In the intricate world of commerce, the bedrock of smooth operations, strategic growth, and financial stability lies in the fundamental relationship between a business and its financial institution. Your business banking account isn’t just a place to park cash; it’s a dynamic tool, a potential growth engine, and a critical component of your financial infrastructure. Selecting the right banking account is paramount. Making the wrong choice can lead to unnecessary fees, operational friction, missed opportunities, and stunted growth. Conversely, a well-chosen account, perhaps with a provider like PNC Banking, Chase Banking, or Wells Fargo Banking, can streamline transactions, offer valuable insights, and support your expansion.

This guide dives deep into the essential features that truly matter when evaluating a business banking account. We’ll move beyond the basics to explore the ten non-negotiable characteristics that separate adequate accounts from exceptional ones, ensuring your business has the financial firepower it needs to thrive in today’s competitive market. Whether you’re a startup founder exploring your first banking account, a freelancer managing fluctuating income, or an established enterprise seeking more sophisticated commercial banking solutions, this information is designed to empower your decision-making. We’ll also touch upon the importance of robust digital banking and mobile banking capabilities, crucial elements in modern commerce.

1. Fee Structure and Transparency: Unpacking the Costs

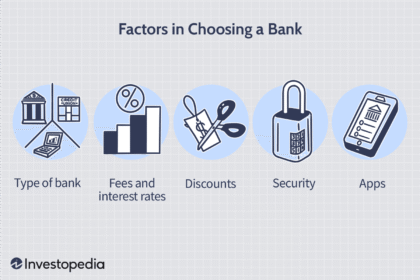

The first hurdle in evaluating any banking account is understanding the associated costs. Fees can silently erode your profits if not carefully monitored. Banks often present complex fee schedules, making transparency a crucial feature to prioritize.

- Monthly Maintenance Fees: Many business accounts come with a monthly service charge. However, most banks, including major players like PNC, Chase, and Regions Bank, offer ways to waive these fees. Common requirements include maintaining a minimum daily balance, meeting a certain number of qualifying transactions per month, or linking the business account to other bank products. Understand these requirements clearly. Is the minimum balance achievable without hindering your operational cash flow?

- Transaction Fees: Be aware of fees charged per transaction once you exceed a certain limit (often tiered based on account type). This includes checks paid, deposits made, ACH transfers, and wire transfers. For businesses with high transaction volumes, these fees can add up significantly. Compare the included transaction allowances and the cost per item thereafter. Some business banking packages offer unlimited transactions, which can be invaluable for growing businesses.

- Wire Transfer Fees: Both domestic and international wire transfers incur fees, which can vary widely between institutions like Wells Fargo Banking and smaller banks. Understand the cost structure for sending and receiving wires, as this is critical for businesses involved in frequent large transfers or international trade.

- Overdraft Fees: Overdrafts can be costly. Investigate the bank’s policies, including the fees charged and any grace periods or courtesy overdraft options available. Better yet, look for accounts that offer seamless overdraft protection linked to a savings account or line of credit.

- Other Potential Fees: Don’t overlook fees for things like ATM usage (especially out-of-network), paper statement copies, stop payments, cash handling (for large deposits/withdrawals), and account closure.

Why it Matters: A transparent and reasonable fee structure directly impacts your bottom line. Choosing an account with manageable fees, or clear paths to waive them, frees up capital that can be reinvested into business growth. Always request a full fee schedule and read the fine print. Staying informed about banking news related to fee changes is also prudent.

Source Suggestion: [Link to a reputable financial comparison site or a major bank’s business account fee schedule page – e.g., NerdWallet comparison, or a specific bank like Chase Business Banking page detailing fees.]

2. Transaction Limits and Processing Speed: Keeping Pace with Your Business

Your business banking account needs to handle the volume and speed of your financial activities without imposing frustrating limitations.

- Deposit and Withdrawal Limits: Understand the daily and monthly limits for cash deposits, check deposits (especially via mobile banking apps), and ATM withdrawals. If your business handles significant cash, ensure the limits are adequate or that the bank offers solutions for higher volumes.

- Transfer Capabilities: Evaluate the limits and speed for ACH transfers (Automated Clearing House), wire transfers, and online bill payments. For businesses needing to pay vendors quickly or manage payroll efficiently, rapid processing is key. Consider how different banks like M&T Bank or Truist handle these transfers within their online banking platforms.

- Check Processing: How quickly does the bank process checks you deposit? How long does it take for checks you’ve written to clear? Faster clearing times mean funds are available sooner, improving cash flow predictability.

- ACH and Wire Cut-off Times: Be aware of the daily cut-off times for same-day processing of ACH and wire transfers. Missing a cut-off can delay crucial payments by a full business day. This is particularly relevant when considering holidays; knowing is today a banking holiday becomes important for transaction timing. Planning around banking holidays 2025 (or the current year) is essential.

Why it Matters: Insufficient transaction limits or slow processing can create bottlenecks, delay payments to suppliers, hinder payroll, and generally disrupt operations. A robust business banking solution should accommodate your current volume and be scalable for future growth. Understanding the EFT meaning in banking (Electronic Funds Transfer) is fundamental, as these are the backbone of many business transactions.

Source Suggestion: [Link to an article explaining ACH vs. Wire Transfers or a bank’s guide on transaction processing.]

3. Digital Banking Capabilities: Online and Mobile Access

In the era of digital banking, a bank’s online and mobile platforms are just as important as its physical branches. These tools are critical for efficiency, convenience, and real-time financial management.

- Robust Online Banking Platform: Look for a user-friendly online banking interface that offers comprehensive features. This includes:

- Real-time balance and transaction history.

- Easy bill pay capabilities (one-time and recurring).

- Funds transfer options (internal and external).

- Detailed account statements and transaction downloads (e.g., CSV, QBO formats for accounting).

- User permissions management (allowing different team members specific access levels).

- Secure messaging with the bank.

- Tools for managing business loans or lines of credit.

- Banks like PNC Online Banking, Chase Online Banking, Online Banking Bank of America, Regions Online Banking, and M&T Bank Online Banking offer varying levels of sophistication here. Explore platforms like www.pncbank.com online banking or chase online.

- Feature-Rich Mobile Banking App: A good mobile banking app allows you to manage your finances on the go. Essential features include:

- Mobile check deposit (with reasonable limits).

- Checking balances and recent activity.

- Transferring funds between accounts.

- Paying bills.

- Setting up alerts (low balance, large transactions, etc.).

- Locating nearby ATMs or branches.

- Many users rely heavily on M&T mobile banking or similar apps from Truist Online Banking or Wells Fargo Banking for daily tasks. Ensure the app is stable, secure, and intuitive. Consider checking reviews for M&T bank mobile banking down issues if evaluating that specific bank.

- Alerts and Notifications: Customizable alerts via email or SMS (often through the mobile banking app or online banking account) are invaluable for staying informed about account activity and security.

Why it Matters: Efficient digital banking saves time, reduces errors, provides immediate access to financial information, and empowers proactive cash management. It’s crucial for modern businesses, regardless of size. The trend towards digital banking is undeniable, and robust features are now standard expectations. For some, managing their finances is often referred to simply as “me banking” when referring to their personal control via these digital tools, but the business versions are far more complex.

Source Suggestion: [Link to a comparison of business online banking platforms or a bank’s specific digital banking feature page.]

4. Integration with Accounting Software and Financial Tools

Manually reconciling bank statements with accounting records is time-consuming and prone to errors. Seamless integration between your business banking account and your accounting software is a significant efficiency booster.

- Direct Integration (API): The gold standard is direct integration, often enabled by Open Banking initiatives. This allows your accounting software (like QuickBooks, Xero, FreshBooks, etc.) to automatically download transactions directly from your bank account. This drastically reduces manual data entry and reconciliation time.

- File Download/Upload: If direct integration isn’t available, check if the bank allows you to easily download transaction data in formats compatible with your software (e.g., OFX, QBO, CSV). While less seamless than direct integration, it’s still far better than manual entry.

- Payment Integration: Some platforms integrate directly with payment systems, allowing you to initiate payments (like vendor bills or payroll) directly from your accounting software, pulling funds from your designated business banking account.

Why it Matters: Smooth integration streamlines bookkeeping, improves accuracy, provides a clearer real-time view of your financial position, and saves countless hours of administrative work. This is becoming a standard expectation for businesses using modern accounting tools.

Source Suggestion: [Link to a major accounting software’s bank connection guide or an article on the benefits of bank-accounting integration.]

5. Overdraft Protection and Credit Options

Cash flow is the lifeblood of any business, and unexpected shortfalls can occur. How your bank account handles these situations is critical.

- Overdraft Protection: As mentioned under fees, understand the options. This could be:

- Linked Savings/Checking: Funds automatically transfer from another account (often a savings account) to cover the overdraft. Interest may apply on the transferred amount, or a small fee per transfer.

- Business Line of Credit: The bank extends a line of credit specifically to cover overdrafts or immediate cash needs. This usually involves interest charges on the borrowed amount but can be more cost-effective than high overdraft fees for larger or recurring shortfalls.

- Access to Business Credit: Beyond overdrafts, consider the bank’s broader offerings for business credit. Does the account serve as a foundation for accessing business loans, lines of credit, or business credit cards? Banks strong in commercial banking, such as JPMorgan Chase or Bank of America, often have integrated solutions for businesses needing significant credit lines. Establishing a solid business banking relationship can be the first step towards securing larger financing.

Why it Matters: Adequate overdraft protection and access to credit lines prevent bounced checks, protect your business reputation, and provide a safety net for managing unpredictable cash flow, ensuring operational continuity.

Source Suggestion: [Link to an article explaining business lines of credit or bank overdraft options.]

6. Merchant Services and Payment Processing Capabilities

For businesses that accept credit or debit card payments from customers, integrated merchant services are essential.

- Payment Acceptance: Does the bank offer its own merchant services or partner with a reputable provider? Look for solutions that allow you to accept various payment types:

- In-person payments (via POS terminals or card readers).

- Online payments (via payment gateways for e-commerce websites).

- Mobile payments (via smartphone apps or mobile card readers).

- Transparent Pricing: Understand the fee structure for merchant services. This typically includes a discount rate (a percentage of each transaction), plus potential per-transaction fees, monthly fees, PCI compliance fees, and statement fees. Compare these rates carefully. Sometimes, consolidating your banking and merchant services with one provider like Chase Merchant Services or offerings from PNC Banking can lead to better overall pricing or streamlined reconciliation.

- Reporting and Reconciliation: Ensure the merchant services provide clear reporting on transactions and easy reconciliation with your bank statements.

Why it Matters: Efficient and cost-effective payment processing is vital for revenue generation. Offering convenient payment options enhances the customer experience and can increase sales. Integrated solutions simplify financial management.

Source Suggestion: [Link to a guide on choosing merchant services or a major bank’s merchant services overview.]

7. International Banking Services

If your business operates across borders, or plans to, international banking capabilities are non-negotiable.

- International Wire Transfers: Assess the fees, exchange rates, and processing times for sending and receiving international wire transfers. Compare offerings from banks like ANZ Banking, Westpac Banking, or NAB Banking if operating internationally is a key focus. Some banks offer specialized global accounts.

- Currency Exchange: Understand the exchange rates offered. Banks often add a margin (spread) to the base rate. Look for competitive rates and transparency about any additional fees. Some banks offer forward contracts or other hedging tools for managing currency risk.

- Foreign Currency Accounts: If you frequently deal in a specific foreign currency, consider if the bank offers multi-currency accounts, which can simplify transactions and potentially reduce conversion costs.

- International ACH: Some banks facilitate international ACH payments, which can be cheaper and sometimes faster than traditional wire transfers for certain countries.

- Letters of Credit & Trade Finance: For businesses involved in international trade, specialized services like letters of credit might be necessary. Check if your bank offers these or can facilitate them through correspondent banks. RBC cross border banking is an example of services targeting this need.

Why it Matters: Efficient and cost-effective international transactions are crucial for businesses engaged in global trade, expanding their market reach, or managing international supply chains. Poor international banking services can significantly increase costs and create delays.

Source Suggestion: [Link to a bank’s international services page or an article on global business payments.]

8. Customer Support and Accessibility

When issues arise or you need assistance, the quality and accessibility of customer support can make a huge difference.

- Dedicated Business Support: Does the bank offer specialized support teams for business clients? Often, commercial banking clients receive dedicated relationship managers or specialized support lines, distinct from standard personal banking support. This ensures the support staff understand business-specific needs and products.

- Multiple Support Channels: Evaluate the availability and responsiveness of different channels:

- Phone Support: What are the hours? Is wait time reasonable? Are calls routed efficiently?

- Online Chat: Is it available during business hours? Are the representatives knowledgeable?

- Email/Secure Messaging: How quickly are responses provided?

- In-Branch Support: If you value face-to-face interaction, consider the bank’s branch network size and location convenience. For some, managing issues like m&t bank online banking issues might require specific channels.

- Problem Resolution: Consider the bank’s reputation for resolving issues efficiently and effectively. Online reviews and word-of-mouth can offer insights.

Why it Matters: Timely and knowledgeable support minimizes disruption when problems occur. A responsive bank can help resolve issues quickly, saving you time and potential financial losses. A good relationship manager can be a valuable resource for navigating complex financial needs.

Source Suggestion: [Link to a business banking review site or a bank’s customer service contact page.]

9. Scalability and Growth Potential

Your banking needs will evolve as your business grows. The ideal bank account should accommodate this evolution.

- Tiered Services: Does the bank offer different account tiers or packages that you can upgrade to as your transaction volume, cash balance, or service needs increase? For instance, transitioning from a basic business banking account to more comprehensive commercial banking services.

- Access to Lending and Credit: As mentioned, assess the bank’s willingness and ability to provide larger loans, lines of credit, equipment financing, or commercial real estate loans as your business expands.

- Treasury Management Services: For larger businesses, sophisticated treasury management services (e.g., cash concentration, liquidity management, fraud mitigation tools) become crucial. Does the bank offer these?

- Investment Banking & Capital Markets: While typically separate, a strong relationship with a bank’s commercial division can sometimes facilitate introductions or pathways to their investment banking services for activities like IPOs, mergers, and acquisitions, although this is usually reserved for larger corporations.

- Industry Specialization: Some banks have specialized divisions or expertise catering to specific industries (e.g., technology, healthcare, agriculture). If your business operates in a niche sector, finding a bank with relevant experience can be advantageous.

Why it Matters: Choosing a bank that can grow with you prevents the disruption of having to switch providers later. It ensures you have access to the necessary financial tools and capital to fund expansion, manage larger operations, and achieve long-term goals.

Source Suggestion: [Link to an article about business growth financing or treasury management services.]

10. Security Features: Protecting Your Business Assets

Safeguarding your business funds and sensitive data is paramount. Robust security measures are essential in today’s environment.

- Multi-Factor Authentication (MFA): Ensure the bank utilizes MFA for logging into online and mobile banking platforms. This typically involves a password plus a secondary verification step (e.g., code sent to phone, biometric scan).

- Encryption: Verify that online and mobile communications with the bank are encrypted to protect data transmission.

- Fraud Monitoring and Alerts: Look for proactive fraud detection systems that monitor for suspicious activity and alert you immediately. Customizable alerts (low balance, large transaction, password changes) through online banking or mobile banking are also vital.

- Account Controls: Features like setting transaction limits, managing user permissions (especially important in larger teams), and requiring dual controls for certain transactions add layers of security.

- FDIC Insurance (or equivalent): Ensure your deposits are insured by the relevant government body up to the maximum limit (e.g., FDIC in the US, CDIC in Canada, FSCS in the UK, APRA indirectly via depositor protection schemes in Australia for banks like ANZ, Westpac, NAB). This protects your funds in the unlikely event of bank failure. Understanding concepts like shadow banking highlights why regulated institutions are crucial.

Why it Matters: Robust security protects your business from financial loss due to fraud or cyberattacks. It also ensures compliance with data protection regulations and provides peace of mind.

Source Suggestion: [Link to a bank’s security center page or a government resource on bank deposit insurance.]

Choosing Between the Giants: Banks Like PNC, Chase, Wells Fargo, and Beyond

Navigating the options often involves comparing the offerings of major players versus smaller institutions or credit unions.

- Large National Banks (e.g., Chase Banking, Bank of America, Wells Fargo Banking, PNC Banking):

- Pros: Extensive branch and ATM networks, wide range of services (from basic business banking to complex commercial banking and investment banking), sophisticated digital banking platforms, often strong international capabilities.

- Cons: Potentially higher fees or minimum balance requirements, customer service can sometimes feel impersonal, processes might be more rigid. Offer robust platforms like chase online, pnc online banking, online banking bank of america.

- Super-Regional Banks (e.g., Regions, Truist, M&T Bank):

- Pros: Often combine the extensive services of large banks with a more regional focus and potentially more personalized service. Offer strong online banking like Regions Online Banking, Truist Online Banking, M&T Bank Online Banking.

- Cons: Geographic limitations compared to national giants, service level can vary.

- Community Banks & Credit Unions:

- Pros: Typically offer highly personalized service, potentially lower fees, strong community focus, decisions often made locally.

- Cons: May have fewer locations, potentially less sophisticated digital banking tools (though this is rapidly changing), might offer a narrower range of complex services compared to large institutions. Some specific online logins like becu online banking login or cadence online banking might serve niche communities.

- Online-Only Banks / Neobanks:

- Pros: Often low or no fees, strong digital banking focus, innovative features, good mobile apps. Examples might include aspects of Robinhood banking aspirations or dedicated business neobanks.

- Cons: No physical branches, reliance entirely on digital channels, may have lower transaction limits or fewer specialized commercial banking services.

When comparing, for instance, PNC Banking vs. Chase Banking, look at the specifics mentioned above – fees, digital features for PNC Online Banking vs. Chase Online Banking, merchant service costs, and relationship manager availability for your specific business needs. Similarly, evaluate Regions Online Banking against Wells Fargo Banking based on your operational requirements.

Staying Current: Daily Information and Banking Holidays

The financial world moves fast. Staying informed is key.

- Check Today’s Offers: Interest rates, promotional offers, and even account features can change. Always check the bank’s official website today for the most current details on rates for savings, checking accounts, or lines of credit. For example, visit www.pncbank.com online banking or chase.com directly.

- Banking Holidays: Be mindful of banking holidays. Knowing is today a banking holiday (or anticipating banking holidays 2025) is crucial for planning transactions, as processing times often extend across these non-business days. This impacts everything from ACH transfers to check clearing.

- Monitor Banking News: Keep abreast of general banking news, regulatory changes, and economic trends that might impact financial institutions or your business.

Conclusion: Your Banking Account as a Strategic Asset

Choosing a business banking account is far more than a procedural necessity; it’s a strategic decision that can significantly influence your company’s efficiency, profitability, and growth trajectory. By meticulously evaluating the ten essential features outlined above – from fee transparency and transaction capabilities to cutting-edge digital banking and robust security – you can select an account that truly serves as a valuable partner.

Don’t underestimate the power of a well-aligned financial relationship. Whether you lean towards established institutions like PNC Banking, Chase Banking, Wells Fargo Banking, Regions Online Banking, or explore niche providers, prioritize the features that align with your specific business model and future aspirations. A great banking account simplifies operations, protects your assets, and provides the foundation upon which your business can confidently scale and succeed. Take the time, do the research, and choose wisely – your future self will thank you.