Navigating the Digital Landscape: A Guide for Banks, Investment Firms, and Fintech Leaders

The financial world is no longer defined by marble pillars and velvet ropes. Today, the most critical interactions happen on the glass screens of smartphones and the dashboards of digital banking platforms. For institutions in the high-stakes realms of investment banking, business banking, and personal banking, establishing a dominant, trustworthy, and results-driven online presence is not just an advantage—it’s a necessity for survival and growth. The right digital marketing strategy can mean the difference between attracting high-net-worth clients for private banking and getting lost in the noise.

But who can you trust to handle the complex, heavily regulated, and fiercely competitive marketing needs of a financial institution? We’ve done the deep dive, analyzing strategies, client success stories, and industry impact to bring you the definitive list of the top 5 digital marketing agencies uniquely equipped to serve the financial services sector in 2025.

Why Financial Services Marketing is a Beast of Its Own

Before we unveil our top picks, it’s crucial to understand why a generic marketing agency simply won’t cut it. Marketing for banks, credit unions, and financial advisors operates under a microscope.

- Regulatory Scrutiny: Every claim, every testimonial, every piece of financial advice in an ad must comply with SEC, FINRA, and other regulatory bodies. Missteps aren’t just embarrassing; they’re expensive and damaging.

- The Trust Factor: In an industry often rocked by banking crisis headlines and skepticism, building and maintaining trust is paramount. Your marketing must convey stability, security, and integrity above all else.

- Fierce Competition: You’re not just competing with the bank down the street. You’re up against Chase Banking, Wells Fargo Banking, agile fintech startups, and even shadow banking entities. Standing out requires sophistication and intelligence.

- The Data-Driven Customer: Today’s client uses their mobile banking app to check rates, reads the latest banking news, and compares your online banking account features against a dozen others before making a move. Your marketing must speak to this informed audience.

An agency that understands these nuances is worth its weight in gold. The following five have consistently proven they are up to the task.

1. The Strategic Growth Architects: Directive Consulting

Source: Directive Consulting Website – Financial Services Case Studies

When it comes to performance marketing for complex B2B financial services, Directive Consulting stands in a league of its own. This agency doesn’t just run ads; they architect entire growth engines focused on measurable ROI, making them a perfect partner for firms in investment banking, commercial banking, and asset management.

What Sets Them Apart:

- Data-First Approach: Directive lives and breathes analytics. They go beyond surface-level metrics to track the entire customer journey, from initial click to closed deal, ensuring that every marketing dollar is accountable. This is critical for demonstrating value in a results-oriented field like finance.

- Expertise in High-Intent Channels: They excel in Search Engine Marketing (SEM) and Paid Search, capturing clients at the very moment they are searching for specific financial services. Imagine a corporate treasurer searching for “commercial banking solutions for mid-market manufacturing.” Directive ensures your firm is the one they see.

- Content that Converts: Understanding that trust is built on authority, they develop deep, insightful content strategies that position your firm as a thought leader. This isn’t just blog posts; it’s whitepapers, market analysis reports, and webinars that speak directly to the C-suite.

Ideal For: Financial institutions looking for a scalable, data-proven customer acquisition model and those competing in the sophisticated B2B finance space.

2. The Content & SEO Powerhouse: The HOTH

Source: The HOTH Blog – Financial Marketing Resources

For any financial institution, visibility is currency. When a potential client is searching for “best online banking account” or “how to switch business banking providers,” you need to be at the top of the search results. The HOTH specializes in making that happen through relentless focus on technical SEO and high-quality content creation.

What Sets Them Apart:

- Unmatched SEO Execution: From meticulous keyword research targeting terms like “truist online banking” or “PNC online banking” to advanced technical audits that ensure your site loads faster than your competitors’, The HOTH builds a foundation of organic visibility that pays dividends long after a campaign ends.

- Scale and Reliability: They are known for their ability to execute at scale, providing consistent, high-quality link building and content production. This is essential for dominating a competitive landscape where content freshness is a ranking factor.

- Local SEO Mastery: For regional banks and credit unions, their ability to optimize for local search—ensuring you appear when someone searches “banking jobs near me” or “open banking branch hours”—is incredibly powerful.

Ideal For: Banks like PNC, Regions, or M&T Bank looking to solidify their local and national organic search presence, and any institution needing to build a massive library of authoritative, SEO-optimized content.

3. The Full-Funnel Digital Innovators: Disruptive Advertising

Source: Disruptive Advertising – Client Results & Testimonials

As the name suggests, Disruptive Advertising is not for financial brands that want to play it safe with traditional marketing. They are masters of building integrated, full-funnel digital strategies that combine paid media, CRO, and analytics to drive explosive growth. They understand the modern consumer’s path to purchase, which for personal banking and digital banking services, is rarely linear.

What Sets Them Apart:

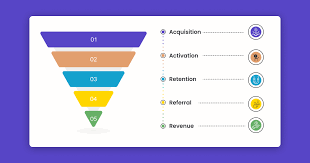

- Full-Funnel Mindset: They don’t just focus on top-of-funnel awareness or bottom-of-funnel conversions. They build strategies that nurture a prospect from a cold audience to a loyal client, using retargeting, email sequencing, and tailored messaging at every stage.

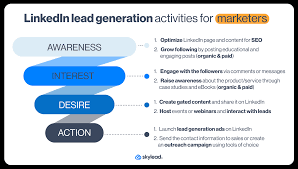

- Paid Social Prowess: While many agencies struggle with financial services on platforms like LinkedIn and Meta, Disruptive has cracked the code. They create highly targeted campaigns that reach decision-makers in business banking and consumers considering a new mobile banking app, all while maintaining platform compliance.

- Radical Transparency: Their reporting is legendary for its clarity and depth. You’ll know exactly which strategies are working for your online banking sign-ups and which aren’t, allowing for agile, data-driven decision-making.

Ideal For: Fintech startups, neobanks, and established banks launching new digital banking products who need a dynamic, agile partner to drive rapid user acquisition and market penetration.

4. The Brand Storytellers & PR Experts: Influence & Co.

Source: Influence & Co. – Industry Expertise

In a digital age saturated with information, authority is the ultimate competitive edge. Influence & Co. specializes in helping financial executives and their firms build that authority through strategic content marketing and digital PR. They don’t just get you traffic; they get you featured in the publications your clients and competitors read.

What Sets Them Apart:

- Authority-Building Focus: Their core service is securing bylined articles, quotes, and insights for your leadership in top-tier financial and trade publications. This third-party validation is more powerful than any advertisement and is a key tactic for private banking and investment banking firms.

- Knowledge Extraction: They are experts at mining the deep expertise within your organization and transforming it into compelling, publishable content. This turns your internal brain trust into your most valuable marketing asset.

- Strategic Content Distribution: They understand that creating great content is only half the battle. They have the networks and strategies to ensure that content reaches the right eyes, driving qualified leads and enhancing brand reputation.

Ideal For: Established financial firms, wealth management advisors, and investment banking leaders looking to elevate their brand above the fray and be perceived as the foremost experts in their niche.

5. The Data-Driven Creative Agency: KlientBoost (now part of Bounteous)

Source: Bounteous (formerly KlientBoost) – Case Studies

KlientBoost, now operating under its parent company Bounteous, brought a unique, high-energy blend of data-driven analysis and bold creativity to the PPC world. This legacy continues, making them a formidable force for financial brands that want their ads to not only perform but also to captivate and engage.

What Sets Them Apart:

- CRO as a Core Competency: Their background is deeply rooted in Conversion Rate Optimization. They don’t just drive clicks to your site for your online banking account application; they obsess over the entire landing page experience, removing friction and dramatically improving application completion rates.

- Creative That Cuts Through: In a sea of bland financial ads, their creative team knows how to develop concepts that get noticed. They A/B test everything from ad copy to visuals, finding the winning combinations that resonate with audiences searching for everything from “chase online” alternatives to “banking holidays 2025.”

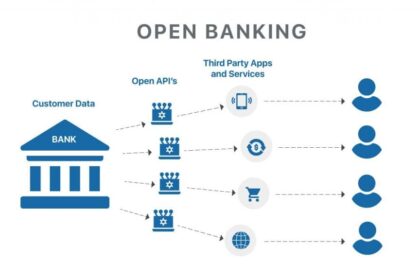

- Integrated View: As part of Bounteous, they can leverage even greater resources in marketing technology and data science, offering a more holistic service that can integrate your mobile banking data with your marketing efforts for unparalleled personalization.

Ideal For: Financial institutions of all sizes that are tired of underperforming PPC campaigns and need a partner who will optimize every step of the conversion funnel, from ad click to funded account.

The Future is Now: Emerging Trends in Financial Services Marketing

Choosing an agency is just the first step. The landscape is evolving at a breakneck pace. To stay ahead, your chosen partner must be fluent in these emerging trends:

- Hyper-Personalization: The era of one-size-fits-all marketing is over. Using data from mobile banking usage and online banking behaviors, campaigns can now be tailored to the individual. Imagine serving a specific home equity line ad to a user who has been browsing mortgage rates within your app.

- The Rise of Video and Interactive Content: Explainer videos on EFT meaning in banking, live Q&As about banking jobs, and interactive calculators for loan rates are becoming standard expectations. They build trust and engagement far more effectively than static text.

- Voice Search Optimization: As more people use voice assistants to ask, “Is today a banking holiday?” or “What’s the nearest PNC banking branch?”, optimizing for conversational, long-tail keywords becomes critical.

- Proactive Reputation Management: With the speed of banking news and social media, a single negative post about M&T Bank online banking issues can spiral. Top agencies now include proactive monitoring and response strategies as a core service.

Conclusion: Forging Your Path to Digital Dominance

The relationship between a financial institution and its marketing agency is a strategic partnership. It’s about finding a team that not only understands the intricacies of digital banking and the competitive pressures from Chase Online and Wells Fargo but also shares your vision for growth and embodies your commitment to trust and security.

The five agencies profiled here—Directive Consulting, The HOTH, Disruptive Advertising, Influence & Co., and Bounteous—each offer a distinct path to that goal. Whether your priority is data-driven lead generation, dominant SEO, full-funnel innovation, unparalleled authority, or conversion-focused creativity, there is a partner on this list ready to help you navigate the future of finance.

The question is no longer if you need a world-class digital marketing agency, but which one will you choose to write your institution’s next chapter of success.