As an entrepreneur navigating the dynamic world of business, establishing a solid financial foundation for your Limited Liability Company (LLC) is paramount. Beyond the initial excitement of launching your venture, a critical step that many overlook, or perhaps underestimate, is the strategic importance of opening a dedicated commercial banking account. This isn’t just about segregating funds; it’s about safeguarding your personal assets, streamlining operations, fostering credibility, and positioning your LLC for sustainable growth in a competitive marketplace.

- Why Your LLC Needs a Dedicated Commercial Banking Account: Beyond the Basics

- The Critical Preparatory Steps Before Application

- Navigating the Commercial Banking Landscape: Choosing the Right Partner

- The Application Process: A Step-by-Step Walkthrough

- Beyond the Account: Maximizing Your Commercial Banking Relationship

- Common Pitfalls to Avoid When Managing Your LLC’s Commercial Banking Account

- The Future of Commercial Banking for LLCs: Embracing Innovation

- Conclusion: Charting Your LLC’s Financial Course with Confidence

In an era where digital banking and mobile banking solutions are rapidly reshaping how businesses manage their finances, the choices available can seem overwhelming. From traditional brick-and-mortar institutions like PNC Banking and Chase Banking to agile online-only platforms, selecting the right banking account requires a thoughtful approach. This comprehensive guide will demystify the process, equip you with the knowledge to make informed decisions, and ensure your LLC establishes a financial backbone designed for long-term success.

Why Your LLC Needs a Dedicated Commercial Banking Account: Beyond the Basics

Many new business owners, particularly those operating smaller LLCs, might initially consider using their personal banking account for business transactions. This common oversight, while seemingly convenient, carries significant risks and can undermine the very protections an LLC structure offers. Understanding these fundamental reasons is the first step toward building a robust financial strategy for your enterprise.

Safeguarding Your Legal Protection and Liability Shield

The primary reason entrepreneurs opt for an LLC structure is the liability protection it affords, separating personal assets from business debts and legal obligations. This “corporate veil” is crucial, but it’s not impenetrable. One of the quickest ways to pierce this veil is through co-mingling of funds, where personal and business finances become indistinguishably intertwined.

- Maintaining the Corporate Veil: A distinct commercial banking account ensures a clear separation between your personal finances and your LLC’s finances. If your business were ever to face a lawsuit or significant debt, this separation is vital in protecting your personal assets (home, car, savings) from being seized to satisfy business liabilities. Without it, a court might rule that the LLC is merely an extension of you, nullifying your limited liability.

- Legal Scrutiny: Should your LLC ever undergo an audit or legal review, demonstrating clear financial boundaries through separate business banking accounts is essential. It provides undeniable proof of your adherence to corporate formalities, reinforcing your LLC’s independent legal standing.

Enhancing Financial Clarity and Streamlining Operations

Managing your LLC’s money through a personal account can quickly turn into an accounting nightmare. Reconciling expenses, tracking income, and preparing for tax season become exponentially more complicated, costing you valuable time and potentially leading to errors.

- Simplified Bookkeeping: With a dedicated business banking account, all your business income and expenses flow through a single, easily traceable channel. This simplifies bookkeeping, making it easier to categorize transactions, track cash flow, and generate financial reports. Platforms offering robust online banking and mobile banking features often integrate seamlessly with accounting software, further automating this process.

- Accurate Tax Preparation: Tax time is notoriously complex for businesses. A separate commercial banking account means you won’t have to painstakingly sift through personal expenses to identify business deductions. All relevant financial data is consolidated, simplifying tax filings and reducing the likelihood of errors or missed deductions.

- Cash Flow Management: Understanding your business’s financial health requires a clear view of its cash flow. A dedicated account makes it easier to monitor income inflows and expense outflows, allowing you to make informed decisions about budgeting, investments, and operational adjustments.

Building Professionalism and Credibility

Perception plays a significant role in business. How your LLC presents itself financially can impact its relationships with clients, vendors, and potential investors.

- Professional Image: Paying vendors from a personal account or receiving payments into one can appear unprofessional and raise questions about your LLC’s legitimacy. A commercial banking account projects an image of professionalism and stability, signaling to others that you operate a serious, well-managed enterprise.

- Fostering Trust: Clients and suppliers prefer to deal with established businesses. Invoicing with a business account name and making payments from a dedicated business account builds trust and confidence, making transactions smoother and more reliable.

- Access to Business Opportunities: When seeking business loans, lines of credit, or investment, financial institutions and investors will invariably scrutinize your financial records. A well-maintained business banking history demonstrates fiscal responsibility and makes your LLC a more attractive candidate for funding. This is particularly relevant when considering services from institutions with strong investment banking divisions.

Unlocking Business-Specific Financial Services

Commercial banking institutions are designed to support businesses, offering a suite of services tailored to their unique needs that are typically unavailable with personal banking accounts.

- Merchant Services: If your LLC accepts credit or debit card payments, you’ll need merchant services to process these transactions securely. Banks like Wells Fargo Banking, PNC Banking, and Chase Banking offer integrated solutions.

- Business Loans and Lines of Credit: As your LLC grows, you might need capital for expansion, inventory, or operational expenses. A strong relationship with a commercial banking partner opens doors to various financing options, including SBA loans, equipment financing, and lines of credit.

- Payroll Services: Managing employee payroll can be complex. Many banks offer integrated payroll solutions to streamline salary payments, tax withholdings, and compliance.

- Treasury Management: For larger LLCs or those with complex financial needs, treasury management services can optimize cash flow, manage risks, and facilitate international transactions. This can include services like EFT meaning in banking (Electronic Funds Transfer) for efficient payments.

In essence, opening a commercial banking account for your LLC is not an option; it’s a fundamental requirement for legal protection, operational efficiency, professional standing, and access to the financial tools necessary for growth.

The Critical Preparatory Steps Before Application

Before you even approach a bank, it’s crucial to have your LLC’s ducks in a row. Financial institutions require specific documentation to verify your business’s legal standing and the identity of its owners and authorized signers. Skipping these preparatory steps can lead to delays and frustration.

1. Ensure Your LLC’s Legal Standing is Unquestionable

Your LLC must be legally formed and registered with the appropriate state authorities. This foundation is non-negotiable for opening any business banking account.

- Articles of Organization (or Certificate of Formation): This is the foundational document filed with your state’s Secretary of State (or equivalent agency) that legally establishes your LLC. Banks will require a copy to verify your business’s existence and official name.

- Employer Identification Number (EIN): Often referred to as a Federal Tax Identification Number, your EIN is essential for your LLC to conduct business, open a banking account, and file taxes. It acts as a social security number for your business. You can obtain an EIN for free directly from the IRS website (IRS.gov). It’s a quick online application process.

- Operating Agreement: While not always required by banks, a well-drafted Operating Agreement is vital for multi-member LLCs. It outlines the ownership structure, member roles, profit/loss distribution, and decision-making processes. Banks may request it, especially if there are multiple authorized signers, to understand the authority vested in each individual.

- Business Licenses and Permits: Depending on your industry and location, your LLC may need specific local, state, or federal licenses and permits to operate legally. While not always directly requested by banks for account opening, having them in order demonstrates full legal compliance.

2. Gather All Essential Documentation

This is where the rubber meets the road. Having all necessary documents organized and readily available will significantly expedite the account opening process.

- Proof of EIN: The official letter from the IRS confirming your EIN.

- Certified Copy of Articles of Organization: Many banks prefer a certified copy, often available from your state’s Secretary of State website.

- LLC Operating Agreement: As mentioned, especially if your LLC has multiple members.

- Identification for All Authorized Signers: Each individual authorized to transact on the commercial banking account will need to provide at least two forms of identification. This typically includes a government-issued photo ID (driver’s license, passport) and often a secondary form of ID (social security card, utility bill with matching address).

- Proof of Business Address: A utility bill, lease agreement, or official business mail showing your LLC’s physical address. P.O. Boxes are generally not accepted as a primary business address.

- Business Resolution (if applicable): For LLCs with multiple members, especially those with complex structures, a formal resolution signed by all members authorizing specific individuals to open and operate the banking account may be required. This ensures all owners are in agreement with the account setup.

3. Understand Your LLC’s Specific Banking Needs

Not all LLCs are created equal, and neither are their banking account requirements. Before choosing a financial institution, take time to assess your business’s unique financial footprint.

- Transaction Volume: How many deposits, withdrawals, and checks do you anticipate making each month? Some accounts have limits or charge fees for exceeding certain transaction thresholds.

- Cash Flow Patterns: Do you have regular, predictable income, or is it seasonal? This can influence your need for overdraft protection or lines of credit.

- International Transactions: If your LLC deals with international clients or suppliers, you’ll need a bank that offers robust international wire transfer services and competitive foreign exchange rates. RBC cross border banking is an example for businesses operating between Canada and the US.

- Merchant Services: Do you need to accept credit card payments? Look for banks that offer integrated merchant processing solutions.

- Payroll Needs: Will you be hiring employees? Consider banks with integrated payroll services or easy integration with third-party payroll providers.

- Future Growth: Anticipate your business’s future needs. Will you eventually require business loans, lines of credit, or more sophisticated treasury management services? Choosing a bank that can scale with you can save you the hassle of switching later.

- Digital vs. Physical Presence: Do you prefer the convenience of primarily online banking and mobile banking, or do you require frequent in-person branch visits for cash deposits or consultations?

By meticulously preparing these aspects, you’ll approach the commercial banking application process with confidence and efficiency, setting the stage for a smooth experience.

Navigating the Commercial Banking Landscape: Choosing the Right Partner

With your documentation in hand and a clear understanding of your needs, the next critical step is to select the right financial institution. The banking industry is diverse, offering a spectrum of choices from global giants to local credit unions and specialized digital banking platforms. The best choice for your LLC depends on a confluence of factors including your business size, operational style, and future aspirations.

Types of Financial Institutions and Their Offerings

- Large National Banks:

- Examples: Chase Banking, Wells Fargo Banking, PNC Banking, Bank of America, Truist Online Banking, M&T Bank.

- Pros: Extensive branch networks, comprehensive range of services (including investment banking, private banking for high-net-worth clients, merchant services, complex loan products), advanced online banking and mobile banking platforms, strong security infrastructure, often good for businesses with multi-state operations. They are generally equipped to handle large transaction volumes and complex financial needs.

- Cons: Can sometimes feel less personal, potentially higher fees for basic accounts, customer service may be more standardized.

- Keywords to integrate: pnc online banking, chase online banking, wells fargo banking, regions online banking, online banking bank of america, truist online banking, m&t bank online banking, www.pncbank.com online banking, www.regions.com online banking.

- Regional and Community Banks:

- Examples: UMB Online Banking, St. George Banking (in Australia), Cadence Online Banking, Greater Bank Online Banking, Heritage Business Banking.

- Pros: Often offer a more personalized approach, can be more flexible with fees for local businesses, strong community ties, good for businesses that prefer a relationship-based banking experience. They balance comprehensive services with a local touch.

- Cons: May have fewer branches or less extensive service offerings than national banks, especially for complex international transactions or highly specialized services.

- Keywords to integrate: umb online banking, st george banking, cadence online banking, greater bank online banking.

- Credit Unions:

- Examples: BECU Online Banking Login, Summerland Credit Union Internet Banking.

- Pros: Member-owned, often lower fees and better interest rates on savings/loans, strong focus on member service, community-oriented.

- Cons: Membership requirements (often geographic or affiliation-based), fewer branches and ATMs than large banks, potentially less sophisticated digital banking platforms, though many are rapidly improving (e.g., becu online banking login indicates a modern online presence).

- Online-Only / Digital Banks:

- Examples: Me Banking, Robinhood Banking (for some services), various fintech platforms. Many traditional banks also offer robust digital-first options.

- Pros: Typically lower fees (or no monthly fees), higher interest rates on deposits, cutting-edge mobile banking and online banking features, highly convenient for businesses that don’t deal with much cash. Excellent for tech-forward businesses or those with distributed teams.

- Cons: No physical branches for cash deposits or in-person support, can be challenging for businesses that frequently handle large amounts of cash, customer service is typically online or phone-based.

- Keywords to integrate: digital banking, mobile banking, online banking account, me banking, open banking (for broader data sharing initiatives), robinhood banking.

- International and Australian Banks (as per keywords):

- Examples: ANZ Banking, Westpac Banking, NAB Banking, Suncorp Banking, Commonwealth Bank, Bendigo Bank, Macquarie Internet Banking, Australian Unity Internet Banking, RACQ Online Banking, Axis Bank Internet Bankin, GMCU Internet Banking, GSB Online Banking, BSP Online Banking PNG, Kenya Commercial Bank Online Banking, Beyond Bank Login Internet Banking Login, Barclays Bank Online Banking.

- Relevance: If your LLC has an international presence or plans to, or if you’re located in Australia (given the numerous Australian banking keywords), these institutions become highly relevant. They offer specialized services for cross-border transactions, foreign exchange, and local market expertise.

- Keywords to integrate: anz internet banking, westpac banking online, nab internet banking, suncorp internet banking, commonwealth bank online banking, barclays bank online banking, rbc cross border banking.

Key Features to Scrutinize When Choosing a Bank

The right bank should be a strategic partner, not just a service provider. Evaluate potential candidates based on these critical criteria:

- Fee Structures:

- Monthly Maintenance Fees: Can these be waived with a minimum balance or certain transaction activity?

- Transaction Fees: Charges per deposit, withdrawal, or electronic transaction.

- ATM Fees: Both for using their ATMs and out-of-network ATMs.

- Wire Transfer Fees: Domestic and international.

- Overdraft Fees: How much, and what are the policies?

- Live Daily Information Context: Always check the most current fee schedules, as banks frequently adjust them based on market conditions and competitive pressures.

- Online Banking and Mobile Banking Capabilities:

- Is the platform user-friendly? Does it offer robust features like bill pay, electronic transfers (EFT meaning in banking), remote check deposit (using your mobile banking app), and account alerts?

- Can you easily integrate it with your accounting software (e.g., QuickBooks, Xero)?

- Does it provide multi-user access with varying permissions for your team?

- Keywords to integrate: online banking bank of america, chase online, m&t mobile banking, regions online banking, pnc online banking, wells fargo banking, truist online banking, internet banking login, anz banking login, nab login, westpac login, st george internet banking, net banking.

- Business Credit Options:

- What types of business credit cards do they offer? (Rewards, low APR, etc.)

- What are their loan products (SBA loans, lines of credit, equipment financing)? Is their lending criteria suitable for new or growing LLCs?

- Investment banking divisions within larger banks can offer more sophisticated capital-raising solutions as your LLC matures.

- Treasury Management Services:

- For businesses with complex cash flow, look for features like automated sweep accounts, remote deposit capture, fraud protection services, and payroll solutions.

- Customer Service and Support:

- How accessible are their business banking specialists?

- Do they offer dedicated relationship managers?

- What are their hours for customer support, and through what channels (phone, chat, email, in-person)?

- Live Daily Information Context: The quality of customer service can vary significantly. Reading recent reviews and talking to other business owners in your area can provide valuable current insights.

- Security Features:

- What measures do they have in place to protect your accounts from fraud? Multi-factor authentication, transaction monitoring, secure login processes are essential.

- Keywords to integrate: m&t bank online banking issues, m&t bank mobile banking down (While these refer to specific issues, they highlight the importance of evaluating a bank’s technical reliability and security infrastructure).

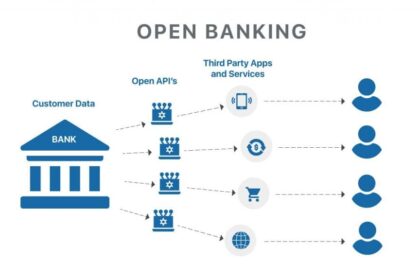

- Open Banking Readiness:

- For tech-forward LLCs, consider banks that embrace open banking standards, allowing secure data sharing with third-party financial apps (with your permission), enhancing financial management and insights.

By carefully weighing these factors against your LLC’s needs and future trajectory, you can confidently select a commercial banking partner that will truly support your business’s financial health and growth.

The Application Process: A Step-by-Step Walkthrough

Once you’ve chosen your preferred financial institution, the actual application to open a commercial banking account is typically straightforward, especially if you’ve completed all the preparatory steps. While the exact procedure might vary slightly from bank to bank, the general flow remains consistent.

1. Initial Contact and Consultation

- Schedule an Appointment: It’s highly recommended to schedule a meeting with a business banking specialist. This allows you to discuss your specific needs, ask questions about account features, fees, and any introductory offers. Many banks offer online scheduling, or you can call your local branch or dedicated business services line.

- Online Application (if available): For some online-only banks or simpler accounts, you might be able to start or even complete the entire application process through their online banking portal. However, for a full-service commercial banking account, an in-person or video consultation is often beneficial.

2. Submitting Your Documentation

- Provide All Required Documents: As outlined in the preparation section, this includes your LLC’s EIN letter, Articles of Organization, Operating Agreement, and personal identification for all authorized signers. Ensure everything is up-to-date and correctly copied.

- Completion of Application Forms: The bank will provide specific forms for the banking account application. These forms will ask for detailed information about your LLC, its owners, and its anticipated financial activities. Be thorough and accurate.

- Signatures: All authorized signers will need to provide signatures, often in person, to verify their identity and consent to the account terms. This ensures legal compliance and proper authorization for transactions.

3. Account Funding and Activation

- Initial Deposit: Most commercial banking accounts require an initial deposit to activate. The amount can vary widely, from a minimal sum to several hundred dollars, depending on the bank and account type. Be prepared to fund this during or shortly after your application.

- Access to Online and Mobile Banking: Once the account is approved and funded, you’ll typically receive instructions on how to set up your online banking and mobile banking access. This will involve creating user IDs and strong passwords. For example, you’ll learn how to navigate www.pncbank.com online banking or set up your chase online profile.

4. Setting Up Additional Services

- Debit Cards/Checks: You’ll typically receive business debit cards for authorized signers and be able to order business checks.

- Merchant Services: If you need to accept credit card payments, this is the time to finalize your merchant services agreement.

- Bill Pay and Transfers: Configure your online banking system for recurring payments, vendor transfers, and other essential EFT meaning in banking functions.

- User Permissions: If you have employees or partners who will need access to specific banking account features (e.g., viewing statements, making payments), set up appropriate user permissions within your digital banking portal.

The application process is designed to ensure compliance with financial regulations and protect both your LLC and the bank. Being organized and prepared will make it a smooth and efficient experience, quickly granting your LLC the financial tools it needs to thrive.

Beyond the Account: Maximizing Your Commercial Banking Relationship

Opening your commercial banking account is just the first step. To truly leverage this financial partnership, your LLC must actively manage the account, utilize the available tools, and maintain open communication with your bank. A proactive approach can unlock further growth opportunities and safeguard your business’s financial future.

Leveraging Digital and Mobile Banking for Daily Operations

In today’s fast-paced business environment, your online banking and mobile banking platforms are indispensable. They provide instant access and control over your LLC’s finances.

- Real-time Monitoring: Keep a close eye on your account balances, recent transactions, and pending payments. This is crucial for proactive cash flow management.

- Remote Deposits: Using your mobile banking app, you can often deposit checks instantly from anywhere, saving trips to the bank. This feature is a game-changer for many small businesses.

- Streamlined Bill Payments: Set up recurring payments for utilities, rent, and vendor invoices directly through your online banking portal. This reduces administrative burden and ensures timely payments.

- Funds Transfers: Easily transfer funds between accounts, initiate wire transfers (both domestic and international), and manage payroll distributions. Many banks, like PNC Banking and Chase Banking, offer robust platforms for these operations.

- Account Alerts: Configure alerts for low balances, large transactions, or specific activities to stay informed and quickly detect any unusual patterns.

- Live Daily Information Context: The sophistication of digital banking and mobile banking platforms is constantly evolving. Banks frequently release updates and new features, so regularly exploring your bank’s portal and app can reveal new efficiencies. Stay informed about any m&t bank mobile banking down or m&t bank online banking issues in the news for reliability checks, though these are typically temporary.

Proactive Fraud Prevention and Security Measures

Protecting your LLC’s financial assets from fraud is paramount. Your bank plays a role, but your vigilance is equally important.

- Strong Passwords and Multi-Factor Authentication (MFA): Always use complex, unique passwords for your online banking login and enable MFA whenever possible.

- Regular Statement Review: Meticulously review your banking account statements each month to identify any unauthorized or erroneous transactions. Report discrepancies immediately.

- Employee Training: If your team has access to commercial banking functions, educate them on phishing scams, secure password practices, and reporting suspicious activity.

- Bank Security Features: Understand and utilize your bank’s fraud detection services, positive pay systems for checks, and secure wire transfer protocols.

Building Business Credit and Accessing Capital

Your commercial banking account is a cornerstone for establishing and building your LLC’s creditworthiness.

- Consistent Activity: A well-managed account with consistent deposits and responsible spending history demonstrates financial stability.

- Responsible Debt Management: If you obtain a business credit card or line of credit through your bank, make timely payments to build a positive credit history. This can be crucial for securing larger loans or investments later.

- Loan Opportunities: As your relationship with the bank grows, you may become eligible for more favorable terms on business loans, lines of credit, or other financing products essential for expansion. This is where the broader services of business banking become evident, potentially even tapping into aspects of investment banking for larger capital needs.

Exploring Additional Business Services

Don’t limit your relationship to just a checking account. Many banks offer a broader ecosystem of services designed to support growing LLCs.

- Merchant Services: Integrate payment processing for credit and debit cards, online payments, and mobile POS solutions.

- Payroll Services: Simplify employee compensation, tax withholdings, and compliance.

- Treasury Management: For more sophisticated cash management, including accounts receivable and payable automation, risk management, and international cash flow optimization.

- Wealth Management/Private Banking: As your LLC generates significant profits, consider services like private banking or wealth management, which can help you and your business manage investments, retirement planning, and succession strategies.

- International Banking: If your business expands globally, services like RBC cross border banking or specialized divisions within larger banks (e.g., Barclays Bank Online Banking for international clients) can facilitate foreign exchange, international wires, and trade finance.

- Business Insurance: Some banks partner with insurance providers to offer business insurance solutions.

Staying Informed About the Banking Landscape

The financial world is constantly evolving. Staying abreast of banking news and industry trends is crucial.

- Economic Trends: Understand how current economic conditions, interest rate changes, and regulatory shifts might impact your business’s access to credit or the cost of banking services.

- Banking Holidays: Be aware of banking holidays 2025 and other federal holidays (e.g., is Columbus Day a banking holiday, is today a banking holiday) as they can affect transaction processing times and cash flow. Plan accordingly.

- New Technologies: Keep an eye on innovations in digital banking, open banking, and financial technology that could offer new efficiencies or cost savings for your LLC.

- Industry Issues: Be aware of broader issues like bad loans in banking industry or discussions around shadow banking or a banking crisis to understand the stability and regulatory environment of the financial sector, though these are typically macro concerns.

By actively engaging with your commercial banking partner and intelligently utilizing the tools they provide, your LLC can transform its banking account from a simple necessity into a powerful engine for financial management and strategic growth.

Common Pitfalls to Avoid When Managing Your LLC’s Commercial Banking Account

While opening a commercial banking account is a crucial step, maintaining it effectively is equally important. There are several common mistakes that LLC owners make, which can undermine the benefits of a dedicated business account and potentially expose them to unnecessary risks. Being aware of these pitfalls can help you steer clear of them.

1. Co-mingling Funds: The Corporate Veil’s Weakest Link

We’ve emphasized this point already, but its importance cannot be overstated. Using your commercial banking account for personal expenses (e.g., paying your mortgage from the business account, or buying groceries with the business debit card) or vice versa (paying business expenses from your personal banking account) is a direct threat to your LLC’s liability protection.

- The Risk: A court could argue that since you don’t treat your business as a separate legal entity financially, it shouldn’t be treated as one legally. This “piercing the corporate veil” can leave your personal assets vulnerable to business debts and lawsuits.

- The Solution: Maintain absolute separation. Pay yourself a salary or make owner’s draws from your commercial banking account to your personal banking account, and then use your personal funds for personal expenses. Every transaction must be clearly identifiable as either business or personal.

2. Ignoring Fees and Account Terms

It’s easy to sign up for an account and then forget about the fine print. However, commercial banking fees can quickly erode your profits if left unchecked.

- The Risk: Unanticipated monthly maintenance fees, transaction fees, ATM fees, or overdraft charges can accumulate. Some accounts have strict minimum balance requirements or transaction limits that, if exceeded, trigger additional costs.

- The Solution:

- Read the Fee Schedule: Before opening an account, thoroughly review the fee schedule.

- Understand Waiver Requirements: Many banks, including PNC Banking and Chase Banking, will waive monthly fees if you maintain a certain minimum balance or meet specific transaction volume requirements. Ensure your LLC can consistently meet these.

- Regularly Review Statements: Scrutinize your monthly statements for unexpected charges.

- Negotiate: For established businesses, it’s sometimes possible to negotiate fees or find a better account type.

- Live Daily Information Context: Fee structures can change. Periodically review your bank’s website or contact them to ensure you’re aware of any updates.

3. Neglecting Regular Account Reconciliation and Statement Review

Assuming everything is correct and only glancing at your account balance is a recipe for disaster.

- The Risk: Unnoticed errors, unauthorized transactions, or even fraudulent activity can go undetected for too long, making it harder to dispute or recover funds. Incorrect reconciliation also leads to inaccurate financial statements, impacting business decisions and tax filings.

- The Solution: Reconcile your banking account with your accounting software (e.g., QuickBooks, Xero) at least monthly. This involves comparing every transaction in your bank statement with your internal records. Promptly investigate any discrepancies.

4. Overlooking Security Best Practices

In an increasingly digital banking world, cybersecurity is paramount. Complacency can have severe consequences.

- The Risk: Weak passwords, falling for phishing scams, or using unsecured Wi-Fi for online banking can lead to unauthorized access, financial theft, and significant data breaches.

- The Solution:

- Strong, Unique Passwords: Use complex, unique passwords for all online banking login portals.

- Multi-Factor Authentication (MFA): Always enable MFA for an extra layer of security.

- Secure Networks: Only access online banking on secure, private networks. Avoid public Wi-Fi.

- Be Wary of Phishing: Be suspicious of unsolicited emails or calls asking for banking account details. Banks will rarely ask for sensitive information via email.

- Keep Software Updated: Ensure your operating system and antivirus software are current.

5. Failing to Re-evaluate Your Banking Needs as Your LLC Grows

The perfect banking account for a startup might not be ideal for a rapidly expanding LLC.

- The Risk: Sticking with an account that no longer meets your needs can lead to higher fees, limited access to necessary services (like expanded credit, international capabilities, or advanced treasury management), and a less efficient financial operation.

- The Solution: Periodically (e.g., annually or bi-annually) review your LLC’s financial activities and compare them against your current commercial banking services.

- Are your transaction volumes within your account’s limits?

- Do you need more sophisticated services like payroll integration, enhanced cash management, or lines of credit?

- Is your bank’s digital banking platform keeping pace with your evolving needs?

- Perhaps exploring services from investment banking divisions becomes relevant as your LLC matures.

- Live Daily Information Context: The banking industry is dynamic. New products and services, especially in online banking and digital banking, emerge regularly. What was cutting-edge last year might be standard today. Stay informed and be open to switching banks if a better fit emerges.

By actively avoiding these common pitfalls, your LLC can ensure its commercial banking account remains a powerful asset, contributing to financial stability, operational efficiency, and sustained growth.

The Future of Commercial Banking for LLCs: Embracing Innovation

The banking industry is not static. The rapid advancements in technology and evolving business demands mean that the landscape of commercial banking for LLCs is continually shifting. Staying ahead of these trends will further empower your business.

- Hyper-Personalization: Expect banks to increasingly leverage data analytics to offer highly customized financial products and services tailored to your LLC’s specific industry, size, and growth stage. This goes beyond generic business banking offerings.

- Integrated Financial Ecosystems: The distinction between your banking account, accounting software, payroll provider, and payment processor will blur. Open banking initiatives facilitate seamless data flow between these platforms, creating a unified financial dashboard for your LLC. This means your online banking portal might become the central hub for all your financial operations.

- AI and Automation: Artificial intelligence will continue to streamline financial tasks, from automated expense categorization and reconciliation to predictive cash flow analysis. Chatbots and AI-driven support will enhance customer service, making interactions with banks like Chase Banking or Wells Fargo Banking even more efficient.

- Emphasis on Cybersecurity: As digital banking becomes more sophisticated, so do the threats. Banks will continue to invest heavily in advanced cybersecurity measures, including biometric authentication and real-time fraud detection. For LLCs, this means a greater reliance on their bank’s security infrastructure and adherence to evolving best practices.

- Specialized Fintech Solutions: Beyond traditional banks, a growing number of fintech companies offer niche banking account and financial tools specifically designed for certain types of LLCs (e.g., e-commerce businesses, freelancers, or specific industries). These can offer unique advantages, often leveraging mobile banking to the fullest.

- Sustainable and Ethical Banking: There’s a growing demand for financial institutions that align with ethical and sustainable business practices. LLCs may increasingly seek out banks that demonstrate a commitment to ESG (Environmental, Social, and Governance) principles.

- Global Reach: For LLCs with international aspirations, the ease of cross-border banking and global payment solutions will improve, making international trade and expansion more accessible than ever. This is particularly relevant given the mentions of institutions like RBC Cross Border Banking and numerous international keywords.

Staying informed about these trends, engaging with your financial advisor, and regularly assessing your LLC’s banking needs will ensure that your commercial banking account remains a dynamic asset, capable of adapting to the future demands of your business and the wider banking industry.

Conclusion: Charting Your LLC’s Financial Course with Confidence

Opening a dedicated commercial banking account for your LLC is far more than a bureaucratic checkbox; it’s a strategic imperative that underpins the legal integrity, operational efficiency, and growth potential of your business. From shielding your personal assets by maintaining the corporate veil to unlocking a suite of specialized services, this foundational step sets the stage for long-term success.

By diligently preparing your documentation, thoughtfully selecting a financial partner from the diverse landscape of business banking options (whether it’s a national powerhouse like PNC Banking or a cutting-edge digital banking provider), and actively managing your account, your LLC will gain a significant competitive advantage. Embrace the power of online banking and mobile banking to streamline daily operations, prioritize robust security measures, and always remain vigilant against common pitfalls.

The banking industry is constantly evolving, offering increasingly sophisticated tools and services. By staying informed about banking news, understanding the nuances of various banking account types, and adapting your financial strategy as your LLC grows, you transform your bank into a true partner.

Take this crucial step with confidence. Establish your LLC’s financial independence, empower its operations, and pave the way for a prosperous future. Your commercial banking account is not just a place to hold money; it’s the financial heart of your LLC, ready to fuel its journey to success.

Sources:

- IRS EIN Information: https://www.irs.gov/businesses/small-businesses-self-employed/employer-id-numbers

- SBA Business Guide: https://www.sba.gov/business-guide

- Federal Reserve Board (EFT Information): https://www.federalreserve.gov/paymentsystems/fedwire_about.htm

- Investopedia on Piercing the Corporate Veil: https://www.investopedia.com/terms/p/piercingthecorporateveil.asp

- Consumer Financial Protection Bureau (CFPB) on Banking: https://www.consumerfinance.gov/consumer-tools/banking/