaluating Traditional National Banks

Major institutions like PNC Banking, Chase Banking, and Wells Fargo Banking offer comprehensive business banking solutions with extensive branch networks and robust digital banking platforms. These national banks provide several advantages:

Broad Geographic Coverage: If your business operates across multiple states or plans to expand, national banks maintain consistent services nationwide.

Comprehensive Product Suites: From basic checking to investment banking services, national banks offer solutions that can grow with your business.

Advanced Technology: Banks like Chase have invested heavily in chase online banking platforms, offering sophisticated mobile banking applications with features like mobile check deposit, bill pay, and real-time alerts.

Established Merchant Services: Integrated payment processing with competitive rates and comprehensive fraud protection.

However, national banks sometimes lack the personal touch and flexibility that growing businesses need. Their standardized approach to lending and services may not accommodate unique business circumstances.

Regional Banking Institutions

Regional banks like Regions Online Banking, Truist Online Banking, and M&T Bank Online Banking occupy a sweet spot between national reach and local service. These institutions offer:

Relationship-Based Banking: Regional banks typically assign dedicated relationship managers who understand your business and industry.

Competitive Pricing: Without the overhead of massive national networks, regional banks often offer better fee structures and interest rates.

Community Investment: Regional banks often have stronger ties to local business communities and participate actively in economic development initiatives.

Flexible Underwriting: Lending decisions are frequently made locally, allowing for more nuanced evaluation of your business’s unique circumstances.

Credit Unions and Community Banks

For businesses prioritizing personalized service and competitive rates, credit unions and community banks present compelling options. These institutions typically offer:

Lower Fees: As member-owned or community-focused institutions, credit unions and community banks generally charge lower fees than larger commercial banks.

Competitive Interest Rates: Both on deposit accounts and loans, smaller institutions often provide better rates.

Exceptional Customer Service: With smaller customer bases, these institutions can deliver more personalized attention.

Local Decision Making: Lending and account decisions are made by people who understand the local economy and business environment.

Digital-First Banking Solutions

The rise of digital banking has introduced entirely new categories of business banking providers. These fintech companies offer:

Lower Operating Costs: Without physical branches, digital banks pass savings to customers through reduced fees and better interest rates.

Superior Technology: Mobile banking applications from digital-first providers often exceed traditional banks in functionality and user experience.

Rapid Account Opening: Many digital banking platforms allow complete account setup in minutes rather than days.

Integration-First Approach: Digital banks are built on modern technology stacks that integrate seamlessly with other business software.

However, digital banking solutions may lack comprehensive lending products and in-person support when complex issues arise.

International Business Banking Considerations

For businesses with international operations or suppliers, consider banks with strong cross-border capabilities. Canadian institutions offering RBC Cross Border Banking provide specialized services for businesses operating in multiple countries, including:

- Multi-currency accounts

- Foreign exchange services

- International wire transfers at competitive rates

- Trade finance products

- Letters of credit

Australian businesses might consider institutions like ANZ Banking, Westpac Banking, or NAB Banking, which offer extensive international banking networks and specialized import/export financing.

Step-by-Step Transition Process

Phase 1: Research and Selection (Weeks 1-2)

Week 1: Assess Your Needs

Begin by thoroughly analyzing your current and projected banking needs:

- Average monthly transaction volume

- Payment types you need to accept

- International transaction requirements

- Lending needs (current and future)

- Cash management requirements

- Integration with existing accounting software

Create a comprehensive requirements document that you’ll use when evaluating banking partners.

Week 2: Compare Banking Options

Research at least 5-7 banking institutions, including:

- 2-3 national banks (PNC Banking, Chase Banking, Wells Fargo Banking)

- 2-3 regional banks (Regions Online Banking, Truist Online Banking)

- 1-2 credit unions or community banks

- 1-2 digital banking solutions

Request detailed fee schedules, product information, and integration capabilities from each institution. Most banks provide comprehensive business banking information on their websites—check pnc online banking, chase online banking, and online banking bank of america sites for detailed product comparisons.

Phase 2: Application and Account Opening (Weeks 3-4)

Required Documentation

Business banking accounts require significantly more documentation than personal banking accounts. Prepare:

- Business formation documents (Articles of Incorporation, LLC Operating Agreement, Partnership Agreement)

- Employer Identification Number (EIN) from the IRS

- Business licenses and permits

- Personal identification for all account signers

- Business financial statements (if available)

- Personal financial information for owners (for credit evaluation)

Application Process

While some digital banking platforms allow completely online applications, many business banking relationships still require in-person meetings, particularly for accounts with lending components or merchant services.

Schedule appointments with your top 2-3 banking choices to discuss your needs in detail. These meetings often reveal information not apparent in online research, including:

- Relationship manager availability and expertise

- Flexibility in fee negotiations

- Specialized industry knowledge

- Problem-resolution processes

Phase 3: Dual Operation Period (Weeks 5-8)

Rather than immediately closing your personal banking account after opening your business account, maintain both during a transition period. This approach prevents disruption to ongoing business operations.

Week 5: Notify Stakeholders

Inform all relevant parties about your new banking account:

- Major clients (provide updated payment information)

- Suppliers and vendors (update autopay arrangements)

- Service providers (subscription services, utilities, etc.)

- Employees (if you process payroll)

- Accounting team or bookkeeper

- Tax professionals

Week 6-7: Redirect Incoming Payments

Systematically redirect revenue streams to your new business banking account:

- Update merchant account settings for credit card processing

- Modify invoices with new account information

- Update payment links on your website

- Configure accounting software to recognize the new account

- Set up mobile banking and online banking access for convenient management

Week 8: Redirect Outgoing Payments

Transfer recurring payments and obligations:

- Autopay arrangements for business expenses

- Supplier payment methods

- Loan payments (if applicable)

- Tax payment arrangements

- Subscription services

Phase 4: Complete Transition (Week 9-10)

Once all transactions are flowing through your business banking account and you’ve verified everything is operating smoothly:

Final Personal Account Review

Thoroughly review your personal banking account to ensure:

- No pending transactions related to business

- All automatic payments have been redirected

- All expected deposits have been received

- Account balance has been transferred

Close or Repurpose Personal Account

Depending on your situation, either:

- Close the personal account that was handling business transactions

- Convert it back to purely personal use

- Maintain it as a backup or secondary business account

Document the Transition

Create comprehensive documentation of your transition for tax and legal purposes:

- Final statement from the old account

- First statement from the new account

- Correspondence with banks

- Notification sent to clients and vendors

Advanced Business Banking Strategies

Velocity Banking for Accelerated Growth

Velocity banking has gained popularity as a strategy for rapidly paying down business debt while maintaining cash flow. This approach involves strategically using a business line of credit in conjunction with your banking account to minimize interest expense and accelerate debt elimination.

According to recent banking news, businesses implementing velocity banking strategies reduce debt 40-60% faster than traditional payment approaches. However, this strategy requires discipline and careful cash flow management.

Multi-Account Structure for Financial Optimization

Sophisticated businesses often maintain multiple banking accounts for different purposes:

Operating Account: Daily transactions, receivables, and payables

Tax Account: Segregated funds for quarterly tax payments, ensuring money is available when obligations arise

Profit Account: Dedicated account for profit distribution, preventing the temptation to reinvest all earnings back into operations

Payroll Account: Separate account exclusively for employee compensation, simplifying reconciliation and compliance

This structure, popularized by the Profit First methodology, creates forced fiscal discipline and improves financial visibility.

Cash Management Optimization

Commercial banking relationships provide access to sophisticated cash management tools:

Sweep Accounts: Automatically transfer excess funds from checking to higher-interest savings or investment accounts, then reverse transfers when operating balances fall below thresholds.

Zero Balance Accounts: Subsidiary accounts that maintain zero balances except when transactions occur, with automatic transfers from a master account ensuring payments are honored while maximizing interest on pooled funds.

Lockbox Services: For businesses with high payment volumes, lockbox services allow customers to send payments directly to a bank-controlled address where they’re processed and deposited immediately, accelerating cash flow.

Merchant Services Integration

If your business accepts card payments, merchant services integration with your business banking account provides significant advantages:

Reduced Processing Time: Funds from card transactions deposit directly to your business account, often within 1-2 business days.

Lower Fees: Banks offering integrated merchant services often provide better rates than third-party processors.

Simplified Reconciliation: When your merchant account and banking account are with the same institution, reconciliation becomes significantly simpler.

Enhanced Security: Integrated solutions typically provide better fraud protection and chargeback management.

Major banks like Chase Banking and Wells Fargo Banking offer comprehensive merchant services packages specifically designed for integration with their business banking accounts.

International Banking Solutions

For businesses with global operations, advanced international banking features become essential:

Multi-Currency Accounts: Hold multiple currencies to avoid constant conversion fees and exchange rate exposure.

Foreign Exchange Services: Access to competitive foreign exchange rates and hedging instruments to manage currency risk.

International Wire Transfers: Simplified processes for sending and receiving international payments with transparent fee structures.

Trade Finance: Letters of credit, documentary collections, and other trade finance instruments that facilitate international commerce.

Institutions like RBC Cross Border Banking specialize in serving businesses operating across international boundaries, offering expertise in navigating complex regulatory environments.

Common Mistakes to Avoid

Delaying Too Long

The most common mistake entrepreneurs make is waiting too long to establish a business banking relationship. Every day you operate without separate business banking increases your liability exposure, complicates your accounting, and potentially weakens your legal protections.

The ideal time to open a business banking account is immediately upon forming your business entity—not after you reach a certain revenue threshold or encounter problems with personal banking.

Choosing Based Solely on Fees

While fee structures matter, selecting a banking partner based exclusively on the lowest fees often proves shortsighted. Consider the total value proposition:

- Relationship manager accessibility

- Lending capacity and flexibility

- Digital banking platform quality

- Integration with your accounting software

- Merchant services availability and pricing

- Geographic coverage matching your expansion plans

A bank charging slightly higher monthly fees but offering superior service and lending capacity often delivers better long-term value than a low-fee provider with limited services.

Inadequate Research on Digital Capabilities

In today’s business environment, digital banking capabilities are essential, not optional. Before committing to a banking partner, thoroughly test their:

Mobile Banking Application: Download the app and test functionality. Can you deposit checks? Transfer funds? Set up alerts? Access account statements?

Online Banking Platform: Whether it’s pnc online banking, regions online banking, or truist online banking, the platform should be intuitive, comprehensive, and reliable.

API Integration: If you use accounting software or custom business systems, verify the bank offers robust API integration for automated data synchronization.

Security Features: Evaluate multi-factor authentication, fraud monitoring, and account protection features.

Neglecting to Build a Banking Relationship

Many business owners treat their banking account as a purely transactional relationship, missing opportunities to leverage their banker’s expertise and access to resources.

Private banking and commercial banking relationships provide access to:

- Industry insights and market intelligence

- Introduction to potential clients or partners

- Consultation on business strategy

- Early access to new financial products

- Preferential consideration for lending

Schedule regular meetings with your relationship manager, even when you don’t need anything specific. These relationships become invaluable during expansion phases or challenging periods.

Failing to Separate Finances Completely

Some business owners open business banking accounts but continue mixing personal and business transactions. This practice eliminates most benefits of separation and creates ongoing complications.

Establish and follow strict protocols:

- All business revenue goes to the business account

- All business expenses come from the business account

- Personal expenses come exclusively from personal accounts

- Owner compensation follows formal processes (salary, distributions, etc.)

Industry-Specific Banking Considerations

Professional Services (Consulting, Legal, Accounting)

Professional service businesses benefit from banking relationships offering:

- Trust account capabilities (for firms holding client funds)

- Merchant services for retainer and invoice payments

- Integration with practice management software

- Professional liability insurance products

E-Commerce and Retail

E-commerce businesses require specialized banking features:

- High-volume merchant services with competitive rates

- Integration with e-commerce platforms (Shopify, WooCommerce, etc.)

- Chargeback management support

- Multichannel payment acceptance (online, mobile, in-person)

Construction and Contracting

Construction businesses face unique banking needs:

- Large transaction capacity for materials purchases

- Specialized lending for equipment acquisition

- Payment and performance bond capabilities

- Progress payment management tools

Healthcare and Medical Practices

Healthcare businesses require banking partners understanding:

- Insurance payment processing

- HIPAA compliance in financial processes

- Medical equipment financing

- Practice acquisition lending

Understanding Banking Holidays and Service Availability

Business owners must understand banking holidays to effectively manage cash flow and payment timing. Banking holidays 2025 include standard federal holidays when banks are closed and transactions don’t process.

The question “is today a banking holiday” becomes critical when you’re managing payroll, supplier payments, or time-sensitive transactions. Columbus Day, for instance, prompts the annual question “is Columbus Day a banking holiday?”—the answer is yes, most banks observe Columbus Day as a holiday.

Plan your business payment schedule accounting for banking holidays, ensuring employees are paid on time and critical vendor payments aren’t delayed.

Technology Integration and Digital Banking

Mobile Banking Evolution

Modern mobile banking has transformed business financial management. Today’s applications offer functionality that previously required desktop access or branch visits:

- Mobile check deposit using your device’s camera

- Real-time balance and transaction monitoring

- Bill pay and vendor payment

- Internal transfers between accounts

- Account alerts and fraud notifications

- Customer support chat

Major banks continuously enhance their mobile banking capabilities—Chase online, Wells Fargo, and PNC banking online have invested millions in creating seamless mobile experiences.

Open Banking and API Integration

The open banking movement is revolutionizing business financial management by allowing secure data sharing between your banking account and third-party applications. This connectivity enables:

Automated Accounting: Transactions automatically sync with QuickBooks, Xero, or other accounting platforms, eliminating manual entry.

Cash Flow Forecasting: Advanced tools analyze transaction patterns to predict future cash positions and identify potential shortfalls.

Expense Management: Integration with expense tracking applications that categorize and organize business spending.

Payment Automation: Scheduled payments, automated vendor payments, and intelligent payment routing.

Cybersecurity Considerations

Business banking accounts face sophisticated security threats. Protect your business with:

Multi-Factor Authentication: Require multiple verification methods for account access.

Device Authorization: Limit account access to specific, authorized devices.

Transaction Alerts: Configure immediate notifications for transactions exceeding specified thresholds.

Regular Monitoring: Review account activity daily, looking for unauthorized or suspicious transactions.

Employee Training: If multiple people access your business banking, ensure all understand security protocols.

Recent banking news has highlighted increasing sophistication in banking fraud—businesses must prioritize security alongside convenience.

The Future of Business Banking

Artificial Intelligence and Predictive Banking

Financial institutions are deploying AI to provide predictive insights and automated financial management:

- Cash flow predictions based on historical patterns

- Automated categorization and reconciliation

- Fraud detection using machine learning

- Personalized product recommendations

- Chatbot support for routine inquiries

Blockchain and Cryptocurrency Integration

Progressive commercial banking institutions are exploring blockchain technology and cryptocurrency services:

- Cryptocurrency custody services

- Blockchain-based payment systems

- Smart contract integration for automated payment terms

- Stablecoin settlement options

While mainstream adoption remains limited, businesses in certain industries may benefit from banking partners offering these capabilities.

Embedded Finance

The trend toward embedded finance allows businesses to access banking services directly within the platforms they already use, without visiting separate banking portals. This evolution makes financial management increasingly seamless and integrated with daily operations.

Sustainability and ESG Banking

Environmental, Social, and Governance (ESG) factors are increasingly influencing banking relationships. Many businesses now seek banking partners with:

- Sustainable lending practices

- Community investment commitments

- Carbon-neutral operations

- Support for businesses pursuing sustainability initiatives

International Perspective: Banking Across Borders

Australian Business Banking Landscape

Australian businesses utilize sophisticated banking infrastructure through institutions like:

ANZ Banking: Offering comprehensive business solutions through anz internet banking and anz banking online platforms, with particular strength in agricultural and export businesses.

Westpac Banking: Through westpac banking online and westpac online platforms, Westpac provides extensive business banking services with strong small business support.

NAB Banking: NAB internet banking and nab login internet banking login provide access to one of Australia’s leading business banking platforms, particularly strong in SME lending.

St George Banking: St George internet banking offers competitive business banking with exceptional customer service ratings.

Suncorp Banking: Through suncorp internet banking, Suncorp provides specialized services for specific industries including agriculture and professional services.

Australian businesses benefit from the Australian Banking Association’s advocacy and standardization efforts, creating relatively consistent service levels across institutions.

European and UK Banking

The European banking landscape offers sophisticated business banking infrastructure:

Barclays Bank Online Banking: One of the UK’s leading business banking providers, offering comprehensive commercial banking solutions.

Open Banking Adoption: European banks have led open banking adoption, providing extensive integration capabilities and innovative fintech partnerships.

African Banking Development

Emerging markets are experiencing rapid business banking evolution:

Kenya Commercial Bank Online Banking: Represents the advancement of African business banking, offering mobile-first solutions aligned with regional business needs.

BSP Online Banking PNG: Bank South Pacific’s online banking in Papua New Guinea demonstrates the expansion of digital business banking in developing markets.

Making Your Final Decision

After comprehensive research and evaluation, synthesize your findings:

Create a Decision Matrix

Evaluate each banking option across critical factors:

- Fee structure (weight: 20%)

- Digital capabilities (weight: 25%)

- Lending capacity (weight: 15%)

- Customer service (weight: 15%)

- Integration capabilities (weight: 15%)

- Geographic coverage (weight: 10%)

Score each institution on a 1-10 scale for each factor, multiply by the weight, and total the scores.

Conduct Final Meetings

Before committing, schedule final discussions with your top two choices. These conversations should cover:

- Negotiation of fees or minimum balance requirements

- Clarification of service levels and relationship manager accessibility

- Discussion of future needs and the bank’s capacity to support growth

- Review of all required documentation and account setup timeline

Review All Documentation Thoroughly

Before signing, carefully review:

- Account agreements and terms of service

- Fee schedules and conditions that trigger charges

- Deposit availability schedules

- Overdraft policies and fees

- Service level commitments

Plan Your Transition Timeline

Create a detailed timeline for your transition, accounting for:

- Account opening processing time (1-2 weeks typically)

- Time needed to notify all stakeholders (1 week)

- Dual operation period (4-6 weeks recommended)

- Final transition and old account closure (1 week)

Conclusion: Your Business Banking Journey

The transition from personal banking to a comprehensive business banking relationship represents a defining moment in your entrepreneurial journey. This shift acknowledges your business has evolved beyond a side project into a legitimate enterprise deserving of professional financial infrastructure.

While the process requires careful planning, documentation, and execution, the benefits—legal protection, professional credibility, superior financial tools, and access to business-specific products—far outweigh the temporary inconvenience of transition.

Whether you choose a national institution like PNC Banking, Chase Banking, or Wells Fargo Banking; a regional provider like Regions Online Banking or Truist Online Banking; or a specialized solution, the key is selecting a partner aligned with your current needs and future growth trajectory.

The banking industry continues evolving rapidly, with digital banking, mobile banking, and open banking creating unprecedented capabilities for business financial management. Today’s business banking accounts offer functionality that would have seemed impossible just a decade ago—real-time financial visibility, automated processes, and seamless integration with every aspect of your business operations.

Take action today. Assess your current situation honestly, research your options thoroughly, and commit to establishing a proper business banking relationship. Your future self—and your business—will thank you for making this critical transition at the right time rather than delaying until complications force your hand.

Remember, successful businesses are built on solid foundations. Proper banking infrastructure represents one of the most fundamental elements of that foundation. Make this transition a priority, and position your business for sustainable growth, professional credibility, and long-term success.

Sources and Additional Resources: