Let’s be frank: if your life savings are languishing in a traditional savings account earning a paltry 0.01% interest, you are actively losing money to inflation. It’s a silent tax on your financial future. But in the dynamic landscape of 2024, a profound shift is underway. The era of high-interest rates has ushered in a golden age for savers, making high-yield savings accounts (HYSAs) not just a smart choice, but an essential component of any sound financial strategy.

- Why a High-Yield Savings Account is Your Non-Negotiable Financial Foundation

- The Top-Tier Contenders: Best National High-Yield Savings Accounts for 2024

- The Challenger Banks and Credit Unions: Rising Stars with Competitive Edge

- Navigating the Business Banking Landscape for High-Yield Solutions

- The Digital Banking Experience: What to Look For Beyond the APY

- A Special Note on Traditional Banks: PNC Online Banking, Chase Online, and Truist Online Banking

- How to Open Your Online Banking Account: A Step-by-Step Guide

- The Future is Open Banking: How It Will Transform Your Savings

- Conclusion: Take Action and Make Your Money Work in 2024

Forget everything you thought you knew about banking accounts. This isn’t your grandfather’s passbook savings. Today’s HYSAs are the pinnacle of digital banking, offering unparalleled convenience, robust security, and, most importantly, annual percentage yields (APYs) that can be 10 to 20 times the national average.

As a finance expert who has navigated everything from the complexities of investment banking to the nuances of personal banking, I’ve done the heavy lifting for you. I’ve scrutinized the fine print, compared countless platforms, and compiled this definitive guide to the best high-yield savings accounts of 2024. We’ll dive into the leaders, the rising stars, and the specific accounts that cater to business banking needs, all while leveraging the power of mobile banking to put you in full control.

Why a High-Yield Savings Account is Your Non-Negotiable Financial Foundation

Before we rank the top contenders, it’s critical to understand why this financial vehicle is so crucial. An HYSA is not for your daily spending; that’s what checking accounts are for. This is your financial safety net, your short-term goal fund, and your peace-of-mind reservoir.

- Combat Inflation: With inflation still a key topic in banking news, earning a 4-5% APY means your money’s purchasing power is protected and growing, rather than eroding in a near-zero-interest environment.

- Liquidity and Safety: Unlike CDs or the stock market, your money in an HYSA is FDIC or NCUA insured up to $250,000. It’s completely safe, yet instantly accessible. This liquidity is priceless for emergency funds or upcoming large purchases.

- The Power of Compound Interest: This is the engine of wealth building. Interest is earned on your initial deposit and on the accumulated interest over time. With rates as high as they are, the compounding effect in 2024 is more powerful than it has been in over a decade.

The shift towards these products is a central theme in modern digital banking, moving away from brick-and-mortar overheads and passing the savings directly to you, the customer.

The Top-Tier Contenders: Best National High-Yield Savings Accounts for 2024

Based on current rates, fee structures, user experience, and customer service, here are the institutions leading the charge. (Note: APYs are dynamic and can change. The rates below were verified as of this writing but always confirm on the provider’s website.)

1. CIT Bank: The Premier Platinum Savings

Live APY: 5.00% (with a minimum balance of $5,000) – one of the most competitive on the market.

CIT Bank has consistently remained at the forefront of the high-yield conversation. Their Platinum Savings account is a powerhouse for those with a solid starting deposit.

- The Verdict: Ideal for individuals with a established emergency fund looking to maximize returns. The minimum balance requirement is its only gatekeeper.

- User Experience: Their online banking platform is sleek and intuitive, making account management and transfers a seamless process. The mobile banking app receives high marks for functionality and security.

2. Ally Bank: The All-Around Champion

Live APY: 4.25% (no minimum balance)

Ally Bank is a veteran in the online banking space and for good reason. They offer a stellar combination of a strong APY, zero monthly fees, and an exceptional customer-centric experience.

- The Verdict: The best overall choice for most people. No minimums, no fees, and a great rate make it incredibly accessible. Their “Buckets” feature within the savings account is a revolutionary tool for goal-based saving.

- User Experience: From their mobile banking app to their 24/7 customer support, Ally sets the standard for customer experience in the digital banking world.

3. Marcus by Goldman Sachs: The Investment Banking Giant’s Consumer Play

Live APY: 4.40% (no minimum balance)

Leveraging the prowess of its parent company, Goldman Sachs, Marcus offers a streamlined, high-performing HYSA. It’s a no-frills account focused on delivering a top-tier yield and robust security.

- The Verdict: Perfect for savers who appreciate a clean, straightforward interface and the backing of a major financial name in investment banking.

- User Experience: The platform is minimalist and efficient. While it may lack some of the niche features of competitors, it excels at its core function: helping your money grow safely.

4. Capital One 360 Performance Savings: The Brand You Know, The Yield You Deserve

Live APY: 4.25% (no minimum balance)

Capital One has successfully bridged the gap between physical and digital banking. Their 360 Performance Savings account offers a competitive rate with the optional convenience of branch access at their Capital One Cafés.

- The Verdict: A fantastic option for those who are brand-conscious and value the potential for in-person service, yet want a top online yield.

- User Experience: The integration between their savings, checking, and credit products is seamless. Their mobile banking app is consistently rated as one of the best in the industry.

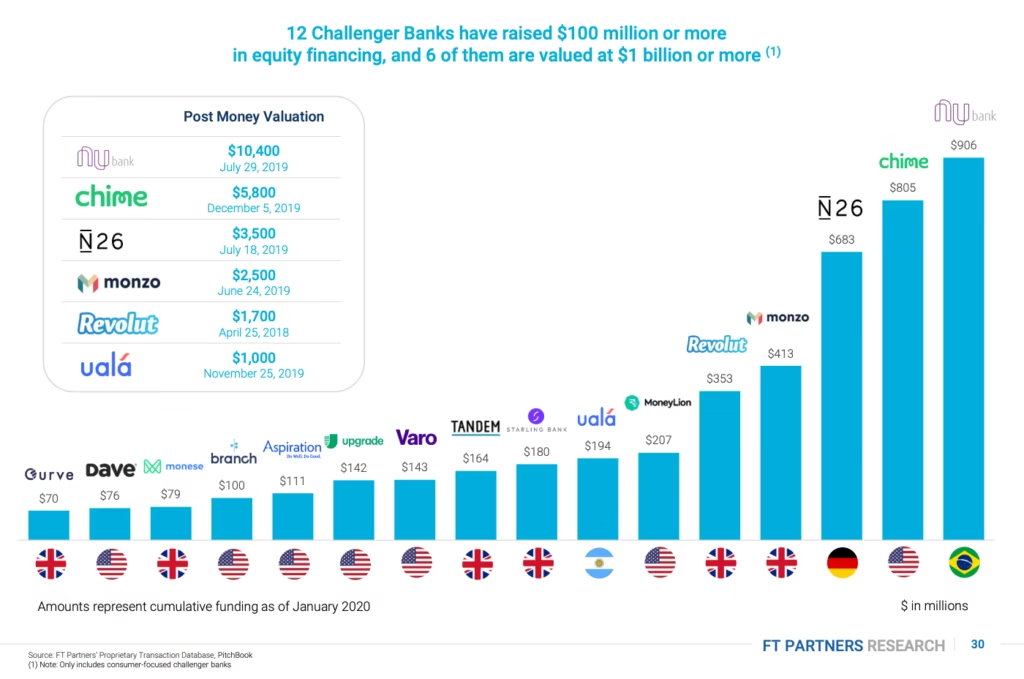

The Challenger Banks and Credit Unions: Rising Stars with Competitive Edge

Beyond the major players, several other institutions are offering fierce competition.

- Discover Bank: Another major name offering a solid HYSA at around 4.30% APY, renowned for its excellent customer service.

- Alliant Credit Union: A top-tier credit union offering a highly competitive rate (often over 4.25%) and a strong, member-focused online banking experience.

- LendingClub Bank: Evolving from its peer-to-peer roots, LendingClub now offers a Rewards Checking account that can earn high interest, blurring the lines between checking and savings in the digital banking revolution.

Navigating the Business Banking Landscape for High-Yield Solutions

For entrepreneurs and small business owners, segregating business funds is paramount. The good news is that the high-yield revolution has extended into business banking.

- Bluevine Business Checking: While technically a checking account, Bluevine offers an impressive APY on balances up to $250,000 for qualified customers, making it a powerful hybrid solution for business liquidity.

- LIVE Oak Bank: A specialist in SBA loans, Live Oak also offers a high-yield business savings account with rates that actively compete with the best personal HYSAs.

- National Institutions like Chase Banking & Wells Fargo Banking: It’s important to note that while traditional giants like Chase and Wells Fargo are pillars of commercial banking, their standard business savings accounts typically offer very low yields. For high returns, business owners are often better served by the specialized digital banking providers mentioned above.

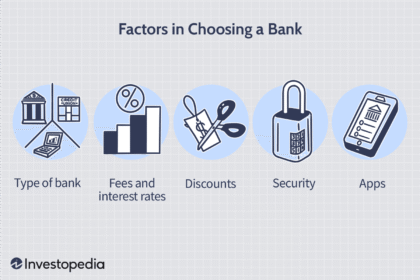

The Digital Banking Experience: What to Look For Beyond the APY

The APY is the headline, but the user experience is the daily reality. When evaluating an institution, scrutinize these features central to modern online banking:

- Mobile Banking App Functionality: Can you deposit checks, transfer funds, and manage your account with ease? Is the app secure and well-reviewed?

- Transfer Speed: How long do ACH transfers to and from external accounts take? Some banks now offer next-day or even same-day transfers.

- Fee Structure: The best HYSAs have no monthly maintenance fees and no minimum balance requirements (or easily waivable ones).

- Customer Support: Is support accessible 24/7 via chat, phone, or email? The quality of customer service can make or break your experience.

- ATM Access & Card Availability: While not for daily spending, some HYSAs offer ATM cards for emergency cash access. This is a bonus feature to consider.

A Special Note on Traditional Banks: PNC Online Banking, Chase Online, and Truist Online Banking

Many consumers naturally look to their existing banks, like PNC Banking, Chase Banking, or Truist (formed from the SunTrust/BB&T merger). While their online banking platforms (like PNC online banking, Chase online, and Truist online banking) are highly developed and integrated, their standard savings accounts are not competitive in the HYSA space.

They often market “premium” savings or money market accounts that may offer slightly higher yields, but these are almost always still below what a dedicated online banking specialist offers. It is a classic case of the innovator’s dilemma. Use Chase online banking for your day-to-day personal banking, but park your savings where it will work hardest.

How to Open Your Online Banking Account: A Step-by-Step Guide

Opening an HYSA is a straightforward process that takes just minutes.

- Choose Your Provider: Select an institution from the list above that aligns with your balance and feature needs.

- Gather Your Information: You’ll need your Social Security Number, a government-issued ID (like a driver’s license), and your funding account information (routing and account number from your current bank).

- Complete the Online Application: Navigate to the “Open an Account” section on the bank’s website. The application will ask for your personal details and will involve a soft credit check (which doesn’t affect your score) to verify your identity.

- Fund Your Account: Once approved, you’ll initiate a transfer from your external bank account. This can take 1-3 business days to complete.

The Future is Open Banking: How It Will Transform Your Savings

A final trend to watch is open banking. This regulatory and technological framework allows you to securely share your financial data between different institutions through APIs. In practice, this means third-party financial apps can get a unified view of your finances (with your permission), helping you find the best savings rates automatically and seamlessly moving your money to maximize returns. Open banking is the next frontier in digital banking, promising a more fluid and intelligent financial ecosystem for consumers.

Conclusion: Take Action and Make Your Money Work in 2024

The difference between a 0.01% APY and a 5.00% APY on a $10,000 savings is nearly $500 in earned interest in a single year. That’s not just pocket change; it’s a fundamental shift in how you treat your hard-earned money.

The best high-yield savings account for you is the one that offers a competitive, sustainable yield, a platform you trust, and the features you need. Whether you choose the raw power of CIT Bank, the user-friendly excellence of Ally, or the prestigious simplicity of Marcus, the critical step is to act.

Don’t let your savings stagnate. Embrace the efficiency of modern digital banking, move your funds into a high-yield environment, and start earning the returns you truly deserve. Your financial future will thank you for it.

Sources and Further Reading

- FDIC: Understanding Deposit Insurance

- Ally Bank Official Site

- Marcus by Goldman Sachs

- CIT Bank Savings Products

- Capital One 360 Performance Savings

- Federal Reserve Economic Data (FRED) – For tracking inflation and interest rate trends.