In the relentless rhythm of modern finance, the grand, marble-lined banking hall has been supplanted by a far more intimate and powerful space: the screen of your smartphone or laptop. The quality of your digital banking experience is no longer a mere convenience; it is the cornerstone of your financial well-being. It dictates how effortlessly you pay bills, how intuitively you track spending, how securely you manage your wealth, and how seamlessly you navigate the complexities of both personal banking and business banking.

Today, we embark on a definitive deep dive into two of the most formidable titans in the American financial arena: Bank of America and Chase. This isn’t just a superficial comparison of features. We are dissecting the very soul of their digital platforms—Chase Online Banking and Online Banking Bank of America—to determine which ecosystem truly empowers the user in an era defined by open banking and financial agility.

As of this week, both institutions are aggressively pushing updates to their mobile interfaces, refining their AI-driven insights, and competing for the title of the most indispensable financial partner in your pocket. We will leave no stone unturned, from the simplicity of opening an online banking account to the sophistication of their security protocols and the nuances of their customer support. Let’s begin.

The First Impression: Onboarding and Account Accessibility

The journey into any digital banking relationship begins with enrollment. This initial handshake sets the tone for everything that follows.

Bank of America: Streamlined, but with Guardrails

Opening an online banking account with Bank of America is a largely frictionless process. Their website and mobile app guide you through a step-by-step enrollment that typically involves your Social Security number, a government-issued ID, and some personal details. Where they excel is in their instant, partial access. Once your core information is verified, you can often begin setting up bill pay and exploring the platform’s features almost immediately, even as they conduct final backend checks. This creates a sense of instant gratification. However, for more complex products or full functionality, you may need to visit a branch, a reminder of the bridge between traditional and modern personal banking.

Chase: The Gold Standard in Speed and Integration

Chase has arguably perfected the art of the quick start. Their application process is famously efficient, often providing near-instant decisions on checking and savings accounts. The integration between applying for a new account and being immediately enrolled in Chase Online Banking is seamless. If you’re an existing customer adding a new product, the process is even smoother, leveraging your established profile. This relentless focus on speed and a low-friction entry makes Chase a formidable competitor for anyone looking to get up and running with a new banking account without delay.

Verdict: For pure, unadulterated speed and a virtually paperless onboarding experience, Chase Online Banking takes a slight lead. Their system feels built for the digital native from the ground up.

The Command Center: Mobile App & Desktop Interface Showdown

This is where the daily relationship is forged. The mobile banking app is your most frequent touchpoint, and its design, speed, and intuitiveness are paramount.

Bank of America’s Mobile Banking: The Power of “Erica”

The Bank of America app presents a clean, if somewhat dense, dashboard. Information is plentiful, with your accounts, credit cards, and investment holdings (if linked to Merrill) displayed prominently. The true star of their mobile banking experience, however, is Erica, their AI-driven virtual financial assistant. Erica is not just a glorified search bar; she can provide cash flow insights, identify recurring charges, lock your debit card with a voice command, and even guide you to relevant educational content. It’s a level of proactive, AI-integrated digital banking that few competitors can match. The desktop experience for Online Banking Bank of America mirrors this functionality, offering a comprehensive, if occasionally cluttered, suite of tools for managing your finances on a larger screen.

Chase’s Mobile Banking: Sleek, Simple, and Surprisingly Powerful

The Chase mobile app is a masterclass in minimalist design. The interface is airy, intuitive, and incredibly fast. Navigation is straightforward, with key actions like transferring money and depositing checks accessible within a tap or two. Recent updates have enhanced their “Snap a Bill Pay” feature, which uses your camera to automatically fill in payee information, a small but brilliant quality-of-life improvement. While Chase has its own chatbot, the overall experience leans more on elegant design and flawless execution than on AI-powered insights. For the user who values speed, clarity, and reliability above all else, the Chase Online experience is hard to beat. The desktop portal is equally refined, making tasks like managing business banking accounts or reviewing statements a visually pleasant experience.

Verdict: This is a tie, but for different user profiles. If you want a powerful, AI-co-piloted financial command center, Bank of America and Erica are unparalleled. If you prioritize a sleek, fast, and intuitively simple interface, Chase Online Banking is the winner.

Beyond the Basics: Advanced Features for the Modern User

Basic transactions are table stakes. The differentiation occurs in the advanced features that help you manage, grow, and protect your money.

Bank of America’s Arsenal: The Merrill Edge Advantage

Where Bank of America truly shines is in its integration with Merrill Edge, its low-cost investing platform. This creates a unified dashboard for your entire financial life—checking, savings, and investments—that is incredibly powerful. You can see your net worth at a glance and move money between your banking account and brokerage account with unparalleled ease. This is a significant value proposition for those who are even mildly interested in investing, blurring the lines between traditional personal banking and investment banking services for the retail customer. Their “Life Plan” tool is another standout, helping you set and track financial goals in a structured way.

Chase’s Ecosystem: The Credit Card & Autosave Synergy

Chase’s strength lies in its deeply integrated ecosystem, particularly if you are a holder of one of their premium credit cards like the Sapphire Reserve or Freedom Flex. The app seamlessly surfaces your credit card rewards, allows you to redeem them directly, and tracks your spending against bonus categories. A killer feature is “Autosave,” which automatically transfers money to your savings account based on rules you set (e.g., round up debit card purchases). For business banking clients, their online platforms offer robust invoicing, payment acceptance, and cash flow analysis tools that rival specialized providers.

Verdict: For the aspiring investor or someone who values a holistic net-worth view, Bank of America’s Merrill Lynch integration is a game-changer. For the frequent traveler or credit card rewards maximizer, the Chase Online ecosystem is more immediately beneficial.

The Fort Knox Factor: Security and Fraud Protection

In an age of sophisticated cyber threats, the security posture of your digital banking provider is non-negotiable.

Both banks offer industry-standard protections: multi-factor authentication, biometric login (fingerprint and facial recognition), and real-time fraud monitoring. However, their approaches have subtle differences.

Bank of America provides a high degree of customizable security controls. You can set geographical limits on card usage, establish “safe” payee lists for transfers, and receive proactive alerts for any suspicious activity. Their security center is comprehensive and educational.

Chase employs a similarly robust system but often feels more proactive in its communication. Their algorithms are exceptionally sharp at detecting anomalous patterns, and they are not shy about temporarily freezing a transaction to send a verification text or email. Some users find this occasionally overzealous, but it underscores a “better safe than sorry” philosophy.

Verdict: It’s a dead heat. Both Bank of America and Chase provide top-tier security for your online banking account. The choice may come down to whether you prefer deeply customizable controls (BofA) or aggressively proactive, algorithm-driven intervention (Chase).

The Human Element: Customer Support When You Need It

Even in a digital world, sometimes you need a human being.

Bank of America offers a wide net of support: 24/7 phone support, a extensive branch network for in-person help, and a secure messaging system within the app. The effectiveness can vary, but the options are plentiful.

Chase also provides 24/7 phone support and has a similarly vast branch presence. Many users report marginally higher satisfaction with Chase’s phone support, citing shorter wait times and more empowered representatives. Their secure message center is equally effective for non-urgent queries.

Verdict: Chase holds a slight, but perceptible, edge in the consistency and perceived efficiency of its customer support, a critical component for both personal banking and more complex business banking needs.

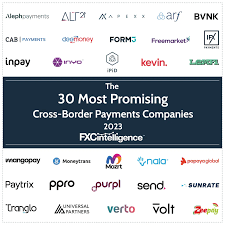

The Competitive Landscape: How Do They Stack Against Others?

While our focus is on BofA and Chase, it’s worth noting how they compare to the broader market. Competitors like Wells Fargo banking have made significant strides with their new interface, while PNC online banking offers a brilliant virtual wallet for cash flow management. Truist online banking is still merging the best of BB&T and SunTrust, and regional players like M&T Bank online banking sometimes face technical hurdles, as seen during recent M&T online banking issues. Meanwhile, the rise of neobanks and open banking frameworks continues to push all traditional institutions to innovate faster.

The Final Tally: Choosing Your Digital Financial Partner

So, who wins this deep dive? The answer, as with all great rivalries, is not absolute. It depends entirely on your financial profile and priorities.

Choose Bank of America if:

- You are an active investor or want a unified view of your banking and investment portfolios.

- You value AI-driven financial insights and proactive money management tools like Erica.

- Your financial life is complex, and you appreciate a vast array of features and educational resources.

Choose Chase if:

- You value a sleek, fast, and intuitively simple user experience above all else.

- You are deeply embedded in the Chase ecosystem, particularly with their premium credit cards.

- You prioritize rapid onboarding and highly reliable, consistent customer service.

- Your business banking needs are centered around ease of use and seamless payment integration.

The Future is Now: Staying Ahead of the Curve

The world of digital banking is not static. As we look ahead, trends like embedded finance, deeper open banking integrations, and the use of AI for predictive lending and personalized investment banking advice will become standard. Both Bank of America and Chase are investing billions to stay at the forefront. The best choice today is the one that not only serves your current needs but also demonstrates the vision and technological prowess to be your partner for the financial future.

Sources & Further Reading: