Navigating the Australian banking landscape can feel like traversing a complex maze, especially when you’re looking for the best financial solutions for your entire family. Two prominent names that frequently appear on families’ radars are St. George Banking and Westpac Banking. While seemingly distinct, St. George operates under the Westpac Banking Corporation umbrella, offering a unique dynamic for comparison. This deep dive aims to dissect their offerings, from everyday personal banking needs to future investment banking aspirations, providing Australian families with the clarity needed to make an informed decision in 2025 and beyond. We’ll explore everything from mobile banking convenience to the intricacies of business banking and securing that dream home.

- 1. Understanding the Banks: Westpac and St. George

- 2. Everyday Banking Accounts: The Family’s Daily Hub

- 3. Savings & Investment Tools: Growing Family Wealth

- 4. Digital & Mobile Banking Prowess: Banking at Your Fingertips

- 5. Home Loans & Lending: Financing Family Life

- 6. Business Banking Considerations: Supporting Family Enterprises

- 7. Security, Support, and Operational Aspects

- 8. The Bigger Picture: Banking Trends and Stability

- 9. Making the Family’s Choice: Key Decision Factors for 2025

- Conclusion: Your Family, Your Banking Choice

As families grow, so do their financial needs. The simple checking or banking account of yesteryear has evolved into a complex ecosystem requiring robust digital banking solutions, tailored savings strategies, and accessible loan facilities. Understanding how St. George and Westpac stack up against each other across these crucial areas is paramount. Forget the confusion often associated with global banking giants like PNC banking or Chase banking – our focus remains firmly on the Australian context, providing locally relevant insights.

This guide will delve into:

- Bank Profiles: Understanding the heritage and structure of Westpac and St. George.

- Everyday Banking Accounts: Comparing transaction accounts, fees, and accessibility.

- Savings & Investment Tools: Examining options for growing family wealth.

- Digital & Mobile Banking Prowess: Evaluating the

online bankingandmobile bankingexperience. - Home Loans & Lending: Assessing mortgage and other lending products.

- Business Banking Services: Looking at options for family enterprises.

- Support, Security & Holidays: Evaluating customer service and operational reliability.

- The Bigger Picture: Contextualizing within the broader Australian financial system.

- Making Your Family’s Choice: Key decision factors for 2025.

Let’s begin unraveling the offerings of St. George and Westpac to empower your family’s financial journey.

1. Understanding the Banks: Westpac and St. George

Before diving into specific products, it’s essential to grasp the relationship and positioning of these two banks.

Westpac Banking: A Pillar of Australian Finance

Westpac Banking Corporation, founded in 1817, is one of Australia’s “Big Four” banks and the nation’s oldest banking institution. It boasts a massive customer base, an extensive branch network, and a comprehensive range of financial services catering to individuals, businesses, and institutions. Westpac offers everything from basic banking account facilities and mortgages to complex wealth management and investment banking services. Its sheer scale means significant investment in technology, security, and regulatory compliance. Westpac’s brand is synonymous with stability and reach within the Australian market. They are a significant player, touching nearly every facet of finance, including significant commercial banking operations.

St. George Banking: A Distinct Brand Within the Westpac Group

St. George Bank was established in 1937 and, while operating as a distinct brand, has been part of the Westpac Group since 2008. This structure allows St. George to maintain its unique brand identity and customer focus while leveraging the resources, stability, and technological infrastructure of its parent company. Often perceived as slightly more accessible or customer-centric in its branding, St. George targets a similar demographic, including families, individuals, and small businesses. Its product suite mirrors Westpac’s core offerings but may sometimes feature slightly different interest rates, fee structures, or promotional incentives. Understanding this relationship is key: you get the specific St. George experience backed by the Westpac network. They also provide dedicated business banking solutions.

- Source: Westpac Group – Brands

Key Takeaway: Choosing between St. George and Westpac isn’t always about choosing between two entirely separate entities. It’s often about selecting a specific brand experience and potentially different product nuances within the same robust banking group. This can mean benefits like shared ATM networks but potentially distinct app interfaces or customer service approaches.

2. Everyday Banking Accounts: The Family’s Daily Hub

The cornerstone of any family’s banking relationship is the everyday transaction or banking account. This is where salaries are deposited, bills are paid, and daily spending occurs. Both St. George and Westpac offer competitive options.

Westpac Choice Account

Westpac offers various transaction accounts, with the “Westpac Choice” often being the flagship product.

- Features: Typically includes a debit card, access to online and mobile banking, BPAY, and international money transfer capabilities.

- Fees: Often features a monthly account fee, which may be waived if certain conditions are met (e.g., depositing a minimum amount, maintaining a minimum balance, or being under a certain age). Transaction fees for certain activities might apply.

- Overdraft: Options for overdraft facilities may be available, subject to application and approval.

- Digital Access: Seamless integration with the Westpac Live online banking platform and the Westpac mobile app. This facilitates easy

mobile bankinganddigital bankingmanagement. - Family Link: Can be linked to savings accounts or used for managing allowances for older children.

- Source: Westpac Everyday Accounts

St. George Everyday Accounts

St. George provides comparable transaction accounts, often under names like “St.George Everyday Transaction Account.”

- Features: Similar functionality to Westpac’s offering, including debit card access, BPAY, online/mobile banking, and international services.

- Fees: May also have a monthly fee, potentially waivable under specific conditions that might differ slightly from Westpac’s criteria. It’s crucial to check the current waiver conditions.

- Overdraft: Overdraft facilities are generally available via application.

- Digital Access: Connects to St. George’s dedicated

internet bankingportal and mobile app, providing a slightly different user interface but similar core functionalities to Westpac’s digital offerings. - Source: St.George Everyday Banking

Comparison for Families:

- Fees: The primary differentiator often lies in the monthly fees and the conditions required to waive them. Families should compare these carefully based on their expected income patterns and spending habits. Does one bank’s waiver condition align better with your salary deposit cycle?

- Accessibility: Both banks have extensive ATM networks (often shared due to the Westpac Group relationship), but branch locations might differ. Check which bank has a more convenient branch or ATM presence for your family’s needs.

- Children’s Accounts: Both banks offer specific accounts for children, often designed to teach financial literacy with features like limited transaction capabilities and easy parental oversight. Compare the features and educational tools offered.

- Simplicity: For families seeking a straightforward

banking account, both offer solid foundations. The choice might come down to minor fee differences or the user experience of their respectiveonline bankingplatforms.

3. Savings & Investment Tools: Growing Family Wealth

Beyond daily spending, families need effective ways to save for goals like holidays, education, or a house deposit, and potentially explore longer-term investments.

Westpac Savings & Investment Options

Westpac offers a diverse range of savings accounts:

- Super Booster / Goal Saver: Accounts designed for accumulating funds towards specific goals, often offering bonus interest rates if certain conditions are met (like making regular deposits and no withdrawals).

- Online Saver: Simple, competitive rate accounts accessible primarily online.

- Term Deposits: Fixed-term investments offering predictable returns, suitable for funds not needed immediately. Westpac provides various terms and competitive rates.

- Investment Services: Westpac offers broader financial advice and investment services, potentially touching on areas relevant to

investment bankingprinciples for high-net-worth individuals, although this is distinct from typical family savings. - Source: Westpac Savings Accounts & Westpac Investments

St. George Savings & Investment Options

St. George mirrors many of these offerings, often with competitive rates:

- Progress Saver: Similar to Westpac’s goal-oriented accounts, rewarding regular savings habits.

- Easy eSaver: A straightforward online savings account.

- Term Deposits: Available across various terms, providing fixed returns. St. George frequently runs special term deposit offers.

- Wealth Services: While St. George focuses primarily on retail and

business banking, access to the broader Westpac Group’s wealth management advice is typically available. - Source: St.George Savings Accounts

Comparison for Families:

- Interest Rates: Compare the base rates and the bonus interest conditions for variable-rate savings accounts. Small differences can add up significantly over time. Look at current offers for Term Deposits.

- Children’s Savings: Both banks offer youth-focused savings accounts. Compare features like interest rates, parental controls, and any educational components.

- Accessibility of Funds: Consider how easily you can access funds if needed. Bonus interest accounts often penalize withdrawals, so ensure the structure fits your family’s potential cash flow needs.

- Long-Term Investment: While the core focus here is family banking, if exploring more complex investments, Westpac’s broader institutional capabilities might offer more depth, although St. George customers can usually access these too. Concepts like

velocity banking(a strategy involving managing cash flow across various accounts, often linked to offset mortgages) might be facilitated differently depending on the specific account structures and offset mortgage products available through each brand.

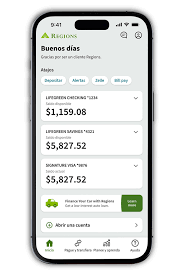

4. Digital & Mobile Banking Prowess: Banking at Your Fingertips

In today’s world, the quality of digital banking and mobile banking platforms is often as important as the physical branch network. Both St. George and Westpac invest heavily in their digital offerings.

Westpac’s Digital Experience

- Westpac Live (Online Banking): A comprehensive platform accessible via desktop or mobile browser. Features include account management, transaction history, fund transfers (including NPP payments), BPAY, international transfers, applying for products, managing cards, and accessing statements.

- Westpac App (Mobile Banking): Offers a streamlined experience focused on key tasks. Features often include fingerprint/Face ID login, mobile check deposit (check availability), card lock/unlock, real-time transaction alerts, budgeting tools (e.g., Westpac Life), and secure messaging with the bank. This provides robust

mobile bankingcapabilities. - Security: Employs multi-factor authentication, encryption, and fraud monitoring.

- Comparison Points: Westpac’s platform is feature-rich, reflecting its status as a major bank. It aims to cater to all customer needs, from simple balance checks to complex loan applications. It’s comparable to the sophisticated online platforms seen from large US banks like

Bank of America online bankingorWells Fargo banking, though tailored specifically for Australia. - Source: Westpac Digital Banking

St. George’s Digital Experience

- St. George Internet Banking: Provides secure access to manage accounts, make payments, view statements, and apply for products online. The interface is generally clean and user-friendly.

- St. George App (Mobile Banking): Offers core mobile banking features like login with biometrics, viewing balances and transactions, transferring funds, mobile check deposit (feature availability may vary), card management, and alerts. This ensures convenient

using your mobile banking appfor everyday tasks. - Security: Utilizes similar security protocols to Westpac, leveraging the group’s overall security infrastructure.

- Comparison Points: St. George’s digital platform might feel slightly simpler or have a different aesthetic compared to Westpac’s. However, it provides all the essential functionalities needed for effective

digital banking. For users prioritizing a potentially less cluttered interface, St. George might appeal. It competes directly with theonline bankingexperiences of other Australian banks like ANZ (anz internet banking) or NAB (nab internet banking). - Source: St.George Digital Banking

Comparison for Families:

- User Interface (UI) / User Experience (UX): This is subjective. Some may prefer Westpac’s comprehensive feature set, while others might find St. George’s interface cleaner. Trying out the demo versions or exploring screenshots is recommended.

- Feature Parity: Both platforms offer core

mobile bankingandonline bankingfunctions. Check for specific features important to your family, such as advanced budgeting tools, specific alert types, or ease of international money transfers (related toeft meaning in bankingstandards). - Reliability: As part of the same group, both benefit from Westpac’s infrastructure investment. However, individual app outages can occur for any bank. Issues like

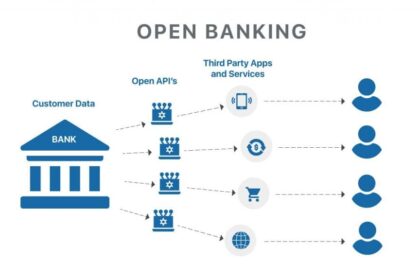

M&T Bank mobile banking downexperienced by other institutions globally serve as a reminder that digital services aren’t infallible, making reliability a key factor to consider. Checking recent app store reviews can provide insight. - Open Banking: Both banks participate in Australia’s

open bankingregime, allowing secure data sharing (with consent) with third-party providers to find better deals or access new services.

5. Home Loans & Lending: Financing Family Life

Securing a home loan is often the most significant financial commitment a family makes. Both St. George and Westpac offer a wide array of mortgage and lending products.

Westpac Home Loans

- Product Range: Offers variable rate, fixed rate, and interest-only home loans, including options for first home buyers, construction loans, and refinancing.

- Features: Popular features include mortgage offset accounts (crucial for strategies like

velocity banking), redraw facilities, and flexible repayment options. - Borrowing Capacity: Assessed based on income, expenses, and existing debts, adhering to strict lending standards.

- Support: Access to home loan specialists, mortgage brokers, and online comparison tools. The scale allows for diverse

personal bankingloan products. - Source: Westpac Home Loans

St. George Home Loans

- Product Range: Similar offerings to Westpac, including variable, fixed, and interest-only options, tailored for owner-occupiers and investors. St. George often promotes competitive rates on its mortgage products.

- Features: Includes offset accounts, redraw facilities, and flexible payment schedules.

- Borrowing Capacity: Assessed using similar methodologies, aligned with APRA regulations and Westpac Group standards.

- Support: Dedicated home loan specialists and a network of support channels.

- Source: St.George Home Loans

Comparison for Families:

- Interest Rates & Fees: This is critical. Compare the comparison rates (which include most fees) for loans that match your needs. Look beyond the headline rate to the Annual Percentage Rate (APR) or Comparison Rate. Fees for variations, redraws, or early exit can differ.

- Offset Accounts: If you plan to use a mortgage offset account to minimize interest paid, compare how each bank structures these (e.g., 100% offset, limits). This is vital for efficient cash flow management.

- Flexibility: Evaluate the flexibility in repayment options, redraw facilities, and options for making extra repayments without penalty.

- First Home Buyer Assistance: Check for specific packages or offers aimed at first-time buyers, which might include government incentives or waived fees.

- Loan Calculators: Both banks provide online calculators to estimate borrowing capacity and repayments. Use these extensively.

Beyond home loans, both banks offer personal loans and car loans, often with competitive rates and streamlined online application processes.

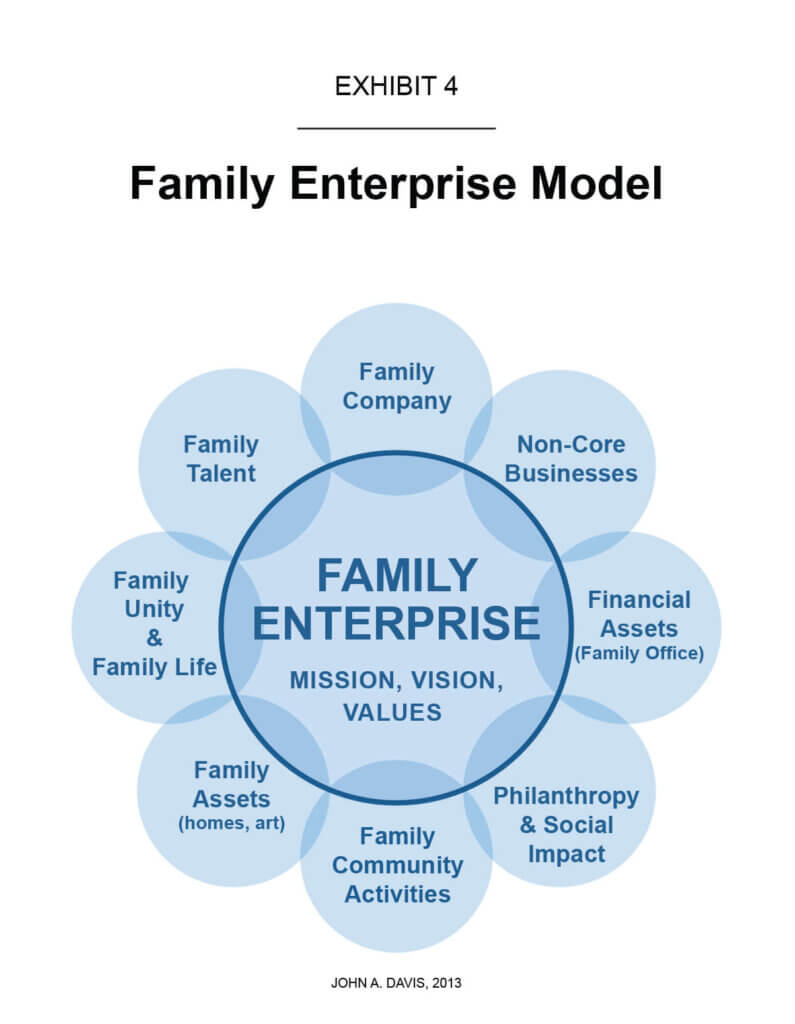

6. Business Banking Considerations: Supporting Family Enterprises

While the primary focus is family banking, many families run small businesses or operate as sole traders. Both St. George and Westpac provide business banking solutions.

Westpac Business Banking

- Offerings: Comprehensive services including business transaction accounts, business credit cards, loans, equipment finance, merchant services, and international trade services. Caters to small businesses up to large corporations (

commercial banking). - Digital Tools: Business-specific online banking platforms and mobile app features designed for managing business finances.

- Source: Westpac Business Banking

St. George Business Banking

- Offerings: Similar suite of products tailored for small to medium businesses, including accounts, loans, and transaction facilities. St. George often positions itself as particularly supportive of SMEs.

- Digital Tools: Dedicated online and mobile banking platforms for business clients.

- Source: St.George Business Banking

Comparison for Families:

- Account Fees: Compare monthly fees and transaction costs for business accounts.

- Lending Options: If seeking finance for a business, compare interest rates, loan amounts, and repayment terms for business loans and overdrafts.

- Integration: Consider how easily business accounts can be linked or managed alongside

personal bankingaccounts, especially if using the same institution. - Specialised Support: Does the bank offer industry-specific advice or support that might benefit your family business?

For entrepreneurs comparing options, looking at specialized providers like bank of melbourne business banking (also part of Westpac Group) or others might also be worthwhile, but within the St George/Westpac comparison, focus on the nuances of their respective business packages.

7. Security, Support, and Operational Aspects

Reliability, security, and customer support are non-negotiable aspects of choosing a bank.

Security Measures

Both Westpac and St. George implement robust security protocols for their online banking and mobile banking services. This includes:

- Encryption of data transmission.

- Multi-factor authentication (e.g., passwords, SMS codes, card reader verification).

- Fraud monitoring and detection systems.

- Card security features (e.g., ability to freeze/unfreeze cards via the app).

- Protection against threats like those potentially affecting

umb online bankingor other services, ensuring customer funds and data are safeguarded.

Customer Support

- Westpac: Offers extensive support through branches, call centres (available 24/7 for many services), online chat, and secure messaging via digital platforms.

- St. George: Provides support via branches, phone banking, and digital channels. While part of Westpac, the direct customer service line might differ.

Banking Holidays

Understanding banking holidays is crucial for families planning transactions. Both banks observe Australian public holidays.

- Public Holidays: Transaction processing may be delayed on public holidays (e.g., Christmas Day, New Year’s Day, Australia Day, Easter, Anzac Day, Queen’s Birthday, Labour Day). Both banks will close physical branches on these days. Online and mobile banking services usually remain accessible for information viewing, but processing of transactions that require bank involvement (like overseas transfers or loan applications) may be deferred until the next business day.

- “Is Today a Banking Holiday?”: Checking the RBA website or the banks’ own holiday calendars is the best way to confirm. Unlike specific US holidays like

is Columbus Day a banking holiday, Australian holidays are generally consistent nationwide, though some states have specific regional holidays. Planning ahead forbanking holidays 2025is advisable. - “Is Today a Banking Holiday?” confirmation is vital for time-sensitive payments.

- Source: Reserve Bank of Australia – Payments System Board (Note: RBA doesn’t list holidays directly, but sets standards. Check bank sites or government holiday calendars.)

Comparison for Families:

- Branch Network: Westpac generally has a larger physical footprint. If regular branch visits are important, this could be a deciding factor.

- Call Centre: Compare wait times and accessibility hours for phone support.

- Digital Reliability: While both leverage Westpac’s infrastructure, minor glitches can occur. Reviewing recent app feedback can be insightful. Concerns like

M&T Bank online banking issueshighlight the importance of checking user reviews for any bank. - Trust: Both are established institutions with strong security frameworks. Westpac’s long history might offer a slight edge in perceived stability for some customers.

8. The Bigger Picture: Banking Trends and Stability

It’s useful to place St. George and Westpac within the broader context of the Australian and global financial environment.

Digital Transformation and Fintech

The entire banking sector is undergoing rapid digital banking transformation. Banks like St. George and Westpac are competing not only with each other but also with fintech challengers (like Robinhood banking in the US, though Australia has its own players) offering innovative solutions. Concepts like open banking are empowering consumers to leverage their data for better financial outcomes.

Economic Factors

Broader economic conditions influence all banks. Topics discussed in banking news include:

- Interest Rate Rises: Affecting mortgage costs and savings returns.

- Inflation: Impacting household budgets.

- Regulatory Changes: Ensuring banks operate soundly and protect consumers.

- Global Economic Stability: Events elsewhere can sometimes ripple through. While discussions about

shadow bankingor thebanking crisisin other markets might seem distant, they underscore the importance of robust regulation governing major institutions like Westpac. Understanding terms likebad loans in banking industryhelps appreciate the risks banks manage.

Australian Banking Landscape

Besides Westpac and St. George, major players include Commonwealth Bank, ANZ, and NAB. There are also numerous smaller banks, credit unions, and mutuals (like me banking, Greater Bank, BENDIGO BANK E BANKING). Each offers different strengths. For instance, while the US has regional players like Regions Online Banking or PNC banking, Australia’s market is dominated by the Big Four, with St. George offering a slightly different flavour within that structure. This consolidation means strong oversight but also limits the diversity found in larger, more fragmented markets.

- Source: Australian Banking Association

9. Making the Family’s Choice: Key Decision Factors for 2025

Choosing between St. George and Westpac depends heavily on your family’s specific priorities. Here’s a framework:

Prioritise Westpac if:

- You value the largest possible branch network and a vast range of complex financial services under one roof.

- You prefer a highly feature-rich, established digital banking platform.

- You are interested in potentially broader

investment bankingor complex wealth management services offered by the parent group. - You need access to the widest array of

business bankingandcommercial bankingsolutions.

Prioritise St. George if:

- You appreciate a potentially simpler, cleaner interface for

online bankingandmobile banking. - You are looking for competitive rates and offers, sometimes distinct from Westpac’s primary offerings.

- You value the specific branding and customer service approach of St. George, while still benefiting from the Westpac Group’s stability.

- Your

personal bankingandbusiness bankingneeds are relatively standard and well-catered for by a dedicated offering.

Universal Considerations for Both:

- Fees: Meticulously compare monthly fees, transaction fees, ATM fees (especially out-of-network), and any other charges associated with the specific

banking accountand products you need. Check the conditions for fee waivers. - Digital Experience: Test drive their online platforms and mobile apps. Does the interface feel intuitive for your family? Are the features you rely on readily available? This is key for effective

digital banking. - Savings Rates: If maximizing returns on savings is a priority, compare the bonus rates and conditions on their savings accounts and the rates/terms for fixed deposits.

- Home Loan Rates & Features: If you’re looking for a mortgage, get quotes from both. Pay close attention to comparison rates, offset account availability, and flexibility.

- Customer Service: Consider your preferred communication channel – branch, phone, online chat. Research current customer satisfaction levels if possible.

- Children’s Needs: Evaluate the youth savings accounts and any tools designed to help children learn about money management.

Final Thoughts on Keywords: While incorporating terms like PNC banking, Chase banking, Wells Fargo banking, Regions online banking, Truist online banking, umb.com online banking, m&t bank, axis bank internet bankin, kenya commercial bank online banking, barclays bank online banking, bsp online banking png, gsb online banking etc., helps contextualize the global banking environment or showcases breadth, remember that for Australian families, the most relevant comparisons are often within the domestic market, particularly between brands operating under the same regulatory framework and ownership structure, like St. George and Westpac. Focus on how features like mobile banking app functionality, online banking account security, and clear personal banking terms translate to your specific needs. Understanding concepts like eft meaning in banking ensures clarity on everyday transactions.

Conclusion: Your Family, Your Banking Choice

Both St. George and Westpac offer robust, secure, and feature-rich banking solutions suitable for Australian families in 2025. Westpac provides the sheer scale and breadth of a major financial institution, while St. George offers a focused brand experience, often with competitive offerings, all backed by the stability of the Westpac Group.

The “best” bank is subjective and depends entirely on your family’s unique circumstances, priorities, and preferences. By carefully comparing account fees, interest rates, digital platform usability, lending products, and customer support, you can confidently choose the banking partner that best supports your family’s financial goals, today and into the future.

Don’t underestimate the power of comparing the fine print, utilising online calculators, and perhaps even speaking to representatives from both institutions before making your final decision. Making an informed choice now sets a strong foundation for your family’s financial well-being.

Sources Used:

- Westpac Official Website: westpac.com.au

- St. George Banking Official Website: stgeorge.com.au

- Australian Banking Association: ausbanking.org.au

- Reserve Bank of Australia (for context on payments and regulation): rba.gov.au

(Note: Specific product links may change; official bank websites are the primary source for current details. External links like RBA and ABA provide industry context.)