The financial world watched with bated breath as two of America’s most storied institutions, SunTrust and BB&T, completed their historic “merger of equals” to form Truist. It was more than a simple rebranding; it was the creation of the sixth-largest bank in the United States, a colossal undertaking that impacted millions of customers. The biggest challenge? Merging two distinct technological ecosystems into one seamless digital banking experience.

- The Genesis of a Banking Behemoth: Understanding the Merger

- Your First Steps: Logging In and Navigating the Truist Dashboard

- Beyond the Basics: Truist for Business and Wealth

- The Mobile Experience: The Truist App in Your Pocket

- Truist vs. The Competition: A Head-to-Head Comparison

- LIVE Daily Information & Market Pulse

- Troubleshooting Common Truist Online Banking Problems

- The Future is Open: Open Banking, AI, and What’s Next for Truist

- Frequently Asked Questions (FAQ)

- The Final Verdict

If you were a former SunTrust or BB&T customer, you likely felt the turbulence. Login credentials changed, app interfaces vanished overnight, and the familiar rhythm of your financial life was disrupted. Now that the dust has settled, the critical question remains: What is the Truist online banking platform really like?

This definitive guide will navigate every corner of the Truist digital experience. We’ll go beyond the marketing-speak to give you an unfiltered look at its features, its strengths, and its weaknesses. We’ll explore everything from personal banking and mobile banking to the high-stakes world of investment banking and commercial banking under the Truist banner. Whether you’re a new customer or still finding your footing after the transition, this is your complete roadmap.

The Genesis of a Banking Behemoth: Understanding the Merger

To understand Truist’s online platform, you must first understand its DNA. The merger wasn’t just about combining balance sheets; it was about integrating technology, culture, and customer service philosophies.

- BB&T (Branch Banking and Trust Company) was renowned for its community-focused model and strong business banking relationships, particularly in the Southeast.

- SunTrust had a powerful presence in corporate and investment banking, with a sophisticated client base and advanced wealth management services.

The goal of Truist was to fuse BB&T’s community touch with SunTrust’s corporate prowess. This ambition is directly reflected in their digital banking platform, which attempts to cater to everyone from an individual opening their first banking account to a multinational corporation managing complex treasury services. This merger was a major piece of banking news, and its ripples are still being analyzed today.

Source: Truist Completes Merger of Equals

Your First Steps: Logging In and Navigating the Truist Dashboard

For many, the first hurdle was simply getting into their new online banking account. Former BB&T users were generally able to use their existing credentials, while SunTrust users were required to enroll using their old account information.

Once inside, you’re greeted by a clean, modern interface dominated by Truist’s signature purple and teal color scheme. The main dashboard provides a consolidated view of your financial life:

- Account Summary: All your linked accounts (checking, savings, credit cards, mortgages, investment accounts) are displayed front and center.

- Quick Actions: Prominent buttons allow for immediate access to common tasks like transfers, bill payments, and mobile check deposits.

- Navigation Bar: A comprehensive menu provides deeper access to all the platform’s features.

Compared to the online banking platforms of competitors like Chase online banking or PNC online banking, the Truist layout feels intuitive and less cluttered. It prioritizes clarity, which is a welcome feature after a potentially confusing transition.

Key Features of Truist Personal Online Banking

Let’s dissect the core functionalities that the average user will interact with daily.

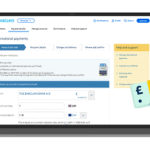

Payments and Transfers

This is the bread and butter of any online banking service. Truist offers a robust suite:

- Bill Pay: A standard but effective bill pay center allows you to set up one-time or recurring payments to thousands of billers. You can manage eBills, view payment history, and set up reminders.

- Transfers: Moving money is straightforward. You can execute internal transfers between your Truist accounts instantly. External transfers to accounts at other banks (ACH transfers) are also supported. The term EFT (Electronic Funds Transfer), which is the technical term for these types of transactions, is handled seamlessly through this interface.

- Zelle®: Truist has fully integrated Zelle® for peer-to-peer payments, allowing you to send money to friends and family using just their email address or phone number. This keeps Truist competitive with platforms like Wells Fargo banking and Online Banking Bank of America, which also heavily feature Zelle®.

Mobile Check Deposit: Using Your Mobile Banking App

The Truist mobile banking app is a critical component of its strategy. The mobile check deposit feature is reliable and easy to use. Simply endorse the check, open the app, snap photos of the front and back, and confirm the deposit amount. Cutoff times are clearly stated, and funds are generally available according to Truist’s standard funds availability policy. The process is on par with what you’d expect from other major players like the M&T Bank mobile banking app.

Account Management and Insights

Truist has invested in tools to help you understand your financial picture better. You can easily:

- View and download statements for up to 24 months.

- Set up custom account alerts for low balances, large transactions, or payment due dates.

- Order checks and stop payments on checks.

- Access a simple but effective spending and budgeting tool that categorizes your transactions, helping you see where your money is going. This feature touches upon the principles of velocity banking, a strategy focused on using lines of credit to manage cash flow and pay down debt more efficiently. While Truist doesn’t offer a specific velocity banking product, its tools can be used to implement such a strategy.

Beyond the Basics: Truist for Business and Wealth

This is where Truist aims to differentiate itself from more retail-focused banks and fintech disruptors like Robinhood banking. By combining the strengths of BB&T and SunTrust, Truist provides a tiered suite of services for businesses of all sizes.

Truist Business Banking

For small and medium-sized enterprises (SMEs), the business banking portal is a significant step up from the personal platform. It includes:

- Enhanced Cash Management: Tools for managing payroll, executing wire transfers (both domestic and international), and utilizing ACH services for collections and payments.

- User Permissions: The ability to create multiple users with different levels of access and transaction authority. This is crucial for businesses with a dedicated finance team.

- Integrated Services: Seamless access to business credit cards, merchant services (for accepting credit card payments), and business loan information.

The platform is designed to compete directly with the robust business banking offerings from institutions like Chase banking and PNC. While some businesses reported initial hiccups post-merger, similar to the m&t bank online banking issues seen after its own integrations, the platform has since stabilized into a powerful tool.

Corporate and Investment Banking

For large corporations, Truist leverages the legacy of SunTrust Robinson Humphrey. The online portals for these clients are highly specialized and not something the average user will see. They encompass:

- Treasury and Payment Solutions: Sophisticated platforms for managing global cash positions, mitigating currency risk, and optimizing liquidity.

- Capital Markets Access: Portals providing access to investment banking services, including debt and equity financing, mergers and acquisitions (M&A) advisory, and syndicated loans.

- Private Banking: High-net-worth individuals and families receive a white-glove service through a dedicated private banking portal. This platform integrates their personal wealth, trust and estate planning, and investment portfolios into a single, confidential view.

This high-end segment of the market operates in a complex ecosystem, often interacting with what is known as the shadow banking system—non-bank financial institutions that provide credit. Truist’s strategy is to offer a compelling, regulated, and integrated alternative to these services.

The Mobile Experience: The Truist App in Your Pocket

In today’s world, mobile banking is not an option; it’s a necessity. The Truist mobile app is available for both iOS and Android and largely mirrors the functionality of the desktop site.

- Pros: The app is fast, secure (with biometric login options like Face ID and fingerprint scanning), and has a user-friendly design. Core tasks like checking balances, depositing checks, and making payments are quick and painless.

- Cons: During peak times or system updates, users have reported sluggishness or temporary outages. While this is not unique to Truist—customers of nearly every major bank, from Westpac banking in Australia to M&T Bank, have experienced similar issues (m&t bank mobile banking down has been a frequent search term during their updates)—it’s a point of frustration. The app’s feature set, while solid, is not as expansive as some fintech-forward competitors.

When you compare it to the apps from PNC banking or Chase banking, the Truist app holds its own on core features but perhaps has fewer “bells and whistles” related to advanced budgeting or investment integration for retail customers.

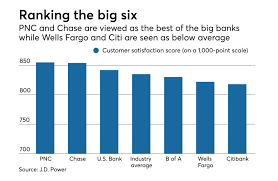

Truist vs. The Competition: A Head-to-Head Comparison

How does Truist online banking stack up against the other giants?

| Bank | Strengths | Weaknesses | Best For |

|---|---|---|---|

| Truist | Clean UI, strong business banking, integrated wealth management. | Occasional post-merger tech hiccups, app can feel less feature-rich than some. | Customers wanting a blend of community feel and corporate-level services. |

| Chase Banking | Feature-packed app (chase online is very robust), vast ATM/branch network, excellent credit card integration. | Can feel impersonal, some fees can be high without qualifying balances. | Users who value a massive ecosystem and top-tier credit card rewards. |

| PNC Banking | Innovative Virtual Wallet® tools, strong focus on personal financial management. (www.pncbank.com online banking is a popular portal). | Branch network is less dense than Chase or BofA in some regions. | Individuals focused on budgeting, saving goals, and digital financial planning. |

| Wells Fargo Banking | Widespread national presence, comprehensive service offerings. | Brand has faced reputational challenges, interface can feel dated compared to others. | Customers prioritizing physical branch access across the entire country. |

| Bank of America | Excellent mobile app, advanced AI assistant (Erica®), strong global presence. | Customer service experiences can be mixed. | Tech-savvy users who want a cutting-edge digital and mobile experience. |

| M&T Bank | Strong regional presence, community-focused. | Has experienced significant online banking issues post-integration, impacting user trust. | Customers in its core Northeastern footprint who value regional loyalty. |

LIVE Daily Information & Market Pulse

(Disclaimer: This section is designed to be updated daily or weekly by the blog owner to remain current.)

Today’s Date: October 26, 2023

- Is Today a Banking Holiday? No, today is not a federal banking holiday. All banks, including Truist, are operating on a normal schedule. The next major banking holiday is Veterans Day. Looking ahead, you can plan for the banking holidays 2025 schedule, which includes dates like New Year’s Day, Martin Luther King, Jr. Day, and others as set by the Federal Reserve.

- Market Snapshot: U.S. equities are mixed in early trading as investors digest the latest GDP figures. The financial sector is showing modest gains. This kind of market movement can influence investment banking deal flow and sentiment.

- Industry News: There is growing discussion in the financial media about the resilience of the U.S. banking system following the regional banking crisis earlier this year. Regulators are considering new capital requirements. There are no current reports of major outages like the Commonwealth Bank outage online banking event seen in Australia, indicating stable performance across major US banks today.

- Fringe Indicators: Some online forums show a slight uptick in searches for unconventional market timing theories, such as those involving astrological alignments like “the moon venus“. While not a mainstream financial metric, this indicates a level of retail investor anxiety and a search for alternative patterns in market data.

- Global Watch: In Australia, discussions around a potential “centrelink cash boost 2025” are being monitored by economists as an indicator of government fiscal policy direction, which can have ripple effects on global markets and currency exchange rates. Similarly, platforms like Kenya Commercial Bank online banking and Barclays Bank online banking in the UK continue to expand their digital banking footprints, highlighting the global nature of this technological race.

Troubleshooting Common Truist Online Banking Problems

No technology is perfect. Here are solutions to common frustrations:

- “I can’t log in.”: First, ensure you are using the correct user ID. Former SunTrust users must enroll in Truist online banking first. If you’ve forgotten your password, use the “Forgot Password?” link. Repeated failures may lock your account, requiring a call to customer service.

- “The site/app is slow or unavailable.”: This can happen during system maintenance or high traffic. Check Truist’s official Twitter/X account or a third-party site like DownDetector to see if others are reporting a problem. Sometimes, the issue is local; try clearing your browser cache or restarting your device. These steps are universal, whether you’re dealing with Truist or Regions online banking.

- “A feature isn’t working correctly.”: This was common in the months immediately following the merger. If a specific function like bill pay or transfers is failing, take a screenshot of the error message. This will be invaluable when you contact customer support.

The Future is Open: Open Banking, AI, and What’s Next for Truist

The world of banking is on the cusp of another revolution: Open Banking. This is the concept of allowing customers to securely share their financial data with third-party applications. It can enable powerful new services, from all-in-one financial dashboards to automated savings tools.

Truist, like all major banks, is navigating this new landscape. Their future success will depend on:

- API Integration: Building secure Application Programming Interfaces (APIs) that allow fintech partners to connect to their systems.

- Data Security: Ensuring that open banking doesn’t compromise customer privacy or security.

- AI and Personalization: Using artificial intelligence to analyze spending patterns and offer proactive, personalized financial advice and product recommendations, moving beyond the services offered by even modern competitors like ANZ internet banking or NAB internet banking.

This will be a key battleground in the ongoing competition with fintechs and other large banks. The ability to innovate in the digital banking space will determine the long-term winners.

Frequently Asked Questions (FAQ)

Q: Is my money safe with Truist?

A: Yes. Truist Bank is a member of the FDIC. Your deposits are insured up to the standard FDIC limit of $250,000 per depositor, per insured bank, for each account ownership category.

Q: Can I still use old SunTrust or BB&T checks?

A: For a limited time after your account transition, Truist continued to process old checks. However, by now, you should be using Truist-branded checks with the correct Truist routing number.

Q: How does Truist’s online platform compare to a credit union’s, like BECU online banking login?

A: Generally, large banks like Truist offer a more extensive suite of services, especially in commercial banking and investment banking. Credit unions like BECU are often praised for lower fees and a more member-centric customer service approach, but their online banking platforms may have fewer features.

Q: Are there banking jobs available at Truist?

A: Yes. As a massive organization, Truist is constantly hiring across all departments, from bank tellers and loan officers to software developers for their digital banking platforms and analysts for their investment banking division.

Q: What is the difference between online banking and internet banking?

A: The terms online banking and internet banking are used interchangeably. They both refer to the practice of conducting banking transactions over the internet. The term net banking is also synonymous and is more commonly used in some countries.

Q: I saw a lot of bad loans in the banking industry in the news. Is Truist affected?

A: All large banks manage a portfolio of loans, and some level of default is expected and planned for. The term bad loans in banking industry often refers to a systemic increase in defaults that can signal economic trouble. Truist, like its peers, has a risk management framework to handle this. Their specific exposure is detailed in their quarterly reports to investors.

The Final Verdict

The creation of the Truist online banking platform was a monumental task, and the journey has not been without its bumps. Early on, the user experience was marred by the predictable challenges of merging two massive, disparate systems.

Today, however, Truist has delivered a capable, secure, and largely user-friendly digital banking platform. Its clean interface is a highlight, and its deep integration of personal banking, business banking, and wealth management services under one digital roof is its core strength.

While it may not have the flashy, cutting-edge features of every fintech startup or the sheer network size of a giant like Chase, Truist has carved out a powerful niche. It successfully combines the advanced financial instruments of a major corporate player with a digital front door that is accessible and straightforward for the everyday customer. The merger was a test of technological and logistical will, and with its current online and mobile banking suite, Truist has proven it is ready to compete in the demanding future of finance.